By Mohamed A. El-Erian

"America’s full recovery is not yet guaranteed. A mix of steadfastness, caution, and good luck is needed for that to happen," writes the CEO and co-CIO of PIMCO.

By Editor Test

“Over the long term, management's decision to exit more volatile businesses such as variable annuities and individual life should help de-risk the company," said Fitch in a release.

By Editor Test

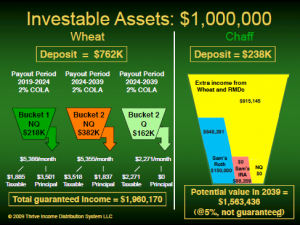

Retirement Illustrator is intended to help advisors present retirement spending requirements and distribution alternatives, accounting for risk events such as withdrawal, longevity, survivor needs and healthcare risks.

By Editor Test

“We envision a world where old school financial advisers are obsolete, except for the very wealthy,” said Bo Lu, co-founder of FutureAdvisor.

By Editor Test

Only 14% of small employers--for-profit firms that employ 100 or fewer people--sponsor some type of retirement plan, according to a new GAO report.

By Editorial Staff

Brief or late-breaking items from DST Brokerage Solutions, Broadridge, BNY Mellon, SIGNiX, VERTEX, Allianz Life, the U.S. Treasury Department, Nataxis Global Investment Management, EBRI, Financial Executives International and Allianz Global Investors.

By Editor Test

The leitmotif of the Retirement/Pension track of the Society of Actuaries Investment Symposium in New York on Monday was that risky assets and pensions mix like, say, metallic sodium and water. Explosively, that is.