By Amir Sufi and Atif Mian

'Credit-supply expansions often sow the seeds of their own destruction,' write our two guest columnists, who collaborated on the 2014 book, House of Debt. They teach at the U. of Chicago Booth School and Princeton University, respectively.

By Editorial Staff

'The industry has been scrambling to find a proactive solution to this demographics problem,' said Marina Shtyrkov, a Cerulli research analyst in a release.

By Editorial Staff

Marlene Debel to lead MetLife's institutional retirement business; Funded status of S&P 1500 pension plans rose 1% in January; TrimTabs reports that global equities outdrew U.S. equities after the recent price dip.

By Editorial Staff

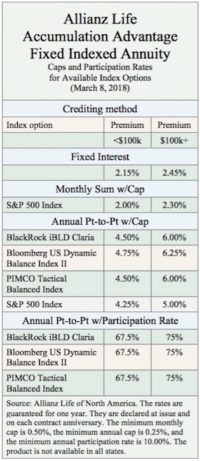

Caps and Participation Rates for Available Index Options