By George A. (Sandy) Mackenzie

Mackenzie, author of two books on pensions and annuities, attended the Pension Research Council’s conference on “The Market for Retirement Financial Advice” two weeks ago at the Wharton School and wrote this summary.

By Editor Test

None of the top five sellers of single-premium immediate annuities in 2003 were among the top five in 2011, and SPIA sales have become more concentrated among the top five sellers over the past nine years, according to data from Beacon Research.

By Editor Test

Domestic stock funds saw net outflows of $9.3 bn and money market funds saw net outflows of $17.3 bn. This story includes a chart of ten mutual fund families with highest net inflows in April and a link to Morningstar's full report.

By Editor Test

“Money is created in two fundamentally different ways… There is outside money, which is created whenever a government pays for something by making a draft on its central bank or by paying for something with banknotes, and which is extinguished when a payment is made by a member of the public to the government, typically in the form of taxes… On the other hand there is inside money, which is created by commercial banks when they make loans, and which ceases to exist when loans are repaid.” – Wynne Godley and Marc Lavoie, Monetary Economics, 2nd ed., 2012, p. 57.

By Editorial Staff

Brief or late-breaking items from Mercer, The Hartford, ING U.S., Edward Jones, Harris Polls, Nationwide Financial, Woodbine Associates, JPMorgan, Fidelity Investments, and FutureAdvisor.

By Editor Test

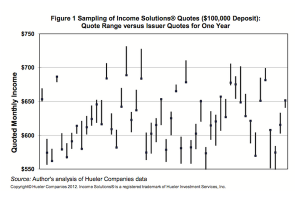

If you're engaged in selling or marketing income annuities, you must read this 2007 white paper by Wharton professor David Babbel. It's an enduring classic.