By Kerry Pechter

By establishing a standard for valuing in-force income annuities, an industry task force hopes to reduce fear of "annuicide" and stimulate SPIA sales. "We're taking a thorn out of the lion's paw," says Gary Baker of Cannex. (Links to pdfs of task force documents included.)

By Kerry Pechter

New York Life launched its Guaranteed Future Income Annuity, a deferred income product, in mid-2011 and has found traction among pre-retirees who want income about 10 years later. We spoke about it with Matthew Grove, vice president of Guaranteed Lifetime Income at the mutual insurer.

By Kerry Pechter

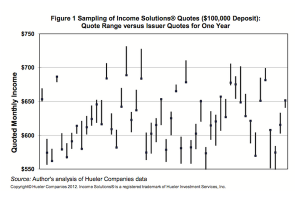

Kelli Hueler, creator of the Income Solutions online income annuity sales platform, delivered an academic paper at the Pension Research Council's annual conference at the Wharton School last week, and provided insight into her "out of plan" income option for rollovers from 401(k) plans.

By Kerry Pechter

The climate was ideal, but annuities upstaged sunbathing at the 2012 Retirement Industry Conference at Walt Disney World Resort in Orlando last week.