We Could Use Some Inflation

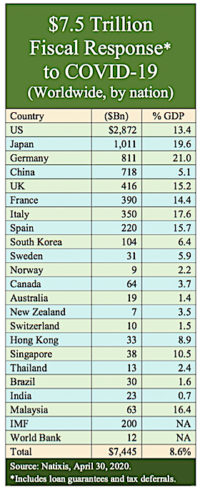

The Treasury said this week that it will borrow (and spend) about $3 trillion this quarter, to cover its stimulus promises. Where does that money come from and where does it go? 'The capital is going from one pocket to another,' explains Vanguard's active Treasury fund manager, who expects the stimulus to be withdrawn in 2022.