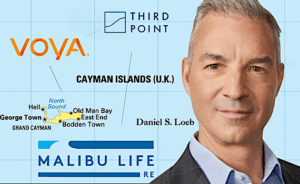

Third Point Joins the Triangle, Cayman-Style

Another asset manager goes subtropical. Third Point Investors Ltd. established Malibu Re in the Cayman Islands, bought a Texas life insurer from Mutual of America, acquired a private credit shop, and received $25m each from Voya and ReliaStar.