By Kerry Pechter

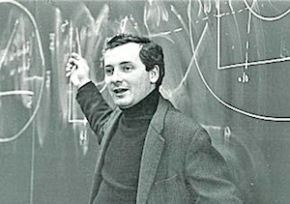

Whether you'd prefer the new Dimensional Target Date Retirement Income Funds over one of the "big three" TDFs might depend on whether you share Robert Merton and Zvi Bodie's belief that stocks aren't necessarily safe in the long run. (Photo: Merton explaining the Black-Scholes-Merton options pricing model in 1977.)

By Kerry Pechter

To satisfy super-rich clients, be as inventive as Ray Croc when he invented the 15-cent hamburger, advisors at UBS, Merrill Lynch and Manchester Capital Management told members of the Money Management Institute last week in New York.

By Kerry Pechter

Participants in Principal Financial defined contribution plans will be able to buy deferred income annuities a little at a time or in a lump sum just before retirement.

By Kerry Pechter

Prudential has dominated the burgeoning market in jumbo pension buyouts. In the week following Prudential deals with JC Penney and Philips Electronics, RIJ spoke with Peggy McDonald (above), an actuary and a leader in the insurer's pension risk transfer team.