How Demutualization Changed Everything

By Kerry Pechter

In the 1990s and early 2000s, a wave of household-name mutual life insurers “demutualized” and become stock companies. The conversion was driven by fundamental changes in the U.S. economy and led to fundamental changes in life insurer products and practices. Part I of a special two-part report.

'She persisted'

By Editorial Staff

Sen. Elizabeth Warren's (D-MA) new white paper details the sales incentives that annuity issuers offer insurance agents; the incentives, she says, show that the DOL's long-denied 'fiduciary rule' is necessary.

By Editorial Staff

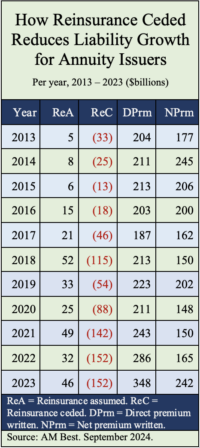

Life insurers’ exposure to risky assets and reliance on reinsurance raises concerns about their interconnectedness and complexity, research from the Bank of International Settlements shows.

Reinsurance ceded allows annuity issuers to reduce premium and therefore liabilities, data from AM Best shows.