Three major publicly held annuity issuers have announced major restructuring moves—a signal that COVID-19 and low interest rates are adding fuel to a life/annuity industry shakeup that began soon after the 2008 financial crisis and has only accelerated since.

Here’s what happened this week:

- AIG announced that it would spin off its life and retirement division, the source of about one-third of its $49 billion in annual revenues, as a separate company.

- Great American Life and its parent, American Financial Group, announced a reinsurance deal that would send $5.7 billion in fixed annuity contracts to Global Atlantic Financial. This will free-up hundreds of millions in capital for Great American.

- Equitable said it would reinsure $12bn in old expensive, variable annuity contracts with income benefits through Venerable Holdings and release about $1.2bn for Equitable.

These deals are allowing established annuity issuers to improve their balance sheets by transferring business they don’t want to reinsurers or a new breed of “insurance solutions” providers who do want it. It’s also unlocking hundreds of millions of dollars of reserve capital that Equitable and Great American can apply to more profitable business lines, new ventures or share buybacks.

“The long-dated liabilities associated with many life insurance and annuity contracts are under pressure from declining investment returns, while other businesses (property/casualty insurance, group businesses, international operations) are now viewed more favorably by institutional investors in publicly traded stock,” said ALIRT, the insurance research firm, in a report issued Wednesday.

Venerable to reinsure Equitable’s AXA-era variable annuities

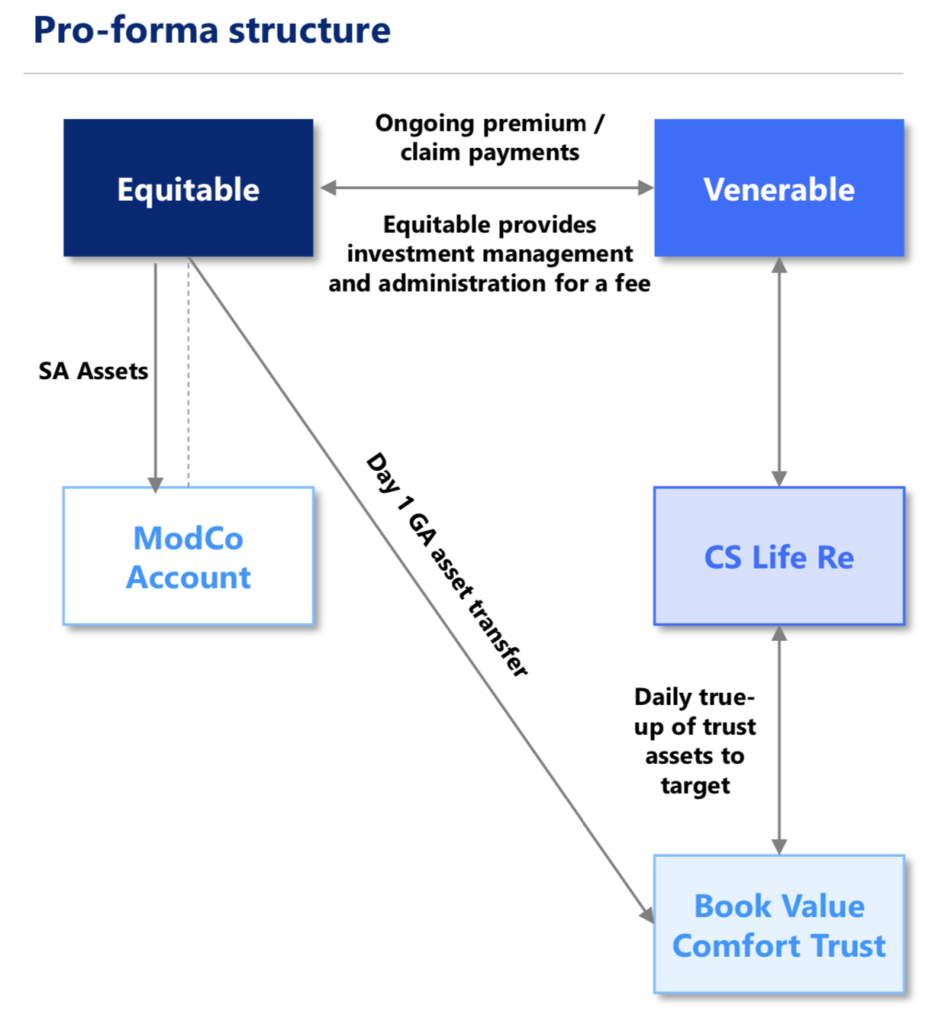

Equitable Holdings (formerly part of AXA, the French financial giant) agreed to a deal where Venerable Holdings, Inc., will reinsure legacy “Accumulator” variable annuity policies sold between 2006-2008 backed by approximately $12 billion of general account assets.

“The transaction accelerates the Company’s strategic actions to de-risk its balance sheet and shift towards less capital-intensive businesses,” Equitable said in a release this week. AllianceBernstein will be the preferred investment manager for the assets.

As part of the transaction, which is expected to close in the second quarter of 2021, Venerable will buy Equitable’s runoff variable annuity reinsurance entity, Corporate Solutions Life Reinsurance Company.

Source: Equitable.

The transaction will generate “approximately $1.2 billion of value for Equitable Holdings on a Statutory basis, which includes an expected $800 million capital release, a positive ceding commission and consideration for Corporate Solutions Life Re totaling approximately $300 million subject to adjustment, and approximately $100 million in tax benefits, according to an Equitable release. Equitable called it a first-ever deal to reinsure a block of variable annuity business.

Equitable’s board has approved share repurchases of $500 million in 2021, subject to the close of the Venerable deal. Voya Investment Management will continue to be the preferred asset manager for Venerable’s existing book of business.

As part of the transaction, Equitable Holdings is discussing taking a 9.9% equity stake in Venerable’s parent, VA Capital Company LLC, including a board seat. Equitable will continue to administer the variable annuity contracts for the contract owners.

Commonwealth to reinsure Great American fixed annuities

In another multi-billion dollar deal, Great American Life’s parent, American Financial Group, Inc., agreed to a deal where Commonwealth Annuity and Life Insurance Co. will reinsure $5.1 billion worth of fixed indexed annuities and $600 million worth of fixed annuities issued by Great American, taking on both the liabilities and the underlying assets.

The blocks represent about 15% of Great American’s in-force annuity business. Commonwealth is a unit of Global Atlantic Financial Group, which is being acquired by private equity giant KKR.

The deal will improve the profitability of the $34 billion in annuity reserves that Great American is keeping. “The assets transferred under the agreement have a lower average yield than AFG’s overall annuity portfolio yield, and the policies ceded have an overall cost of funds that is higher than that of AFG’s retained business,” a press release said. “AFG expects to earn an increase in the net interest spread on its retained $34 billion of annuity reserves.”

assets transferred under the agreement have a lower average yield than AFG’s overall annuity portfolio yield, and the policies ceded have an overall cost of funds that is higher than that of AFG’s retained business,” a press release said. “AFG expects to earn an increase in the net interest spread on its retained $34 billion of annuity reserves.”

The deal will also release capital that was backing the blocks. According to the release, “As a result of the assets and reserves transferred in this transaction, this agreement is expected to free up between $300 million and $325 million of Great American’s statutory capital in the fourth quarter of 2020. The transaction is expected to create $375 million to $400 million of additional excess capital for AFG.”

AIG to spin off its Life & Retirement division

Last Monday, American International Group, Inc. (AIG) announced its intention to separate its Life & Retirement business from AIG in order to “create value for shareholders and benefit all stakeholders,” according to an AIG release.

AIG also announced that Peter Zaffino, AIG’s current President, will become AIG’s Chief Executive officer in March 2021 (succeeding Brian Duperreault).

Like Equitable and Great American, AIG has engaged in reinsurance transactions. According to ALIRT, in 2018, the AIG life insurers entered into a reinsurance agreement with Fortitude Re (previously an affiliated company) to reinsure certain closed blocks of life, health, and annuity business.

AIG has sold the vast majority of Fortitude Re and retains a small (3.5%) ownership stake in the company. The reinsurance transactions were executed on a modified coinsurance basis, and as a result the AIG U.S. life insurers (AGL, USLNY, and VALIC) retain the legal control of the policy liabilities and the assets that are in support of those liabilities.

AM Best commented on Tuesday that the Long-Term Issuer Credit Rating (Long-Term ICR) of “bbb” of American International Group, Inc. (AIG) (headquartered in New York, NY) remains unchanged following its announcement to pursue a separation of its life and retirement business.

“Historically, the consolidated group has benefited from the operational profitability and diversification brought by AIG L&R,” AM Best said in a release. “However, AM Best notes the significant changes in underwriting, volatility reduction actions taken through reinsurance purchases and product portfolio repositioning that have been implemented at AIG PC over the last few years, all of which have improved AIG PC’s operational profile.

AM Best also has commented that the Financial Strength Rating (FSR) of A (Excellent) and the Long-Term ICRs of “a” of AIG’s property/casualty insurance subsidiaries (collectively referred to as AIG PC) remain unchanged. Concurrently, AM Best has commented that the FSR of A (Excellent) and the Long-Term ICR of “a” for the members of the AIG Life & Retirement Group (AIG L&R) also remain unchanged. The outlook of these Credit Ratings (ratings) is stable.

(c) 2020 RIJ Publishing LLC. All rights reserved.