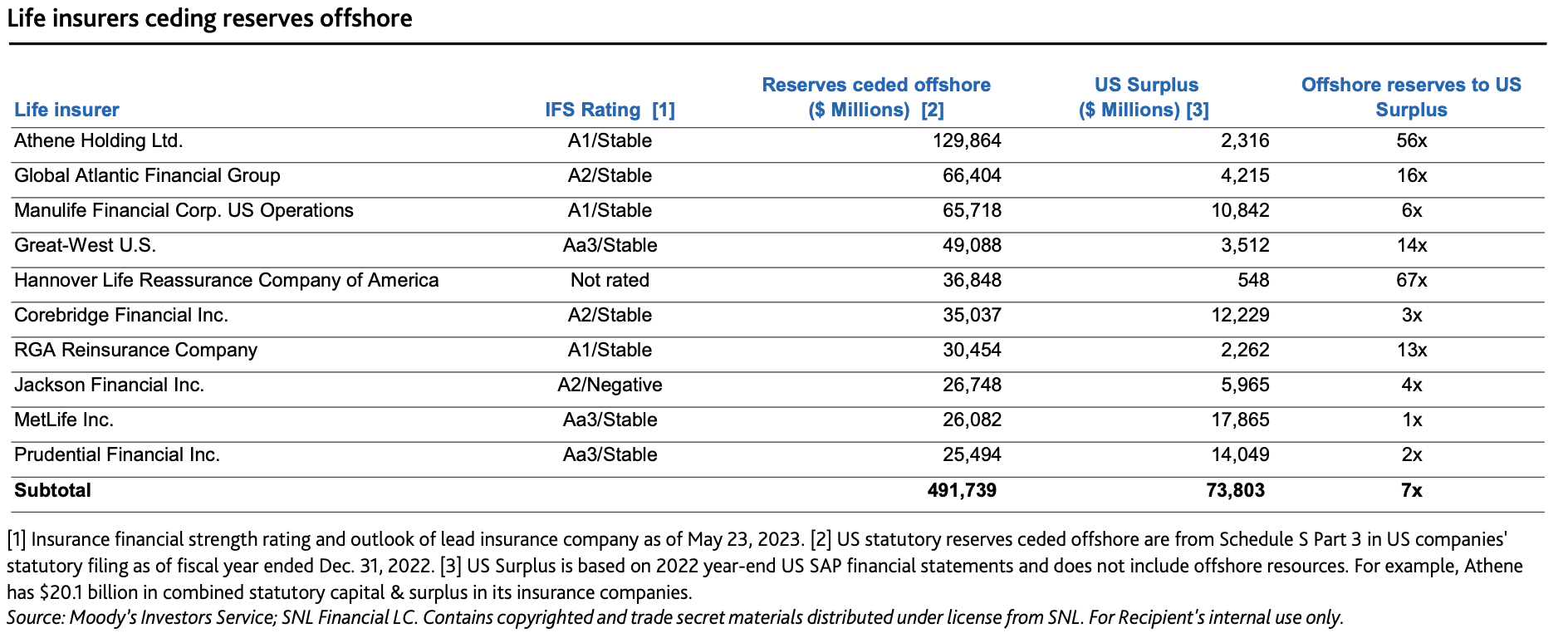

Concerned that some life/annuity companies may hurt their policyholders’ interests by using offshore reinsurance to reduce the capital backing annuity- and life insurance-liabilities, two regulators have urged the National Association of Insurance Commissioners (NAIC) to tighten its rules on the practice.

The NAIC’s Life Actuarial Task Force, which oversees such issues, will meet February 15. In RIJ‘s reporting, we have described this form of regulatory arbitrage as the “Bermuda Triangle” strategy. It is typically coordinated by triads of affiliated US annuity issuers, “alternative” asset managers, and offshore reinsurers,

In their February 5 letter to the Life Actuarial Task Force, David Wolf, New Jersey’s acting assistant commissioner, Office of Solvency Regulation, and Kevin Clark, Iowa’s chief accounting and reinsurance specialist, wrote:

State insurance regulators in various forums have discussed and identified the need to better understand what assets, reserves and capital are supporting long duration insurance business that relies heavily on asset returns (“asset-intensive business”).

In particular, there is risk that domestic life insurers may enter into reinsurance transactions that materially lower the total asset requirement (the sum of reserves and required capital) in support of their asset-intensive business, and thereby facilitate releases of capital that prejudice the interests of their policyholders.

The purpose of this letter is to propose enhancements to reserve adequacy requirements for life insurance companies by requiring that asset adequacy analysis (AAA) use a cash flow testing methodology that evaluates ceded reinsurance as an integral component of asset-intensive business. The asset adequacy analysis requires reserves to be held at a level that meets moderately adverse conditions, or approximately one standard deviation beyond expected results.

When a reinsurance transaction lowers the ceding insurer’s reserves, the new reserves established by the reinsurer could be materially less than what would be needed to meet policyholder obligations under moderately adverse conditions in addition to providing an appropriate level of capital.

May 30, 2023, Moody’s Investors Service.

“The ability of insurers to significantly lower the total asset requirement for long-duration blocks of business that rely heavily on asset returns appears to be one of the drivers of the significant increase in reinsurance transactions,” Wolf and Clark wrote, adding:

The ceding company’s Appointed Actuary might not recognize this insufficiency for the following reasons:

Some Appointed Actuaries believe that the requirements of AAA for reinsured business only require evaluation of the counterparty risk. So, if the counterparty is financially strong, no testing is done to assess whether the invested assets supporting the reserves are sufficient under moderately adverse conditions.

Some Appointed Actuaries may combine the reinsured business with other direct written business, so that the inadequacy in the reinsured business (and the associated shortfalls in the reinsurer’s assets supporting that business) are offset by margins in the cedant’s other lines of business.

Some Appointed Actuaries may not be able to obtain sufficient information from their reinsurers in order to do AAA, and therefore place reliance on the reinsurer to do so.

The letter continued:

Regulators are concerned that the level of policyholder protection may be declining for the reasons outlined above. Therefore, this proposal intends to ensure that the AAA safeguard continues to apply within the domestic cedent for all business for which it remains directly liable to pay policyholder claims.

This will ensure that the assets supporting reserves continue to be held based on moderately adverse conditions, whether those assets are held by the direct insurer or a reinsurer. Specifically, we recommend the following requirements for all reinsurance transactions, including but not limited to long-duration business that is subject to material market or credit risks or is subject to material cash flow volatility.

AAA must be performed using a cash flow testing methodology.

AAA must be performed at the line of business and treaty level (so within each individual treaty,

AAA must be performed standalone for life insurance, annuities, long duration health insurance, etc.).

These requirements could be incorporated into VM-30 via an Amendment Proposal Form (APF) or as an Actuarial Guideline.

These requirements will allow for reserve levels, and associated supporting assets, that will be sufficient under moderately adverse conditions consistent with the minimum reserve requirements. This approach would also still allow companies to enter into reinsurance arrangements with reinsurers subject to various formulaic, economic or principles-based reserving standards, and would still allow for application of judgement by the Appointed Actuary in determining the methods and assumptions underlying the cash flow testing analysis.

In order to conform with these requirements, consideration should also be given to updating the Life and Health Reinsurance Agreements Model Regulation (#791) and SSAP No. 61R—Life, Deposit-Type and Accident and Health Reinsurance in the Accounting Practices and Procedures Manual to require reinsurance treaties to include the necessary information for the cedent to perform cash flow testing.

Several steps remain to be taken and hurdles cleared before any rule changes are enacted. Clark and Wolf noted that “To move forward with the requirements proposed above, we recommend LATF consider drafting an Amendment Proposal Form for changes to VM-30. The APF could then be referred to the Reinsurance Task Force for consideration and support. Additional referrals may be necessary and/or desired to be made to the Statutory Accounting Principles Work Group, the Macroprudential Working Group and the Financial Stability Task Force.”

© 2024 RIJ Publishing LLC. All rights reserved.