Reinsurance

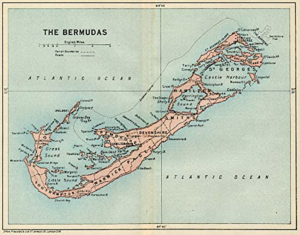

My bias regarding the Bermuda Triangle' was confirmed when I read “The Law of Capitalism” (Yale, 2025) and “The Code of Capital” (Princeton, 2019) by Columbia law professor Katharina...

News from around the Bermuda Triangle

Corebridge moves the last of American General's variable annuity business to Venerable, which is partly owned by Apollo and Athene. AM Best confirmed the ratings of Bermuda reinsurers of...

A Bridge from Private Markets to 401(k)s?

Secondaries are to private markets what repo markets once were to banking —a critical but sometimes invisible layer of leverage and liquidity.

Corebridge sheds the risks of its $51 billion VA business

The transaction will generate about $2.1 billion of net distributable proceeds after-tax for Corebridge, whose board authorized a $2 billion increase in share repurchases, said president and CEO Kevin...

Cross-Fire: NAIC and Fed Economists Release Same-Day Zingers

On March 21, Federal Reserve economists published research warning about increases in high-risk lending by U.S. life insurers. On the same day, the National Association of Insurance Commissioners asked...

Open Letter to NAIC’s Life Actuarial Task Force

'You encourage and abet the whack-a-mole behavior of insurers that regulators have tolerated in the industry—to the detriment of consumers... I don't want to be left holding the (empty)...

Open Letter to Scott O’Neal, Actuary, NAIC

'In the 12 years since , insurance regulators have done little other than allow this situation to now mushroom,' writes Rybka, a prominent...

A Flood of ‘Flow Reinsurance’

Flow reinsurance involves the ongoing, immediate transfer of risks from a life insurer to a reinsurer as soon as annuities are issued. Life/annuity companies have used flow reinsurance for...

‘Asset-intensive’ annuity reinsurance has NAIC’s attention

At an Oct. 24 meeting, the NAIC's Life Actuarial Task Force (LATF) continued to hammer out a new guideline for 'asset adequacy testing' of offshore reinsurance reserves. Starting in...

US life/annuity insurers cede $1.74 trillion to reinsurers, 2016-23

New capital keeps flowing into the reinsurance segment, primarily via reinsurers owned by investment managers focused on annuity business, AM Best analysts write. These newer entrants co-insure assets that...

British regulators scrutinize ‘FundedRe’ in pension deals

The Prudential Regulatory Authority, the Bank of England's financial regulatory arm, told UK life insurers in late July that it has concerns about the use of 'funded reinsurance' (FundedRe)...

Offshore Regulatory Arbitrage by US Insurers Explained

In a recent report, Moody's analysts showed that the accounting 'regime in Bermuda tends to allow for a higher discount rate than other jurisdictions' and this 'directly impacts the...

The case for affiliated reinsurance in the Cayman Islands

The Cayman Island's "legislative and regulatory regime is less prescriptive and therefore affords prospective Cayman reinsurers greater flexibility to propose a bespoke capital model to our regulator without being...

NAIC Urged to Limit ‘Bermuda Triangle’ Strategy

'The ability of insurers to significantly lower the total asset requirement for long-duration blocks of business that rely heavily on asset returns appears to be one of the drivers...

Of Athene, Pension Risk Transfers, and Fiduciaries

The ERISA Advisory Council recently heard comments on changing the criteria that fiduciaries use when vetting annuity providers in pension risk transfer deals. Athene's vice chairman defended his company's...

USAA inked a pair of reinsurance deals in 2021

USAA, a reciprocal insurer, completed reinsurance transactions with Commonwealth Annuity and Life and Fortitude Re, according to its 2021 annual statements.

Fortitude Re, Midwest Holdings pursue ‘triangle’ strategies

Fortitude Re, a reinsurer backed by The Carlyle Group, a $276 billion private equity firm, is completing its annuity-reinsurance-asset management strategy. Midwest Holdings' life insurer, American Life, has launched...

Prudential Sells $31bn Annuity Block to Bermuda Reinsurer

Fortitude Re will assume the assets and liabilities of a $31 billion block of Prudential annuities, and pay Prudential $1.5 billion. The block consists mainly of variable annuities with...

Athene Takes Another Bite at Pensions Apple

In a pension risk transfer deal, Athene Holding will acquire about $4.9 bn in pension assets and liabilities from Lockheed Martin. But when do these deals become too much...

Aspida Financial to begin issuing annuities in 2022

With approximately $2.3 billion in assets under management as of March 31, 2021, Aspida plans to 'underwrite new insurance products, execute reinsurance transactions, and pursue opportunistic acquisitions.'