USAA Life Insurance Company entered into two reinsurance arrangements in 2021, with a combined value of about $6 billion, according the Texas-domiciled mutual insurer’s 2021 Annual Statement, filed with the Texas Department of Insurance on February 10, 2022.

USAA “entered into a coinsurance arrangement with Commonwealth Annuity and Life Insurance Company (CALIC) to reinsure its closed block of fixed rate annuity business representing approximately $3 billion in ceded annuity reserves,” the statement said. The deal with effective July 1, 2021.

USAA also “entered into a coinsurance agreement with Fortitude Re to reinsure 100% of its legacy annuity closed block of business on a funds withheld basis. This reinsurance agreement represents approximately about $3 billion in ceded reserves.” The deal was effective October 1, 2021.

USAA is a “reciprocal” insurance company, which is similar to a mutual insurance company. In July 2019, Charles Schwab announced that it would acquire the assets of USAA’s Investment Management Co., including brokerage and managed portfolio accounts, for $1.8 billion in cash. The companies agreed to a long-term referral agreement, effective at closing of the acquisition, that would make Schwab the exclusive wealth management and brokerage provider for USAA members.

For 2021, USAA, which is headquartered in San Antonio, reported $2.72 billion in new annuity premiums, $743 million in individual life insurance premium, and $1.11 billion in net investment income. USAA markets insurance products and services primarily to current and former members of the US military and their families.

Because of “reinsurance ceded” of $7.6 billion, however, the company reported a negative $3.7 billion in life and annuity premium and a $4.9 billion reduction in aggregate reserves. USAA reported about $26.4 billion in assets, $23.6 billion in liabilities, and a surplus of about $2.8 billion (10.6% of assets), according to the annual statement.

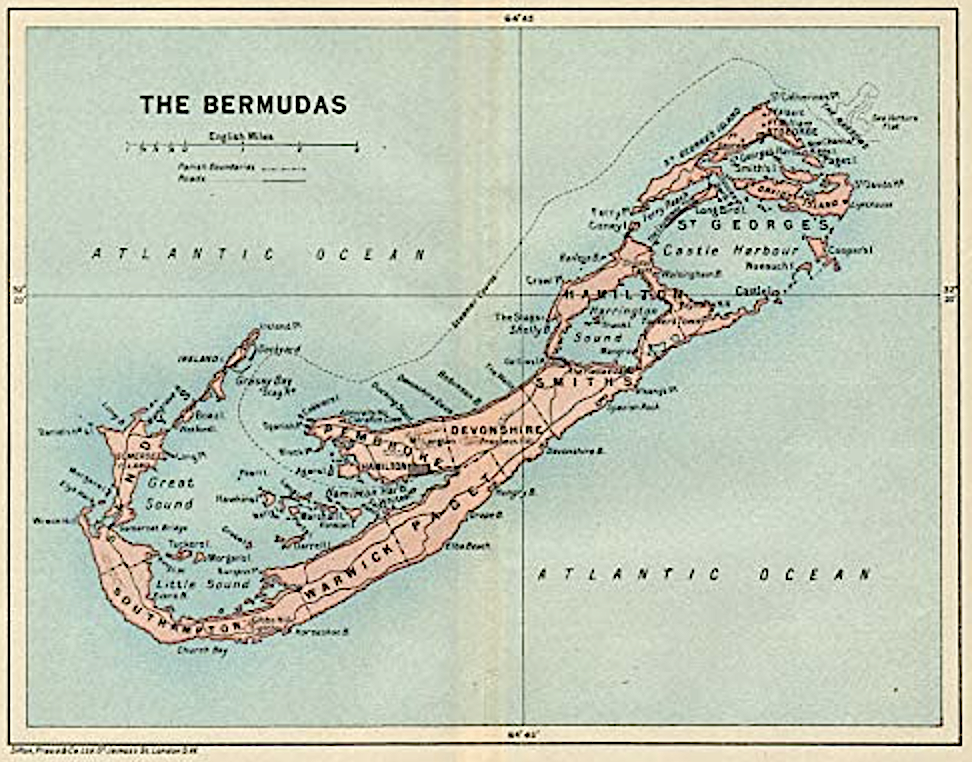

CALIC is a Massachusetts-based subsidiary of Global Atlantic Financial Group, which is a Bermuda-based, US-focused annuity life insurance and reinsurance company owned by KKR, the global asset manager, and by Goldman Sachs. CALIC executed a coinsurance deal with USAA.

In a coinsurance deal, “the ceding insurer transfers a proportionate share of all the policy risks and cash flows. The reinsurer receives its share of premiums, pays its share of benefits, sets up its share of reserves, and pays an allowance to the ceding insurer to cover its share of the costs of administering the policy,” according to the American Council of Life Insurers.

Fortitude Re and USAA have a “funds withheld” reinsurance deal. USAA received a reserve credit from Fortitude Re of $2.84 billion for business ceded to Fortitude Re. USAA included that $2.84 billion among its liabilities as “funds withheld.”

Like many other life insurers, USAA used funds-withheld reinsurance to transfer away the risk associated with certain contracts while keeping the corresponding assets under its own management.

Fortitude Re is a Bermuda-based multi-line reinsurance company “specializing in transactional solutions for legacy life, annuity and property and casualty line of business.” The Carlyle Group and other investors created and financed Fortitude Re over a period of several years after 2018 to acquire or reinsure AIG annuity contracts.

© 2022 RIJ Publishing LLC. All rights reserved.