More asset managers and life insurers are pitching new annuity products to 401(k) plan sponsors, for both altruistic and selfish reasons. That is, they want to help participants turn their tax-deferred savings into safe retirement income and, simultaneously, to retain or grow the level of participant assets in their funds and annuities.

One recent entry in this market, State Street GTC Retirement Income Builder, is a target date fund (TDF) with an annuity inside. It’s backed by a deep-pocketed strategic partnership that currently includes ARS (formerly part of Annexus), State Street Global Advisors, Athene Annuity and Life, Nationwide Financial, Transamerica Life (as recordkeeper), and Global Trust Company (GTC; a unit of Community Bank).

Annuities are still new to most 401(k) plan sponsors and participants. State Street GTC Retirement Income Builder seems to anticipate (and remove) most of the usual objections to weaving annuities into plans. But this product may be especially hard for the average plan sponsor or participant to understand. (The product’s offering memorandum and brochure are available.)

Aimed at auto-enrolled participants who don’t actively sign up for their employer’s 401(k) plan, the State Street GTC Retirement Income Builder is a target date fund (TDF) containing both mutual fund-like investments and an “in-plan” group deferred fixed indexed annuity (FIA). Participants contribute while they are employed by the plan sponsor.

All TDFs are qualified default investment alternatives (QDIAs), into which plan sponsors can automatically move auto-enrolled participants’ contributions. The annuity can grow like the other funds in the TDF, whose allocations to equities and bonds become more conservative over time. The TDF is always liquid; participants can move their money to another investment option or, if they leave the plan, pull it out of the plan.

‘Nesting doll’ structure

The structure of the overall product is like a matryoshka or nesting doll. At the core is the group deferred FIA designed by ARS. The annuity tracks an index with an underlying asset pool of 55% equities and 45% fixed income. The index is custom-built and governed by a stabilizer or volatility-control mechanism.

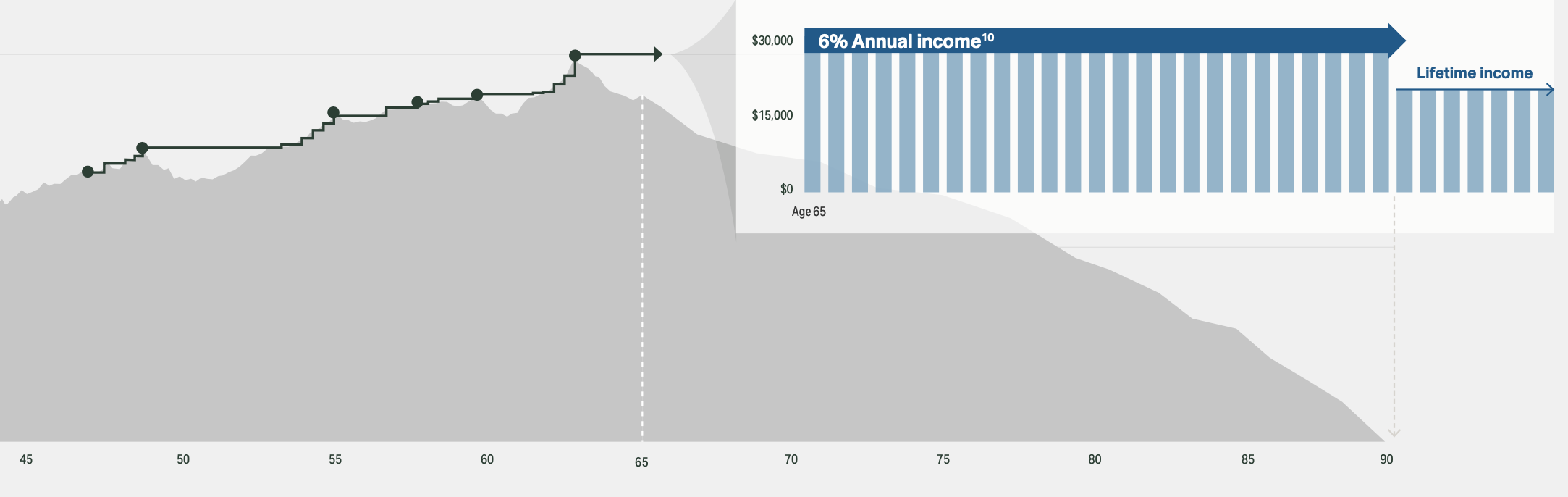

The annuity sits inside the TDF alongside State Street funds. When TDF investors reach age 47 or so, some of their monthly contributions start going into the annuity instead of into a fixed income fund. Through an auction process, five or six life insurers (Athene and Nationwide, initially) can bid for a portion of the incoming premium by offering a competitive crediting rate (a “participation rate,” or percentage of the index return). At the maturity date of the TDF, when the participants start reaching age 65, about 65% of the value of the TDF will be in the ARS Lifetime Income Builder FIA and about 35% in State Street equity funds.

Each insurer deposits its share of the premium into its general fund. Just as it would when managing an individual FIA, the insurer uses an amount roughly equal to the anticipated annual return on its general fund as a budget for buying a call option on the index. The insurer also guarantees that the annuity will provide the contract owner (or joint owners) with income for life.

All of these investment and insurance assets are held inside in a collective investment trust (CIT), a tax-exempt investment vehicle provided in this case by Global Trust Company. As the TDF’s investment fiduciary, Global Trust Company is responsible for choosing the TDF provider (State Street in this case) and the insurers (Athene and Nationwide, so far). Transamerica is the recordkeeper.

All of the insurers use the ARS Lifetime Income Builder FIA, so it’s a more or less level playing field for the insurers. Over time, index gains are locked in and credited to the annuity. Participants who own the TDF accrue units in the annuity, whose value is calculated daily, like that of a mutual fund share.

Dave Paulsen

“We unitized the indexed annuity, so that it trades like a mutual fund,” Dave Paulsen, chief distribution officer of ARS, told RIJ. “If it were sold to individuals, they could buy into it at today’s NAV [net asset value]. It’s fully liquid and transparent. We embed this in the TDF.” The daily NAV is calculated independently by Milliman, the global actuarial consulting firm.

The annuity “is a ‘holding’ in the TDF,” Paulsen told RIJ. “The value that participants see on their statements is fully liquid and available to move or withdraw. So participants get the growth of Lifetime Income Builder regardless of whether they stick around until retirement, when income payments begin. This is a key point. The participant does not give up growth during the accumulation phase, and has full flexibility to transfer or move the assets at any time.”

The income stage

At age 65 or so, the retired participant begins receiving an income stream fixed at 6% of the TDF’s peak value. Of that fixed income amount, about three-quarters (4.5%) will come from the annuity and about one-quarter (1.5%) from the equity funds. The product aims for the 6% payout, but doesn’t guarantee it. If the equity funds are ever depleted (by a combination of withdrawals and market volatility), the income will drop to 4.5% and remain there until all owners have died.

Distributions begin automatically when the TDF reaches its maturity date; the participant makes no active choice to enter the income phase and no IRA rollover is needed. The payments, Paulsen said, would move into a separate tax-deferred sleeve.

The retiree can either start spending that money or leave it in the plan (until Required Minimum Distributions begin) for continued growth. The annuity remains permanently deferred, so retired participants can always withdraw lump sums or liquidate their accounts (and receive proportionately less income).

The expense ratio of the State Street GTC Retirement Income Builder TDF is nine bps (total) per year until the participant reaches age 47. At that point, when contributions start going into the FIAs and the insurers set a floor under the value of the participant’s credits in them, the fee goes up to 20 basis points.

These costs are only a fraction of the annual costs of an income guarantee on a variable annuity, which can run as high as 1.5% per year. That’s because the FIA’s income rider wraps only around the value of the annuity, not the entire TDF value, and because the performance of the FIA is much more predictable than the performance of risky portfolio.

Insulating sponsors from liability

The use of the CIT (collective investment trust) to package the TDF, in lieu of a mutual fund structure, reduces the cost of the product while further distancing plan sponsors from legal responsibility for choosing insurers that will always keep their contractual promises. While the plan sponsor bears fiduciary responsibility for choosing the TDF provider (State Street, in this case), the CIT (Global Trust Company) is liable for selecting solid life insurers to underwrite the FIA.

CITs are gradually becoming the preferred legal structure for 401(k) annuity providers. In August 2023, Nuveen, the investment manager of TIAA, introduced its Lifecycle Income Series, a TDF containing the TIAA Secure Income Account deferred group annuity. “The trustee for the new CITs is SEI Trust Company, a leading provider of collective investment trusts to the U.S. retirement market and the ultimate fiduciary authority over the management of and investments made in the CIT, with Nuveen serving as advisor,” a Nuveen release said.

According to a white paper from MFS, “total CIT assets have doubled over the past decade due to its increased adoption among 401(k) plans. In 2022, total CIT assets were $4.6 trillion, and comprised 37%, or about $2.5 trillion, of total 401(k) plan assets. CIT growth has come primarily at the expense of mutual funds, which saw their share of 401(k) assets decline to 42% of total 401(k) assets.”

“The upswing in CITs, relative to mutual funds, as the vehicle of choice for TDFs appears largely due to cost,” writes attorney Maureen Gorman of the law firm of Mayer Brown, in a recent white paper. “For structural and regulatory reasons, they do not have boards of directors and are not subject to SEC filing requirements, and their target market consists of institutions rather than individual investors, resulting in lower marketing costs. With the explosion of excessive fee litigation relating to 401(k) investment options, plan fiduciaries have become increasingly sensitive to cost. Although mutual fund expense ratios have generally declined, CITs remain a bargain in many cases.”

Gorman touched on the idea that plan sponsors can reduce fiduciary responsibility for the choice of insurer by letting the CIT investment manager choose the insurer to guarantee the annuity embedded in a TDF that’s packaged in a CIT.

“Many employers who are reluctant to cause their plans to enter into insurance contracts directly with insurers on account of the fiduciary exposure are more comfortable selecting a CIT TDF, with an investment manager responsible for choosing the insurers backing the lifetime income options offered by the TDF,” she wrote.

“While the choice of the TDF as an investment option is itself a fiduciary act, many plan fiduciaries are more comfortable with evaluating the fund and its manager than with evaluating different insurance carriers. In the Setting Every Community Up for Retirement Enhancement Act (“SECURE”) Act of 2019, Congress created a new fiduciary safe harbor for choosing an annuity provider of “in-plan” annuities, but plan sponsors may continue to prefer that the choice of insurers (and satisfaction of the conditions of the safe harbor) be performed by a TDF investment manager.”

“Unfortunately,” she added, “the published guidance did not address several aspects of these products, especially those of guaranteed minimum withdrawal products, and the gap in guidance has widened with the development of more, and more sophisticated, versions of these products.”

Target market

Despite its internal complexity, State Street GTC Retirement Income Builder is meant to be virtually self-driving for the participant. “The annuity is purchased at the investment manager level,” Paulsen said in an interview. “There are no participant-level decisions. The complexity is taken off of the individual. If you force participants to make tradeoffs, take-up of the product will be low. By not asking people to make decisions that they are not prepared to make, but still making the fund fully liquid, you’ll see adoption rates increase rapidly.”

Paulsen sees middle-class plan participants as the product’s target market. “I think the top 10-15% of savers, those with the most assets, are likely to go to a financial adviser and roll assets over to a brokerage IRA. The bottom 15% probably won’t have enough savings to fund an annuity,” he said.

“For the remaining 75% in the middle, it will be important to have more guaranteed income in retirement. State Street GTC Retirement Income Builder can complement Social Security. If we attract the mass affluent, I think we can make a difference in how people retire.”

© 2024 RIJ Publishing LLC. All rights reserved.