Target Date Funds

The SECURE Act of 2019 did too little, too soon, in opening up 401(k) plans to all kinds of annuities. Some big 401(k) plans are ready to offer in-plan...

A ‘Nesting Doll’ of an In-Plan Annuity

ARS, State Street Global Advisors, Nationwide, Athene, Transamerica and Global Trust Company have brought to market the State Street GTC Retirement Income Builder, a target date fund with a...

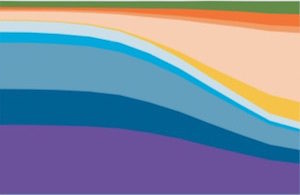

Target-date fund assets grow to $3.27T: Morningstar

Five providers control 79% of the target-date market: Vanguard, Fidelity, BlackRock, State Street, and American Funds, according to Morningstar's 2022 Target-Date Strategy Landscape report.

Are Target Date Funds the Perfect Vehicle for ‘In-Plan’ Annuities?

'Nearly two-thirds (63%) of target-date managers suggest the first-quarter 2020 period of heightened market volatility will increase client demand for guaranteed investments,' according to a Cerulli Associates analyst.

Wells Fargo’s New Annuity Wagon

Wells Fargo Asset Management's new target-date series of CITs comes with a built-in, optional retirement income strategy: systematic withdrawals plus an annuity starting at age 85.

BlackRock Makes a Bundle (with Annuities)

BlackRock, the giant asset manager, is adding a lifetime income dimension to its LifePath target date funds by partnering with Brighthouse, Equitable and Voya on a service that will...

T. Rowe Price adds growth to its TDFs

The third-largest issuer of target date funds, which reportedly lost TDF market share from 2017 to 2019, said it will raise the equity allocation of the funds' glide paths...

The SECURE Act Set To Pass (Finally)

'This is an early Christmas present,' said Melissa Kahn, managing director of the Defined Contribution team at State Street Global Advisors (SSgA), in an interview yesterday.

Voya rolls out risk-adjusted TDFs

In addition to selecting an age-appropriate target date fund (TDF), participants can select a risk-appropriate TDF (conservative, moderate or aggressive).

Wide variation seen in British target date funds

Here’s another instance--along with coverage ratios, fiduciary duties of advisors, and the decline of pensions--where the British and American retirement industries share certain challenges.

Target-date CITs grew in 2018: Morningstar

Assets in target-date strategies totaled more than $1.7 trillion at the end of 2018, with $1.1 trillion in mutual funds and approximately $660 billion in target date CITs. Vanguard...

New Fidelity TDFs are funds of active and passive funds

'We are introducing the Freedom Blend funds to meet the growing demand for a target-date strategy that incorporates active and passive investment capabilities in a single mutual fund,” said...

Inside new target date funds, Lincoln offers risk-adjustment options

Morningstar Investment Management LLC will provide the glide path, portfolio construction and ongoing management for each of the portfolio strategies.

In Target-Date Space, It’s Vanguard, Et Alia

Vanguard’s domination of TDF flows in recent years has paralleled its domination of overall mutual funds flows. Competitors search for ways to be different, but not too different.

Target Date Funds: What’s Under the Hood?

TDF investment returns, on average, fall short of their benchmark indices but perform about the same as all other mutual funds, say the authors of a new brief from...

Schwab’s new TDFs sport ultra-low fees

The new funds, which are available to employer-sponsored retirement plans, have an across-the-board expense ratio of eight basis points (0.08%) and no minimum investment requirements regardless of plan size.

DFA and S&P Collaborate on STRIDE Index

STRIDE stands for Shift To Retirement Income and DEcumulation. 'We see the index as an appropriate benchmark for the transition from wealth accumulation to income,' said Philip Murphy, vice...

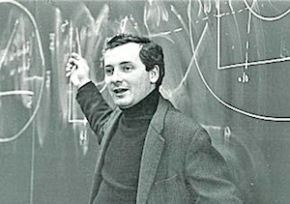

DFA’s Gerard O’Reilly Explains His Firm’s New TDFs

Dimensional Fund Advisors calls its new target date funds "Retirement Income" funds. How does DFA justify that ambitious title? O'Reilly, DFA's co-Chief Investment Officer and head of research, explains....

TIPS for the Long Run?

Whether you'd prefer the new Dimensional Target Date Retirement Income Funds over one of the "big three" TDFs might depend on whether you share Robert Merton and Zvi Bodie's...

Managed accounts gain ground against TDFs as default investment: Cogent

'This increased usage of managed accounts among Mega plans signals a growing desire in the industry to offer a more personalized solution for plan participants,' said Linda York, vice...