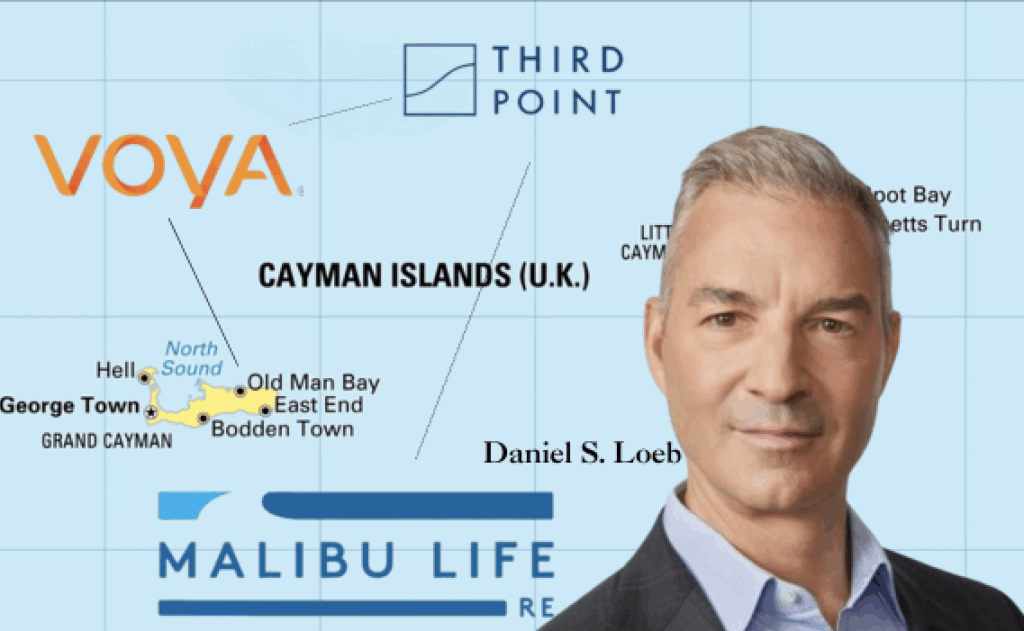

Daniel S. Loeb, the billionaire CEO of asset manager Third Point LLC, is going all-in on the arbitrage that RIJ calls the “Bermuda Triangle.” You know: The strategy involving fixed deferred annuities, private credit and offshore reinsurance.

Loeb, who happens to be a great-nephew of the inventor of Barbie, is charging into a mature, crowded, rate-sensitive, complicated business. It’s a business that has drawn scrutiny from U.S. and global regulators. Presumably, he knows all that.

In under two years, Loeb and his team have:

- Converted Third Point to London-listed Malibu Life Holdings

- Moved Third Point from Guernsey to the Cayman Islands

- Bought an $8 billion private-credit investment specialist

- Established Malibu Life Re, a reinsurer in the Cayman Islands

- Acquired a Texas-domiciled U.S. life insurer

- Hired a veteran Cayman reinsurance executive to run Malibu Life

- Agreed to provide “flow reinsurance” to an unnamed “blue-chip annuity platform”

- Secured equity commitments from Voya and its ReliaStar unit

- Prepared to issue a fixed deferred annuity in the U.S. in the first half of 2026

Loeb’s main departure from the Bermuda Triangle template involves choosing the Cayman Islands instead of Bermuda as Malibu’s headquarters.

Otherwise, he’s following the playbook written by Apollo/Athene, KKR/Global Atlantic, Brookfield/American Equity, etc. Like them, Loeb has set up the pure version of the Triangle. That’s where a fixed annuity issuer, an offshore reinsurer, and a private debt originator are siblings in the same holding company.

Who?

Key staffers in the new venture include Loeb, Robert Hou, and Gary Dombowsky. Loeb, 63, is not a direct descendant of the founders of the investment firm Kuhn, Loeb & Co. (which lasted from 1867 to 1984). His father, Ronald, was a director and briefly president at Mattel. His great-aunt, Ruth Handler, created Mattel’s Barbie Doll.

A 1984 economics graduate of Columbia, Loeb worked in distressed debt and high-yield bonds as an executive at Jeffries LLC and Citicorp, respectively, in the early 1990s. He started Third Point Management in 1995 “with $3.3 million from family and friends.”

Robert Hou, who will serve as Malibu’s COO, joined Third Point in 2021 from Blackstone’s Insurance Solutions Group. He had helped launch that group, which now manages hundreds of billions of dollars in insurance company assets.

For experience running a reinsurer in the Cayman Islands, Third Point hired Gary Dombowsky as CEO of Malibu. Dombowsky had co-founded Knighthead Annuity & Life with $230 million raised from 30 investors in 2014. His co-founder, Nate Gemmiti, is now CEO of Cayman-based Triangle upstart Ibexis Life & Annuity.)

In October 2020, the two men founded the Cayman International Reinsurance Companies Association (CIRCA). The two had a shared history at Scottish Re’s since-defunct reinsurance operations (later bankrupt) in the Cayman Islands. Dombowsky left Knighthead and joined Malibu this year.

What?

In its new organization, Third Point owns all of Malibu Holding, which owns all of Malibu Life Re and TruSpire. Malibu Life Re owns all of Malibu Life Re Segregated Portfolio 1.

TruSpire, which Third Point acquired from Mutual of America, has been in run-off. The life B++ insurer is licensed in 44 states. It’s a member of the Federal Home Loan Bank, a key lender of low-cost funds to Bermuda Triangle companies.

[Last month, AM Best placed the Financial Strength Rating of B++ (Good) and the Long-Term Issuer Credit Rating of “bbb+” (Good) of TruSpire Retirement Insurance Company (TruSpire) (Irving, TX) “under review with developing implications” in the wake of the Malibu Re deal.]

Malibu Life Holdings was, at last notice, more or less an address in Georgetown, Grand Cayman. It still outsources most of its functions; its local management and Cayman residency requirement is outsourced to a Cayman company, Artex (Artexrisk.com).

Malibu Life Re has already reinsured $981 million in annuity liabilities (on a 25% quota share, funds-withheld coinsurance basis) for a so-far unnamed “blue-chip” U.S. annuity platform that was established in 2020. There’s an estimated $2 billion more in that pipeline.

Voya is also in the picture, as an investor, and possibly more. Voya Retirement Insurance and Annuity and Voya-unit ReliaStar Life Insurance Company both agreed last July to buy up to $25 million in ordinary shares of Malibu.

Is Voya Malibu’s anonymous blue chip reinsurance partner? A Voya spokesperson offered a “no comment” response.

The Birch Grove acquisition, which raises Third Point’s total AUM to ~$21 billion, should give Third Point new expertise in finding borrowers, originating leveraged loans and bundling the loans into collateralized loan obligations (CLOs).

If Malibu Life follows the Triangle playbook, it would finance the private credit business, keeping only the senior tranches of the CLOs on its own balance sheet. Third Point, the investment arm and ultimate owner of the insurer and reinsurer, would presumably sell lower tranches to other institutional investors and keep the highest risk or “equity” tranche for itself.

Why and why not?

In 2024, Third Point’s back was to the wall. Its flagship closed-end fund was trading at a 20% discount. Investment returns were lagging the benchmark. Its investors were restless. In August 2024, Loeb created a team to brainstorm a corporate reboot.

Loeb’s decided to do a “reverse takeover” that would turn Third Point into London-listed Malibu Life Holdings and clone the Apollo/Athene insurance strategy. That proposal didn’t please all the investors, who marshalled opposition to it.

One Third Point investor told the Financial Times in August 2025 that the proposed business was a latecomer in a crowded field. “Every alternative asset manager now has some sort of reinsurance or insurance client,” said Tom Treanor of Asset Value Investors, part of the investor group opposed to the takeover.

But Loeb, a 25% owner of Third Point, was able to push the plan through. Rupert Dorey, chair of the board of TPIL, told FT: “The board is confident it has found that balance through a thorough, transparent and independent process, and on behalf of shareholders is genuinely excited by the potential within Malibu.”

Even if Loeb is a latecomer to the party, the party is arguably getting bigger. In an August executive order, President Trump blessed the distribution of private credit, crypto, and annuities through 401(k)s. There’s about $9 trillion in U.S. defined contribution plans, and trillions more in other retirement vehicles. Whether regulators will remove all barriers to the distribution of alternative assets through qualified plans remains to be seen. BlackRock, Apollo and Empower are campaigning to make sure they will.

What could spoil the party? Revenue from the sale of fixed deferred annuities (fixed-rate and fixed indexed) by asset manager-led life insurers is essential to the funding and warehousing of private credit instruments. Legal arbitrage—between state/federal regimes and onshore/offshore regimes—is also essential to the success of the strategy.

Anything that slows the sale of fixed deferred annuities could steal the trend’s fuel supply. Any future regulations that shrink the benefits of offshore reinsurance or rail against the conflicts of interest of the pure Bermuda Triangle strategy (where counterparties are closely-affiliated) could hurt the trend. Future Democratic administrators may try (again) to reclassify FIAs as securities, or to put hurdles between them and qualified plans.

Changes in interest rates could also affect the sale of deferred annuities. The effect of interest rates is complex. Higher rates mean higher yields and higher sales of fixed deferred annuities. On the other hand, falling rates have been correlated with rising equity prices, which are correlated with more attractive FIA returns.

And, of course, a big credit crisis would wreak havoc with valuations.

© 2025 RIJ Publishing LLC. All rights reserved.