New York Life Insurance Company today announced that all four of the major rating agencies have recently affirmed the company’s highest possible ratings for financial strength. Earlier this week Standard & Poor’s affirmed its triple-A financial strength rating on New York Life, which followed recent similar actions by Moody’s Investors Service (Aaa), Fitch Ratings (AAA) and A.M. Best (A++).

Ted Mathas, chairman, president and CEO of New York Life said, “We continue to manage the company for long term financial strength, maintaining robust capital and liquidity, so we can always maintain the highest level of policyholder safety and security, no matter what the external environment brings our way.

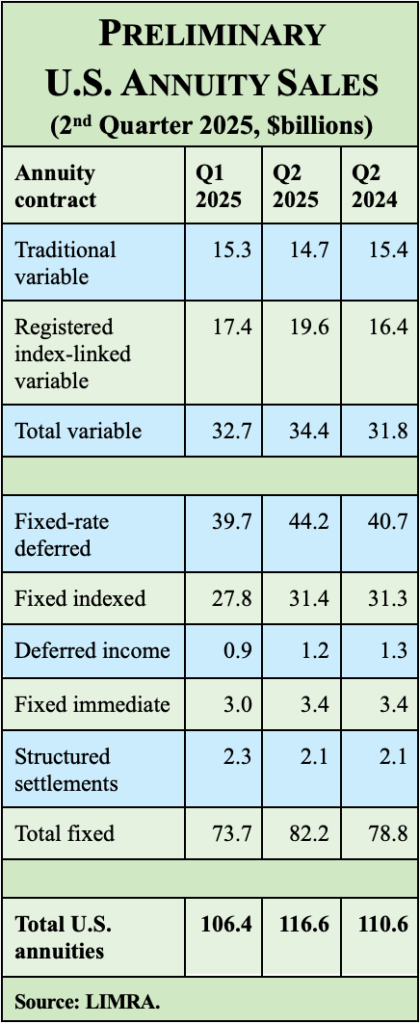

“The recent actions of both consumers and the rating agencies provide validation of our strategic positioning as a mutual company operating for the sole benefit of our policyholders. In the current crisis we are witnessing a flight to quality with our life insurance sales outperforming the industry by a wide margin, and annuity sales setting new records.

“All of the four major rating agencies have affirmed our unique place as one of three life insurers with the highest ratings out of more than 1,000 in the United States. We will continue to manage the company solely in the best interests of our policyholders’ safety and not in anticipation of the reaction of the rating agencies. We do think, however, that these affirmations of the highest possible ratings accurately reflect our continued financial strength and strong operating results.”

In Moody’s news release, the agency commented, “New York Life has performed well in a very difficult economic environment. Although the company has not been immune to industry stresses, its modest financial leverage, prudent investment portfolio, strong liquidity profile, and conservative product designs have limited financial stress during a period in which many other life insurers have seen considerably greater strain.”

Among the highlights from the rating agencies’ comments in affirming New York Life’s ratings are:

Standard & Poor’s – Rating of AAA (highest) affirmed June 17, 2009

- Noted the exceptional quality of the company’s career agency force, its very strong risk based capital position, its very strong operating earnings, and its growing presence in international markets;

- The company’s superior brand and competitive position in individual life and annuities;

- Sustained extremely strong competitive position and business profile, even in the current harsh economic environment;

- The group’s financial profile remains very strong despite relative pressures from investment losses and capitalization;

- S&P considers New York Life to be one of the most respected names in the domestic life insurance business, characterized by a commitment to mutuality and its policyholders.

Moody’s – Rating of Aaa (highest) affirmed March 17, 2009

- Noted New York Life’s continued leading position in the U.S. life insurance market, as well as on its significant financial flexibility and operational scale, earnings diversity, very strong liquidity, and outstanding capitalization;

- Stable and productive career-agency distribution system;

- Well-recognized and highly regarded brand name;

- Strong national and growing international presence;

- Significant embedded profitability in the existing book of business;

- Overall quality of New York Life’s investment portfolio is excellent.*

Fitch – Rating of AAA (highest) affirmed April 16, 2009

- Noted New York Life’s very strong capital position and very strong capital adequacy;

- Very strong liquidity and more than adequate financial flexibility;

- Favorable business profile, characterized by its excellent market position in traditional individual life insurance and fixed annuity markets.

A.M. Best – Rating of A++ (highest) affirmed June 11, 2009

- Noted New York Life’s leading market position in U.S. life insurance;

- Highly productive career agency force;

- Superior risk adjusted capitalization;

- Commitment to mutuality;

- One of the most creditworthy liability profiles in the industry;

- New York Life’s investment management capabilities are strong.

For the agencies’ complete news release commentary on New York Life click here:

New York Life Insurance Company, a Fortune 100 company founded in 1845, is the largest mutual life insurance company in the United States and one of the largest life insurers in the world. Headquartered in New York City, New York Life’s family of companies offers life insurance, retirement income, investments and long-term care insurance. New York Life Investments** provides institutional asset management and retirement plan services. Other New York Life affiliates provide an array of securities products and services, as well as institutional and retail mutual funds.

Visit New York Life’s Web site at http://www.newyorklife.com for more information.

* From Moody’s credit opinion report, March 20, 2009

** New York Life Investments is a service mark used by New York Life Investment Management Holdings LLC and its subsidiary, New York Life Investment Management LLC.