Can Retirees “Thrive” On Deferred Income Annuities?

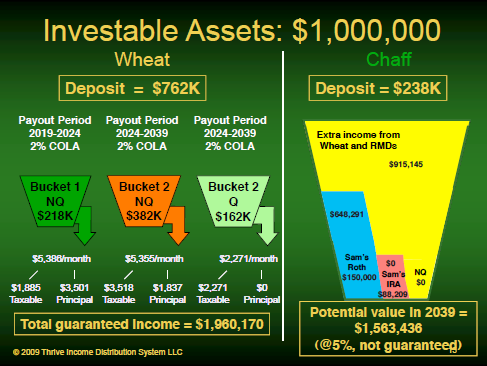

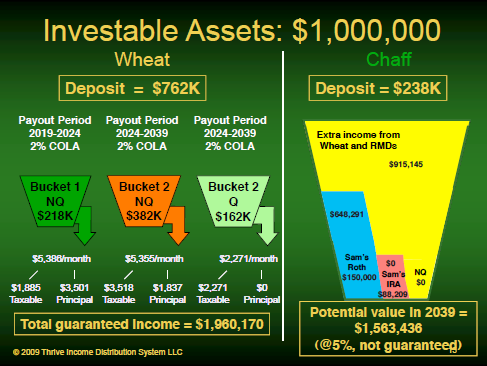

Iowa insurance man Curtis Cloke thinks he has solved the "annuity puzzle" by building ladders of deferred income annuities for his clients. Now he and his partners are scaling up his "Thrive" system and taking it national.