Money Myths, Legal Realities

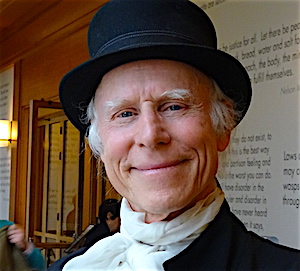

At a conference at Harvard Law School called "Money as a Democratic Medium," law professors debated the origins, purposes, and rightful ownership of money in the modern era. (Photo: Bil Lewis portraying President James Madison, at the conference.)