Annuities

Eight years after collapsing under the weight of CDS losses and four years after emerging from federal ownership, AIG is again atop the annuity sales charts, with $9.78 billion...

Great American Offers No-Commission Indexed Annuity

'The DOL gave it some impetus, but the real issue is that the markets are pretty much topping out,' said Great American senior vice president Malott Nyhart.

Great Hopes Ride on Great-West’s New Annuity

Great-West Financial's new Smart Track II variable annuity contract has four different income riders. Will it help Bob Reynolds achieve his goal of making Great-West a top-five retirement company...

Surrender to Lapse Risk? Not These Insurers

Over-estimates of variable annuity lapse rates have cost life insurers billions. A group of VA issuers is now working with actuaries at Ruark Consulting to predict those rates more...

A Quiet Winter for Variable Annuities: Morningstar

'A quiet quarter is not a bad thing,' writes Morningstar's Senior Product Manager in his quarterly report on VA product updates. 'It gives advisors a chance to focus their...

The Cinderella Annuity

Has the time finally arrived for the variable income annuity? At TIAA, where the VIA was invented, they say it never left. New research from the TIAA Institute compares...

Voya Launches Quest Indexed Annuities

The new contracts are aimed primarily at the independent broker-dealer channel and offer a lifetime income option, said Chad Tope, Voya Financial's president of Annuity and Asset Sales.

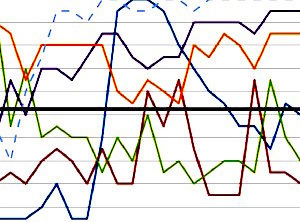

Indexed annuity industry sets sales record in 1Q2016: Wink

Allianz Life was the dominant carrier, with an 18.4% share of the indexed market. Its Allianz 222 Annuity was the top-selling indexed annuity for the fifth consecutive quarter.

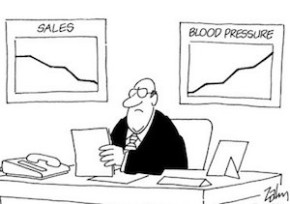

Expect Sharp Drop in VA Sales: LIMRA

'We are seeing a significant shift in the annuity market,” said Todd Giesing, assistant research director at LIMRA's Secure Retirement Institute. 'We have to go back 20 years—to 1995—to...

First quarter annuity sales: Better for fixed than variable

Jackson National was again the top seller of variable annuities, Allianz Life the leader in indexed annuities and New York Life led fixed-annuity sales. But AIG issued the most...

First Sign of Blood from DOL Fiduciary Rule

'The unexpected change regarding FIAs in the final DOL rule and the related Best Interest Contract Exemption has cast a cloud over our future growth rate,' said John Matovina,...

Integrity Life enhances popular Indextra indexed annuity

Launched Sept. 29, 2014, Indextra has garnered sales to date of more than $800 million, making it the most successful first-year product debut in W&S Financial Group Distributors history....

Symetra’s new indexed annuity offers rising lifetime payout rates

If a single person age 60 to 64 invested $100,000 in a Symetra Income Edge FIA contract, under the level option he or she would be eligible for a...

Record sales of indexed annuities brighten otherwise flat 2015

Fixed indexed annuity sales hit a new high of $16.1 billion in the fourth quarter of 2015, up 11.9% from $14.4 billion in the prior quarter and up...

Security Benefit offers floating-rate fixed deferred annuity

Contract owners receive a guaranteed base rate of interest that is set for the contract’s guarantee period, plus the 3-month ICE LIBOR USD Rate (subject to a cap), which...

With 14.5% market share, Allianz Life led FIA sellers in 2015

LIMRA Secure Retirement Institute and Wink Inc. offer differing views on the way indexed annuity sales will be affected by the impending DOL fiduciary rule.

Stan the Annuity Man Goes (Almost) Robo

Insurance super-agent Stan Haithcock, aka Stan the Annuity Man, says that his new cluster of annuity sales websites position him to become the first truly direct seller of fixed...

Indexed annuities post new sales records in 2015

Total annuity sales improved for the third consecutive quarter, driven by strong fixed annuity results. In fourth quarter, annuity sales were $61.4 billion, 5% higher than the prior year....

Bank annuity sales dip 2.5% in first three-quarters of 2015

Over two-thirds (68.4%) of BHCs with over $10 billion in assets earned third quarter year-to-date annuity commissions of $2.49 billion, constituting 94.8% of total annuity commissions reported.

The Principal offers “simpler” indexed annuity

At a time when other indexed annuity issuers are experimenting with custom indices, this product links its performance only to the S&P 500, according to the issuer.