_Position: Cover

The DOL may have put a crimp in the sales of the hot-selling but controversial annuity product when, without specific warning, it raised the regulatory bar for the sale...

The Reverse Mortgage Puzzle

With so many Boomers retiring with low average savings but high average home equity, demand for government-insured reverse mortgages, or HECMs, should be growing. Instead, it's shrinking. Here's why....

Bright Ideas from the SOA Investment Meeting

Last week, the Society of Actuaries held its investment conference in New York. We weren't far from the brass statue of the Wall Street bull, but the sell-side's unquenchable...

Proof that SPIAs Still Make Sense

Even when interest rates are low, adding a lifetime income annuity to a fund portfolio 1) reduces the risk of portfolio ruin, 2) increases current income, and, 3) if...

Stan the Annuity Man Goes (Almost) Robo

Insurance super-agent Stan Haithcock, aka Stan the Annuity Man, says that his new cluster of annuity sales websites position him to become the first truly direct seller of fixed...

Scaling Retirement Solutions

At the EDHEC Risk Institute in France, financial researchers are trying to figure out how advisors can leverage technology to "mass customize" the goal-based approach to retirement income planning....

What Social Media Can Teach Retirement Marketers

Target marketers, the word "retirement" is a buzzkill. That's what sociologists at research startup MotivIndex concluded after studying Facebook threads, Instagram feeds, and LinkedIn posts.

Insurance U. Becomes Retirement U.

Conceived by Solomon Huebner (pictured in the 1950s) to give life insurance salesmen a professional gloss, The American College has, with money from New York Life, become Retirement Income...

Advisors: How to Outsmart the Smartphone

The shorthand message to registered investment advisors at the Technology Tools for Today (T3) conference in chilly Fort Lauderdale this week: Don't end up as a Yellow Cab in...

Legal Defenses

Will the financial services industry sue the Department of Labor if it doesn't like the final wording of the fiduciary rule? And if it does, what happens next? Four...

Betterment Wants to Build a Better 401(k)

Betterment, the largest independent retail robo-advisor, said Wednesday that it has entered the small company segment of the 401(k) market. But will its model confine it to the shallow...

More Than a Nice Interface?

Jon Stein, CEO of Betterment, the biggest of the 'robo-advisors,' talked with RIJ recently at Betterment headquarters--three converted lofts in an historic building just west of the Flatiron Building...

Video: Income ‘Roundtable’ at The American College

Retirement income sources, including annuities, reverse mortgages, Social Security and LTCI, were topics of this two-hour seminar from the Retirement Income Certified Professional program at The American College. (Above:...

Tales from the Annuity Frontier

Three pioneers in the creative use of annuities in retirement portfolios--Wade Pfau, Joe Tomlinson, and Steve Vernon--have created an "efficient frontier" for deferred income annuities in two reports published...

‘The Big Short’ Is No Tall Tale

'The Big Short,' in which the actress Margot Roddie (above) provides exposition from her bath, is an excellent docudrama based on Michael Lewis' bestseller. It blames the financial crisis...

Bob Pozen Knows Retirement

'My proposal was to link the growth of Social Security benefits of the upper third of earners to CPI growth while letting the benefits of the lower third of...

No-Nonsense Income Planning

Jim Otar has explained his "zone" approach to retirement income planning in hundreds of presentations to thousands of advisors since 1997. He spoke at the IMCA retirement conference in...

Waiting on the Fed

'The long end of the curve will stay stable but the front end of the curve will go up, so that we’ll have eventually have 2.5% at the short...

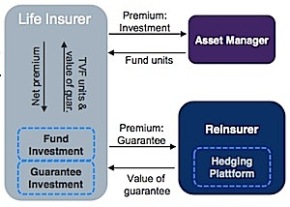

Removing ‘Lapse Risk’ from Variable Annuities

“Almost every major variable annuity writer has absorbed large write-downs on ‘policyholder behavior assumption updates,’” said a Munich Re executive. “So how do we take out that risk?”

Deep in the Data Mines

At the Society of Actuaries Equity-Based Insurance Guarantees conference in Chicago this week, the use of 'predictive modeling' to unearth buried or cryptic data was strongly encouraged.