_Position: Cover

After my father died, I called his reverse mortgage lender and said the house was theirs. Little did I know that I'd get "sued," that the house had to...

Video: RIJ Editor at The American College

In this video, Retirement Income Journal publisher and editor Kerry Pechter chats with David Littell of The American College about opportunities and challenges that await advisers who choose to...

Obama Gives ‘Auto-IRA’ a Shout Out—and a New Name

Mr. Obama has ordered the creation (on a pilot basis) of a "myRA" program, bringing closer to fruition a multi-year effort by liberal policymakers to expand access to workplace...

A Physician Heals Himself (Financially)

Baltimore radiologist Dimitri Merine hopes to retire in seven years, at age 63. So he created a do-it-yourself retirement income plan, using systematic withdrawals, dividends, a bond ladder and...

A Chat with Jackson’s Cliff Jack

The executive vice president and head of retail at Jackson National Life (and former chairman of the National Association of Variable Annuities) spoke with RIJ about the two kinds...

Probing the Minds of Advisers

Manufacturers trying to build retirement income solutions for advisers face the fact that advisers vary widely in their approaches to retirement planning, says Howard Schneider of Practical Perspectives, which...

A Liquidity Option for DIAs?

The desirability and feasibility of allowing owners of deferred income annuities to convert income streams to lump sums was discussed at the American Law Institute's Continuing Legal Education Conference...

Comment: Goodbye, Mature Market Institute

Last spring, MetLife pulled the plug on its popular, respected thought-leadership unit after a 15-year run. Did the decision signify a loss of faith in the Boomer retirement opportunity?

Is There a Retirement Crisis or Not?

Two recent reports from different organizations paint very different portraits of retirement readiness in the U.S.

The Ghost of VA Contracts Past

Insurers and asset managers love managed-vol funds and VA portfolios, whose sales are climbing. But in a low-vol bull market, advisors wonder about their value.

RetiremEntrepreneur: Lou Harvey

Louis S. Harvey is president and CEO of Dalbar, Inc., a Boston-based research firm that performs a variety of evaluations and quality ratings of financial services practices and communications.

VA Issuers Limit Inflows in 3Q: Morningstar

During 3Q 2013, carriers filed 84 annuity product changes. AXA Equitable made a buyout offer, several carriers limited new payments to contracts, and Jackson National made living benefits available...

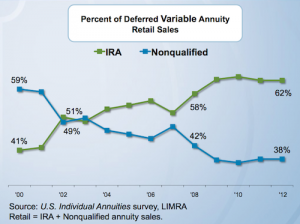

The Hangover

Publicly held annuity issuers could be handicapped in the future by lingering liabilities, and should have foreseen the impact of IRA money flowing into VAs starting in 2002, says...

FINRA Talks a Good Game

FINRA's recent report on conflicts of interest at brokerages laid bare some dingy practices. Some say it's a move to burnish FINRA's credentials as a candidate for regulator of...

In Finland: Saunas are Hot, Retirement is Cool

Finnish people love their saunas and their nation's retirement system, which features a basic tax-funded pension, a compulsory collectively-managed DC plan for private-sector workers, and a government pension for...

A Case of Low Book Yields

“Even if rates were to slowly rise, they would still be historically low. There would be less pressure on companies, but the overall portfolio rate of return could continue...

The ‘Floor-Leverage’ Model

An easy income recipe from Financial Engines: Put 15% of your savings in a triple- leveraged stock ETF and the rest in something safe, like a TIPS ladder.

A Roundup of RIIA’s Meeting in Texas

Michael Finke of Texas Tech, John Salter of Evensky & Katz Wealth Management, Larry Cohen of Strategic Business Insights and others presented at the Retirement Income Industry Association's annual...

A Conspiracy against Public Pensions?

Either paranoid or perceptive, public pension administrators say they are being sandbagged by a pervasive, persistent stealth effort to convert their DB plans to DC and gain greater control...

Why Retirees Should Choose DIAs over SPIAs

While partial annuitization causes an initial drop in financial assets, the income from annuities reduces the subsequent drawdown from investments. "In fact, the financial legacy is larger for...