Featured

The shortcomings of the voluntary retirement savings system in the U.S. should no longer be ignored, writes our guest columnist, the co-founder, president and CEO of Convergent Retirement Plan...

Leave Retirement to the Professionals, Actuaries Say

A new report from the American Academy of Actuaries posits four basic principles that, if followed, it believes will lead to better pension plans and more secure retirements for...

BlackRock declares itself the retirement leader, hires Bruce Wolfe

This week, BlackRock has created a combined United States Retirement Group (USRG) to coordinate and grow its sales into the DC and IRA markets. Chip Castille will be CEO...

Fidelity sued again over plan fees

The same plaintiff's attorneys are after Fidelity again--for overcharging its own plan for recordkeeping. The alleged overcharge--about $90 million over five years--amounts to less than 20 basis points (about...

Take Me to Your Leader

The retirement movement needs more focus. There are lots of strong voices, but they're not singing in the same language from the same hymn book at the same time.

RetiremEntrepreneur: Borden Ayers

Borden Ayers is creator of the Retirement Management Executive Forum, a unit of Diversified Services Group in Philadelphia. The RMEF hosts meetings where executives from 33 select retirement companies...

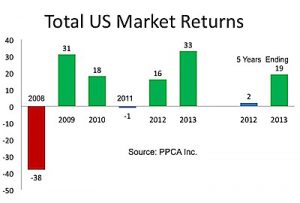

The Equities Outlook for 2014

Even though stock prices have surged, both dividends and earnings have kept pace. Prices therefore appear to be reasonable going into 2014, according Ron Surz, who analyzes the markets...

FINRA Talks a Good Game, Part II

FINRA Regulatory Notice 13-45, on the heels of the FINRA Conflict of Interest report, may be its way of telling the DoL that FINRA can make the suitability standard...

A Guide that Perplexes

“An annuity is a contract with an insurance company.” Sadly, many texts about annuities begin this way. You might as well describe marriage to teenagers as “a legal contract...

Inflation-Proof Retirement Income

American College professor Wade Pfau shows how to build a ladder of Treasury Inflation-Protected Securities for retirement income. At current prices, a 30-year ladder that would generate $50,000 a...

Seven Wishes for the Year Ahead

What will happen in the retirement industry in 2014? Beats me. I can only share a few of the things I hope might happen.

A Crash in Late 2014?

"We can guess at a market peak sometime between Sept. 2014 and June 2015, at a level much higher than the current one. We can, however, be pretty sure...

RetiremEntrepreneur: Robert Klein

West Coast CFP, CPA and RICP Robert Klein has jumped on the retirement bandwagon, recasting his business as the Retirement Income Center, becoming a MarketWatch RetireMentor and putting fixed...

What Fools These Mortals Be

E*Trade, TD Ameritrade and Merrill Edge all dangle a $600 signing bonus to people who open new brokerage accounts with cash--lots and lots of cash, it turns out.

Deconstructing Warren

In new research, three quants from AQR Capital Management have tried to explain exactly why Warren Buffett has been so successful. They neglect to mention that he made the...

Nationwide Ties New VA Income Rider to Managed-Vol Funds

For its deferral bonus, the "Income Capture" GLWB offers a simple interest rate credit of 3% plus the nominal rate of the monthly 10-year Treasury constant maturity (currently 2.86%).

The Long Short Run

In the world as it is, we are all Japan in the early 1990’s, looking ahead to two or more decades of lost economic growth, observes the economist at...

PacLife launches fixed annuity with GLWB and roll-up

The product, which may be unprecedented, merges the most popular annuity options with the most basic annuity chassis. It’s a little like opting for heated leather seats, turbo and...

Four Fallacies of the Second Great Depression

The statement, 'The more the government borrows, the more it has to pay for its borrowing,' is sometimes true and sometimes false, writes this economist and author.

Use These Maps to Find Boomer Wealth

Recent surveys of plan participants and IRA owners from Cerulli Associates and the Investment Company Institute shed light on a pivotal question: Which type of account will most Boomers...