International

Since 2012, when auto-enrollment was launched in Britain, workplace pension participation in the public and private sectors has increased to 78% in 2016 from a low of 55% in...

DB-DC hybrid idea resurfaces in UK; launches in Germany on January 1

The British government is looking anew at a hybrid defined contribution plan design that would give participants a non-guaranteed variable income (with or without smoothing) in retirement.

Allianz, Aegon et al Inject New ‘Variable’ into Dutch DC Biz

In the Netherlands, American-style drawdowns of variable payments from defined contribution plans is a novel idea.

Political turmoil sidelines UK pension reform

'If you’re under 40 your income has been eroding and your ability to grow wealth assets is almost non-existent,' said one official. 'The parties’ promises need to catch up...

How Ticos Turn DC Savings to Income

Retirees can take a monthly income equal to 1/12 of the earnings on their DC savings, or they can take a “scheduled withdrawal” where their accumulation is divided by...

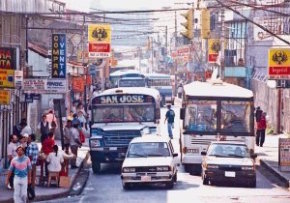

Más o Menos: Ticos Cheerfully Eke By

With 4.8 million people, Costa Rica’s problems are comparable to those of a big U.S. city, like Los Angeles or Chicago. Yet the tensions of a large U.S. city...

Dream-House Shopping in Costa Rica

The house was for sale. Its mystical vibe seduced them into paying $150,000 in cash. Monkeys, sloths, macaws, butterflies and gekkos would be their neighbors as the couple aged....

Skin in the (Costa Rican Retirement) Game

How do Costa Ricans pay for retirement? In San Jose, Alvaro Ramos Chaves (above), the pensions regulator, told RIJ how his nation’s mandatory DB and DC plans work. His...

Tilting at windmills

A Danish pension fund's investment in American wind farms looked like a safe diversification bet--until the prevailing price of electricity in Texas dropped by more than 50%.

In the Netherlands, DB plans said to out-deliver DC plans

Seven percentage points of the extra return produced by DB plans were due to shared investment risk between current and future generations. The remaining 13 percentage points came from...

Investors not applauding Genworth sale to China Oceanwide

Shareholders, who have been stewing for months over Genworth’s debt load, reacted to the acquisition by selling Genworth stock. The share price fell almost 4%, to $4.26, in early...

Jackson National and the Rolling Stones. Of course.

Sponsored by the British-owned, Michigan-based insurer, a massive traveling exhibit called "Exhibitionism" will feature the personal memorabilia of Mick Jagger, Charlie Watts, Keith Richards and Ronnie Wood. It opens...

Chile’s Pension Crunch

The author, a former presidential candidate and finance minister of Chile, teaches at Columbia University's School of International and Public Affairs.

Brexit a “negative” for US life insurers: Fitch Ratings

The Brexit vote will negatively affect GDP growth in the UK and elsewhere, which will likely prompt central banks around the world to extend their monetary easing policies, Fitch...

A new topic for Brits to argue about: Decumulation

Two UK small-plan providers, The People's Pension and Now Pensions, don't want NEST, the public DC option for small companies, to offer a retirement income strategy in competition with...

Poland’s experiment with private pension funds nears end

Inspired by the late-90s equities boom, the so-called OFE program helped Poland develop a fledgling capital market, centered on the Warsaw Stock Exchange. But then came the financial crisis....

Brexit: A Long Goodbye, Not a Clean Break

Britain's unemployment rate was low in the run-up to its referendum on EU membership, and the UK needs its 2.1 million European workers, writes The Conference Board's senior economist...

European pension executives criticize quantitative easing

The European Central Bank is “distorting the market” for corporate debt, several pension executives said at an institutional investors' summit in Vienna this week.

Chinese bid to acquire Fidelity & Guaranty Life delayed

Anbang withdrew its application to acquire the company with the New York State Department of Financial Services, Fidelity & Guaranty said in a filing on Tuesday with the Securities...

In UK, Aegon shifts focus from annuities to web-mediated advice

In 2010, Aegon decided to start withdrawing from the UK annuity market, believing that annuities wouldn’t meet its long-term risk adjusted return requirements.