Research

Here's new research on tax avoidance among the very rich, the logic that millionaires use when buying equities, considerations for plan sponsors when estimating income from 401(k) balances, and...

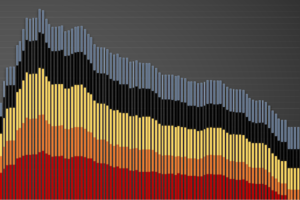

Where investors put their money in February: Morningstar

ETFs collected roughly $92 billion, driven by a move into passive equity funds, while open-end mutual funds took in $53 billion, led by flows into actively managed fixed-income strategies,...

Comfort with CITs has grown: Cerulli

Driven by plan sponsors’ pursuit of lower-cost alternatives, CITs have captured marketshare from mutual funds, says the latest issue of The Cerulli Edge--US Monthly Product Trends report.

‘COVID-19 is not a retirement story’: CRR

'A hot topic these days is how COVID-19 and the ensuing recession have affected retirement. The surprising answer may be: Not very much,' write Alicia Munnell and Anqi Chen...

Beware the ‘Specialized’ ETFs

In this month's Research Roundup, RIJ shares four recent academic papers on the proliferation of ETFs, the danger (or not) of national debt, rational inflation expectations, and the impact...

Fear of longevity: A victim of COVID-19?

The percentage of consumers surveyed who rated lifetime income as highly valuable fell to 63% from 71% between February and August 2020, according to a recent CANNEX-Greenwald Research survey.

How to Solve the World’s Retirement Crisis

Retrofitting 401(k) plans with lifetime income options is one of the thorniest challenges of our time. We describe three possible solutions to that puzzle, from Nobelist Robert Merton and...

Take ‘AIM’ at Retirement Income Goals

In this excerpt from his new book, 'Lifetime Income to Retire with Strength,' AM Best actuary Bruno Caron presents an example of his 'AIM' retirement income planning method. He...

Election’s Impact on Financial Services Industry: Aite Group

A team of analysts at the Aite Group offers tentative forecasts of the incoming Biden administration's impact on the regulation of the financial services industry in the US. The...

Pace of portfolio construction outsourcing will slow: Cerulli

In times of uncertainty, more advisers prefer to retain control over investment decisions rather than follow outsourced or company-mandated portfolio adjustments, the research firm said in a new report....

The top 1%’s share of U.S income (and more)

The latest crop of research includes a CBO report on U.S. income distribution, a look at the low usage of reverse mortgages, a study of the effect of accumulation...

A Closer Look at CLOs (and Other U.S. Credit)

Bond mavens, check this out. A new SEC report describes how most of the $54-trillion dollar U.S. credit market survived last spring's financial crisis. It covers securitized 'leveraged loans,'...

Who Rules the Top 1%?

Private businesses and partnerships lead most often to the top wealth brackets in the U.S., new research shows. In this edition of Research Roundup, we bring you summaries of...

COVID-19 Will Cause a Drop in AUM: Cerulli

'Around the world, investments into private markets slowed in the first half of 2020, with only US$433.7 billion of capital raised,' said an analyst at the global analytics and...

Virus and low-rates cut deep into Q2 annuity sales: LIMRA SRI

'We believe investors will hold off purchasing income annuity products, hoping interest rates rebound over the next 6–12 months,' said Todd Giesing, senior annuity researcher at LIMRA SRI.

Demand for income-generating products is underestimated: CANNEX

Only one in seven advisors believes the average client is very interested in an income-generating product, but 42% of consumers say they are (or already own one), according to...

CBO: Crisis will cost US economy $15.7tr over 10 years

The Congressional Budget Office projects that from 2020 to 2030, cumulative nominal GDP will be $15.7 trillion (5.3%) less than the CBO projected in January.

Research Roundup

For weeks, interesting studies have been gushing from the National Bureau of Economic Research and elsewhere on the economic implications of COVID-19. We've selected and summarized seven of them...

Advisers feel confidence and caution, survey shows

While most advisers say that social-distancing hasn't hampered their ability to serve clients, 'they acknowledge a negative impact on revenues and profitability,' according to a new report from Practical...

Portfolio Rebound: How Long Should It Take?

Using his proprietary 'aftcasting' technique instead of Monte Carlo simulations, the author shows how long it will probably take different portfolios to recover after a negative market shock.