Blueprint Income is the new name of what was Abaris Financial, a firm created in 2014 in Philadelphia to sell immediate and deferred income annuities via licensed phone reps to do-it-yourself Gen-Xers and others over the Internet.

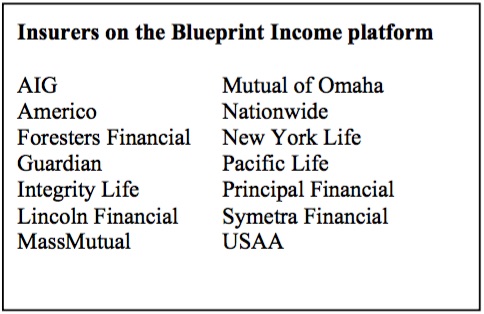

Abaris stalled, but the new platform looks more viable. It has a friendly interface and a mission to sell not just single premium products but also multi-premium income annuities, or “personal pensions,” to people five or more years from retirement. It also boasts more than dozen carrier partners (including Nationwide, which has been running its own experiments with Internet-sold multi-premium income annuities in the Arizona market.)

Matt Carey, a co-founder of Abaris with Wharton School credentials, told RIJ this week that the company, whose website now indicates a Manhattan address, is delaying publicity until a hard launch of its new brand in a few weeks.

“We’re releasing a bunch of new tech in the next couple weeks, along with a funding announcement, so we’ve decided to hold off on talking to media outlets until then,” Carey said in an email. On its website, the company promises, “We put the customer first by taking lower commissions from insurance companies to offer you the highest possible rates.”

Recognizing the tainted image of annuities in the public mind, Blueprint Income has distanced itself from the most widely-sold products, even distinguishing between what it calls “good” annuities (income annuities, qualified longevity annuity contracts, plain-vanilla fixed deferred annuities) and “bad” annuities (indexed and variable annuities) on its website.

Virtually all of the major income annuity issuers are represented on Blueprint Financial’s quote engine. An RIJ request entered at the site for bids on a $100,000 deferred income annuity (DIA) for a 66-year-old male with a deferral to age 80 elicited monthly payout offers between $1,224 and $1,434 from New York Life, MassMutual, Guardian, Mutual of Omaha, Lincoln Financial, Principal, Pacific Life, Symetra, and AIG.

Mutual of Omaha offering the highest monthly payout. (See chart on RIJ homepage). Along with those quotes, the website indicated that it had information about additional contracts from USAA, Integrity Life, Nationwide, Americo and Foresters Financial.

The initial quote list from Blueprint Income did not give details about the contract structures. A comparable request sent to immediateannuities.com returned an average payout of $1,502 a month for a life-with-cash-refund DIA and $1,933 a month for a life-only DIA.

A January 5 post on the Blueprint Financial website said, “Frankly, the decision to update our name and brand has been an easy one. Abaris never clicked with users, investors or even us. Abaris, in Greek mythology, advised Apollo on important decisions. But not everyone knew that. And not everyone pronounced it the same way. We love how Blueprint Income gives us a way to talk about what we do and how we do it in a simple and emotive way.”

In past statements, Carey and co-founders Adam Colombo and Nimish Shukla have said they’re focusing on the self-reliant Gen-X market and female markets, with an emphasis on transparency and integrity and a website that follows the airy, colorful, simple, utterly unambiguous user-interface style that has for at least three years been the standard in the fintech world and beyond.

A just-published report on insurance fintech from Aite said Abaris/Blueprint Income said:

“Abaris is providing a great tool for consumers in the market for annuities to buy without guidance or solicitation. It is perfect for the do-it-yourself buyers who know what they want. Its extensive online application helps to complete the transactions online without additional carrier contact. Carriers are obviously comfortable with its approach, given the breadth of quality annuity providers brokering through its platform.”

“Abaris is convinced that purchasing annuities online will become the preferred annuity purchase method going forward. In fact, Abaris is so convinced of this approach that it is launching a companion website called Blueprint Income. Blueprint Income will focus on delivering what it calls “personal pensions” online and will target Generation Xers (people born roughly between 1965 and 1981).”

Back in 2014, Carey told RIJ:

“We have two business lines. First, we represent a new sales channel for insurers. We act as an insurance producer and work on a commission basis. We have relationships with seven insurance carriers in this market. As the largest fixed annuity underwriters (such as New York Life, MassMutual, and Northwestern Mutual) unveil their QLAC [qualified longevity annuity contracts] products later this year, we hope they will also join our platform.

“Our second business line is analytics. We’re building out a data-driven platform that will enable carriers to make more informed underwriting, marketing and new product development decisions. You glean a lot more about potential customers when they are researching and getting quotes online than when they are being sold a product offline. We think this shift to online research and purchasing represents an exciting opportunity for the carriers to harness data to make better decisions.”

The online income annuity sales landscape is by no means crowded—U.S. sales of immediate and deferred income annuities were just $7.9 billion in the first three-quarters of 2017, according to LIMRA. It has always been a bit complicated by the fact that the big mutual insurers, which are the main issuers of income annuities, have their own agents and don’t want to cannibalize that channel. But New York Life, for instance, has said it would like to stimulate third-party sales.

Blueprint Income enters an online annuity marketplace field populated with Fidelity’s income annuity platform, Kelli Hueler’s Income Solutions platform, and Hersh Stern’s incomeannuities.com.

In the past year, Nationwide has been testing direct online sales of multi-premium income annuities with a pilot program limited to the Arizona market. Stan “the Annuity Man” Haithcock, a champion of insurance-only annuities, has also announced a venture in direct income annuity sales.

Each of these firms has its own business model. Many if not most of the purchases on Fidelity’s platform are driven by Fidelity clients whose Fidelity-affiliated advisors recommend them. Income Solutions serves individuals and advisors, but its primary mission has been to serve people who are retiring from large 401(k) plans, including those of Boeing, GM and IBM, and all Vanguard-administered plans. Nationwide’s platform will be proprietary. Stern’s business is independent.

All of these platforms provide competitive bids from competing insurers. That gives consumers an informational advantage that they don’t have when buying from a captive agent who presents only his or her company’s product. Cannex, the Canadian-American annuity quote and price comparison site, is the biggest provider of real-time annuity quotes to the platforms (with the exception of Income Solutions).

Direct-selling annuities to consumers challenges the conventional wisdom that annuities are sold, not spontaneously bought, by the investing public. There’s also the obvious issue with regulation; sales of annuities require the intermediation of a licensed insurance agent, and fixed annuity issuers, sold online or not, have historically paid a one-time fee of 2% to 3% to independent agents. The purchaser doesn’t see that fee; it’s baked into the monthly payment.

But consumer habits have changed. It’s now assumed that not just Millennials but Americans of all ages have become accustomed to and may even prefer online financial transactions. Research has suggested that consumers feel more “in control” of the process when they buy online, where there’s little or no sales pressure and they may have an informational advantage.

© 2018 RIJ Publishing LLC. All rights reserved.