By Kerry Pechter

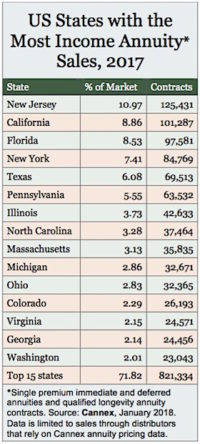

Cannex, the Canadian-American annuity data shop, has just released its analysis of 2017 sales of immediate and deferred income annuities. It turns out New Jersey-ites buy the most income annuities, and the Boss is exactly the right age for one.

By Editorial Staff

The 'pause that refreshes,' said the old Coca-Cola tagline. That's also how Cerulli characterizes the recent slowdown in the practice of assigning management of insurance carrier general account assets to third-party asset managers.

By Editorial Staff

Dementia, preventative care, ageing workforces, technologies and accessibility are just some of the areas of standardization that the committee proposes to work on, said ISO/TC 314 Secretary Nele Zgavc from BSI, ISO’s member for the UK, in the release.

By Editorial Staff

Source: Cannex, January 2018