If you’re driving a decade-old car, the needle on the fuel gauge shows you roughly how many gallons of gasoline are still in your tank. But if you’re driving a new car, your digital gas gauge probably also shows you the exact number of miles you can drive before you’re on “E.”

That innovation has taken a bit of the anxiety out of long car trips. Retirement is also a kind of long trip, and most of us would probably welcome a tool that shows retirees not only how much they’ve still got in their 401(k) plans or brokerage accounts, but also how many more years their savings are likely to last.

In this article, I describe a simple tool that inputs historical market performance, a client’s account balances, her personal “sequence of returns” during the first five years of retirement, and her expected withdrawal rate, to calculate the longevity of her current portfolio in years.

For some clients, the concept of sequence of returns may be hard to grasp. You can ask instead, “Based on your first five years of retirement, did your withdrawals come from portfolio growth or from principal?” If portfolio growth paid for the withdrawals, then the client was lucky: the market financed her expenses. If withdrawals came from principal, she was unlucky.

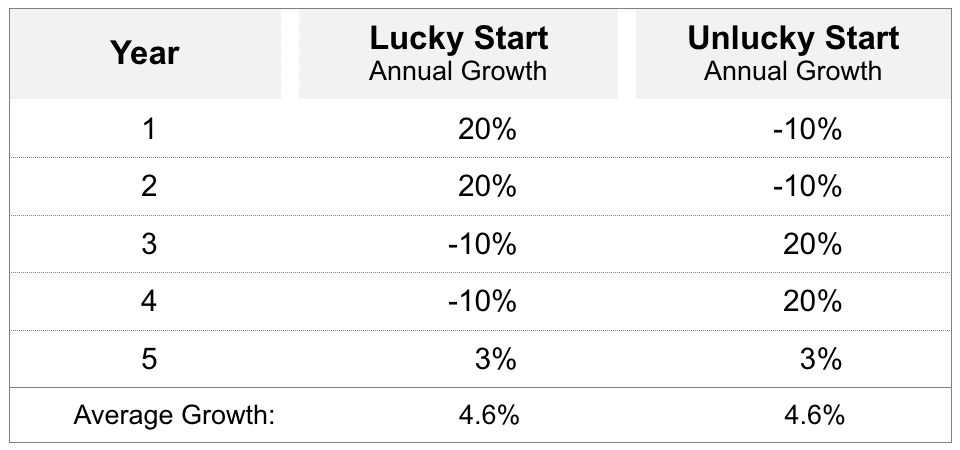

To demonstrate the long-term effect of different initial sequences of returns on long-term portfolio life, walk your client through the following scenarios. In the first scenario, the client’s portfolio grows by 20% in each of the first two years of retirement. Then it declines by 10% in each of the subsequent two years. In the fifth year, the growth rate is 3%. This client has had a lucky start.

In the second scenario, the retiree’s portfolio declines by 10% in each of the first two years, then grows by 20% in each of the subsequent two years. In the fifth year, the growth rate is 3%. This is an unlucky start. Both scenarios are shown in Table 1.

Table 1. Sequence of Returns

Notice that the average annual growth rate for each scenario is exactly the same, 4.6%.

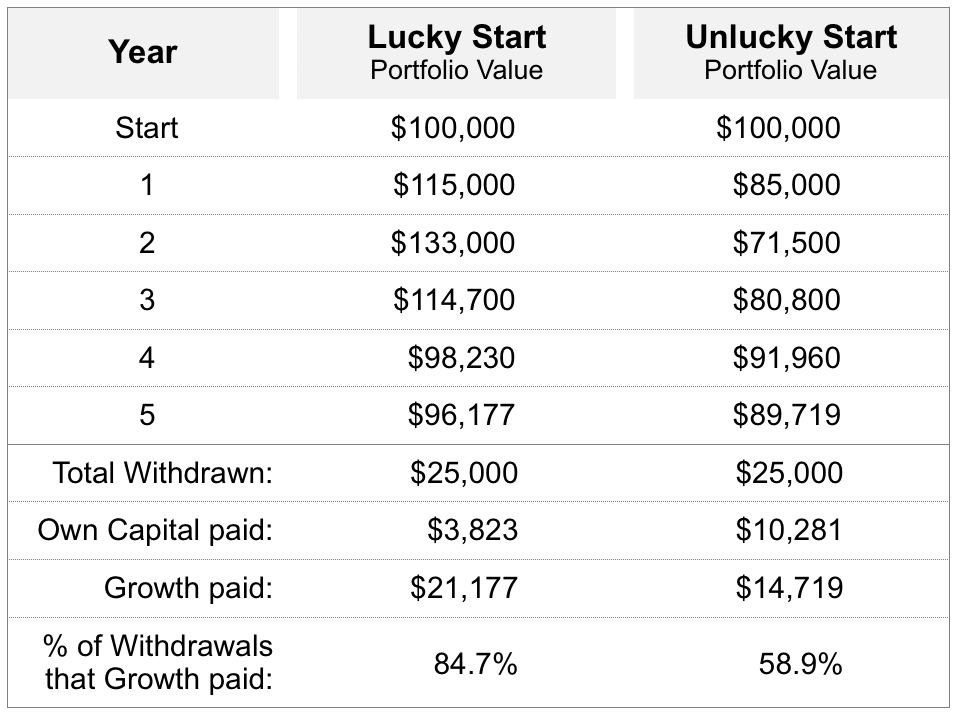

Now, let’s look at dollar value of assets. This retiree starts with a portfolio balance of $100,000. He withdraws $5,000 at the end of each year. Table 2 shows the portfolio value at the end of each year.

Table 2: Sequence of Returns, Distribution Portfolio

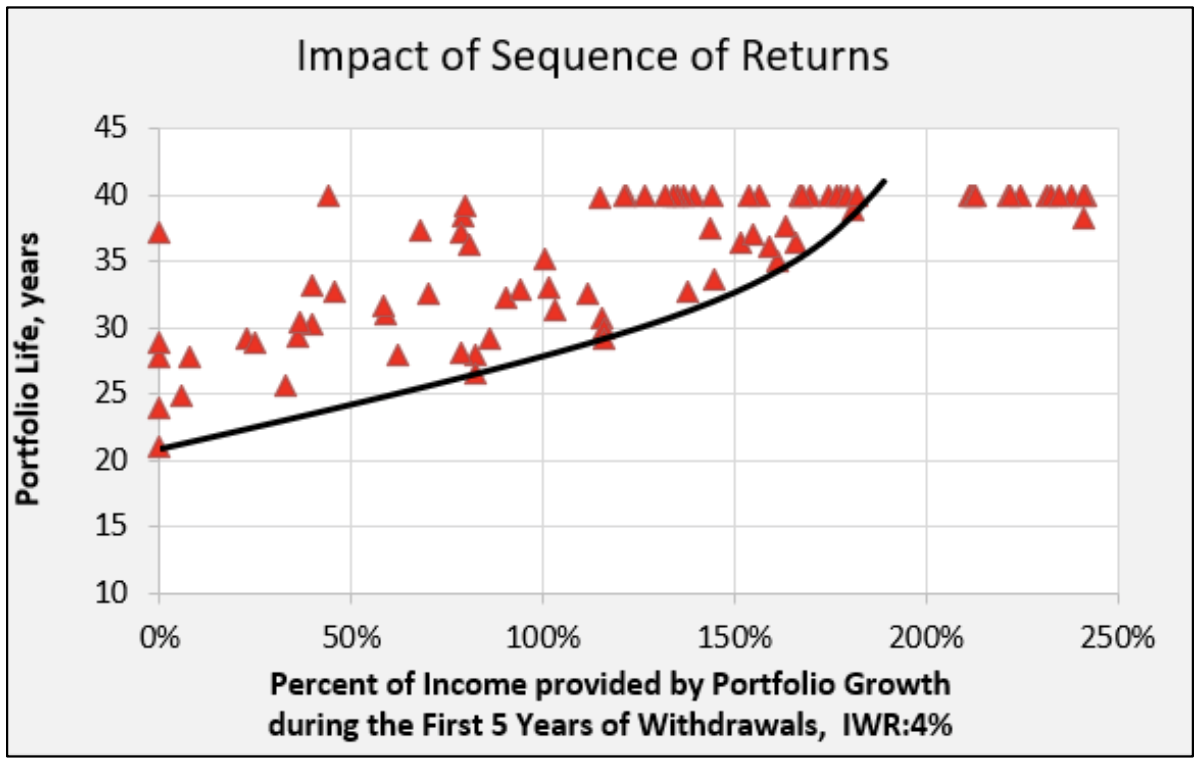

The initial sequence of returns can help us predict approximately how long a portfolio will last. Figure 1 depicts the portfolio life (the y axis) as it relates to the percentage of income paid by growth during the first five years (the x axis). We assume a 40% stocks/60% fixed income asset allocation and an initial withdrawal rate (IWR) of 4%.

Each plot point (red triangle) shows the portfolio life for a specific year between 1900 and 2000. The heavy black line on the graph tracks the worst-case (shortest) portfolio lives. For instance, if portfolio appreciation was able to cover 100% of income in the first five years, the portfolio would likely last between 31 and 35 years.

Figure 1: Portfolio life versus the percentage of income paid by growth during the first 5 years

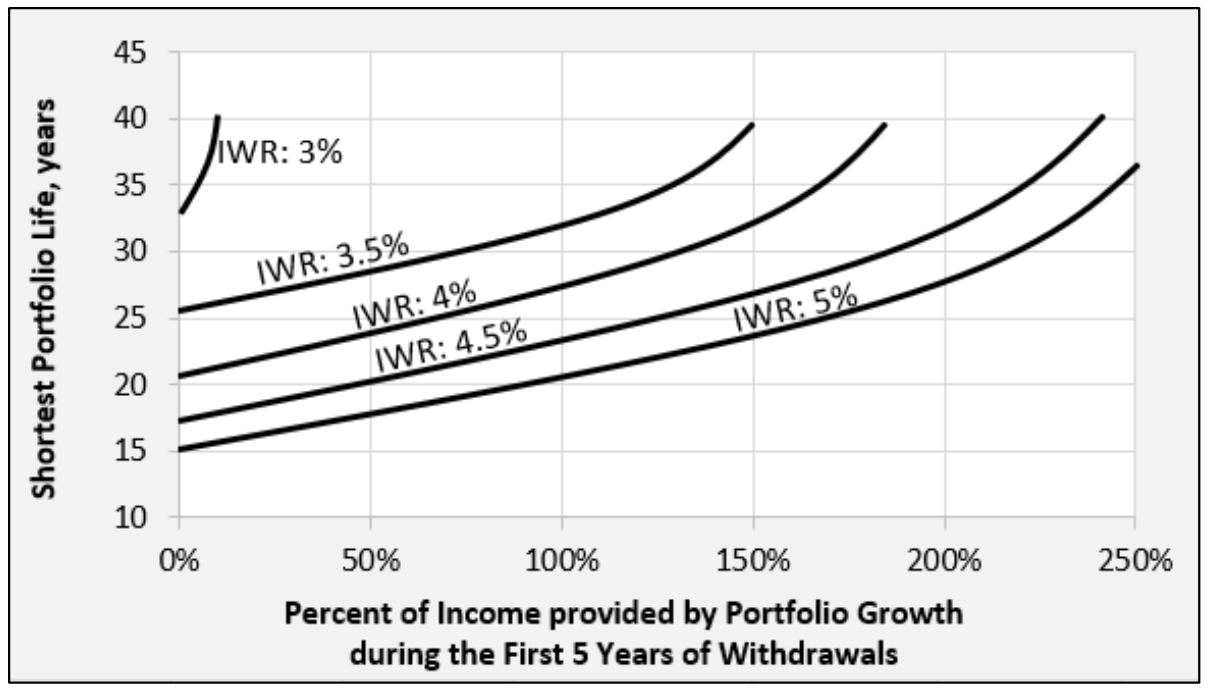

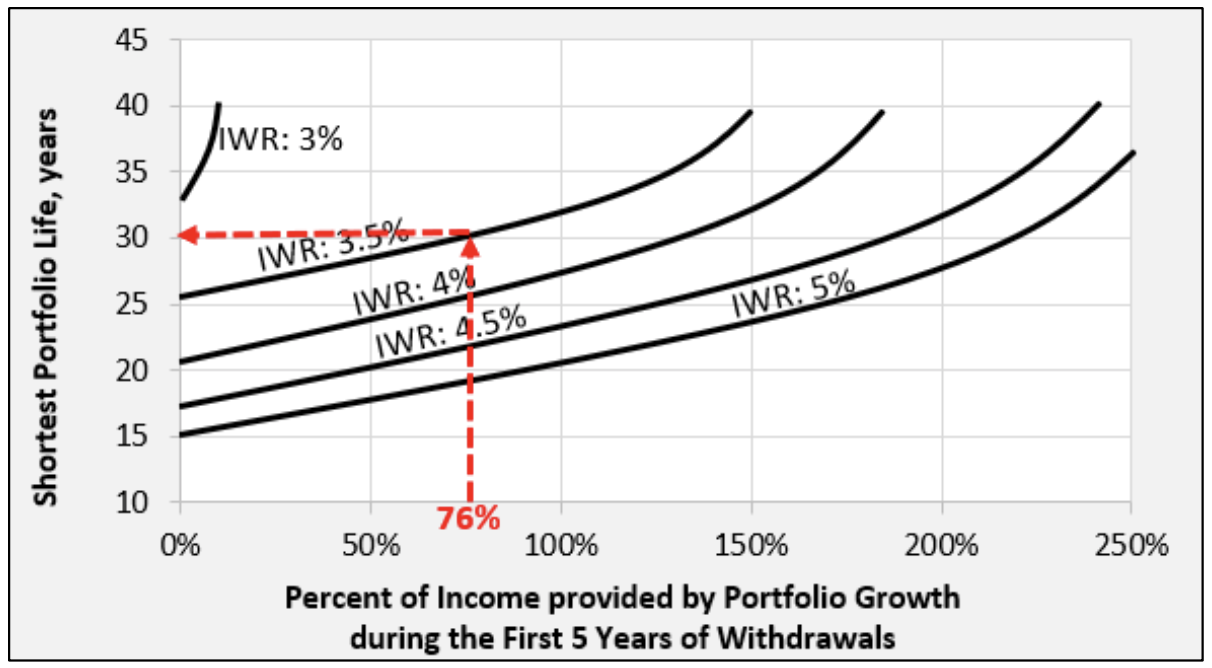

In Figure 2 below, I show the estimated portfolio life for the same 40/60 portfolio but with a range of withdrawal rates. If we used a more aggressive asset mix or a higher withdrawal rate, the heavy black line would shift down, indicating shorter portfolio lives.

Figure 2: Shortest Portfolio Life versus Percentage of Income paid by Growth

Example: Bob retired five years ago at age 65 with $1 million in his portfolio. He needed to spend $35,000 per year (a 3.5% withdrawal rate), subject to indexation for inflation (CPI). After withdrawing a total of $181,410 during those first five years of retirement, his portfolio is now worth $956,000.

Objective: Calculate the shortest likely portfolio life.

Answer: Bob’s net investment is $818,590 ($1 million minus his cumulative withdrawals of $181,410). The portfolio’s net growth is $137,410, calculated as $956,000 (current market value) less $818,590 (his net investment). The growth during these five years covered 76% of his cumulative withdrawals, calculated as $137,410 (net growth) divided by $181,410 (total withdrawals).

Since Bob’s withdrawal rate is 3.5%, draw a vertical line (red dashed line on the graph) starting at 76% on the horizontal axis until it meets the IWR of 3.5%. From there, draw a horizontal line until it meets the vertical axis on the left. The figure shows that Bob’s portfolio should last 30 years, or until he reaches age 95.

Figure 3: Estimating the Shortest Portfolio Life in the Example

What if the worst-case portfolio life is shorter than the clients want or need? As an adviser, you can recommend that they consider purchasing guaranteed income (annuities), reducing expenses (downsize home, reduce gifting, take fewer vacations), or finding other sources of income (rent the basement, create a business, or generate part-time income).

This simple technique enables you to predict the likelihood of a potential shortfall under varying conditions and make changes while there’s still time to do something about it. Keep in mind that the shortest portfolio life calculated here is based on US market history since 1900. Future outcomes may be different.

© 2021 Cemil Otar. Printed by permission of the author.