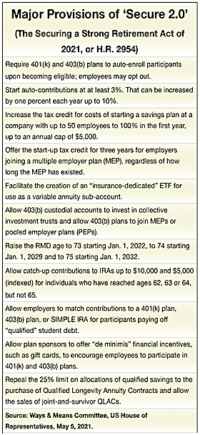

Secure 2.0: A Booster Shot for Qualified Savings Industry

The proposed bill would allow ETFs in variable annuities and remove the 25% limit on the share of IRA money that can be used to buy a Qualified Longevity Annuity Contract. But it would keep the QLAC dollar cap at $135k. (Photo: Ways & Means Committee chair Richard Neal (D-MA), left, with ranking member Kevin Brady (R-TX).