If you heard that Morningstar chairman Joe Mansueto and eBay founder Pierre Omidyar were investing in the same little robo-advisor, you’d probably want to learn more about it. You might even let their start-up manage your savings.

Meet United Income. Since its launch in 2017, only about 300 households have chosen it to manage assets of about $500 million, so it’s tiny. But it’s not obscure: its founding CEO, Matt Fellowes, is the fintech entrepreneur who created personal finance tool HelloWallet and sold it to Morningstar for $52 million. (KeyBank owns it now).

To demonstrate United Income’s capabilities for RIJ readers, one of its ten in-house advisors, Davey Quinn, used the firm’s software to create a retirement investment and spending plan for the M.T. Knestors, a real but anonymous couple with about $750,000 in savings. We present that plan below.

Matt Fellowes

United Income’s approach to income planning avoids annuities and focuses more on the low-cost passive investments and tax-efficient withdrawal strategies that appeal to Boomer and Gen-X households with $1 million or more. To calculate life expectancies, it also incorporates personal health information that other robo-advisors don’t typically ask for or build into their plans.

The plan that Quinn showed us—the first draft of a plan—is outwardly simple and straightforward, which in itself is a bit unorthodox. The plan doesn’t enforce a 4% withdrawal rule, or employ a time-segmentation (bucketing) strategy, or incorporate annuities. It doesn’t rely on mental accounting techniques like setting up emergency funds or capital accounts and sequestering them from income-producing assets. Instead, its algorithms use adaptive, automatic asset rebalancing behind the scenes to offset spikes in spending or market turbulence.

The plan’s main curb-appeal is a projection that the M.T. Knestors could become much richer in the future by following United Income’s suggested asset allocation than by sticking with their existing stocks-to-bonds ratio.

United Income charges 80 basis points per year for its full suite of services, applied to whatever money clients decide to custody with United Income for discretionary management. United Income is built for individual investors, not advisors. It also manages some institutional money.

The ‘M.T. Knestors’

You might remember the Knestors from previous RIJ studies of their case. Besides their savings accounts, they own a home worth about $300,000 and own three paid-off cars. Their mortgage will be paid-off by 2021. Their children have no remaining college debt. After he retires at age 70, Mr. Knestor expects to earn about $2,000 per month as a consultant. The Knestors expect a combined $4,000 per month from Social Security starting in 2021. They told Quinn that they’d like to annuitize Mrs. Knestor’s 403(b) account, which would pay about $1,400 per month (inflation-adjusted) for life.

The Knestors expect these four sources of income to cover their essential expenses ($4,000 per month), discretionary expenses ($1,000 per month), health care expenses ($1,000 per month) and miscellaneous expenses and taxes ($1,000 per month).

For any additional expenses, they’d have to liquidate invested assets. The Knestors expect a number of one-time, big-ticket expenses during their first ten years of retirement: a new roof in 2019, a wedding in 2020, another wedding in 2022, bathroom remodeling in 2025, and a new car in 2026.

United Income’s recommendations

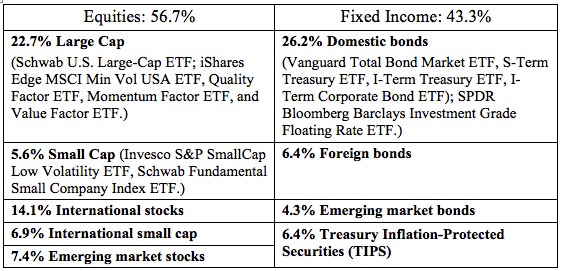

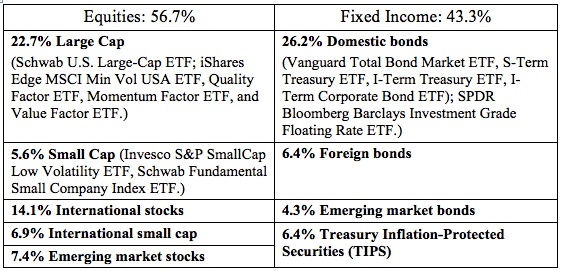

The first draft of the United Income analysis showed that if the Knestors convert Mrs. Knestor’s 403(b) savings of $222,000 to an annuity, the remaining $533,000 would be allocated as follows.

What drives United Income’s asset allocation process?

United Income has an unusual process for assessing their clients’ tolerance investment risk. Each client’s overall risk profile is a composite of his or her tolerances for the risks of failing to meet specific expenses. In other words, United Income weighs the importance to the client of each expense or goal.

“For all spending needs, we ask our members on a scale of 0 to 10, how much risk would you accept for this spending need?” Quinn said. “Most members choose 2-4 for essentials and 6-7 for discretionary expenses. Lastly, members can rank their priority for each of these spending needs and add any additional spending needs as well. For additional spending needs, our members can specify the frequency, length and inflation rate for that goal. In addition, they assign a risk score for these spending needs.”

As those expenses are paid and eliminated, the client’s risk profile and asset allocation changes accordingly.

What withdrawal rate philosophy does United Income use?

United Income doesn’t use the famous-but-flawed 4% “safe withdrawal” rule. According to their plan, the Knestors would withdraw as much 10% or more per year from their savings, including more than $200,000 over three years. That’s because they planned for those big expenses (mentioned above) during the first ten years of retirement.

To maintain a sustainable withdrawal rate in every year of retirement, other advisors might have set up an all-cash “capital expense” fund that would be sequestered from the client’s more risky core income-generating portfolio. This tactic would insulate the core portfolio from “sequence risk”—the risk that high withdrawals and a market downturn might coincide in the early years of retirement, irreparably reducing account balances.

United Income does not prescribe this kind of bucket approach. “Instead of using mental accounting strategies, we factor the costs and risks of specific goals into the client’s recommended asset allocation. We based this target asset allocation on the level of risk for each spending goal,” Quinn told RIJ.

“For instance, if you want to invest conservatively in order to meet a specific expense in the next few years, your asset allocation will incorporate that expense into our calculation of the equity allocation. If the wedding risk score were changed to ‘1,’ then the target stock/bond mix would shift toward bonds. The target asset allocation is re-calculated every day, so each client’s asset allocation changes as each goal is met.”

Will the M.T. Knestors run out of money?

Not according to United Income. Quinn’s plan predicted that their portfolio had a 99% chance of lasting at least for as long as the Knestors live, and United Income predicted, on the basis of the Knestors’ self-reported health status, that they would both live into their 90s.

United Income’s projections showed that, starting in 2026 or so, after an anticipated period of high expenses and lackluster market returns, the Knestors’ net worth would begin to climb steadily. By 2050, if they adopted United Income’s 56% stock/43% bond allocation, the Knestors’ would be worth a projected $2.5 million if future market performance is “typical,” more than $3 million if performance is “very strong,” and $2.2 million if performance is “very weak.”

United Income uses Morningstar Capital Market Assumptions to make its market projections. Those assumptions call for 2.5% to 3.2% growth for a balanced portfolio over the next 10 years, and about twice that performance in subsequent years as the market reverts to its long-term average growth rates.

What about annuities?

Annuities generally aren’t a priority for United Income’s clients, Quinn said. The firm’s clients fall into two categories. About 28% have balances of over $1 million, and 72% have balances under $1 million. They want low cost investments, tax-efficient distribution strategies, and someone to handle their RMDs automatically. But United Income does offer an “annuity service” on its website.

“The annuity service is something that we do as human wealth managers for clients,” Quinn said. “We review any annuities they currently hold and evaluate the cost-benefit of keeping vs. surrendering the annuity. We may recommend an annuity if it makes sense for a client and will help them find an annuity provider to work with. We receive no commissions. We just look for competitive products for our clients. Also, as we have done in this sample plan, our software can analyze and model annuities.”

© 2018 RIJ Publishing LLC. All rights reserved.