The Biden administration unveiled its plan for generating more revenue from US corporations yesterday. The plan would raise the statutory tax rate on corporate profits to 28% from 21%. That’s about halfway back to 35%, its level before the Tax Cut and Jobs Act (TJCA) in 2017.

Treasury Secretary Janet Yellen released a 19-page summary, “The Made in America Tax Plan” on Wednesday. The tax reforms described in the plan are intended to help offset his eight-year, $2 trillion project to renew the nation’s infrastructure and tilt from fossil fuels to green energy.

President Biden

The tax measures described in the white paper would do more than simply raise money to replace rusty bridges and subsidy solar panels. The administration would explicitly use the tax code to correct what it characterizes as long-standing ethical injustices, such as wealth inequality.

The paper reflects the stark change in Oval Office philosophy that occurred last January 20—an about-face as abrupt as any since 1932. President Biden might be counting on broad public support for his initiatives—evidenced by polls—to overcome his skinny majorities in Congress. He must know, however, that tax increases are the “third rail” of Republican politics: Raise them and you die.

Since the measures in this latest segment of Biden’s tax plans apply mainly to multinational enterprises, rather than to taxes that directly hit citizens’ wallets, they might be difficult for anyone outside of the tax department of a multinational corporation tax department to tell what their exact impact might be. But here they are.

‘GILTI’ or not guilty

Much of the summary focuses on the alleged practice by US multinational corporations of minimizing taxes by reporting profits in tax havens overseas instead of at hone. In a reversal from the previous administration, the Biden plan accuses Corporate America of underpaying its taxes, not paying punitively high taxes. It distinguishes between tax rates and what corporations actually pay. In a sense, it charges companies with doing too good a job of reducing their US tax burdens.

“The effective tax rate on US profits of US multinationals—the share of profits that they actually pay in federal income taxes—was just 7.8%,” the report said. “And although U.S companies are the most profitable in the world, the US collects less in corporate tax revenues as a share of GDP (gross domestic product) than almost any advanced economy in the Organization for Economic Co-operation and Development (OECD).”

The Biden plan would eliminate incentives in the TCJA that it claims encourage the “offshoring of assets.” The TCJA “created new offshoring incentives through two provisions, the Global Intangible Low-Tax Income (GILTI) provision and the foreign-derived intangible income (FDII) deduction.” The administration would work with other nations to set a uniform minimum corporate tax rate that would discourage regulatory arbitrage.

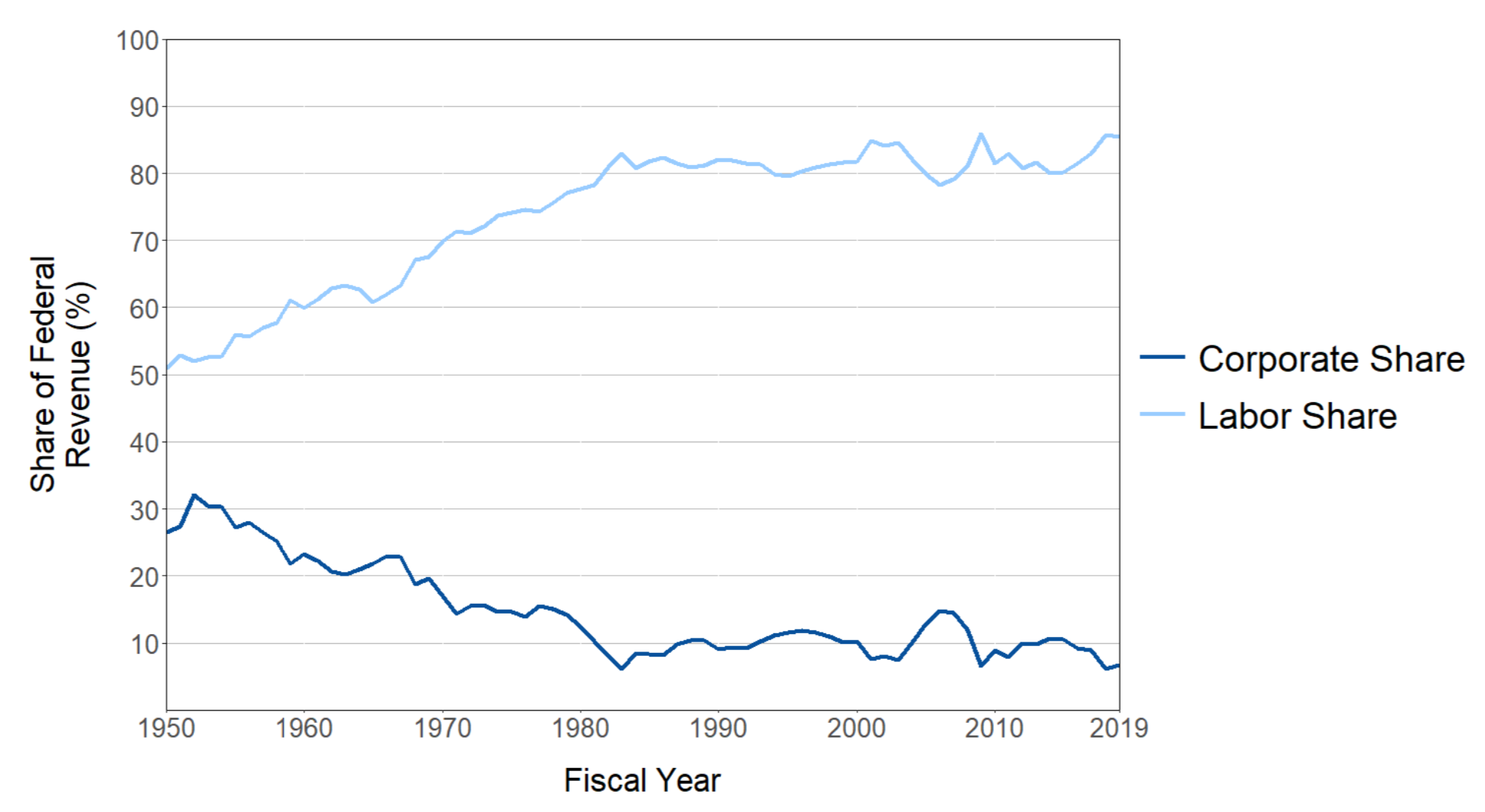

Labor and Corporate Share of Federal Tax Revenue (1950-2019)

The Made in America Tax Plan would end the tax exemption for the first 10% return on foreign assets, would calculate the GILTI minimum tax on a per-country basis (raising an estimated $500 billion over a decade, and increase the GILTI minimum tax to 21% (three-quarters of the proposed 28% corporate tax rate, instead of the current one-half ratio).

“In addition to these reforms to GILTI, the plan would disallow deductions for the offshoring of production and put in place strong guardrails against corporate inversions. Overall, the stronger minimum tax regime would substantially reduce the current tax law’s preferences for foreign relative to domestic profits, creating a more level playing field between domestic and foreign activity,” the report said.

Paying at the pump, or not

The Biden plan also proposes deep changes in the taxation of energy, with an eye toward removing implicit and explicit subsidies for fossil fuel producers and creating incentives for developing sources of renewable energy. These changes are intended to slow the catastrophic warming of the earth under a shroud of heat-trapping gasses—a phenomenon that many Republicans still claim to disbelieve, despite well-documented evidence.

“Eliminating the subsidies for fossil fuel companies would increase government tax receipts by over $35 billion in the coming decade,” the report said, citing figures from the Treasury’s Office of Tax Analysis. The main impact would be on oil and gas company profits, not gas or energy prices, the report predicted.

For instance, the production tax credit and investment tax credit for clean energy generation and storage would be extended for ten years. There would be a new tax incentive for long-distance transmission lines and expansion of incentives for electricity storage projects.

The proposal would remove so-called allowances that shield corporations from federal taxes, such as the use of separate “book” and “tax” reporting. “Corporations are simultaneously able to signal large profits to shareholders and reward executives with these returns, while claiming to the IRS that income is at such a low level that they should be freed from any federal tax obligation,” the report said.

Instead, there would be a minimum tax of 15% on book income (the profit firms generally report to the investors). Firms would pay the IRS for the excess, up to 15%, on their book income over their regular tax liability. A firm with zero federal income tax liability computed based on its taxable income would still face a minimum tax of 15% on book income.

Easing labor’s pains

The Biden administration has previously announced its desire to reduce disproportionate wealth and income inequality in the US. His tax proposal would address that problem. “The labor share of national income has been declining for years, representing a worrying trend for workers and a contribution to rising income inequality,” the report said.

Inequality is “is exacerbated by a worldwide trend of governments shifting relative tax burdens away from corporations and capital and onto workers by reducing tax rates on capital gains, dividends, and corporate income while increasing tax burdens on sales and wages.” Consequently, the share of federal revenue raised by the corporate tax has fallen to under 10%, while the share of revenue raised by taxing labor has grown to over 80%.“In 2019, the top 5% of the income distribution earned just 26% of labor income, but 71% of capital income,” the report said.

© 2021 RIJ Publishing LLC. All rights reserved.