Politics

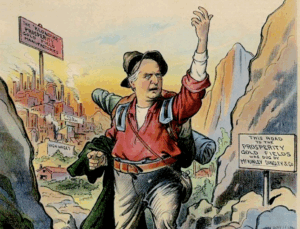

President Trump said his "Liberation Day" tariffs would boost the U.S. economy the way President William McKinley's tariffs did in the 1890s. But the boom of the 1890s came...

Crypto-Blitz: A Timeline of Presidential Emolument

As president, Donald Trump is in a unique position to connect the public purse to his own purse, and so far he's shown no resistance to temptation. The Wall...

‘SECURE 2.0’ Passes House, Moves to Senate

Retirement industry stakeholders and their representatives praised the passage of the bill, HR 2954, which loosens the rules on RMDs and QLACs and clears the way for ETFs in...

Progress for retirement provision in ‘Build Back Better’ bill

'Among other things, the legislation would require employers without employer-sponsored retirement plans to automatically enroll their employees in IRAs or 401(k)-type plans,' according to a report today in the...

Did QLACs Get a Last-Minute Haircut?

The Ways and Means Committee considered raising the limit on pre-tax contributions to a deferred income annuity to $200,000, but then, apparently for budget reasons, let the current limit...

Secure 2.0: A Booster Shot for Qualified Savings Industry

The proposed bill would allow ETFs in variable annuities and remove the 25% limit on the share of IRA money that can be used to buy a Qualified Longevity...

Raising Revenue–and Consciousness

With his Made in America Tax Plan, announced Wednesday, President Biden would raise corporate tax rates and try to stop transfer pricing worldwide. He wants to raise revenue and...

Will Biden tinker with tax deferral?

'Biden will equalize benefits across the income scale, so working families also receive substantial tax benefits' when they save, a former official told the Financial Services Institute.

New law to show who qualifies for a PPP loan

This article, provided by the Wagner Law Group, explains the modifications made to the Paycheck Protection Program (PPP) by the Economic Aid to Hard-Hit Small Businesses, Non-Profits, and Venues...

Treasury Nominee Janet Yellen (the Un-Steve Mnuchin)

Yellen, the first woman nominated for Treasury chief, is an academic economist, not a Wall Streeter. As Fed chief, she was known as an interest rate “dove;” more inclined...

Biden’s Retirement Policy

Biden has made strong promises about fixing Social Security, strengthening labor unions, and helping to finance a green economy. Will he be able to keep those promises? Does he...

The ‘Securing a Strong Retirement Act of 2020’

The House has introduced a sequel to last year's SECURE Act. Once again, legislators have listened to the retirement industry and tried to remove what the industry considers obstacles...

A Look at Biden’s Social Security Plan

There's more to Biden's proposal than raising payroll taxes on >$400k earners. The wealthy would see their benefits go up more in dollars, while the poor would see theirs...

Long Guns as Leading Indicators

In past election periods, when I’ve canvassed door-to-door, some people have told me they won’t bother to vote because politicians are all alike. But they aren’t.

Two Cheers for DOL’s Lifetime Income Disclosure

The Department of Labor's 'interim final rule' on disclosure of estimated lifetime income from 401(k) balances is welcome, but it lacks a critical feature. Public comments might improve it.

We Could Use Some Inflation

The Treasury said this week that it will borrow (and spend) about $3 trillion this quarter, to cover its stimulus promises. Where does that money come from and where...

Please Don’t Raid Your Retirement Account

It would be smart, not paternalistic, to ease today’s financial pain without contributing to an even bigger retirement funding crisis down the road.

The ‘Fed Put’ Hurts Annuities—and Retirees

Low rates encourage excessive risk-taking. But the Fed keeps accommodating market sell-offs, which sets up a new round of boom and bust. Retirees (and the annuity issuers who serve...

An Imperfect Demand Stimulus

While the Great Depression of the 1930s saw a massive contraction in demand, the current crisis entails a massive shock to the economy’s supply side, writes our guest columnist,...

Why Bernie is So Demanding

Sen. Sanders is the atavistic avatar of demand-side economics, which dominated public policy from 1932 to 1971. Supply-side economics has held sway since the Reagan years. The 2020 election...