Equitable, the life insurer that originated the registered index-linked annuity (RILA, aka structured variable annuity) over a decade ago, has added a guaranteed lifetime withdrawal benefit (GLWB) rider to the latest iteration of its popular Structured Capital Strategies RILA.

“Structured Capital Strategies Income (SCS Income) allows investors nearing and beginning retirement to take advantage of equity market growth potential while maintaining partial protection against market declines. SCS Income also provides for a predictable stream of income,” said Steve Scanlon, Head of Individual Retirement at Equitable, in a release.

RILAs, which use put and call options on the performance of an equity index or hybrid index to generate positive returns up to a cap and a buffer against initial market losses in a given contract year, have been used mainly as safe investment vehicles that lock in gains or losses at the end of each crediting term. But a few life insurers have added income riders.

Because RILA contracts can lose money, a RILA, like a traditional variable annuity, is a registered securities product that only securities-licensed reps of broker-dealers can sell. A related options-based product, the fixed indexed annuity, can be sold by insurance agents without securities licenses because the contract can’t lose money if held to term.

Industry wide, about $28.4 billion in RILA assets were reported at the end of the third quarter of 2021, according to LIMRA Secure Retirement Institute. According to Wink, Inc., Equitable held an industry-high 21% share of the RILA market.

The annual fee for the GLWB in this contract, according to the prospectus, is 1.50%, with a permissible maximum of 2.50% in the future if the issuer requires it. That’s for either the B-version of the contract, which pays a commission to a licensed broker and has a first-year surrender charge of 7%, or for the fee-based Advisor version, which has no surrender charge period.

The GLWB rider guarantees that the “benefit base”—the notional amount used to calculate the annual income that the client can withdraw from the account for life—will never fall below a certain level. The initial benefit base is the purchase premium. The actual account value—the investor’s money—can go down as a result of poor market performance, withdrawals and fees.

Independent advisors would presumably add a 1% asset management fee, bringing the total annual fees to 2.50%, plus up to 0.71% of any money allocated to a separate account. (According to the prospectus, advisor fees can’t come from the contract itself without adverse consequences; they would have to come from an after-tax side account.)

The GLWB rider rewards the annuity owner for delaying taking income from the contract by offering to increase the benefit base by 5% for every year the owner postpones taking withdrawals from the contract. As a second incentive, the maximum withdrawal rate also goes up by one-tenth of a percentage point for each year that withdrawals are deferred. These incentives reflect the actuarial fact that the owner has aged a year, and has one less year of life expectancy in which to receive payments under the contract.

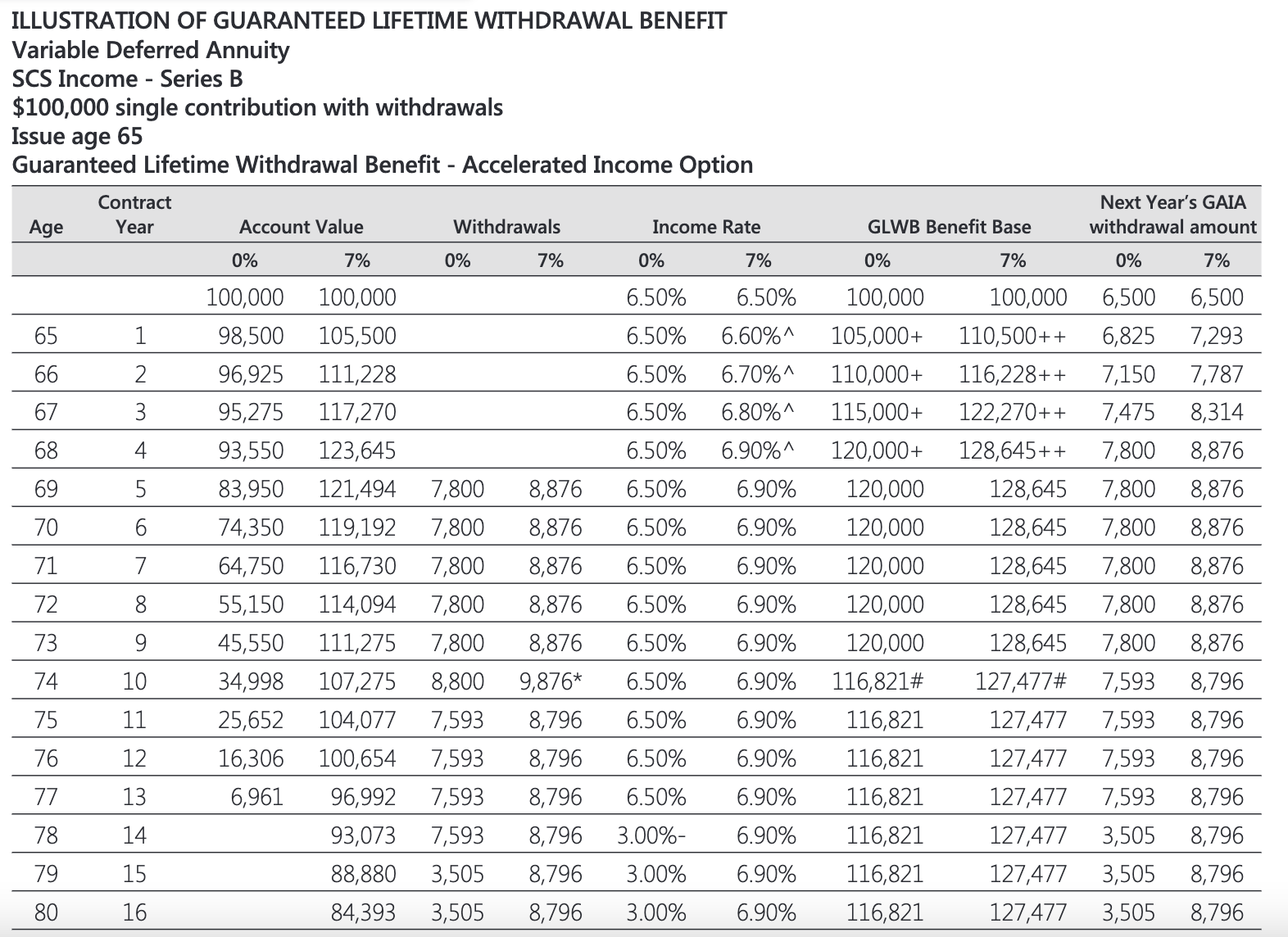

Here’s an example from the SCS Income prospectus (p. 115) of how the income rider might work.

(Note: The example uses the “accelerated” income option, which over-weights income in the first 10 or so years of retirement with a 6.5% withdrawal rate at age 65, and then offers a reduced benefit of 3% when the contract owner has spent all of his or her own money. The “level” income option offers a lifelong annual payout rate of 5% of the benefit base if income starts at age 65.) For a table of payout rates by age and number of annuitants, click here.

In this example, a single 65-year-old buys an SCS Income contract with a $100,000 premium. Instead taking a $6,500 payment in the first year, he defers income until the fifth year, when his payout rate is 6.9%, his benefit base has risen to between $120,000 and $128,645, and his withdrawals are $7,800 to $8,876, depending on the market performance.

If or when a combination of annual withdrawals, fees, and low returns reduces his account value to zero, the client’s annual withdrawal rate will drop to 3% (because we have used the accelerated income option as an example), or about $3,500 a year.

The prospectus shows us that an unlucky client with zero index returns would have a zero account value when he or she reached age 78. A lucky client who experienced 7% returns every year, however, would continue receiving 6.9% (about $8,800) until age 92, when his account value zeroes out and his withdrawal rate drops to 3%. Alternately, the 65-year-old client could have taken a level benefit of at least $6,480 (5.4% of $120,000) a year for life starting at age 69, after a four-year wait.

The indexes that clients can buy options on include: S&P 500 Price Return Index, Russell 2000 Price Return Index, MSCI-EAFE Price Return Index, NASDAQ-100 Price Return Index, and MSCI Emerging Markets Price Return Index. A “price return” version of a market index, unlike a “total return” version, lacks the dividend yields that would otherwise enhance the index performance.

For the sake of comparison, a 65-year-old could buy a single premium immediate annuity with $100,000 at current rates and receive about $6,700 a year for life (with cash refund of unpaid premium upon death) starting at age 69. The SPIA would not offer liquidity but it would not be subject to any future increases in fees on the part of the insurer.

According to an Equitable press release, SCS-Income options that Equitable describes as “new to the industry” include:

- The level income option, which provides an income rate initially based on age at the time of purchase and that does not decrease

- The accelerated income option, which provides a higher rate of income in early retirement when individuals may have higher expenses. Income under this option is initially based on the age at which the product is purchased and only decreases if the account balance drops to zero by means other than excess withdrawal.

- Both income options offer opportunities to increase income by 5% of contributions per year each year before beginning to receive income, as long as the contract holder has not yet taken a withdrawal. This extra growth will be credited for up to 20 years, or the contract maturity date, whichever is earlier.

© 2021 RIJ Publishing LLC. All rights reserved.