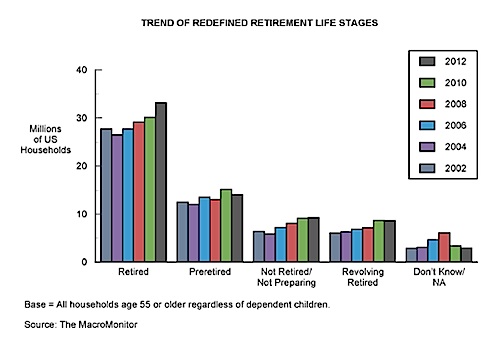

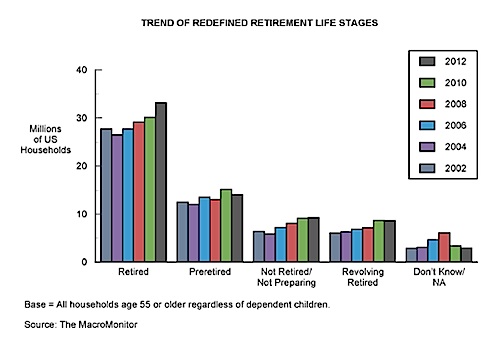

First you’re retired, then you’re not

"As retirement evolves into a more flexible yet complicated life stage, financial services providers could benefit from understanding the multiple stages of retirement better," says SRI Consulting-Business Intelligence.