Sales of non-variable deferred annuities surpassed $23.1 billion in the first quarter of 2018, up 9.4% over the previous quarter and up 0.2% when compared to the same period last year, according to the 83rd edition of Wink’s Sales & Market Report.

The report covers fixed indexed and traditional fixed annuities, MYGA (multi-year guarantee annuities) products and, for the first time, structured annuities (aka registered index-linked annuities). Sixty indexed annuity providers, 64 fixed annuity providers, 74 MYGA providers, and six structured annuity issuers participated.

Structured annuity sales in the first quarter were $2.9 billion. Structured annuities have a limited negative floor and limited excess interest linked to the performance of an external index or subaccounts. At that quarterly sales rate, these products will easily surpass their $9.2 billion in sales for 2017.

AXA US, which created the structured annuity category in 2010, was the top-seller of those products, with a market share of 51.5%, but the top-selling contract in that space across all channels was the Brighthouse Life Shield Level Select 6-Year contract.

Sheryl Moore

“Some [insurance companies] call these products ‘buffered annuities,’” said Wink’s CEO, Sheryl J. Moore. “Others refer to them as ‘indexed VAs,’ and still, others refer to them as ‘collared annuities.’ The important thing to remember is that these aren’t indexed annuities, although some companies are marketing them in that manner,” she said.

LIMRA Secure Retirement Institute calls them “Registered Index-Linked Annuities,” to reflect the fact that these products are generally registered with the Securities & Exchange Commission.

New York Life ranked as the top-selling carrier overall for non-variable deferred annuity sales in 1Q2018, with a 9.6% market share. Allianz Life, AIG, Global Atlantic Financial Group, and Athene USA followed. Allianz Life’s Allianz 222 Annuity, an indexed annuity, was the overall top-selling non-variable deferred annuity.

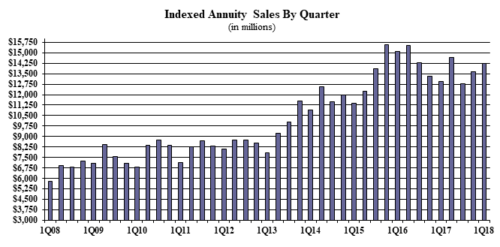

Indexed annuity sales for the first quarter were $14.2 billion; up 4.4% over the previous quarter, and up 10.0% from the same period last year. (Indexed annuities have a floor of no less than zero percent and limited excess interest linked the performance of an external index, such as the Standard and Poor’s 500.

“We haven’t had an increase in indexed annuity sales this big in nearly two years,” said Sheryl J. Moore, president and CEO of both Moore Market Intelligence and Wink, Inc.

In the first quarter, Allianz Life retained its top ranking in indexed annuities, with a market share of 11.7%. Athene USA, Nationwide, American Equity Companies and Great American Insurance Group followed, respectively. Allianz Life’s Allianz 222 Annuity was the top-selling indexed annuity, for all channels combined, for the fifteenth consecutive quarter.

Traditional fixed annuity sales in the first quarter were $729.7 million; down 3.3% when compared to the previous quarter, and down 32.1% when compared with the same period last year. Traditional fixed annuities have a fixed rate that is guaranteed for one year.

Jackson National Life ranking as the top-seller of fixed annuities, with a market share of 15.1%. Modern Woodmen of America, Global Atlantic Financial Group, Great American Insurance Group, and American National followed, in that order. Forethought Life’s ForeCare Fixed Annuity was the top-selling fixed annuity for the quarter, for all channels combined.

Multi-year guaranteed annuity (MYGA) sales in the first quarter were $8.1 billion; up 20.9% when compared to the previous quarter, and down 9.8% when compared to the same period last year. MYGAs have a fixed rate that is guaranteed for more than one year.

New York Life was once again the top-seller of MYGAs, with a market share of 27.2%. Global Atlantic Financial Group, AIG, Symetra Financial, and Pacific Life followed. Forethought’s SecureFore 3 Fixed Annuity was the top-selling multi-year guaranteed annuity for the quarter, for all channels combined.

© 2018 RIJ Publishing LLC. All rights reserved.