Amid falling bond and equity prices, investors sought the humble predictability of fixed rate deferred (FRD) annuities in the first quarter of 2022, according to the LIMRA’s latest report.

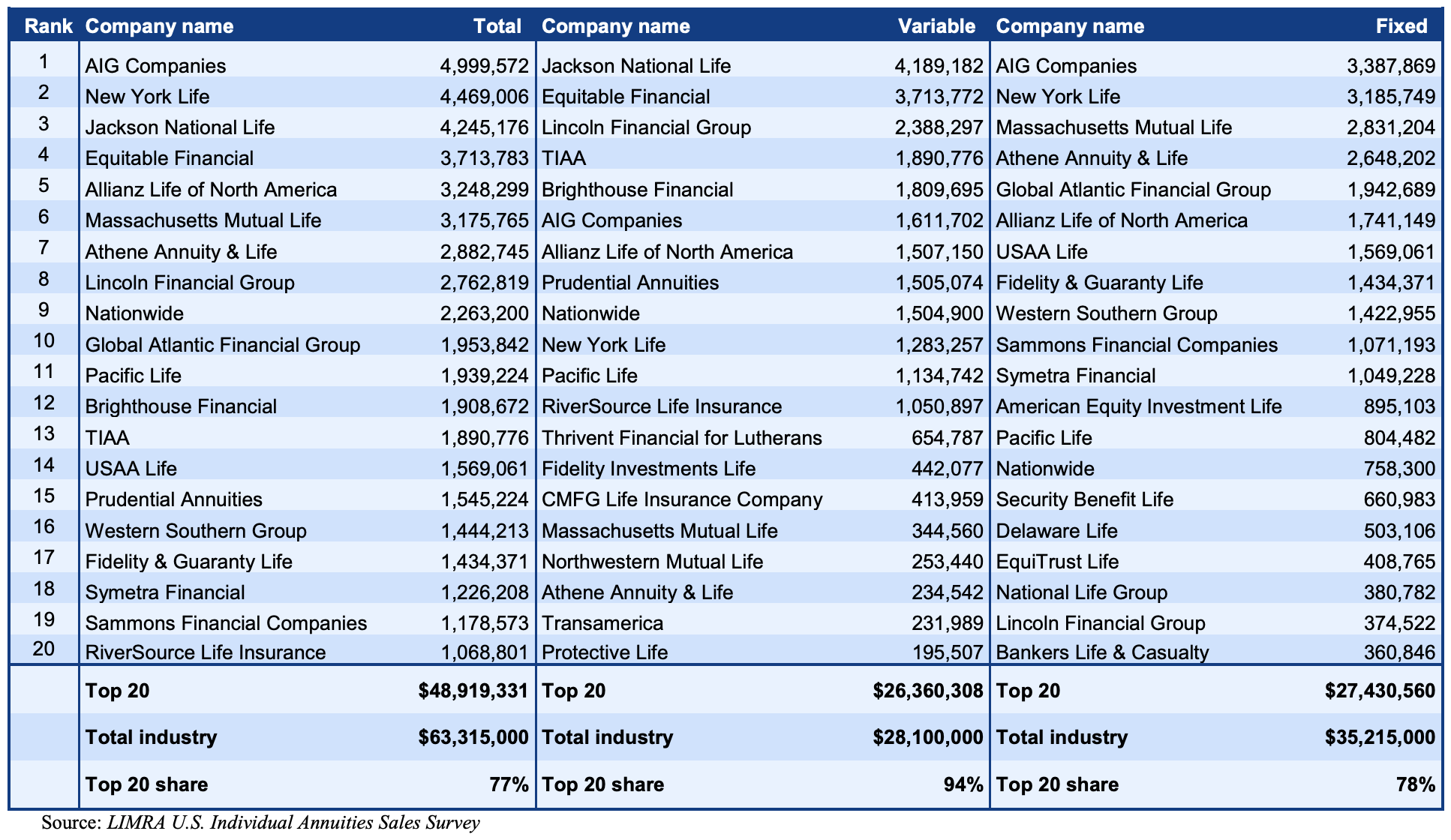

FRD sales were up 45% from the previous quarter, to $15.9 billion, as the average yield on the three-year product rose to 2.25%. Top-five FRD issuers were New York Life ($2.78bn), AIG ($1.82bn), MassMutual ($1.62bn), USAA ($1.21bn), Western Southern Group ($1.15bn) and Global Atlantic ($999m).

For more annuity sales data, see LIMRA’s Fact Tank.

Todd Giesing

Overall, sales of fixed annuities (FRDs, fixed indexed, and payout) rose 14% from the prior quarter, to $35.2 billion. At $16.3 billion, FIA sales were down 2% from the previous quarter. Sales of deferred income annuities were down 15% and immediate annuities were down 12%. but 21% higher than the first quarter of 2021. All fixed products except income annuities recording positive growth.

Relative to the first quarter of 2021, fixed-rate deferred annuity sales were up 9%. FIA sales were up 21% from the year-ago quarter. LIMRA expects FIA sales to grow as much as 10% and fixed-rate sales to grow as much as 7% in 2022.

“FIA and FRD sales benefited from rising interest rates and increased market volatility as investors sought protected growth options,” said Todd Giesing, assistant vice president, LIMRA Annuity Research, in a release.

Some carriers were apparently more nimble than others in incorporating rising rates into their products. “We’ve heard that some life/annuity companies are having challenges with rates moving so quickly, even though the rates are changing in their favor. Some carriers are changing rates only once a month, while others have the flexibility to change once a week,” Giesing told RIJ in a phone interview.

1Q2022 Annuity sales

Meanwhile, investors moved away from equity-linked annuities such as fixed indexed annuities (FIAs) and registered index-linked annuities (RILAs). RILA sales were down 7% from the prior quarter but were up 5% from the year-ago quarter.

At $16.3 billion, first-quarter FIA sales were down 2% from 4Q2021 but up 21% from 1Q2021. Top-five FIA issuers were Athene Annuity & Life ($2.23bn), Allianz Life of North America ($1.74bn), AIG ($1.45bn), Sammons Financial Group (and $1.02bn) and Fidelity & Guaranty Life ($962m).

“FIA and RILA sales were both slightly down from the prior quarter. That might reflect some investor uneasiness about equity index-linked products. But fixed-rate sales went to $16 billion in first quarter of 2022 from $11 billion in the fourth quarter of 2021,” Giesing said. LIMRA’s quarterly annuity sales survey represents 91% of the total market.

Overall US annuity sales were up 1% from the fourth quarter of 2021 in the first quarter of 2022 and up 4% from the year-ago quarter, according to LIMRA’s US Individual Annuity Sales Survey.

The top five sellers of annuities in 1Q2022, of any type, were AIG Companies ($5.0bn), New York Life ($4.47bn), Jackson National Life ($4.25bn), Equitable Financial ($3.71bn) and Allianz Life of North America ($3.25bn).

1Q2022 Annuity Sales

Immediate income annuity sales were $1.5 billion in the first three months of 2022, equal the results from prior year. Deferred income annuity sales totaled $365 million in the first quarter, down 14% year-over-year. With higher interest rates expected this year, LIMRA has forecast as much as 15% growth collectively for immediate and deferred income annuity sales.

Total variable annuity sales fell 6% in the first quarter, to $28.1 billion. Registered index-linked annuity (RILA) sales grew 5% to $9.6 billion in the first quarter. Traditional variable annuity (VA) sales were $18.5 billion in the first quarter, down 11% year-over-year.

The top five variable annuity issuers in 1Q2022 were Jackson National Life ($4.19bn), Equitable Financial ($3.71bn), Lincoln Financial Group ($2.39bn), TIAA (1.89bn) and Brighthouse Financial ($1.81bn). By the end of 2022, LIMRA has predicted traditional VA sales to grow by as much as 8%. LIMRA expects RILA sales to increase as high as 30% by year-end 2022.

© 2022 RIJ Publishing LLC.