A few things you should know about Bill Sharpe: He’s fascinated by probabilities, he’s passionate about computer programming and he’s worried that millions of Baby Boomers are about to slam into retirement unprepared.

“Here’s the challenge,” the goateed Stanford emeritus professor of economics, who created the Capital Asset Pricing Model, co-founded Financial Engines, and, yes, nabbed the Nobel Prize in 1990, told RIJ recently. “What should people do when they hit retirement? Ordinary people don’t have the foggiest idea.”

Sharpe, who lives in Carmel, California and will turn 80 in June, has responded to this challenge, most recently, in a modern way: he started a blog. It’s called RetirementIncomeScenarios, and he’s posted there intermittently since last August. The posts describe his progress toward writing an easily accessible software tool for testing decumulation strategies.

When he finishes the tool, he said, advisers and their clients will be able to input their own personal data and market assumptions and so forth, and determine the sustainability of a particular income or spending rate.

“Ideally, I can envisage an adviser sitting down with a client and saying, ‘We talked about doing a four percent withdrawal for retirement income. Here’s what would happen. And if you bought an annuity, here’s what would happen,’” Sharpe said.

Starting from ‘Scratch’

To see this work-in-progress for yourself, just tune your browser to scratch.mit.edu, a whimsically serious website created by the Massachusetts Institute of Technology to teach children how to program using a simplified language called Scratch. (Sharpe himself programs mainly in MatLab, but chose Scratch for this purpose because it’s easy and available to everyone.)

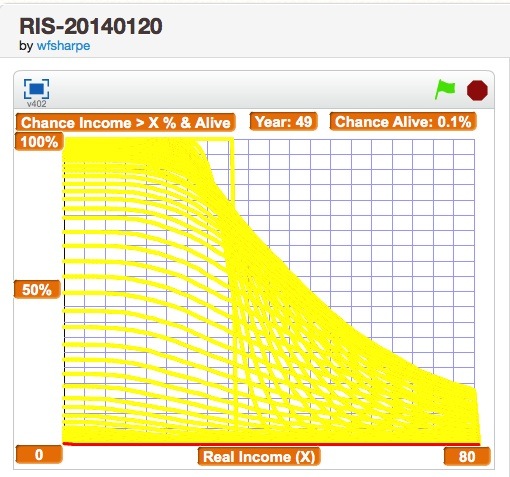

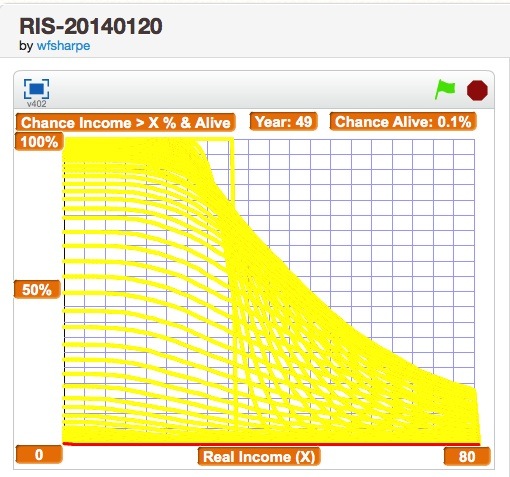

Once you reach the Scratch website, search for “wfsharpe,” then choose “RIS-20140120” from the subsequent list. You’ll see a blue column of “Settings”—the inputs—and an orange column of graphs, scenarios and analyses—the outputs. These represent Sharpe’s latest work on the analyzer.

Click on the “Analyses” button and, on the next screen, on the “Yearly Incomes” button. You can watch as a Monte Carlo simulator generates 5,000 scenarios and reveals the likelihood, in an particular year of retirement, that either member of a couple would be alive and their portfolio could generate an income greater than $40,000 (with a maximum of $80,000).

Using Sharpe’s default settings, for instance, one can see that 18 years into retirement, the chance of either spouse being alive is 89.7%, and the chance of that one will be alive and receive at least $40,000 in income is about 75%. The chance of receiving $68,000, however, is just 25%. Looking ahead to a hypothetical forty-ninth year of retirement, the couple’s probability of being alive and receiving more than a tiny income is close to zero.

“At the moment, I have introduced two account types, one that follows a 4% payout rule, with some extra parameters, and an RMD-based proportional payout rule. You put in your age and sex, and it calculates the mortality risk. You can do Monte Carlo analysis for a particular scenario, and then see how much uncertainty is entailed,” Sharpe said.

“In time, I’ll add other strategies. I’ll add Social Security. You [will] see what the range of possible outcomes might be. It’s not going to lead someone to say that a particular strategy is right or wrong, but you’ll be able to see the range of potential outcomes,” he added.

Lorenzo di Tonti’s big idea

Sharpe himself doesn’t need retirement help—Financial Engines, Inc., the participant advice and managed account firm that he co-founded in 1996, now has a market capitalization of about $2.66 billion—but he acknowledges the synergies that a combination of insurance and investments can offer retirees in general.

“It’s important that people have some understanding of the insurance and non-insurance side” of retirement income solutions, he said. “If you have a lot of money, fine, spend whatever you want to spend, but I’m more interested in the people who don’t have a lot of money.”

Like a lot of academics in the retirement field, Sharpe thinks that longevity insurance—low-cost annuities that offer income starting at age 85—make financial sense. But he also sees the difficulty of marketing such a product. “Behaviorally, if you say to people, ‘Give us half your money and if you’re alive at age 85, you’ll get an income,’ that’s a hard sale.”

He speaks favorably of “tontines,” an idea from 17th century France that has attracted attention lately. Invented by Lorenzo di Tonti in 1653 as way to raise capital, tontines provide lifetime income. But, unlike annuities, they don’t involve life insurers. After investing, individuals receive annual dividends proportionate to what they contributed, how the underlying investments performed, and how many participants are still alive. The last survivor collects whatever is left. The participants themselves bear the volatility risk and—more to Sharpe’s point—the risk that the participants might live too long.

“The idea of the tontine is to have the annuitants bear the longevity risk, instead of the insurance companies,” he told RIJ. “If actuarial tables turn out to be wrong, there’s no way for annuity issuers to diversify away all that risk. This would be better than having annuitants worry about counter-party risk, which could be huge.”

For the average person, looking at retirement through a prism of probabilities is just bewildering, if not scary or even blasphemous. For Sharpe, there’s no other way.

“The only way you can look at this [retirement] problem is through probability. You can’t look at it not with probability. Everywhere you turn there are probabilities: of inflation, of market performance, of mortality,” he said. “[It’s true that you] don’t know the range of possible outcomes for next year, let alone for 40 years from now. But you try to come up with the most credible set of probabilities that you can.”

But “people don’t want to think probabilistically,” he added. “Nobody wants to think about mortality as a probability issue. There is so much denial and so much refusal to think about this problem. That makes me concerned, because we’re moving to an era where we’re putting the onus on people to save and invest, and to know what to do with their money when they retire. That’s a huge burden for an expert, let alone for the average person.”

The 1990 Nobel Prize

It’s worth taking a moment to reflect on the career that led up to Sharpe’s Scratch project, and on what he’s contributed to economics since he earned his Ph.D. at UCLA in 1961. Above all, perhaps, there’s the Capital Asset Pricing Model (CAPM), for which he won a third of the 1990 Nobel Prize in economic sciences (Harry Markowitz and Merton Miller also won for separate contributions).

The CAPM, as described in Burton Malkiel’s A Random Walk Down Wall Street, helps market participants determine “what part of a securities risk can be eliminated by diversification and what part cannot.” Along with other insights we now take for granted, it shed new light on the mysteries of securities risk and asset pricing and enabled investors to build portfolios in a more rational manner.

Retirement income was always among the applications of the CAPM, and for a period Sharpe worked with pension funds. “That was the focus for much of my research from the passage of ERISA [in 1974] onward. In the latter part of the 1980s I had a research consulting firm. We were focused on the problems of the defined benefit plan sponsor, which involved risk analysis, hedging, and asset-liability matching. I’ve also run a seminar at Stanford on that topic.

“When I went back to Stanford in 1990-91 academic year, I saw a sea-change coming. We were starting down the path to defined contribution. My view was, and still is, not that defined contribution a wonderful new idea, but that it was the by-product of an aging society. It was a response to the need [among pension fund sponsors] to share risk with retirees,” he said.

“I knew that people would not have a clue about what to do. So I shifted my focus to accumulation in the defined contribution world. [In 1996], I co-founded a company that, until recently, was focused entirely on accumulation.”

That company is Sunnyvale, Calif.-based Financial Engines, Inc., which first put scalable online investment advice at the fingertips of millions of 401(k) plan participants and later offered them pre-fab managed accounts. Three years ago, the firm launched Income Plus, a service that allows participants to keep the same managed accounts after they retire. Its main competitors in that space are Guided Choice and Morningstar, Inc.

Sharpe has had a busy consulting career. At various times over the past 20 years, he has advised some of the world’s biggest pension plans, including AT&T, Altria, CalPERS, Hewlett-Packard, United Technologies, and the University of California Regents. Since 1995, he’s consulted for C.M. Capital Corp., the U.S. investments business of the Hong Kong-based Cha family, which has an office in Silicon Valley.

‘There are no obvious solutions’

Despite the fact that he’s entering his ninth decade, Sharpe doesn’t appear to have slowed down much. “I had a shoulder replaced not long ago and it set me back a bit,” he told RIJ. “But I’m a workaholic.”

In May, he’ll travel to Aix-en-Provence to deliver a speech at the 31st annual conference of the French Finance Association. The speech is called “Providing Retirement Income: TIPS, Total Investment Funds, Risky Asset Tranches, Tontines and Trills.”

Also this spring, Sharpe will co-host a conference at the Stanford Longevity Center. Plan sponsors, academics and industry professionals will talk about the barriers that prevent many plan sponsors from providing in-plan guaranteed lifetime income products. (Sharpe’s co-host, Steve Vernon, advises the Institutional Retirement Income Council, or IRIC.)

Then there’s his blog. “I figure I’m good for the rest of my career working in this area,” he told RIJ. “Retirement is a meaty topic. It’s meaty because there are no obvious solutions. There’s no ah-ha moment, where the answer is ‘x.’” As for his Scratch-based retirement analysis tool, he said, “It’s very much a work in progress. But it’s getting better with each release.”

© 2014 RIJ Publishing LLC. All rights reserved.