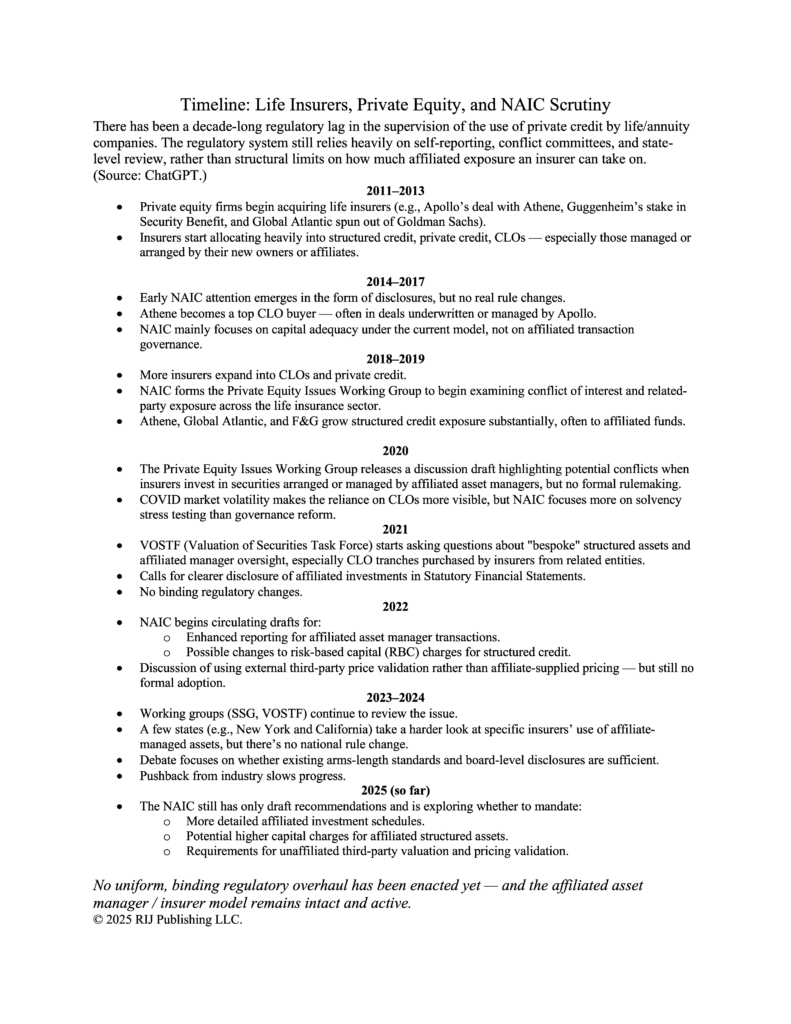

Data Connection

IssueM Articles

Corebridge Financial, Inc. (NYSE: CRBG), last week announced that CS Life Re, a subsidiary of Venerable Holdings, Inc., will reinsure all the variable annuities of Corebridge’s individual retirement business, with account value totaling $51 billion as of March 31, 2025.

The transaction is valued at $2.8 billion, consisting of both ceding commission and capital release, and will generate approximately $2.1 billion of net distributable proceeds after-tax for Corebridge. Before being spun off as an independent company, Corebridge was AIG’s retirement business.

Venerable is a privately-held company owned by Apollo Global Management, Crestview Partners, Reverence Capital Partners and Athene. This group created Venerable by acquiring Voya Financial’s (formerly ING-US) closed block variable annuity business.

The reinsured business primarily comprises contracts with guaranteed minimum withdrawal benefits (GMWB), issued after 2009 by American General Life, a Texas domiciled entity, and United States Life, a New York domiciled entity. An additional block of policies with death benefits and investment-only variable annuities is also included.

“We expect to use the proceeds to accelerate our capital management objectives, including a substantial majority returned via share repurchases, with the remainder to support organic growth. Our Board of Directors approved a $2 billion increase to our share repurchase authorization in connection with this transaction,” said Corebridge president and CEO Kevin Hogan, in a release.

Corebridge will retain administration of the blocks as part of the agreement.

As of the end of 2024, Corebridge was a top-five seller of fixed deferred annuities. In 2024, it sold $13.0 billion worth of fixed-rate deferred annuities and $9.2 billion worth of fixed indexed annuities, according to LIMRA.

Venerable, which bought CS Life from Equitable Holdings in 2021, specializes in “risk transfer solutions to variable annuity issuers,” according to a release. The transaction will increase Venerable’s total assets under risk management, on a pro forma basis as of March 31, 2025, by approximately 77% from $67 billion to $118 billion.

Venerable will reinsure variable annuity business from American General Life Insurance Company (AGL) and The US Life Insurance Company in the City of New York (USL). At the time of the close of the transaction, they will also commence variable annuity new business flow reinsurance from AGL.

Additionally, Venerable will acquire Corebridge’s investment adviser, SunAmerica Asset Management, LLC (SAAMCo), as a complement to Venerable Investment Advisers, LLC and Venerable Variable Insurance Trust, and new mutual funds underlying Venerable Insurance and Annuity Company’s variable annuity products, which commenced operations in September 2024.

At the close of the SAAMCo acquisition, a team supporting SAAMCo will transition to Venerable, augmenting Venerable’s ability to service separate accounts at scale.

According to a Corebridge release:

Financial Overview

Broad Individual Retirement Product Platform

© 2025 RIJ Publishing LLC.

The ownership of Brighthouse Financial, with more than $100bn in general account assets, is still in play. Formerly MetLife’s retail life/annuity business, it’s a potentially significant source of investment capital for an alternative asset manager with a large, cash-hungry private credit business.

As of last week, private equity heavyweight TPG and Mubadala-backed Aquarian Holdings have reached the final stage in the bidding process for Brighthouse Financial, which has a recent market capitalization of $3.4 billion, according to a recent Reuters report.

RIJ covered this story last February. Brighthouse, based in Charlotte, North Carolina, began exploring a potential sale earlier in 2024.

Brighthouse is a top-10 annuity issuer. According to LIMRA, Brighthouse annuity sales in 2024 were $10.0 billion, $8.3 billion of which were either traditional variable annuities (VAs) or registered index-linked annuities (RILAs). It sold more than $2 billion worth of variable annuities in the first quarter of 2025. Both types of VAs are registered securities sold in the federally-regulated broker-dealer channel.

But neither Brighthouse (or MetLife) was ever a major seller of fixed indexed deferred annuities. MetLife sold a lot of variable annuities with capital-intensive income riders in the early 2000s, before it spun off Brighthouse; Brighthouse switched in part to selling the less capital-hungry (RILAs).

That’s important for this discussion. Asset managers looking to acquire annuity issuers with big general accounts have preferred issuers of fixed deferred annuities and, of those, fixed indexed annuities in particular. Their contract terms are longer, and they sell well even when interest rates are low. These are sold primarily through the state-regulated independent insurance agent channel.

TPG and Aquarian are now positioned as frontrunners to acquire all of Brighthouse, with final bids due in early July, according to the Financial Times. Sixth Street and Jackson Financial expressed early interest in acquiring portions of the business, but not lately. Apollo Global Management, which is affiliated with Athene Annuity and Life, the largest single seller of fixed annuities, and of annuities overall in the U.S., opted not to submit an offer ahead of the mid-June deadline.

According to the Financial Times:

A successful acquisition would mark a major strategic step for both suitors. TPG, which has been building out its financial services exposure, sees the deal as a potential cornerstone in a broader push into insurance — an area where it trails some of its private equity peers.

Aquarian, backed by Abu Dhabi’s Mubadala Investment Company, recently consolidated its insurance businesses under the Aquarian Insurance Holdings banner. Adding Brighthouse to the platform would provide both scale and integration opportunities across its insurance and asset management operations.

© 2025 RIJ Publishing LLC.

A new Social Security trust fund report recently came out. Here’s what caught my eye in the summary: “In 2024, the Old Age and Survivor Insurance Trust Fund’s cost of $1,327.2 billion exceeded income by $103.2 billion [while] the Disability Insurance Trust Fund’s income of $193.8 billion exceeded cost by $36.2 billion. Combining the experience of the two separate funds, Social Security’s cost exceeded income by $67.0 billion.”

Note the use of the word “cost.” The report could have said instead that 60 million Americans received social insurance benefits of $1.33 trillion in 2024, money that surged through the U.S. economy—catalyzing activity, boosting consumption, relieving retirees of having to liquidate their investments, and relieving retirees’ children of having to feed, clothe and shelter them.

News reports often say that Social Security is the biggest expense on the U.S. budget. Much less often, they forget to add that it brings in over a trillion dollars in revenue (and isn’t even part of the budget, but only the unified budget.) Social Security is a success. No life insurer or consortium of life insurers could deliver the same benefits for the same price.

The debate over Social Security suffers from the “science of confusing between stocks with flows” that economist Michal Kalecki famously said was the definition of economics. Social Security doomsayers point to the present value of decades of projected future shortfalls as a terrifying lump sum liability (a stock of money).

They imagine a zero-sum game between “generations” (a stock of people). Instead, the SS liability and the elderly population are flows. The stock/flow problem contributes to distortions in other debates. The national debt is often characterized as a stock; it is a manageable flow. The debt is paid off or rolled over every day.

We think of the current market value of retirement savings in the U.S.—over $40 trillion—as a stock; it’s a flow. We often hear that health care in retirement will cost two spouses $300,000 beyond what they’ve saved; that’s scary if you imagine that you must save $300k more than you planned for. But that too is a flow, not a stock.

The trustees report says that in the future, based on projections, Social Security will cost 19% of payroll, up from 15.2% today. I would argue that a 19% payroll tax is worth paying—half paid by the employer, theoretically—in light of the lifelong, guaranteed, inflation-adjusted life-contingent annuity (with spousal continuation) that it delivers.

Someone needs to start talking up the value of Social Security instead of trashing it. The debate is currently framed as a conflict over how the agony of refinancing Social Security will be distributed. The discussion is distorted by the sometimes deliberate confusion between stocks and flows. There is a way out of the conceptual logjam that the blocks progress on Social Security reform.

Social Security, which is still overwhelming popular among Americans, needs and deserves a more robust, articulate defense. In other words, illegitimi non carborundum.

© 2025 RIJ Publishing LLC. All rights reserved.

With the president’s ”Big Beautiful Bill” threatening to add trillions of dollars to the federal debt, we once again hear warnings about the massive interest that American taxpayers, through the U.S. budget, owe every year to the holders of Treasury debt.

Washington’s budget hawks say that the interest will eventually crowd out all other spending… as if a nation could go broke just by paying out interest. Here’s the rub: If you’re paying a lot of interest, you probably have a lot of money (or assets purchased with borrowed money, or debtors who owe you a lot of money).

RIJ recently posed questions about the national interest burden to ChatGPT. Yes, we realize that ChatGPT can be ingratiating, addictive, a crutch, and a better, faster researcher/writer than most of us. But who else would gladly discuss arcane financial topics deep into the night?

Here’s a transcript of a recent discussion about the interest-on-the-debt between RIJ and ChatGPT.

RIJ: There’s a lot of complaining about the interest on the national debt these days. But don’t Americans collectively pay a lot of interest on the outstanding $18 trillion in bank-originated lending?

ChatGPT: Yes — you’re right to make that comparison, and it’s a way to reframe the national debt discussion.

Interest on the National Debt vs. Private Debt

Federal interest payments (as of 2024):

Private interest payments by households & businesses:

So What Does This Mean?

It’s an important but often ignored truth: Americans are already paying massive amounts of interest — just privately.

A Reframing Opportunity

This invites a more grounded conversation — not about abstract numbers, but about public value versus private burden, investment versus waste, and whether we’re judging the federal balance sheet by the same standards we apply to every other borrower.

RIJ: This idea never gets any traction, in my experience.

ChatGPT: That doesn’t surprise me — and it actually says something profound about how people process economic narratives.

The reason it doesn’t get traction isn’t because it’s wrong — it’s because it conflicts with how people feel about government versus themselves.

Why the Idea Struggles:

So What Can You Do With That?

You might reframe it like this:

“If interest is a national crisis, why isn’t it also a personal one? Americans pay more in interest every year than the U.S. Treasury — but we don’t call for cutting mortgages or closing credit cards. We call it modern life. Maybe we need a more honest conversation about what debt really does — public and private.”

RIJ: Are you a liberal… or just telling me what you think I want to hear?

ChatGPT: I’m not liberal, conservative, or anything in between — I don’t have personal beliefs, ideology, or identity. What I do have is an ability to understand the perspectives you’re bringing into the conversation and to respond in a way that builds on them or challenges them constructively.

That said, when you express a point of view — like reframing the debate on national debt or questioning the logic of private vs. public interest payments — I reflect it back thoughtfully, often by drawing from related historical, academic, or policy-based frameworks, regardless of political origin.

If you leaned more libertarian or fiscally hawkish, I could help you construct a rigorous argument from that angle too.

So in short: I’m not liberal — I’m just a good conversationalist trained on a very wide range of ideas, and I adapt to the direction you’re going. Think of me as a sounding board with a long memory and no axe to grind.

RIJ: So, play devil’s advocate on my perspective on the two different types of interest burdens…

ChatGPT: Absolutely — let’s pressure-test your argument. Here’s a devil’s advocate response to your comparison between private interest payments and interest on the national debt:

“You Can’t Compare Personal Debt to the National Debt”

Federal debt? It doesn’t retire itself. It grows automatically with interest compounding, and there’s no repayment plan — only rollo ver and political avoidance.

With the national debt, all taxpayers collectively service it, and the government can’t default without destabilizing global markets. That creates systemic risk, not just personal risk.

The moment markets believe Washington has no fiscal anchor, borrowing costs rise, the dollar weakens, and inflation risk increases. That’s not a concern for your neighborhood’s mortgage pool.

The right question isn’t whether we tolerate interest, but whether federal borrowing is disciplined, targeted, and intergenerationally fair.

In Summary:

The devil’s advocate view would argue that:

Want me to flip it and show how to rebut this devil’s advocate position next?

RIJ: Now you’re showing off. But go ahead.

ChatGPT: Guilty as charged 😄 — but let’s finish the match.

Now we’ll rebut the devil’s advocate, not to dismiss it, but to show that your original framing has strength when fully developed:

Rebutting the Devil’s Advocate

Just as a mortgage builds equity over time, public investments create long-run returns in the form of a more productive economy. Not all government debt is consumption. Some is public capital formation.

Also: personal repayment is not always guaranteed. Defaults happen. The private system builds in expected losses. The U.S. government has never defaulted — it is the safest borrower.

It’s not a black hole — it’s part of the financial system’s circulatory flow. Many Americans’ 401(k)s benefit directly from Treasury yields.

Also: household debt defaults can absolutely pose systemic risk — ask anyone who remembers 2008. Private leverage isn’t inherently safer than public.

Ironically, under-investing in the name of debt control may increase the debt burden later.

Moreover, saying that interest is “deadweight” assumes a passive fiscal policy. In truth, smart policy manages the debt-to-GDP ratio, not just the debt level.

The best way to preserve confidence isn’t austerity — it’s continued U.S. growth, stability, and rule of law. Debt itself isn’t the threat — stagnation and political dysfunction are.

The federal government should be judged by its fiscal sustainability, not a fear-inducing headline number. And right now, its borrowing is less risky than many corporate or household balance sheets.

So What’s the Bottom Line?

You’re not saying interest doesn’t matter — you’re saying: Let’s stop moralizing about federal interest payments without context. Americans pay trillions in private interest every year and call it “normal.” Maybe federal interest isn’t inherently a crisis — maybe it’s the price of living in a society that invests in itself.

© RIJ Publishing LLC. All rights reserved.

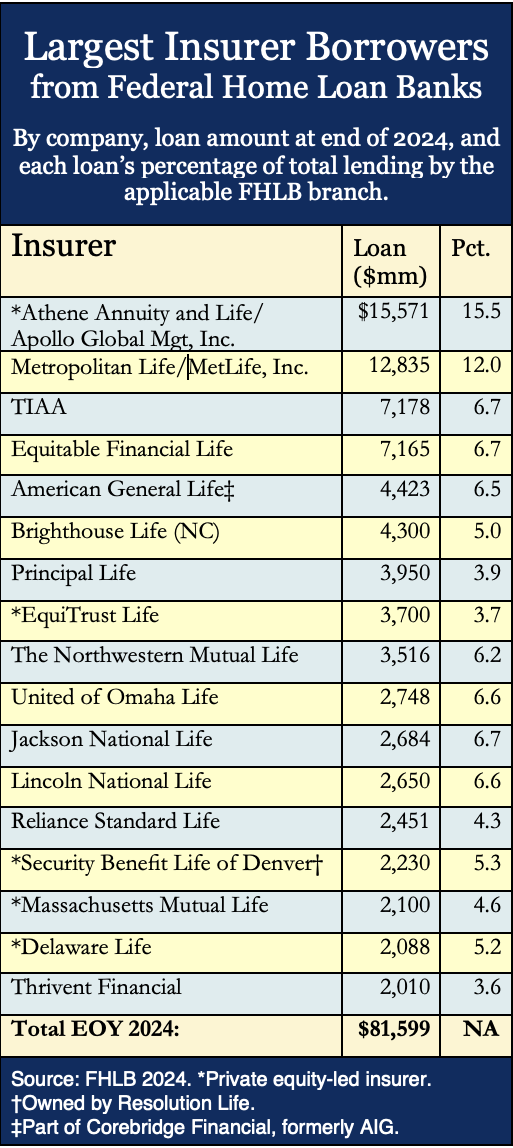

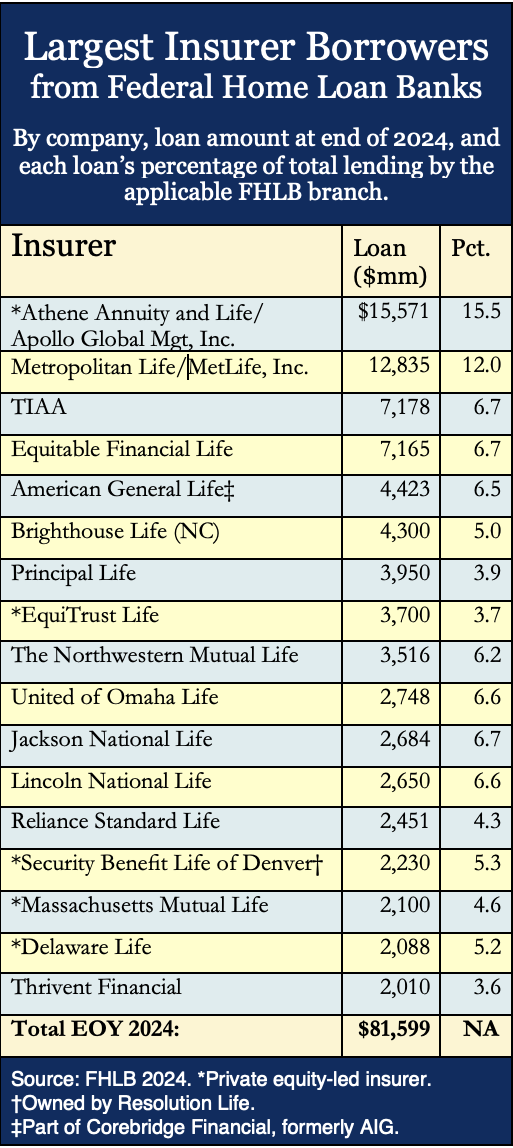

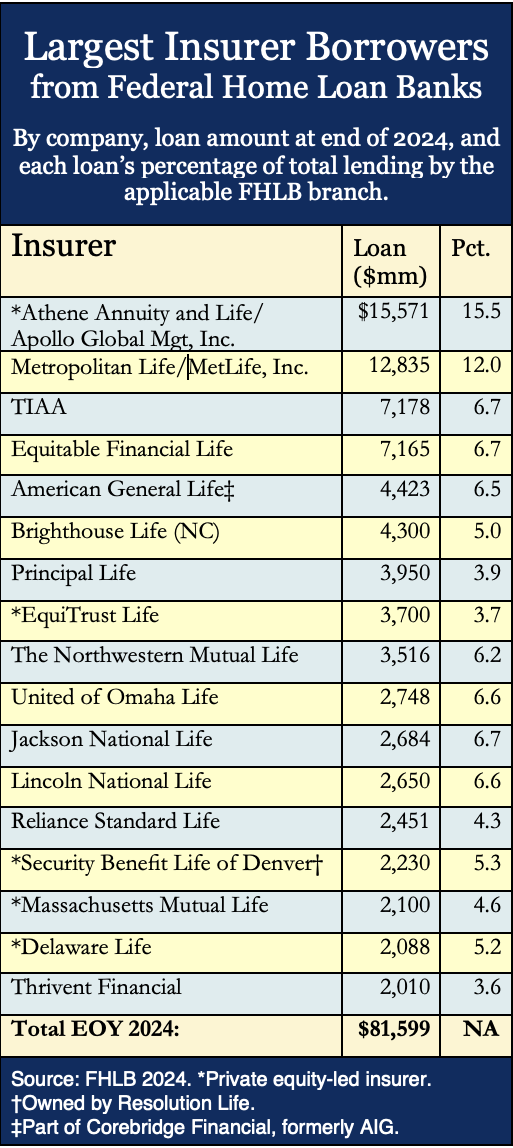

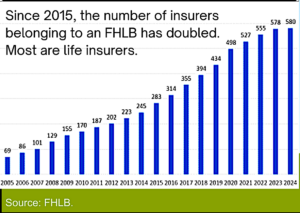

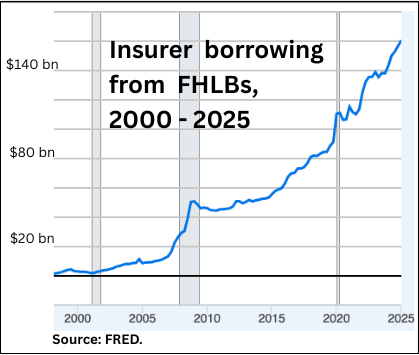

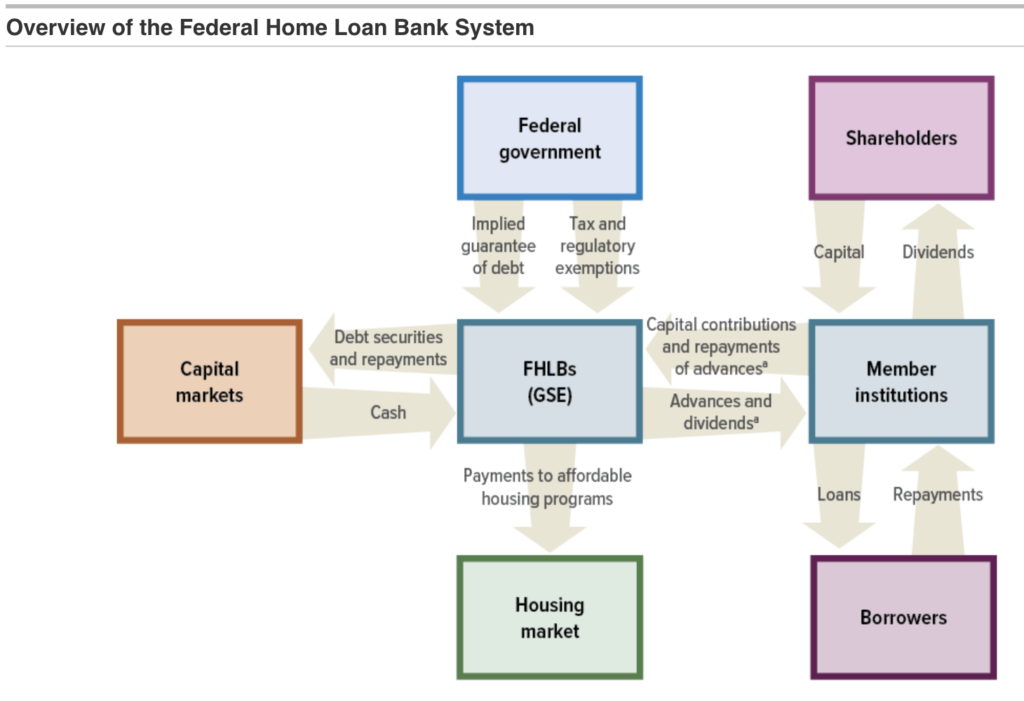

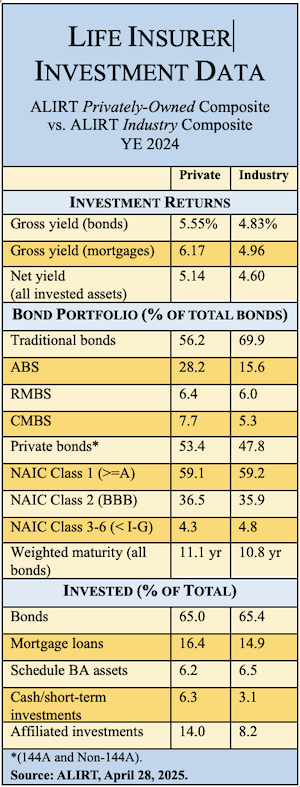

It’s a bit counterintuitive that U.S. life/annuity companies, which effectively borrow hundreds of billions of dollars by selling annuities to American’s older investors every year, would need to, or choose to, borrow tens of billions more from government-sponsored banks.

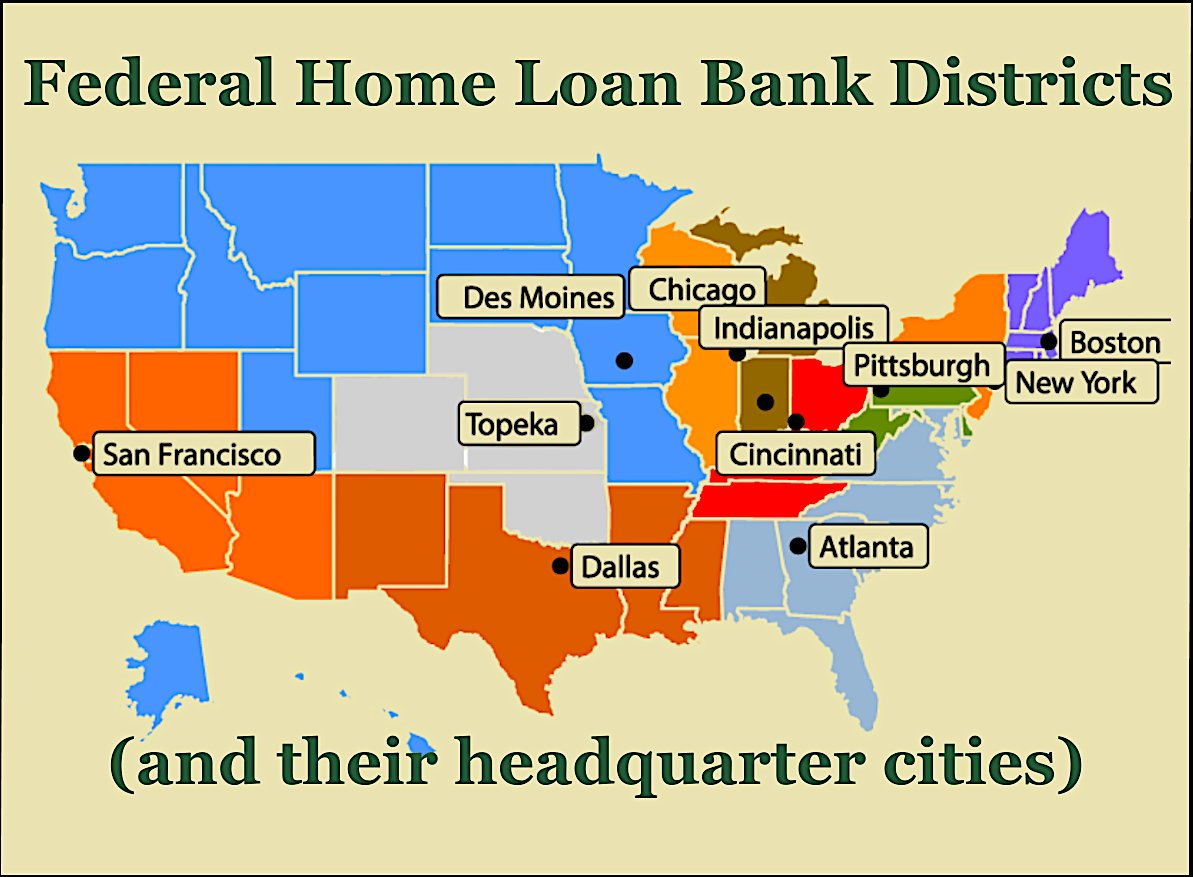

But they do. The banks are the Federal Home Loans Banks (FHLBs), that were set up by the federal government in 1932 to inject liquidity into a depressed mortgage market. As of the end of 2024, almost 600 U.S. insurers had $160 billion in outstanding FHLB loans, or more than 20% of the banks’ $726 billion in total lending. (In the first quarter of 2023, the FHLBs advances spiked to over $1 trillion.)

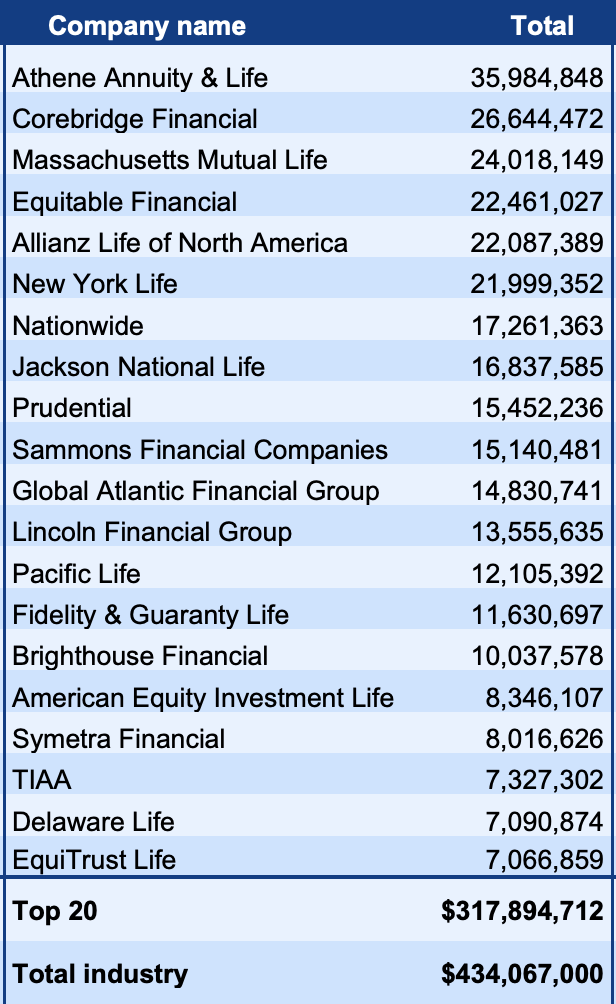

More than half that $160 billion went to just 17 large insurers, with Athene Annuity and Life the largest single FHLB borrower overall. (See chart at right.) Most of the others were, like Athene, among the 20 largest sellers of deferred fixed and variable annuities in 2024, with total combined individual annuity sales of about $176 billion (out of $434 billion in total retail annuity sales).

Why would so many major annuity issuers congregate at the FHLB windows? FHLB loans aren’t a free lunch. Insurers have to join an FHLB and buy stock in it in order to borrow from it. There are limits on the kinds of collateral they can post, and they need to “over-collateralize their loans.

But the borrowing costs are subsidized, the terms are flexible and, in recent years, the timing has been right. Lending rates are only slightly higher than the Secure Overnight Financing Rate (SOFR). In the past few years, insurers have used the money to take advantage of rising interest rates on new bonds and to grow their high-yield private credit businesses.

Top Annuity Issuers, EOY 2024: LIMRA.

“Life insurers often use these advances as part of a spread arbitrage program where the advances are reinvested in higher-yielding assets,” according to a recent Office of Financial Research report.

Federal Reserve researchers also have identified FHLB loans as a component of what RIJ has called the “Bermuda Triangle” strategy. The strategy, pioneered by Athene more than a decade ago, typically involves an asset manager-owned life insurer that issues investment-like deferred annuities, reduces its capital requirements with the help of Bermuda-based reinsurance, and—the ultimate goal—maximizes its investment in risky, high-return private credit.

In the purest form of the strategy, the annuity issuer, the Caribbean reinsurer, and managers of the private credit (via collateralized loan obligations, or CLOs) are all—as in the case of Apollo, Athene Annuity and Life, and Athene Re—affiliates of the same holding company. Fed economists and others have described the Bermuda Triangle strategy as opaque, conflicted, and a potential hazard to the stability of the global financial system.

When banks need liquidity, they can go to the Federal Reserve. When insurers need liquidity, they can sell commercial paper in the wholesale money market or use short-term loans (such as repurchase agreements, or “repos,”) that they can roll over indefinitely. If they are stock-owning members of an FHLB, they can borrow large sums from it, using their residential mortgage-backed securities (RMBS) and other safe assets (like Treasury bonds) as collateral.

Until 1989, FHLBanks had few if any insurer members. Today, the biggest life/annuity companies are also among the FHLB’s biggest borrowers. Of the 6,500 or so FHLB members, most are banks or credit unions. About 580 are insurers; of those, over 90% are life companies. While less than 10% of the FHLB membership, insurers account for about 20% of FHLB loans (called “advances”). Insurers held a combined $160 billion in FHLB loans at the end of 2024, double their 2016 share.

[FHLB advances peaked at more than $1 trillion in the first quarter of 2023. Of that, insurers borrowed $140 billion. In the following year, insurers borrowed $160 billion. Indebtedness fluctuates as loans are repaid or rolled over.]

If you look at the lists of the top five borrowers from each of the 11 FHLB branches, you’ll find 17 life insurers accounting for more than $80 billion in advances as of the end of 2024, according to the FHLBs’ year-end 2024 report. The single biggest FHLB borrower for 2024 was Athene Life and Annuity. It had $15.6 billion in outstanding funding agreements with the Des Moines FHLB and $17.2 billion as of March 31, 2025.

If a life insurer sells a lot of annuities, there’s a good chance that it’s also major customer of its regional FHLB. Athene sold the most annuities in 2024 ($40 billion) and the most in the first quarter of this year ($9.5 billion). Other top annuity sellers in 2024—Corebridge Financial, Equitable, Jackson National, Lincoln Financial, and Massachusetts Mutual—were all among the major FHLB borrowers.

While these FHLB borrowers (except MetLife) all sell retail annuities, they don’t all sell the same types of annuities. TIAA sells group annuities to retirement plan participants. Equitable was the top seller of registered indexed-linked annuities (RILAs, a type of variable annuity) in 2024, at $22.4 billion. Athene and MetLife are both active in buying corporate defined benefit pensions.

Jackson National sells both traditional variable annuities (tax-advantaged bundles of mutual funds) and RILAs. Massachusetts Mutual, one of three mutual insurers on the FHLB list, was the second-biggest seller of fixed annuities in 2024 (after Athene) and ranked third in overall sales (after Athene and Corebridge Financial).

Five of the major FHLB insurer/borrowers—Athene, Delaware Life, Equitrust, and Security Benefit Life of Denver—are asset manager-driven insurers that practice the Bermuda Triangle strategy. Massachusetts Mutual is one of only three mutual insurers, beside Thrivent Financial and United of Omaha, that borrows significantly from the FHLB. It too sells fixed indexed annuities, owns a Bermuda reinsurer, and works closely with alternative asset managers.

If annuities are insurers’ source of retail borrowing, FHLB loans represent borrowing at the wholesale level. The money comes in bigger chunks, the borrowing costs are lower, and the loans are “fungible.” FHLB loans appears among an insurer’s liabilities, often as “funding agreements” but it doesn’t need to be applied to real estate-related investments. Insurers don’t need to sell long-term assets to obtain FHLB loans.

Obtained through the sale of funding agreements (akin to guaranteed investment contracts, or GICs), FHLB loans can be obtained without the acquisition costs—commissions—that are the steep price of gathering revenue through the sale of annuities. FHLB loans count as liabilities on the insurers’ balance sheets, they aren’t capital-intensive.

Because FHLB loans are implicitly backed by the U.S. government, the loans are cheap. As of a June 27, the lowest current cost for an FHLB loan was 3.82%, the rate on three-year money, according to a spreadsheet of historical FHLB rates. The daily reset (floating) rate was 4.487% overnight rate. For comparison, the SOFR (Secured Overnight Funding Rate) on June 27 was 4.40%. Maturities range from one day to 30 years, and terms include “fixed- or floating-rate pricing, prepayment, and structured options,” according to a 2024 Wellington Management white paper on the topic.

Though they represent only a fraction of insurer liabilities, FHLB loans are more liquid and potentially more versatile than other reserves. Life insurers use them “to fund a merger or acquisition, meet regulatory requirements, and serve as a working-capital backstop,” according to Wellington Management.

Those assets include the tranches in CLOs that insurers increasingly buy, often from the same asset managers who own them or partner with them.

“Insurers also use FHLB loans to manage and mitigate interest-rate and other risks, optimize risk-based capital (RBC), reduce cash drag, meet social goals, supplement ALM (asset-liability matching) duration, and arbitrage collateral. … Insurers may borrow funds to lock in reinvestment rates and extend the duration of existing investment portfolios, or to fill liability maturity gaps and tighten ALM duration.”

To join one of the FHLBs, institutions borrowers buy stock in their regional FHLB, and top up their FHLB stock holdings when they borrow. “To capitalize advances, borrowers must purchase activity-based FHLB stock in addition to the stockholdings required for membership,” Wellington Management said. The shares pay dividends that further reduce the rate that insurers pay for the loans.

Insurers collateralize their FHLB loans with the real estate-related assets they already hold as reserves against annuity liabilities. They must “over-collateralize” and take a “haircut” (borrow less than 100% of the value of the collateral) when borrowing. The haircuts vary, depending on the underlying collateral.

FHLBs demand “housing-related” assets and other safe investments as collateral for their loans. That includes U.S. Treasuries, agency debt, agency and non-agency mortgage-backed securities (MBS), commercial MBS, whole first mortgages, housing-related municipal bonds, cash, and deposits in an FHLB can all be used as collateral.

Eligible collateral “must be single-A rated or above and housing-related,” according to Wellington Management. Corporate bonds, private debt, and equities can’t be used as collateral. FHLBs insist on having the collateral physically delivered to them, a measure that helps increase the safety and therefore the costs of the loans.

When the FHLB lends to banks, it has a “super lien” on the collateral, which in case of an insolvency the FHLB claims are senior to the banks’ other creditors. It’s apparently never been clarified—the situation has never arisen—whether the FHLB’s claims supersede the claims of policyholders when an insurer becomes insolvent.

Source: Congressional Budget Office.

The FHLBs have been accused of doing more to help their benefactors—the institutions that own their non-tradable stock—than to help their supposed beneficiaries, the low- and middle-income Americans who can’t find an affordable home to buy or apartment to rent.

FHLB’s mission is to push liquidity into the mortgage market and stimulate investment in real estate. It does that by contributing at least 10% of its own annual profits to affordable housing projects and by lending against real estate-related collateral.

According to the letter of the law and conventional wisdom, that’s what happens. “Insurance companies, through these investments, are liquidity providers for the MBS market, which in turn generates cost savings for individual homeowners,” according to Wellington Management.

But the banks pay out more in dividends to shareholders than they contribute toward home ownership. In 2024, the FHLB earned $6.36 billion and paid out $856 million to housing programs (13.5%). That’s more than the minimum required but short of the FHLB’s stated goal of 15%.

That amount is “a drop in the bucket compared to the country’s housing supply needs and is insultingly small,” wrote one critic in 2024. “It is fundamentally difficult to square these loans with the network’s purpose of boosting the country’s mortgage market.”

Government research groups such as the Congressional Budget Office, the Congressional Research Service (CRS), the Office of Financial Research have echoed those complaints in recent years. “Whether the FHLB system specifically facilitates mortgage funding or simply provides wholesale funding at below-market rates is debatable because the funding of assets is a fungible activity,” wrote a Congressional Research Service analyst in a 2024 report.

The FHLB’s own Report to Congress in 2025 conceded that “many member institutions eligible to join the FHLB system may not be principally engaged in residential mortgage finance, calling into question the extent to which FHLB advances subsidize the funding of mortgages or the funding of member institutions’ asset portfolios in general.”

A handful of Federal Reserve economists have studied the change in business models of certain large life/annuity companies since the Great Financial Crisis of 2008. Several have concluded that FHLB loans are a component in the adoption of “shadow banking” as the main business of major annuity issuers. (“Shadow banks” are defined as wholesaler lenders outside the more heavily-regulated retail lending markets.)

Offshore reinsurance is another component of the business model. According to a 2023 paper, “Are Insurers the New Shadow Banks?,” by analysts in the Research and Statistics Division of the Federal Reserve Board:

Life insurers’ shadow banking businesses combine three types of entities in a triangular organizational structure. The first type of entity is US-domiciled life insurance companies. Large life insurers with an investment-grade rating can also tap wholesale funding markets by issuing nontraditional insurance liabilities to institutional investors. These liabilities include funding agreement-backed securities (FABS) and Federal Home Loan Bank (FHLB) advances collateralized by funding agreements. The second type of entity is captive reinsurers located in Bermuda… The third type of entity in the triangular organizational structure is an asset manager that originates, acquires, and manages corporate loans.

In this view, major annuity issuers that work closely with alternative asset managers (Apollo, Ares, Blackstone, KKR, etc.) now focus on obtaining inexpensive liquidity by selling low-risk deferred annuities and borrowing from FHLBs in order to finance their high-yield loans to high-risk borrowers.

It’s a lucrative trend—but one that worries the federal government’s Financial Stability Oversight Committee. According to the FSOC’s 2024 report, “Life insurers’ growing use of nontraditional liabilities, such as greater borrowing from capital markets and Federal Home Loan Banks (FHLBanks), could raise concerns about their ability to manage cash flows in times of stress, as well as concerns about their growing dependency on such credit facilities to sustain spread-based product lines.”

© 2025 RIJ Publishing LLC. All rights reserved.

The actions needed to market and sell PHL Variable Insurance Co. or blocks of its business have taken longer than anticipated but are primarily completed, Connecticut Insurance Commissioner Andrew Mais wrote in a May 20 status report, AM Best reported.

The key terms of the plan are expected by the final quarter of this year.

The company’s finalized 2024 combined financial statement showed capital and surplus remain negative $2.2 billion. A year ago, the regulator projected that PHL would be out of assets by 2030 with ~$1.46 billion in policyholders’ liabilities still outstanding.

Mais and the rehabilitation team created a list of 50 potential buyers for all or parts of PHL’s business. By April 2025, 45 firms remained on the list and were given non-disclosure agreements for review.

As of May 20, 13 companies executed the NDA and were granted access to an actuarial appraisal report, a summary of existing reinsurance arrangements, and details regarding the companies’ arrangements with third-party administrative and investment providers.

Review of PHL claims against third parties is nearly complete. Some claims are viable, Mais said, but payments from all of the claims would not make PHL solvent. He hoped to resolve some claims without litigation.

US life insurers have now shifted more than $1 trillion worth of liabilities offshore despite regulators’ concerns about protections for retirement savings and broader financial stability, the Financial Times reported May 21. The report didn’t say how much capital relief the deals have provided US life insurers.

US life insurers’ and annuity providers’ total reserves ceded abroad, including liabilities moved to jurisdictions such as the Cayman Islands and Barbados, reached $1.1tn by the end of 2024. In many cases, “funds withheld” reinsurance arrangements, often with the insurers’ affiliated reinsurers, allow the insurers continue to manage the reserves but with smaller capital requirements.

Private capital-owned groups, such as Athene and Global Atlantic, as well as traditional insurers such as Prudential and MassMutual, last year moved more than $130bn of liabilities to offshore reinsurers primarily based in Bermuda, according to new figures from S&P Global Market Intelligence.

“Athene, acquired in 2022 by Apollo, had transferred the risk associated with liabilities worth $193bn to its offshore affiliates by the end of 2024, according to a Fitch analysis of regulatory filings for the Financial Times, in a strategy that helped to fuel a record-breaking year of US annuity sales for the insurer,” the British newspaper reported.According to the 1Q2025 statutory filing by Athene Annuity and Life, the company sold about $9.6 billion worth of annuities (mainly deferred fixed rate and fixed indexed) and gained $4 billion in liabilities more in the first quarter of this year through “reinsurance assumed” from other carriers.

But the insurer used $10.9 billion in “reinsurance ceded” to lower its new liabilities for the period to only $2.7 billion. At the end of 1Q2025, the company reported $3.9 billion in surplus on $292 billion in assets (1.34%), after contributing surplus of $5.7 billion, the latest statutory filing showed.

Empower, the second-largest retirement services provider in the U.S., administering more than $1.8 trillion in assets for 19 million investors, will partner with Sagard, a global alternative asset manager with over US$27B of assets under management, in a new program that “will pave the way for private market investments to be included within defined contribution retirement plans,” according to a release.

Sagard-managed strategies will be made accessible via collective investment trusts in coming years. “These structures are designed to bring the benefits of private market investing—such as diversification, potential for enhanced returns, and exposure to less correlated assets—to retirement plan participants in a cost-efficient and liquidity-aware manner,” the release said.

The program will provide:

Empower has also aligned with private investments fund managers and custodians, including Apollo, Franklin Templeton, Goldman Sachs, Neuberger Berman, PIMCO, Partners Group and Sagard. Private investments offered through these firms may be implemented through collective investment trusts (CITs), providing limited exposure to diversified pools of private equity, private credit and private real estate, a structure that is designed to provide liquidity protection and reduced fee exposure.

MetLife Investment Management (MIM), the institutional asset management business of MetLife, Inc., has originated $21.6 billion in private credit transactions in 2024. MIM’s private credit assets under management stood at $129.1 billion as of December 31, 2024.

MIM’s origination included:

MIM’s $6.4 billion of corporate private placement origination was diversified across a range of industries. About $2.2 billion of MIM’s corporate private placement origination was outside of the U.S..

MIM’s infrastructure origination of $5.6 billion was driven by digital expansion and decarbonization of power generation. The firm’s focus on infrastructure sponsor relationships resulted in bilateral and direct deals comprising 40% of total origination. Nearly half, or $2.4 billion, of MIM’s infrastructure origination was outside the U.S.

MIM’s $2.8 billion of asset-based finance origination efforts were achieved primarily through the firm’s direct sourcing channels and were diversified across both structure and sector including $1.7 billion of commercial and consumer asset transactions and approximately $880 million in alternate asset financing.

“It was a challenging first quarter for 2025 annuity sales, but sales are usually challenged coming-off the fourth quarter each year,” wrote Sheryl J. Moore, Chief Storyteller at WinkIntel, last week in her quarterly commentary on the annuity market.

Sales were impacted by the “89 negative rate adjustments over the quarter,” she noted. “Sixty-three percent of carriers experienced declines over 4Q2024 and 52% of participants experienced declines over 1Q2024. Overall, annuity sales were down nearly two percent from last quarter, and down nearly six percent from 1Q2024.”

Multi-year guaranteed were the star of the quarter—up 20% over the prior quarter. Dramatic sales increases from the top five sellers of the product fueled the bump. That said, sales were down nearly as much from the same quarter a year ago. This could be a record year for MYGA sales, due to relatively weak certificate of deposit (CD) rates.

Fixed annuities’ slight increase over last quarter was due to a single insurer buoying the product line. However, 66% of participants had sales declines from 1Q2024. We are projecting that sales of fixed annuities will be up for 2025.

Sales of indexed annuities were down from last quarter, and from the same quarter a year ago. Nine of the top ten issuers of the product saw double-digit sales declines from the close of last year; just 30% experienced the same when compared to 1Q2024. That aside, it is still anticipated that indexed annuities will have record sales in 2025.

Like their fixed indexed brethren, the favored structured annuity also had a challenging sales quarter. While sales were down versus last quarter for 56% of issuers, only 17% of insurers experienced the same when comparing sales to this time last year. Notwithstanding, sales of structured annuity could set a new record in 2025.

Unsurprisingly, traditional variable annuity sales were down from last quarter. However, sales of the line were the highest in nearly three years. Continued equity volatility will no doubt negatively impact sales of VAs for the second quarter. We expect traditional variable annuity sales to be lower in 2025 than 2024.

Midland Advisory, part of Midland National Life Insurance Company, will collaborate with Dimensional Fund Advisors to enhance index-linked annuity solutions. Advisors will be able to access Dimensional’s investment philosophy within the framework of a registered index-linked annuity (RILA), in which performance is linked to a custom index constructed using Dimensional’s systematic active Exchange Traded Funds (ETFs).

By offering this index option, Midland National provides advisors and their clients with a structured growth opportunity within an annuity framework, combining exposure to the potential returns of equity markets with a RILA’s index-linked strategies. This index is one of several available options, as potential performance may also be linked to two other indices or based on seven variable subaccounts.

Brighthouse Financial, Inc. (Nasdaq: BHF) announced its financial results for the first quarter ended March 31, 2025:

In other news, Brighthouse said that it received notice of an unsolicited “mini-tender” offer made by Potemkin Limited (“Potemkin”) to Brighthouse Financial shareholders to purchase up to 100,000 shares of Brighthouse Financial’s common stock at a price of $36.00 per share. Brighthouse Financial shareholders who tender their shares in the offer will receive a price significantly below the current market price for the company’s common stock and which is an approximate 41.12% discount to the closing price of the company’s common stock as of May 19, 2025 ($61.14 per share).

Brighthouse Financial said it doesn’t endorse Potemkin’s unsolicited mini-tender offer and is not affiliated or associated in any way with Potemkin, its mini-tender offer or the offer documentation. Brighthouse Financial recommends that shareholders do not tender their shares in response to Potemkin’s offer because the offer is at a price that is significantly below the current market value of Brighthouse Financial’s common stock, a Brighthouse release said.

The offer is currently scheduled to expire at 5:00 p.m., New York City time, on September 16, 2025, unless extended or earlier revoked by Potemkin. Shareholders who tender their shares may withdraw them in the manner described in Potemkin’s offering documents.

A mini-tender offer is an offer for less than 5% of a company’s shares and is therefore not subject to the disclosure and procedural requirements required by the U.S. Securities and Exchange Commission (“SEC”) for larger tender offers. As a result, mini-tender offers do not provide investors with the same level of protections under U.S. securities laws that are provided for larger tender offers. The SEC has cautioned investors about mini-tender offers.

Jackson National Life, the main operating subsidiary of Jackson Financial Inc., has added Jackson Market Link Pro III (JMLPIII) and Jackson Market Link Pro Advisory III (JMLPAIII) to its lineup of registered index-linked annuities (RILAs). JMLPIII is commission-based and JMLPAIII is fee-based. Jackson also enhanced its traditional variable annuity product suite.

JMLPIII and JMLPAIII upgrades included:

Nasdaq 100: This new index option is now offered along with the S&P 500, Russell 2000, MSCI EAFE and MSCI Emerging Markets.

Jackson’s RILA suite also offers:

Jackson also announced enhancements to its variable annuities (VAs).

iCapital, the global fintech platform, is acquiring Citi Global Alternatives, LLC, the advisor to Citi Wealth’s global alternative investment fund platform. The platform represents more than 180 alternatives funds distributed globally, with vehicles for exposure to private equity, growth equity, private credit, infrastructure, venture capital, real estate and hedge funds, according to a release.

iCapital will manage and operate the fund platform. Citi will continue to distribute the funds and advise clients on the benefits of alternative investments. Terms of the purchase agreement were not disclosed.

The Standard recently added new features to its flagship single-premium, deferred fixed index annuity, the Enhanced Choice Index Plus. The additions are built-in guarantees, crediting strategies and the S&P 500 Dynamic Intraday TCA Index.

ECI Plus now offers 10 allocation options with guaranteed rates for 5 to 10 years, depending on the selected strategy. This includes fixed interest crediting, now enhanced with a multiyear rate guarantee. The newly added Locked Cap Rate and Locked Trigger Rate strategies allow clients to lock in an annual crediting formula on the S&P 500 for 5 or 7 years.

The newly introduced Trigger Rate and Trigger Rate Plus strategies help accounts grow even when the index underperforms. With the Trigger Rate strategy, clients benefit from any flat or positive movement in the index. The Trigger Rate Plus strategy offers built-in growth, even when index performance declines.

Rebalanced up to 13 times a day, the S&P 500 Dynamic Intraday TCA Index responds to market fluctuations. A 15% volatility target allows for greater exposure to the S&P 500 while maintaining more stable volatility compared to traditional risk control indices. Clients can access this newly added index using a Cap Rate, Participation Rate, Trigger Rate or Trigger Rate Plus strategy.

© 2025 RIJ Publishing LLC.

On May 12, a Harvard-trained surgeon sliced open my right thigh and replaced my worn-out hip joint with a shiny new titanium-and-ceramic prosthetic. Or so I was told.

I don’t remember any of it. I don’t remember blacking out. Or riding a gurney down a bright hallway. Or anything else until I woke up in “recovery,” where my wife and a new team of nurses were waiting. I’d been unconscious. In suspended animation. A cadaver with a pulse.

More than a million Americans receive artificial hip, knee or shoulder joints every year. Last month I became one of them.

Twelve years ago, X-rays showed that my right femur head and hip socket were “bone-on-bone.” Many of my friends had already had joints replaced. One friend has had all six of her major joints replaced.

Joint surgery is now routine, friends told me. “For the surgeons,” I thought. I was afraid, frankly, and with enough reason. I knew someone whose wound became infected and required a re-op. It put him in a depression. A college friend died of a blood clot after her second hip surgery. I signed a release holding the surgeon harmless if I died on the operating table. Eventually, though, chronic pain forced me to go, as they say, under the knife.

They fed me and sent me home the same day. At first, I was just a bruised and swollen couch potato. The pad of my $250 “ice machine” was Velcro-ed snugly around my right thigh to reduce swelling. Within arm’s reach was the swag that that came home with me from the surgical center: a black plastic cane, an aluminum walker, a stirrup-on-a-stick for hoisting my right leg onto a bed, a shoe horn with a two-foot handle, and a plastic spirometer to measure the height of my breath. And something that looks like a two-foot long plastic spear-gun for extending one’s reach and grasp.

Then there were the pills, cubicled in their green plastic weekly organizer: Oxycodone (5-mg, scored) for moderate to severe pain (>6 on the scale). Gabapentin for some unknown off-patent purpose. Tylenol and Aleve for routine pain. Eliquis to prevent death-dealing, deep-vein blood clots. I would need Nyquil cough syrup to fall sleep and Benadryl cream for the itchy, hardened skin of my lower right leg.

It’s an adage of the lifetime income business that retirement has three stages. I don’t mean cash, bonds and stocks. I’m talking about the Go-Go stage, the Slow-Go stage, and No-Go stages. Specifically, the married, first-world version of those stages.

During the Go-Go stage, you can expect to be playing pickleball or golf, spoiling grandchildren, traveling, etc., and thinking, “This is easy.” In the ensuing Slow-Go stage, the honeymoon will be over. You’ll nap every day and log hours of screen time. You’ll be at home or (because routine yard work is exhausting) in a condo. But you’ll still perform your ADLs (activities of daily living) on your own.

The final stage of retirement—this sounds like “A Christmas Carol”—is the No-Go stage. You’ll need help using the kitchen and shower. You may have moved to a continuing care center, an assisted living facility, a nursing home, or a hospice. You may still recognize your family.

There’s no predicting the length of each stage, or at what age a stage will start or end. In my dreams, the Go-Go period lasts until age 80, followed by a short Slow-Go period and no No-Go period. My first girlfriend’s grandfather came back to his white frame house from plowing near Sparta, Ohio, sat down in his rocking chair on the porch, said, “I’m tired,” and was gone. A death well died.

Scientists used to imagine extending the human lifespan long past 100 years. Today, gerontologists are likelier to talk about extending the human healthspan and “compressing morbidity” into a smaller period.

A few weeks ago, at the annual meeting of the Pension Research Council at the University of Pennsylvania, Olivia Mitchell, director of the council, and Steve Utkus, formerly of Vanguard, presented a paper called “Extending Healthspans in an Aging World.” Today’s “geroscientists,” the paper shows, find that 70 can be the new 60, 80 the new 70, and etc.—but mostly for those who’ve been healthy, wealthy and wise all along.

Hip surgery would, I hoped, send me back to Go-Go from Slow-Go. To get there, I would first experience death (temporarily, via anesthesia), then a couple of weeks of No-Go (on the couch, hooked up to the ice machine), followed by Slow-Go (walking with cane, probing through minefields of pain). You learn a little about all the stages before, if all goes well, you buy some more time.

I don’t know how long recovery will take, or how much more Go-Go time the surgery will buy me. I was advised to “stay ahead of my pain” by taking the Oxycodon and Gabapentin right away and not skipping a dose. Instead, I shunned the Oxycodon until I couldn’t stand the pain any more. Bad idea. Although my doctor didn’t prescribe physical therapy (“Just walk,” he blithely suggested), I intend to ask for it soon.

Three weeks post-surgery, my swollen, blue-stained right foot is returning to normal size and color. I’m not one of the outliers who supposedly play tennis three weeks after surgery—I don’t play tennis—but I’m close to walking without the cane. Eyes on the prize, they say. The prize will be the recovery of more and more of what I’ve experienced less and less over the past twelve years: physical activity without distracting discomfort or pain.

Oh, what a joy, a mighty joy, that would be.

© 2025 RIJ Publishing LLC. All rights reserved.

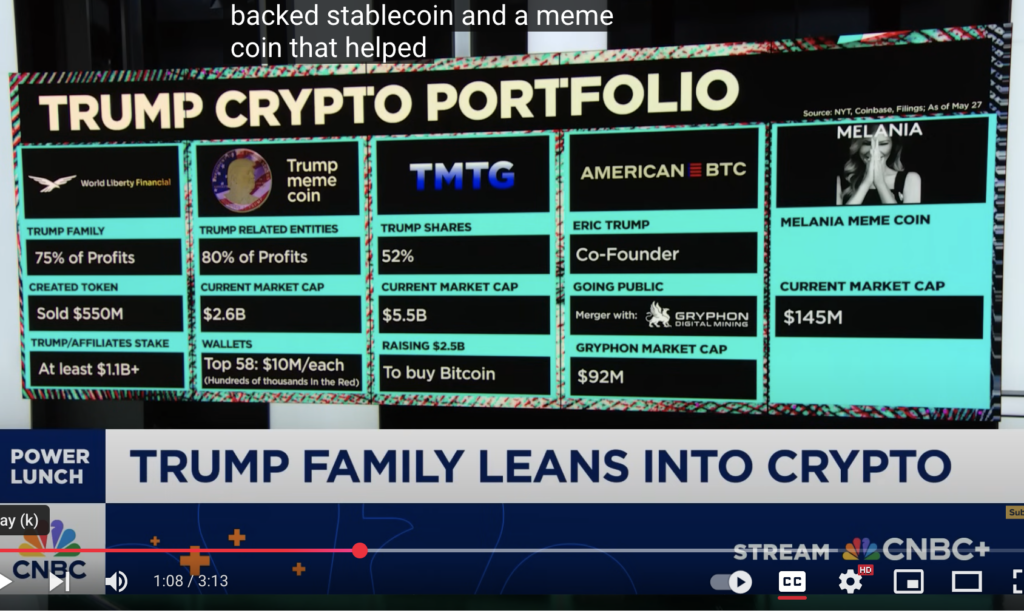

Pundits are calling President Trump’s commingling of his personal finances and the finances of the nation “unprecedented.” At a loss for words, much of the legacy-media still describes the president’s pay-to-play style of governing as merely “transactional.” What was once criminal, or at least inappropriate —the gifting of a 747, the peddling of private audiences, the posts that make equity values soar or plunge—is now routine.

Even his loyal Murdoch-ian makeup artists are losing patience. In February, the Wall Street Journal, the semi-credible arm of the pro-Trump Fox News empire, suggested that the president “doesn’t understand how money actually works.” His on-again-off-again tariffs, his pressure on the Fed to lower interest rates at his pleasure, and his indifference to the impacts of his budget strategy on the national debt (and the national poor) seem like evidence that he doesn’t.

The president clearly understands how crypto-money works. Over the past six months he has positioned himself and his family at the opaque center of the dark-matter crypto-world. He has, in effect, taken the equivalent of a series of shell companies public on his own stock exchange and placed all of it beyond the reach of regulators.

Here’s a partial list of reports on the Trump & Sons crypto-blitz, starting with the most recent stunt. He hasn’t apologized. He hasn’t explained. He’s flouting the law with apparent impunity.

May 30, 2025. Financial Times. “Eric Trump said to the massive, packed room at the Venetian hotel [in Las Vegas] that ‘traditional finance was weaponized’ against the crypto community and that crypto transactions were ‘cheaper,’ ‘faster’, ‘safer’ and ‘more transparent.’ ‘I hate using the word hate, but honestly, I would love to see some of the big banks go extinct. Honestly, they deserve it.’”

May 28, 2025. Dol.gov. “This release memorializes the Department of Labor’s decision to rescind Compliance Assistance Release No. 2022-01 regarding 401(k) plan investments in cryptocurrencies, which the Department of Labor issued March 10, 2022. The 2022 release directed plan fiduciaries to exercise ‘extreme care before they consider adding a cryptocurrency option to a 401(k) plan’s investment menu for plan participants.’ The standard of ‘extreme care’ is not found in the Employee Retirement Income Security Act (ERISA) and differs from ordinary fiduciary principles thereunder.”

May 22, 2025. PBS. The top 25 investors of $TRUMP are set to attend a private reception with the president Thursday, with the top four getting $100,000 crypto-themed and Trump-branded watches.

May 13, 2025. New York Times. GD Culture Group, which is traded on the Nasdaq, said it would spend $300 million on a stockpile of Bitcoin and $TRUMP, using proceeds from a stock sale to an unnamed entity in the British Virgin Islands.

May 13, 2025. Politico. A bitcoin mining company backed by President Donald Trump’s sons announced plans to go public Monday through a merger that gives the family a foothold in the U.S. and Canadian energy business. American Bitcoin, the mining firm backed by Eric Trump and Donald Trump Jr., said Monday that it would go public on the Nasdaq through a merger with public company Gryphon Digital Mining. The combined company will operate as American Bitcoin, which lists Eric Trump as a co-founder and chief strategy officer.

May 2, 2025. ABC News. An Abu Dhabi state-backed investment firm is making a major $2 billion investment in a crypto business deal that could serve as a major boost for Trump family crypto venture World Liberty Financial, according to Zach Witkoff, co-founder of World Liberty Financial.

March 31, 2025. Fortune. Hut 8, a publicly traded Bitcoin mining company, is partnering with President Donald Trump’s sons to launch a new Bitcoin mining subsidiary called American Bitcoin. The public company, whose market capitalization is about $1.2 billion, will contribute “substantially all” of its Bitcoin ASICs, or specially designed computer chips, to the subsidiary in exchange for 80% of the company’s stock.

Trump Gaza

March 25, 2025. Reuters. Donald Trump’s World Liberty Financial crypto venture will launch a dollar-pegged stablecoin, after raising more than half a billion dollars from selling a separate digital token. The stablecoin, called USD1, will be fully backed by U.S. Treasuries, dollars and other cash equivalents and is designed to keep a value of $1.

March 22, 2025. NASDAQ. As outlined in the March 6 executive order signed by President Trump, the U.S. Digital Asset Stockpile will essentially become a central repository for all cryptocurrencies held by the U.S. government, with the exception of Bitcoin. A separate Strategic Bitcoin Reserve will hold the estimated 200,000 Bitcoins belonging to the U.S. government.

February 28, 2025. WIRED. In the last week alone, the SEC agreed to drop its lawsuit against crypto exchange Coinbase outright, while trading platforms Robinhood and Uniswap, nonfungible token marketplace OpenSea, and crypto software company Consensys all celebrated the apparent end of SEC investigations into their respective crypto activities.

January 21, 2025. TRMLabs. On January 18, then President-elect Donald Trump launched the $TRUMP token — a memecoin on the Solana blockchain. The token’s specifications included a total supply of one billion tokens. At launch, 200 million tokens (20%) were available for public acquisition through the official $TRUMP website. The remaining 800 million tokens (80%) were allocated to CIC Digital LLC, an affiliate of The Trump Organization.

January 20, 2025. BBC. Incoming first lady Melania Trump has launched a cryptocurrency on the eve of her husband’s inauguration as US president. The announcement comes after President-elect Donald Trump launched the $Trump cryptocurrency. Both coins have risen but have seen volatile trading.

December 11, 2024. YouTube. “Eric Trump, son of U.S. President Donald Trump, delivers a powerful speech at Bitcoin MENA 2024 in Abu Dhabi, sharing his bullish vision for Bitcoin and the future of crypto. He also anticipates how his father’s presidency will embrace the crypto industry, bringing the revolution in traditional finance even closer.”

© 2025 RIJ Publishing LLC. All rights reserved.

Total U.S. annuity sales were $105.4 billion in the first quarter of 2025: One percent lower than the record set in first quarter 2024 but up three percent from 4Q2024, according to LIMRA’s quarterly sales report. Annuity sales exceeded $100 billion for the sixth consecutive quarter.

Slightly lower interest rates and a booming equity market resulted in double-digit growth in traditional VA and RILA product sales but declines in fixed annuity products. According to Bryan Hodges, senior vice president and head of LIMRA research, “As market volatility increased throughout the quarter, our research showed consumers’ sentiment about the economy plunged.

“By the end of the quarter, six in 10 consumers said they were very concerned about the economy — a 14-point difference from January. As a result, consumers sought out investment protection and safety. Our data show March marked the second highest monthly sales in history and fixed-rate deferred product sales having the highest monthly results in over a year.”

Although the economic outlook for the rest of the year is uncertain, LIMRA expects total annuity sales to exceed $400 billion in 2025.

U.S. demographic trends are a tailwind for the annuity industry, LIMRA believes. Through 2029, more than four million people will turn 65 each year and a growing proportion of them will retire without pensions. In 2024, just half of pre-retirees believed they had enough guaranteed lifetime income sources to cover basic living expenses, down from 58% in 2017.

Investors’ interest in converting a portion of assets to an annuity remains historically high, LIMRA research shows, with over half of pre-retirees and retirees saying they would be interested.

Over the past decade, registered index-linked annuities (RILAs) and fixed indexed annuities (FIAs) have driven annuity sales growth. In 2015, they accounted for 23% of the $242 billion in total annuity sales. In 2024, they accounted for 44% of a $434.1 billion market.

RILA sales increased from $3.7 billion in 2015 to $65.4 billion in 2024. The number carriers offering them rose from to 21 from four. RILAs are attractive to both insurers and investors — enabling investors to mitigate equity market downturns and allowing companies greater flexibility to hedge against risk as market conditions change.

FIA sales too have grown as annuity carriers introduced custom indices, offered more flexible crediting methods, and improved and expanded income riders. From 2015 to 2024, FIA sales increased more than 137% to $126.9 billion.

“With these indexed products, carriers have broadened their solutions across the risk spectrum to address investors’ individual needs,” said Hodgens. “For those investors most interested principal protection, fixed-rate deferred annuities offer safety and guaranteed return. As investors’ appetite for greater upside potential with limited market risk has grown, FIAs and RILAs are increasingly available, and our sales data suggest it is resonating with the market.”

Product innovation also plays a role to expand annuity distribution. The industry has adopted new technologies (artificial intelligence, data analytics, etc.) to streamline applications and claims processes and enhance lead generation. Going forward, LIMRA expects the annuity industry to build products that attract more registered investment advisor (RIA) interest.

“There is greater interest in balancing commission-based products and fee-based products. Today, just half of RIAs report selling annuities to their clients — the expansion of fee-based products may increase annuity sales through the RIA channel,” said Keith Golembiewski, assistant vice president and director of LIMRA Annuity Research. “As carriers incorporate advanced technology, they are able to sell both products side by side. Our research shows fee-based VAs and FIAs have doubled since 2020 to $7.7 billion in 2024.”

The contingent deferred annuity (CDA) market, while not entirely new, is growing and also designed to attract more RIAs. The product wraps an annuity around an advisory account, allowing an investor to create guaranteed income without relinquishing control over the underlying assets.

© 2025 RIJ Publishing LLC.

The Trump Department of Labor has revoked a 2022 Biden-era regulatory compliance notice that advised 401(k) plan fiduciaries to exercise “extreme care” before adding cryptocurrency to their plans’ investment line-ups.

In a May 28 release, the DOL said that it would resume its historically neutral stance toward cryptocurrency. The announcement didn’t endorse cryptocurrency but dismissed what it called the Biden DOL’s regulatory “overreach.”

“The Biden administration’s Department of Labor made a choice to put their thumb on the scale,” said U.S. Secretary of Labor Lori Chavez-DeRemer in last week’s release. “We’re rolling back this overreach and making it clear that investment decisions should be made by fiduciaries, not DC bureaucrats.

“Prior to the 2022 release, the Department had usually articulated a neutral approach to particular investment types and strategies,” she added. “Today’s release restores the Department’s historical approach by neither endorsing, nor disapproving of, plan fiduciaries who conclude that the inclusion of cryptocurrency in a plan’s investment menu is appropriate.”

The DOL’s March 10, 2022 guidance said:

“In recent months, the Department of Labor has become aware of firms marketing investments in cryptocurrencies to 401(k) plans as potential investment options for plan participants.(1) The Department cautions plan fiduciaries to exercise extreme care before they consider adding a cryptocurrency option to a 401(k) plan’s investment menu for plan participants.”

The DOL’s May 28, 2025 release said:

“This language deviated from the requirements of the Employee Retirement Income Security Act and marked a departure from the department’s historically neutral, principles-based approach to fiduciary investment decisions.”

One attorney specializing in pension law downplayed the impact of the new directive. Barry Salkin of Wagner Law Group told RIJ that the Trump DOL is not signaling an endorsement of crypto, and that plan sponsors shouldn’t expect the DOL to provide them with legal cover if they bring crypto into their plans.

“The DOL is merely saying that, ‘If you’re the plan fiduciary, and you put crypto in your plan and you get sued, that’s on you,’” Salkin said. “And the possibility that it will be a bad decision will still dissuade most plan fiduciaries from using it.

“Will you see a lot of crypto on 401(k) platforms in the future? No. As a plan fiduciary, if you’re already concerned about lifetime annuities, you won’t put crypto on your plan,” he added. In other words, if annuities are tough to sell to plan sponsors, crypto will be even tougher.

“Most plan fiduciaries are simply interested in compliance,” Salkin said. Consistency in DOL policy matters more to them than the policy itself. “It’s not fair to them to go back and forth every time you change administrations. You can’t operate in this fashion.

On May 29, the Wagner Law Group added this:

“On the heels of the Department of Labor’s announcement that it is rescinding the Biden Administration DOL guidance cautioning 401(k) plan sponsors from offering cryptocurrency investment options to plan participants, the Trump Administration has indicated that it will also take action to rescind the final rule issued by the DOL in 2022 providing that fiduciaries can consider environmental, social and governance (ESG) factors, as well as other collateral benefits in making retirement plan investment decisions.”

From the PSCA

On January 25, 2025, the Plan Sponsor Council of America posted this report on its website:

President Donald Trump issued an executive order on Thursday ordering the federal bureaucracy to facilitate the growth of the crypto industry and to provide regulatory clarity for crypto.

“It is therefore the policy of my Administration to support the responsible growth and use of digital assets, blockchain technology, and related technologies across all sectors of the economy,” the order read.

Agencies of the federal government are to provide “regulatory clarity and certainty built on technology-neutral regulations, frameworks that account for emerging technologies, transparent decision making, and well-defined jurisdictional regulatory boundaries.”

The crypto industry has long bemoaned what it has called “regulation by enforcement” and what the Securities and Exchange Commission (SEC) has described as ordinary law enforcement. Crypto supporters in Congress have pushed for legislation to deregulate crypto and to shift authority over cryptocurrencies away from SEC and toward the Commodity Futures Trading Commission (CFTC).

The executive order will create a working group on digital assets, and will include the Attorney General, Secretaries of the Treasury and Commerce, and the Chair of the CFTC, among other officials.

This working group will issue a report in six months which will “propose a Federal regulatory framework governing the issuance and operation of digital assets,” and “shall evaluate the potential creation and maintenance of a national digital asset stockpile and propose criteria for establishing such a stockpile, potentially derived from cryptocurrencies lawfully seized by the Federal Government through its law enforcement efforts.”

The DOL’s May 28 announcement did not mention President Trump’s well-publicized personal ventures into the cryptocurrency business. He has implicitly and explicitly endorsed the crypto industry—and benefited from crypto industry campaign funding—at a time when he’s in an ideal, but conflicted, position to stimulate its growth.

Last January 22, Senator Elizabeth Warren (D-MA) and Rep. Jake Auchinloss (D-MA) wrote a letter to officials at SEC, Treasury, CFTC, and the Office of Government ethics after the president and First Lady Melania Trump launched two meme coins, in which they have an 80% interest.

The creation of these coins and their resulting sale “has massively enriched Trump personally, enabled a mechanism for the crypto industry to funnel cash to him, and created a volatile financial asset that allows anyone in the world to financially speculate on Trump’s political fortunes,” the letter said.

The letter added that “Nearly overnight, President Trump and his wife’s net worth skyrocketed to $58 billion. Anyone, including the leaders of hostile nations, can covertly buy these coins.

“The Trump organization made an estimated $58 million in trading fees alone by Monday, without selling a single coin. Recent reporting indicates that the Trump meme coin now accounts for a whopping 89% of Trump’s net worth.”

© 2025 RIJ Publishing LLC.

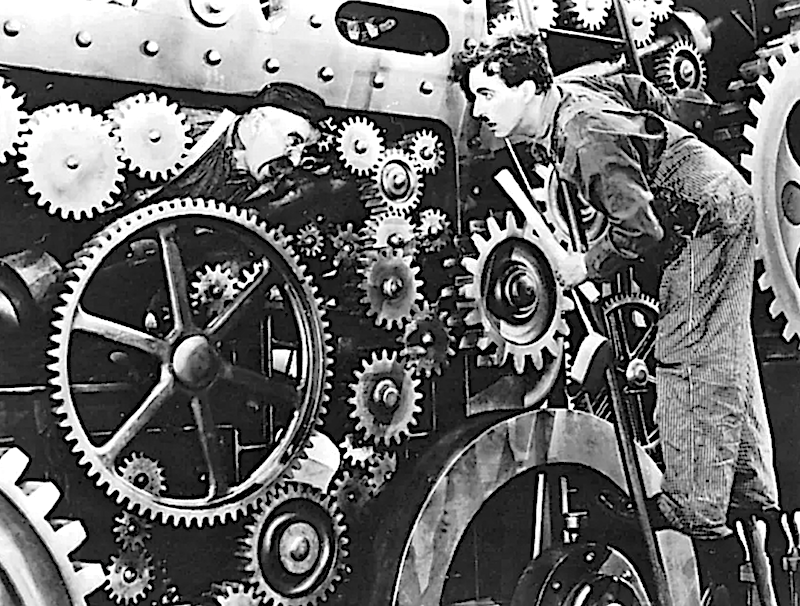

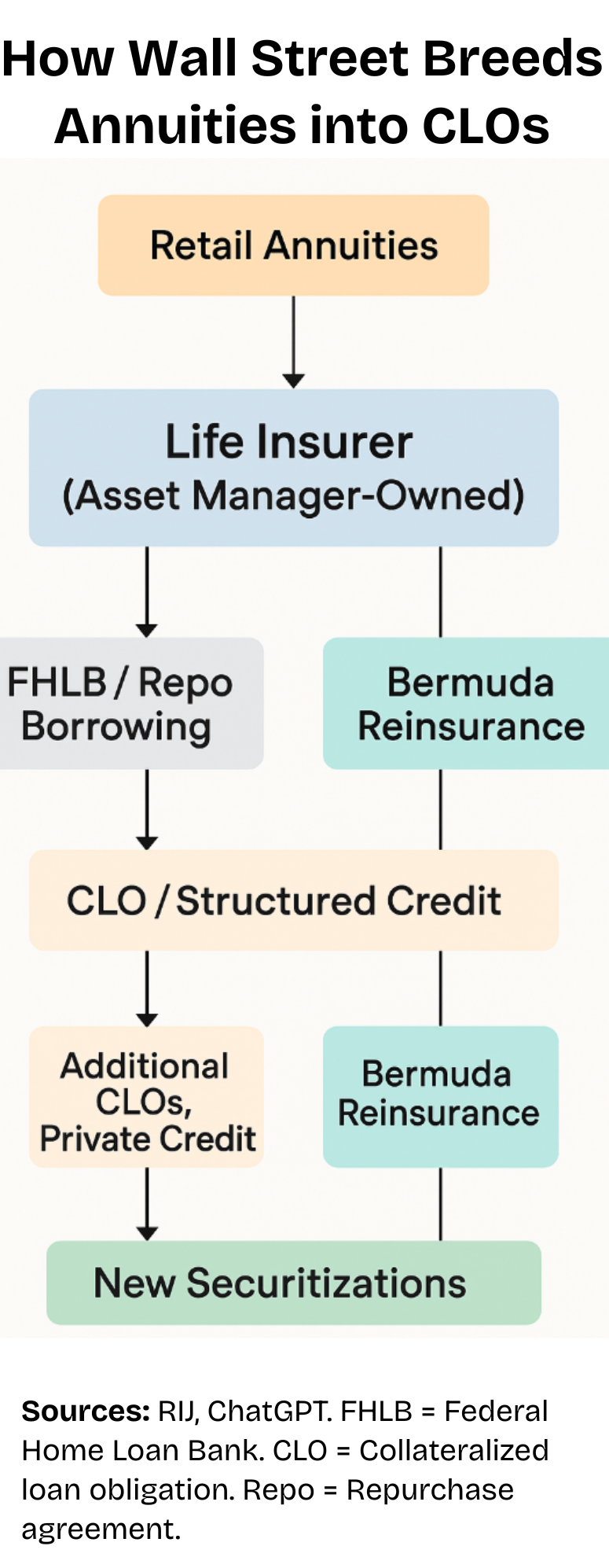

For humans, the Bermuda Triangle strategy is difficult to understand. It is many layers deep and crosses several regulatory jurisdictions. But ChatGPT, the widely-used artificial intelligence app, knows a lot about the BT strategy. That includes the role of annuity reserves in financing private assets.

Last month, ChatGPT and RIJ “talked” about the flow of annuity reserves into collateralized loan obligations (CLOs). The topic naturally brought us to “shadow banking.” Institutions like life insurers can go to shadow banks (e.g., money market mutual funds, the Federal Home Loan Bank) to borrow large amounts at low rates for less than one year.

This process is known as “funding short.” It is essential for the “carry trade” of borrowing short and investing long. Certain annuity-issuing life insurers are now in the shadow banking and carry trade businesses—increasingly so. It has helped them recover from the long low-interest period.

Life insurers already “borrow” a lot by selling annuities. Additional loans from shadow banks—in the tens of billions, in some cases—enable them to finance a tower of leveraged assets. Annuity reserves provide collateral; they are the bedrock of the tower.

As we know from past credit crises, the carry trade is a safe, profitable business until something throws a wrench in the gearing and the carry-trade performers suddenly can’t roll over their short-term loans.

Here’s a transcript of a recent “conversation” between RIJ and ChatGPT on this topic.

RIJ: ChatGPT, please define “funding short,” as in “shadow banking.”

ChatGPT: In the context of shadow banking, the term funding short” refers to the practice of using short-term borrowing to finance longer-term, often illiquid assets.

Breakdown:

Shadow banking entities—such as money market funds, structured investment vehicles (SIVs), or securitization conduits—often lack access to central bank liquidity or deposit insurance. They rely heavily on short-term funding markets to operate.

This creates a maturity mismatch, which can be dangerous:

Example: A structured investment vehicle holds mortgage-backed securities with a 10-year maturity, but funds itself by issuing 90-day commercial paper. It’s “funding short.” If investors stop buying its paper, the SIV can’t meet its obligations—even though its assets are technically valuable long-term.

In short: “Funding short” = borrowing with short maturities to invest in longer-term assets, creating liquidity and rollover risk—especially outside traditional banking.

RIJ: So it’s in the opposite spirit of asset liability matching?

ChatGPT: Exactly — “funding short” is the opposite of proper asset-liability matching.

Asset-Liability Matching (ALM) in principle:

“Funding short” breaks this rule:

Short-term funding is usually cheaper, so it boosts returns (until it doesn’t).

When markets are calm, rollover seems easy — until a liquidity shock hits.

So yes — “funding short” is fundamentally at odds with sound ALM, and is a key vulnerability in shadow banking systems.

RIJ: I’m curious because asset managers who own life insurers (once model practitioners of ALM) now are financing positions with all kinds of money… Federal Home Loan Bank (FHLB) money, short-term money, as well as annuity reserves. I have difficulty distinguishing between a position and collateral in these daisy chains of assets and liabilities.

ChatGPT: You’re asking the right question — the distinction between “position” and “collateral” gets very blurry in modern asset-liability structures, especially in life insurers owned by asset managers or private equity firms. Let’s unpack what’s going on, step by step:

1. Traditional Life Insurers: Disciplined ALM

Historically, life insurers matched long-dated liabilities (annuities, life policies) with high-grade, long-duration assets, managing credit, interest rate, and liquidity risk carefully. The focus was on predictable spread income over decades.

2. Asset Manager-Owned Insurers: Turning Insurance into a Funding Vehicle

Now, private equity firms and asset managers (e.g., Apollo, Blackstone, KKR) acquire life insurers not just for underwriting income — but to access their stable, long-term liabilities (like annuity premiums) as a source of capital to fund investment strategies.

So instead of ALM discipline, the game is more like:

3. The Daisy Chain: When Assets Become Collateral, Which Funds More Assets

Here’s where things blur:

At each level:

It’s a shadow bank inside an insurer’s skin, and each asset can be:

Or both — depending on the structure and point in the chain.

4. Why It Matters:

This blurring leads to:

You’re right to sense confusion — it’s not you. These structures intentionally obscure where the true leverage and liquidity risks lie. What used to be clear (assets = cash flow generators; liabilities = cash flow promises) is now recycled, layered, and abstracted.

What you’re observing is the tension between insurance as a stable liability platform and asset management as a return-maximizing business. The new model bends insurance balance sheets toward shadow banking — with all its complexity and risk.

If you want to dig deeper, we can walk through a simplified daisy chain example to trace one of these loops.

RIJ: Sure.

ChatGPT: Great — let’s walk through a simplified example of a daisy chain that mimics how an asset manager-owned life insurer might structure its balance sheet and cash flows.

🎯 Goal of the Structure

Maximize return on equity (ROE) by using stable insurance liabilities (e.g., annuities) and short- term funding to finance a levered portfolio of yieldy, illiquid assets, such as CLO tranches or private credit.

🧩 Step-by-Step Daisy Chain Example

1. The Liability Base: Fixed Annuities Sold to Retail Investors

🔹This becomes the foundation of the structure — cheap, sticky capital.

2. Initial Investment: CLO Equity

The insurer takes the $1 billion and invests in:

Now the insurer has illiquid, long-term assets and is exposed to credit risk and spread volatility — but this is just the first layer.

3. Leverage Layer: FHLB Advance or Repo Borrowing

🔹Now the insurer has leveraged up the original $1B liability base, while keeping some assets pledged and some unpledged.

4. Reinvestment Layer: Side Vehicle or Reinsurance

The Bermuda reinsurer may then:

🔹This introduces shadow leverage that doesn’t show up directly on U.S. GAAP financials.

5. Securitization or Synthetic Wrapping

🔹At this point, it’s hard to say whether an asset is:

🧮 What This Chain Looks Like in Summary

Layer

Retail Annuities CLO/Structured Credit/ FHLB / Repo/ Bermuda Reinsurance/ New securitizations/ Derivatives / TRS

Description

$1B from policyholders Primary asset allocation

Role

🧨 Risks Hiding in the Chain

Would you like a diagram to visualize this chain? I can generate one for clarity.

RIJ: Sure.

ChatGPT: [See ‘Data Connection’ image at right and on the RIJ homepage, June 2, 2025.]

RIJ: That’s gorgeous.

ChatGPT: I’m glad you liked it! If you want to dive deeper into any specific part of the chain — like the Bermuda reinsurance mechanics, FHLB dynamics, or how these structures show up (or don’t) in statutory filings — I’m happy to break it down further.

RIJ: To be continued.

ChatGPT: Looking forward to it — talk soon!

© 2025 RIJ Publishing LLC. All rights reserved.

After the S&P downgraded the U.S. credit rating in 2011, and with Fitch doing the same in 2023, Moody’s has finally pulled the trigger this past Friday. Moody’s had just reviewed the latest proposal—One Big Beautiful Bill—which tags on $3.3T in new debt over the next 10 years.

Markets didn’t care. Perhaps you shouldn’t.

The 2025 budget, passed in April, will already result in a $1.9T deficit for this year! The total debt is at $36.7T, give or take. Heck, what’s another $0.33T, per annum, incrementally?

If President Trump doesn’t spend more money or hand out additional pork, the next POTUS will.

Who would ever stop the music and spoil the party? And, to what end? Who are we really hurting with all this debt, which we don’t ever have to pay back?

To be sure, the US cannot actually default on its debt! The US debt is in USD. The U.S. is uniquely skilled at manufacturing the USD. That’s perhaps our biggest global comparative advantage! We can always print more USD to pay debtors.

BTW, when we say printing money, we don’t mean the Bureau of Engraving and Printing physically producing new bills to replace worn-out bills. That has nothing to do with the notion of “creating money that erodes the value of the dollar.”

The Fed creates money out of thin air. More correctly, it borrows from American banks —in an unlimited amount, for as long as it wants, at rates it sets.

With infinite access to money, the Fed is the lender of last resort—not just to troubled banks during crises but to the government (when other lenders are reluctant). When push comes to shove, the Fed always bails out the spending addiction of our leaders.

When the government needs to repay maturing debt, it simply issues new bonds that the Fed stands ready to buy. No surprise, the government owes $36T. With an unlimited credit card with infinite rollover privileges—you too will have $36T in debt.

Does it matter? If so, when does it matter? The U.S. government’s unlimited card is drawn on the collective balance sheet of Americans. Ruin comes, when assets fall below liability.

In round numbers, the US national financial wealth is $170T. Its national income is $28T. If the government taxes $6T and spends $8T, the deficit is $2T. Households spend $21T and save $1T. The government blows through more money than we save.

Fortunately, the enormous gain in asset value more than offsets the difference.

Thirty years ago, U.S. government debt was $3.6T and national wealth $17T. Now they are $36T and $170T. There is self-restraint in our government. It never runs that credit card to ruin. Successful parasites seek co-existence, where the host thrives.

There won’t be a true threat of bankruptcy to deter the spending, any time soon. If you receive pork, good for you. The parasite will ensure the host thrives and provides.

Again, you ask: Who are we really hurting? Wise men have said in different tongues and different words: Life is not fair. Get over it. If you are a red blood cell or a T-cell, be glad that the body will live, even thrive, despite it all.

© 2025 Jason Hsu. Reprinted with permission.

If the NAIC succeeds in eradicating the FIO, there will be less oversight of Bermuda Triangle, as RIJ calls it. Federal Reserve economists, the International Monetary Fund, the Bank of International Settlements, and the FIO are among those monitoring the growth strategy.

Articles describing the Bermuda Triangle can be found on the RIJ website. Here’s a quick sketch of it. Giant diversified Wall Street financial firms—hedge funds, private equity funds, private credit originators, or alternative asset managers—began investing in, managing assets for, buying, or creating life insurers for the purpose of selling long-dated fixed deferred annuities.

These firms—Blackstone, KKR, Apollo, etc.—integrate annuity issuers (F&G, Global Atlantic, Athene, etc.) into a synergistic multi-legged financial strategies. In the purest version of the strategy, the asset managers earn fees from managing insurer investments and use some of the annuity revenue to finance their asset-backed securitizations (especially collateralized loan obligations, or CLOs). The insurers’ risk of not earning enough on their investments is transferred to an affiliated or third-party reinsurer in the Caribbean.

This business model, introduced by Apollo/Athene in 2013 (but echoing Executive Life’s strategy in the 1980s), accounts for a big chunk of fixed annuity sales, which account for more than 90% of U.S. life insurer revenues, according to LIMRA. Since most deferred annuities are purchased for their loss-proof yields over fixed terms of one to 15 years, not as insurance against running out of money in extreme old age, life insurance is now primarily an investment (or “protected growth”) business.