Larry Summers, former US Treasury secretary, former chief economist of the World Bank, president emeritus of Harvard, and predictor of a looming era of “secular stagnation,” is playing the role of Cassandra again.

The US won’t be able to chill inflationary trends in 2023 without a recession, say Summers and colleague Alex Domash of the Harvard Kennedy School of Government in a recent paper, “A labor market view on the risks of a US hard landing.” (NBER Working Paper No. 29910.) And the Federal Reserve, they say, shouldn’t soft-pedal the situation by predicting a “soft” economic “landing” after a few brake-tapping rate hikes.

Larry Summers

The authors cite economic precedent as their guide. “The empirical evidence supports the view that taming accelerating inflation requires a substantial increase in economic slack. Since 1955, there has never been a quarter with price inflation above 4% and unemployment below 5% that was not followed by a recession within the next two years,” the authors write.

The root of the problem, in their view, is that too many Americans have jobs and are earning more. Where more sanguine economists have pointed to supply-chain bottlenecks and high petroleum prices as the drivers of the current inflation, Summers and Domash see high wages.

Today’s labor market “is significantly tighter than implied by the unemployment rate,” they write. “The vacancy and quit rates currently experienced in the United States correspond to a degree of labor market tightness previously associated with sub-2% unemployment rates.”

They link the tight labor market to wage inflation of 6.5% in the past year—the highest level experienced in the past 40 years—and point to data showing that high levels of wage inflation have historically been associated with a substantial risk of a recession over the next one to two years.

“There have also only been two periods where wage inflation fell by more than one percentage point in a year—in 1973 and 1982—and both times coincided with a recession. We show that periods that historically have been hailed as successful soft landings—including 1965, 1984, and 1994—all had labor markets that were substantially less tight than the present moment,” the paper says.

Summers and Domash take the sobering position that workers only benefit from rising wages to a limited degree, and then begin to lose their subsequent wage gains to inflation.

“Historically, when wage growth reaches such high levels, inflation tends to accelerate and erodes workers’ real wages. Labor costs represent more than two-thirds of all business costs across the economy, which means that wage inflation contributes significantly to underlying inflation and drastically increases the risk of a wage-price spiral. Using quarterly data going back to 1965, we document how real [inflation-adjusted] wages increase with nominal wages up until nominal wage growth reaches about 4.3%, and fall thereafter,” the authors write.

“While some have argued that the Fed has successfully engineered soft landings in the past, we note that these periods had significantly lower inflation and higher levels of labor market slack than the current moment. Our results suggest that it is unlikely that we are going to have wage inflation come down with a level consistent with low product price inflation without a significant increase in economic slack.”

In other recent research:

“Trends in Retirement and Retirement Income Choices by TIAA Participants: 2000–2018,” by Jeffrey R. Brown, Gies College of Business, University of Illinois at Urbana- Champaign; James M. Poterba, MIT, and David P. Richardson, TIAA-CREF Institute. NBER Working Paper No. 29946, April 2022.

This paper reveals how thousands of retirees from TIAA 403(b) plans withdrew their savings after entering retirement over the past 20 years. The authors found that a rising percentage of TIAA retirees don’t withdraw from their accounts until the IRS forces them to take required minimum distributions, or RMDs. (Until 2019, the RMD age was 70½; it is now 72.) A falling percentage of retirees take income as a life-contingent annuity.

“The fraction of retirees taking no income until the RMD age of 70.5 rose from 10% in 2000 to 52% in 2018,” write authors Brown, Poterba and Richardson. Over the same time period, shrinking numbers of TIAA retirees took income in the form of life-contingent annuities. “The percentage of all TIAA beneficiaries with life annuities… declined from 52% to 31% between 2008 and 2018,” the paper said.

Distribution choices depended on the retirement age of the participant and the size of the account balance, the authors found. As might be expected, those who postponed retirement until after age 70 were more inclined, relative to those who retired before age 70, not to take any distributions of their TIAA savings until the RMD age. Participants in the middle 60% of the account balance spectrum were more likely to choose a life annuity than were those with the highest or lowest balances.

“The Savings Glut of the Old: Population Aging, the Risk Premium, and the Murder-Suicide of the Rentier,” by Joseph Kopecky, Trinity College, Dublin, and Alan M. Taylor, University of California at Davis. NBER Working Paper No. 29944, April 2022.

The authors of this paper tie the demographic changes that followed World War II—the 1946-1964 “baby boom” and the subsequent aging of the boomer generation—to the bull markets in stocks and the decline in safe interest rates over that time.

“A large mass of aging households—the boomers—drive a savings glut which, as they near retirement, especially depresses real interest rates on safe assets,” Kopecky and Taylor write. “As they age, they reduce portfolio allocations to equity, so they do not have the same effect on risky equity returns, widening the equity risk premium.”

Aging households “accumulate more wealth, but then they also tend to shift its composition towards safe and away from risky assets (i.e., into bonds and out of equities). Household assets by age peak in the 70s in the 2016 Survey of Consumer Finance, but the equity share peaks at a much younger age, in the 50s.”

The authors predict that there won’t be a sequel to the boomer-driven shock wave of the past and present. “The current weight of demographic forces on asset returns appear to be much closer to a return to an old normal rather than a new normal that some have described… the boomer-driven demographic forces from the 1960s to the 2010s were a truly abnormal feature by historical standards,” they write.

“A Sustainable, Variable Lifetime Retirement Income Solution for the Chilean Pension System,” by Olga M. Fuentes, Pension Regulator Chile, Richard K. Fullmer, Nuova Longevita Research, and Manuel García-Huitrón, Nuovalo Ltd. March, 2022.

Chile is one of the few countries in the world, along with Canada and the US, to have a “deep and efficiently functioning annuity market,” according to this paper. But because the country’s existing retirement system faces the same stresses as elsewhere—a rising elderly population and low interest rates—the government is looking at new ways to finance Chileans’ retirement.

The number of old age dependents per 100 working-age Chileans is expected to rise from 27 in 2020 to 59 by 2050 and to 86 by 2100. The proportion of the population aged 60+ is on track to more than double, to 40% in 2100 from 17% in 2020. In 2050, the ratio of individuals aged 80 and over to the working-age population is expected to be three times larger than it is today.

Fullmer, a tontine entrepreneur, actuary and former senior executive at Russell Investments and T. Rowe Price, and his co-authors suggest that Chile adopt tontines. Their paper includes descriptions of the Chilean retirement system (the typical three-legged stool: a modest basic pension, a mandatory defined contribution plan with optional annuitization, and private savings). It follows with a description of tontines and their potential role in the future of retirement financing—in Chile and elsewhere, including the US.

Tontines, for the uninitiated, are a type of life annuity; participants make an irrevocable investment and later receive an income from a chosen inception date until they die. But they are cheaper than annuities because they eliminate the middleman: No life insurance company guarantees the income stream or adds its overhead to the cost. Instead, participants bear the investment risk (i.e., income can fluctuate) and longevity risk (the risk that their investment pool might be exhausted before all of them have died).

One of the main benefits of this paper is its detailed description of tontines and its demonstration that tontines can be adapted to almost any situation that might call for an annuity. Tontines, in short, have come a long way since they were invented in the mid-17th century.

“A Comparative Perspective on Long-Term Care Systems,” by Rainer Kotschy and David E. Bloom. NBER Working Paper No. 29951, April 2022

Even if demand for long-term care insurance (LTCI) rises, there may not be an adequate supply of caregivers for the rising numbers of elderly men and women—insured or not—who can’t feed, bathe, or dress themselves, according to new research.

The authors look at the trends in rates of partial disability among the elderly—as reflected in data on deficits in activities of daily living (ADL)—in European Union countries, Switzerland, Israel, the UK, and the US.

“Our results predict an average increase in care demand of 47%, with the largest increases in Southern and Eastern Europe,” they write. But many countries will lack a sufficient number of well-trained caregivers. To relieve that anticipated shortage, wages for caregivers may need to rise, or immigration rates increase, or licenses be required of caregivers.

Unlike the US, Germany, the Netherlands, Israel, Japan and South Korea have compulsory public long-term care insurance. The coverage is financed variously through payroll taxes, copayments, and subsidies from taxing authorities.

The authors suggest that old-fashioned preventive health maintenance through a healthy diet and regular exercise may be the best way for individuals and societies to reduce their needs for long-term care services.

“Good population health—in terms of a low disability share among the elderly—can moderate growth in care demand,” they conclude. But “only a few countries explicitly target disability prevention in their long-term care strategy.”

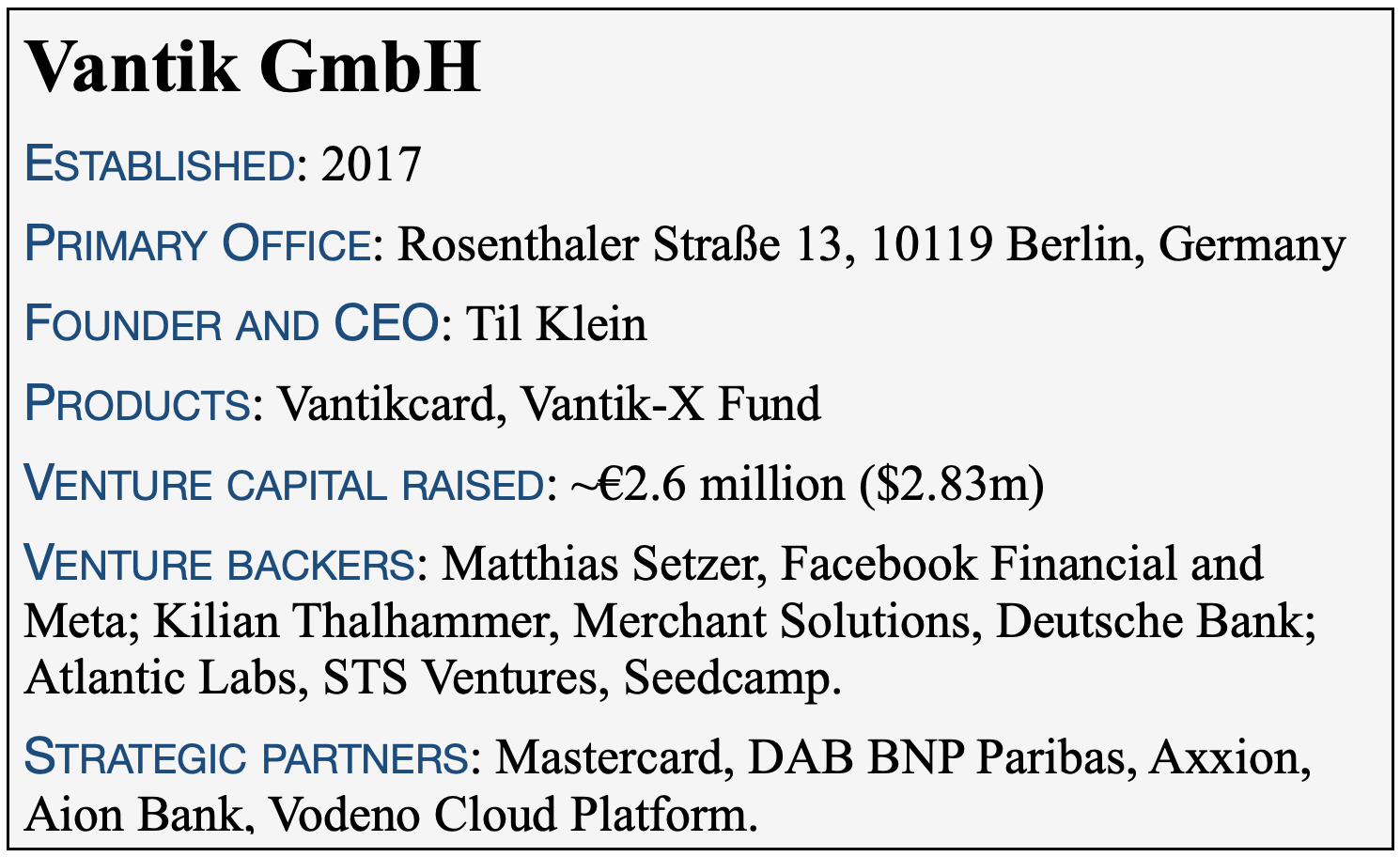

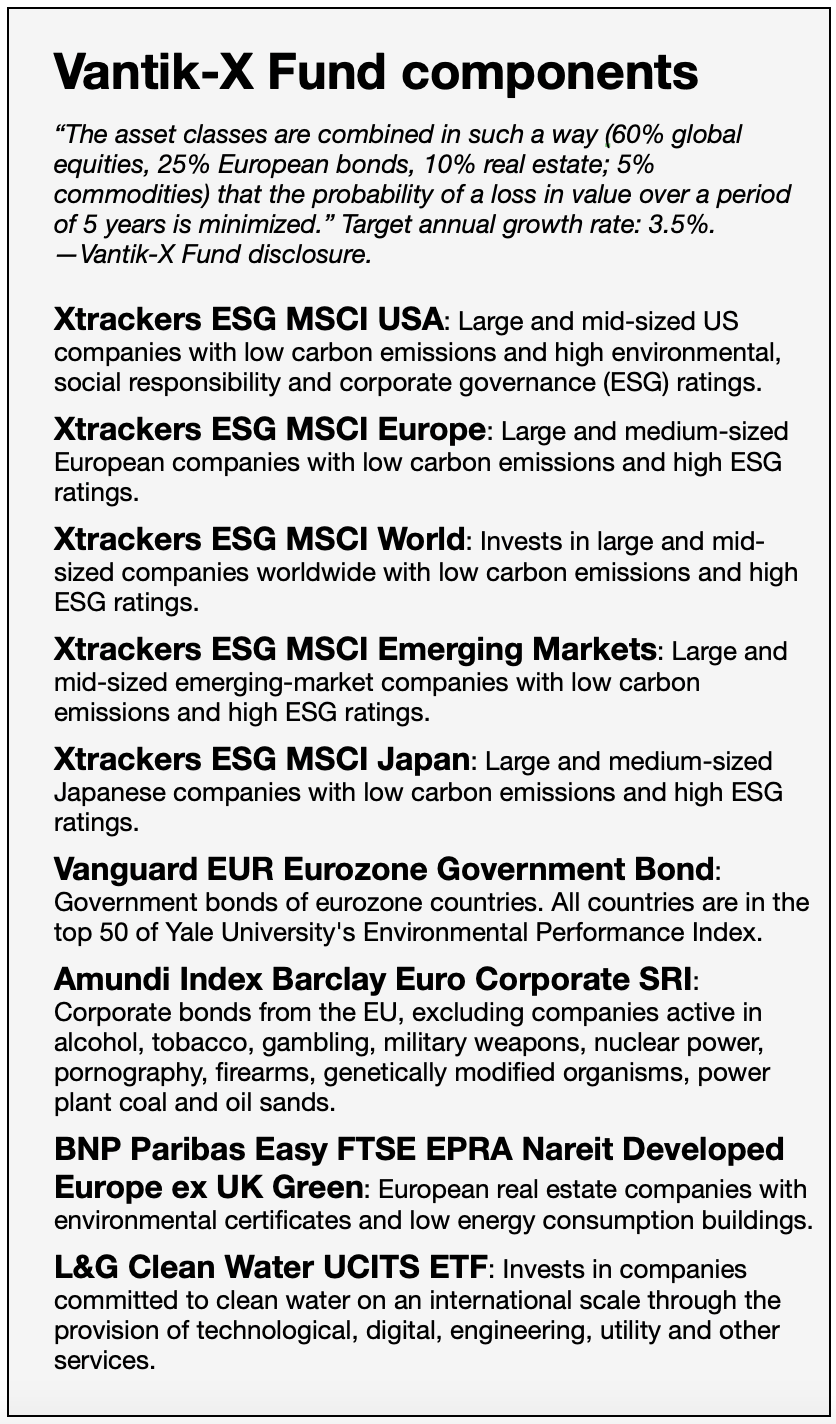

Somewhere down the road, annuities could enter the picture. At age 55, Vantik X shareholders can sell their shares and take a lump sum or buy an annuity that pays out a regular lifetime income, according to press reports. In the meantime, they pay an all-in annual expense ratio of 0.95%. That covers fund management, transfers, trading, etc. (The card itself is free and has no annual fee.)

Somewhere down the road, annuities could enter the picture. At age 55, Vantik X shareholders can sell their shares and take a lump sum or buy an annuity that pays out a regular lifetime income, according to press reports. In the meantime, they pay an all-in annual expense ratio of 0.95%. That covers fund management, transfers, trading, etc. (The card itself is free and has no annual fee.)

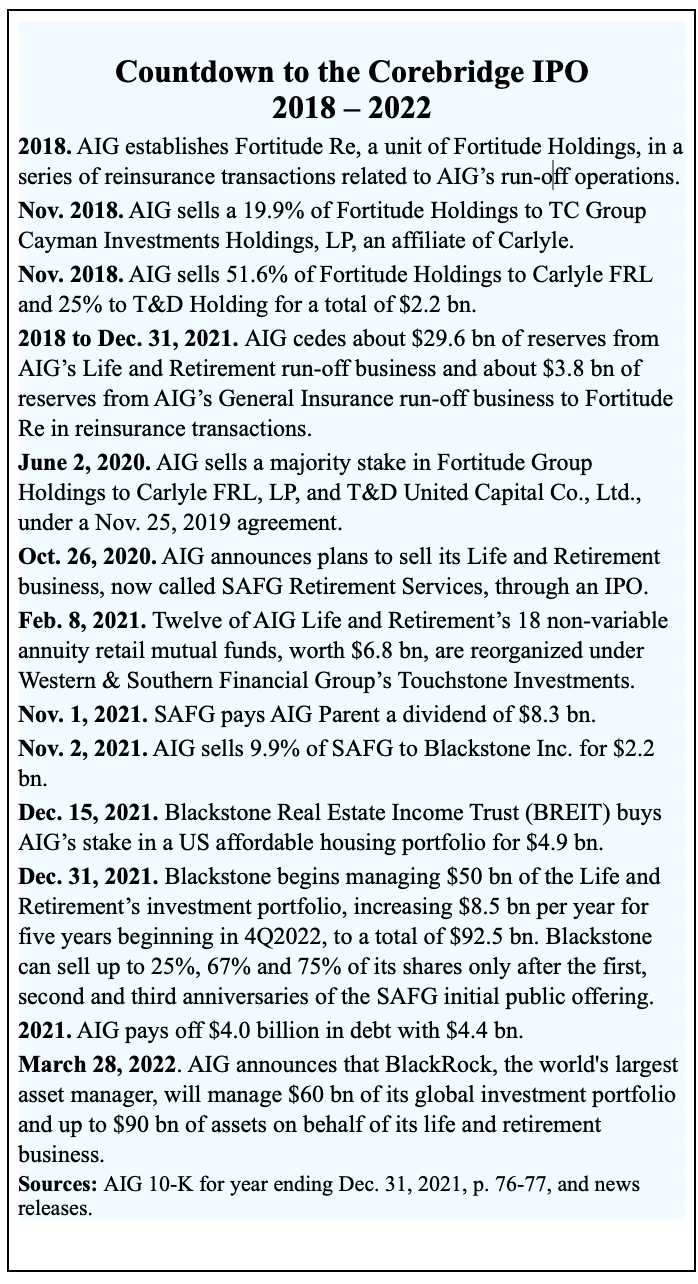

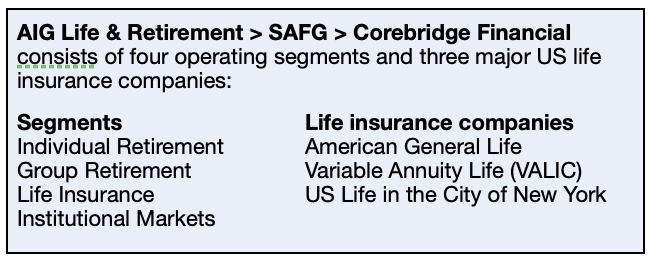

In this case, the entities collaborating to give birth to Corebridge Financial bring expertise in one or more corners of the triangle. The primary life insurers inside Corebridge are AIG’s American General and VALIC; The asset managers are Blackstone and BlackRock. The Bermuda-based reinsurer is Fortitude Re. These strategic partners have interlocking parts.

In this case, the entities collaborating to give birth to Corebridge Financial bring expertise in one or more corners of the triangle. The primary life insurers inside Corebridge are AIG’s American General and VALIC; The asset managers are Blackstone and BlackRock. The Bermuda-based reinsurer is Fortitude Re. These strategic partners have interlocking parts.

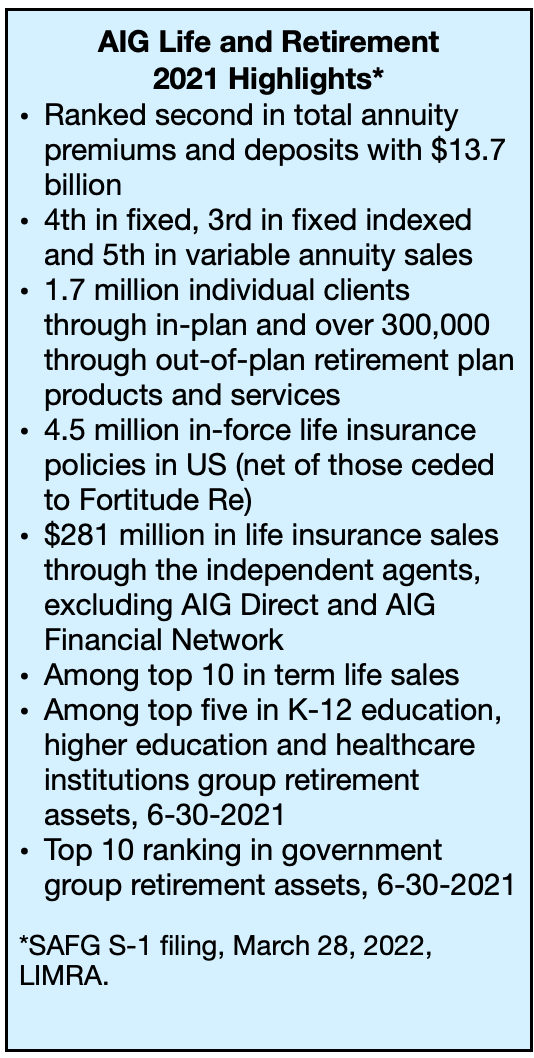

AIG Life & Retirement collected $13.7 billion in individual annuity premium in 2021 and $19.2 billion in total annuity considerations, according to the NAIC and AIG. That was second only to Apollo Global Management’s Athene Life, with $23.1 billion in individual and group annuity premiums, and Jackson National Life, with $19.6 billion in premiums, last year. (In mid-2020, Jackson National sold $27.6 billion in fixed and fixed indexed annuity business to Athene Holding.)

AIG Life & Retirement collected $13.7 billion in individual annuity premium in 2021 and $19.2 billion in total annuity considerations, according to the NAIC and AIG. That was second only to Apollo Global Management’s Athene Life, with $23.1 billion in individual and group annuity premiums, and Jackson National Life, with $19.6 billion in premiums, last year. (In mid-2020, Jackson National sold $27.6 billion in fixed and fixed indexed annuity business to Athene Holding.)