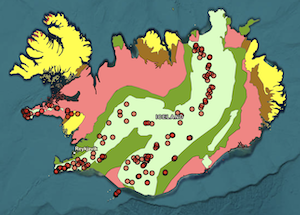

Glaciers, geysers, active volcanoes, and the Northern Lights. Mountains, lava fields and rivers full of coldwater anadramous fish. Iceland’s freaky natural wonders— it’s the polar opposite of Hawaii—attract millions of (mostly estival) visitors every year.

The subarctic tourist-magnet has another feature, less visually striking but as notable: its retirement system. The Icelandic pension scheme was rated number one in the world by Mercer Consulting in 2021 for its integrity, adequacy and sustainability.

The scheme is an example of the workplace-based defined ambition (DA) and collective defined contribution (CDC) systems with which several countries have replaced “pay-as-you-go” plans (for example, Social Security in the US).

The system is collective in the sense that Icelanders workers put their pre-tax contributions in one of 21 diversified investment funds. Ideally, participants’ notional accounts will grow steadily and deliver a taxable life annuity at retirement.[1]

The scheme’s ambition is for full-time workers with 40 years of contributions to replace up to 72% of their average pre-retirement incomes by age 67. Iceland’s system also has its share of complicated options and exceptions, as I’ll explain.

I visited Iceland in mid-2022 (when the volcanoes were spitting and smoking but much less than in December 2023) to interview pension experts in Reykjavik, the capital city and to fish for brown trout in the rivers near Akureyri, a harbor town on Iceland‘s north coast. I wanted to compare Iceland’s retirement policies with pension practices back home in the US.

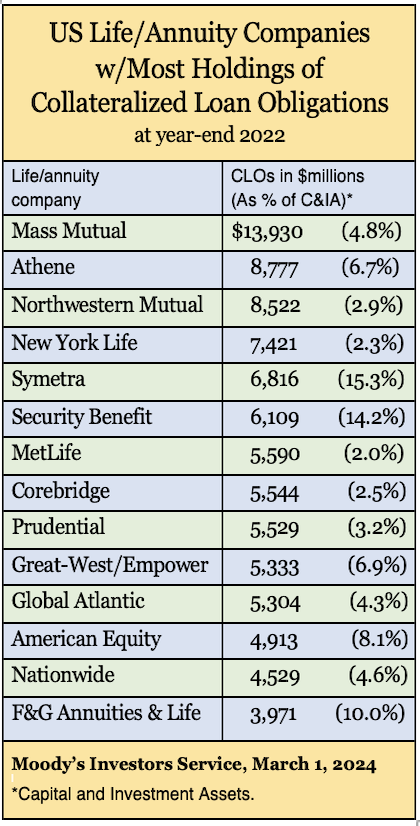

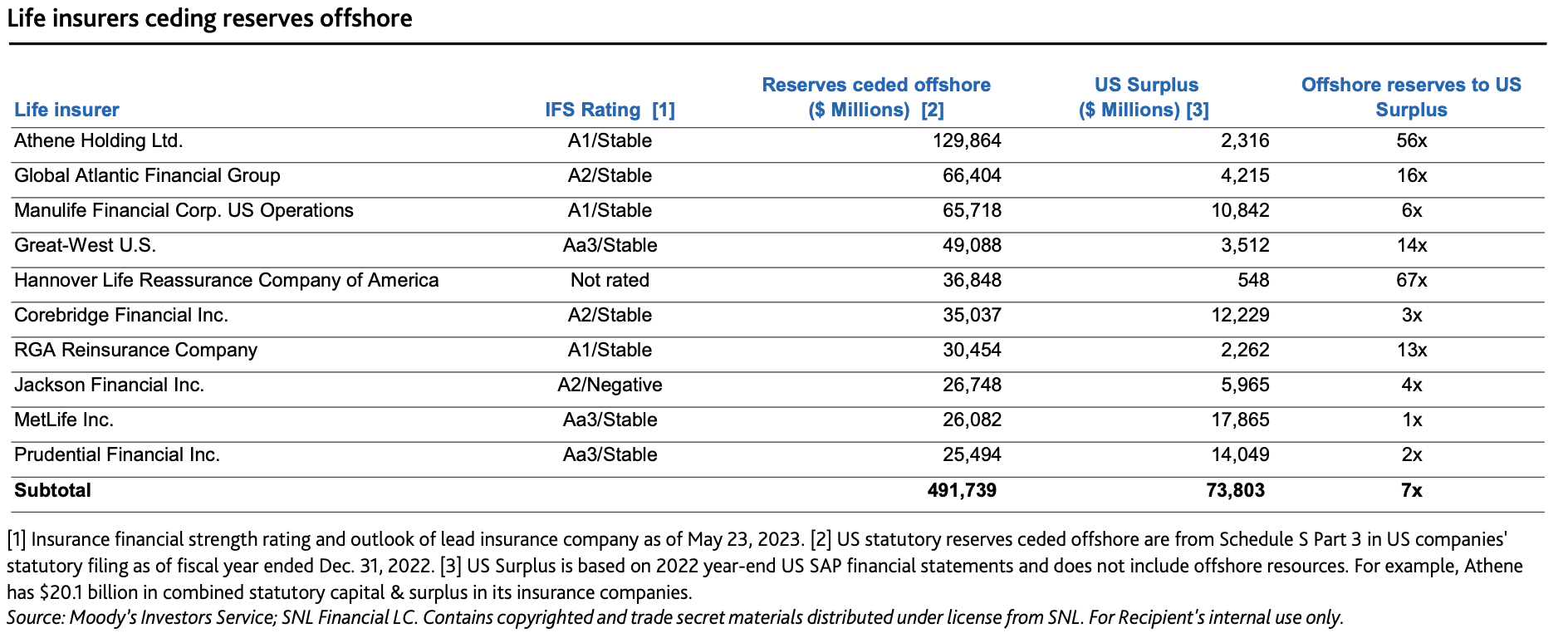

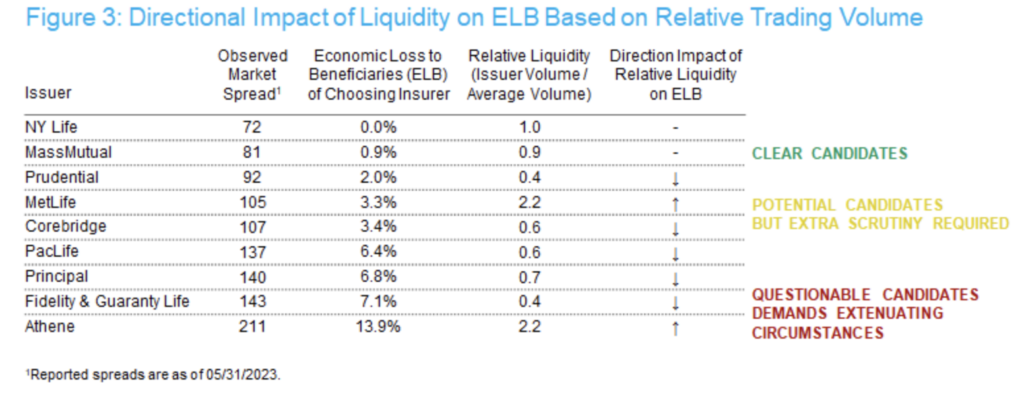

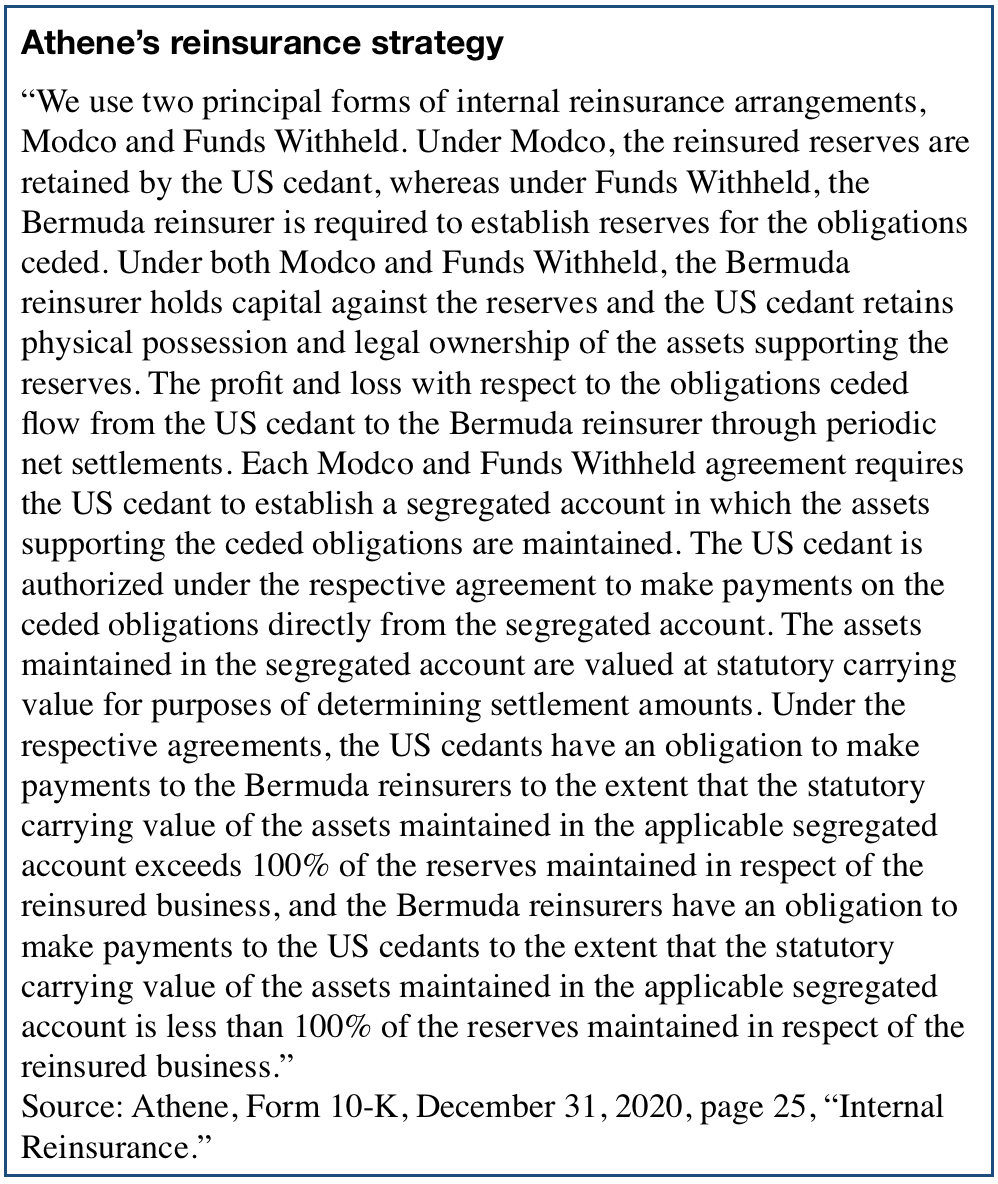

As many pension-watchers know, the US retirement system is in transition. Social Security is on track for a funding shortfall in about 2034; multi-employer defined benefit plans need a federal bailout; life insurers intend to market individual annuities through 401(k) plans; large corporations are selling their pensions to financial giants like Athene, MetLife and Prudential.

Though Iceland is too small for direct comparisons with the US (it has fewer people than Wyoming), a review of Iceland’s highly ranked retirement system could help US firms and policymakers imagine some new possibilities for our domestic reforms.

The three-legged stool

Since 1997, Iceland has been using the “three-legged stool” or “three-pillar” retirement system recommended by the Organization for Economic Cooperation and Development, or OECD. The three legs are:

A first-pillar basic pension. Every employer in Iceland contributes 6.35% of payroll to the social security first pillar pension. Icelanders call it the “Social.” This contribution or tax helps finance a means-tested pension. Icelanders who have worked full-time in the country for 40 years can receive pensions of up to $3,000 per month if they have no other pension wealth. Workers who qualify typically start benefits at age 67 but can defer until as late as age 80 and take advantage of actuarial increases. Iceland’s goal is for most workers eventually to accrue a large enough benefit in their second pillar accounts (see next section) so that fewer qualify for, or need, any of the tax-financed “Social.”

A second-pillar defined ambition (DA) or collective defined contribution (CDC) pension where all risks are borne by the members. As of January 1, 2023, every Icelandic employer (including the self-employed) contributes 11.5% of workers’ pay to one of the 21 pension funds and each employee contributes 4% of pay. This contribution covers retirement benefits, disability insurance and a death benefit for families. The entire payroll is subject to the 15.5% levy; there’s no equivalent of the US taxable maximum or FICA limit of $147,000 (in 2022).[2] Funds invest in a variety of domestic and foreign securities. Benefits accrue, on average, at a rate of 1.8% of income per year. Icelanders who work for at least 40 years can expect a lifetime pension equal to 72% of their CPI-indexed average annual pre-retirement income. The monthly payout can start as early as age 62 (60 in some cases) or as late as age 70, with annual step-ups for deferral, as in the US. Savings and benefits are indexed to the cost of living, and may fluctuate with fund performance or changes in longevity.

A third-pillar, voluntary, tax-deferred non-collective DC savings program. Icelanders with a high propensity to save can contribute up to 4% of their pay on a pre-tax basis to an investment fund of their own choosing. Employers must match up to 2%. These accounts can experience losses as all risks are borne by the members. Participants own their accounts and can access them as needed after age of 60 subject to income tax.

By newly passed law, members can choose to allocate 3.5% of their mandatory 15.5% mandatory second-pillar contribution to the third-pillar. The vast majority of the third-pillar savings are managed by the pension funds. There are as well seven financial companies offering third-pillar savings. The third pillar resembles the 401(k) system in the US.

A close look at the second pillar

There were once more than 100 pension funds in Iceland. Consolidation has brought the number down to 21. Certain funds align with certain occupations, unions, industries, or even levels of education. There are specialized funds for dentists, engineers, and farmers. One fund, the Almenni Fund, caters to doctors, tour guides, technologists, architects and musicians. Other funds are open to anyone who wants to join. Workers who change jobs several times might contribute to several different funds over their careers. Every worker can track the growth of all their notional accounts funds at the Pension Portal.[3]

Teams of professional fund managers run each fund. Icelanders, in most cases, don’t pick their own second-pillar investments. They don’t trade within or between their accounts and can‘t transfer accrued savings from one fund to another when changing jobs.[4] They can’t access their first-pillar or second-pillar entitlements before retirement.

Iceland has one of the highest ratios of pension savings to Gross Domestic Product (GDP) in the world. With a market value (in 2022) of about 7 trillion krona or $49 billion, the 21 pension funds are double Iceland’s GDP of $21.7 billion. Of that $49 billion, about 85% is in the second pillar and 15% is in the third pillar. About 35% or $17 billion of the pension funds are invested overseas; there’s a cap of 50% on foreign investment.

Who guarantees the success of the pension funds? No one. No employer, governmental body, or life insurance company backs the funds. Instead, each fund aims to be fully funded at all times. Contributions are paid into and benefits are paid out of the same risk-managed fund. There’s no transfer from a variable separate account to a general account at retirement, nor any reserve or buffer fund to smooth payments across years or across cohorts of retirees. Only the funding rules imply some smoothing and buffer mechanism.

But a smoothing element does apply to the funded ratio. “In the mandatory second pillar, benefits have to be adjusted when the difference between liabilities and assets is plus or minus 10%,” said Bjorn Z. Asgrimsson, senior risk and pension policy analyst at the Financial Supervisory Authority of the Central Bank of Iceland. We spoke at the modernist headquarters of Sedlabank, as Icelanders call their central bank, in downtown Reykjavik.

“If the funding ratio is down 10% for a year or down 5% for five consecutive years, they have to cut benefits,” he added. Asgrimmson grabbed a marker and scribbled the formula for the funding ratio on a whiteboard in one of the Central Bank’s conference rooms: “Current assets plus future contributions divided by total liabilities.” Inflation adjustments are applied both to the notional accounts of participants and to the payments to retirees.

Some funds hire outside managers. Pension fund managers enjoy some investment freedom within investment rules set by the Central bank and enforced by risk management rules. Expenses for the funds are about 0.35% (35 basis points) of total AUM per year. Workers can claim second-pillar benefits as early as age 65 or defer up to age 80, with benefits adjusted upward for deferral. They receive income from every fund to which they contributed. After the death of a married retiree, the surviving spouse receives the deceased spouse’s first pillar and/or second pillar benefits for three years. The female labor force participation rate is high in Iceland. Between 80% and 90% of women in Iceland are said to have their own earned second-pillar benefits.

Those who study or build tontines might see similarities between Iceland’s second pillar and a tontine. A pure tontine is a centrally managed investment fund whose retired participants who are roughly the same age and who pool their “longevity risk”—their risk of living to age 90 or 100 and incurring the financial liabilities associated with such persistence.

Each year, surviving participants inherit a share of the investment gains and principal proportionate to their contributions, as well as a “survivor’s credit” that represents a share of the assets forfeited by participants who have died. A private annuity does the same, but the tontine eliminates the fees that life insurers charge for guaranteeing a fixed income stream for life.

“I would certainly say that Iceland’s pension and retirement system is infused with ‘tontine thinking,’ in which longevity risk is pooled and shared,” said Moshe Milevsky, a finance professor at York University in Toronto who has written histories of tontines and collaborated with a Canadian life insurer on the launch of a tontine in Canada. All else being equal, tontine payouts are 15% to 30% higher than annuity payouts, he said.

Iceland’s government would like to see the first pillar pension shrink to the point where few or no Icelanders still depend on it for retirement income. Iceland is the only European Economic Area member country where some retirees means-test entirely out of their country’s tax-funded first pillar, Asgrimson said. Iceland recently established minimum support for permanent residents with little or no income.[5]

Limits to rationality

Gylfi Zoega, a professor of macroeconomics at the University of Iceland and an adviser to Icelandic pension funds, has two perspectives on Iceland’s system, as a participant and as an academic. I met him at his book-filled office in the Oddi Building, a white Bauhaus-style building that houses the social science departments on the university’s Reykjavik campus.

At age 59, Zoega, who earned his doctorate in economics at Columbia University, has contributed to the mandatory second pillar and voluntary third pillar of Iceland’s retirement system for most of his career. “Altogether, I put about 25% of my pay into my pension,” he told me. At the level of income he expects his contributions to produce in his retirement, he won’t qualify for any first-pillar benefits.

Recently, he and a colleague reviewed Icelanders’ savings rates in the year after the government, employers, and labor unions agreed to raise the mandatory employer contribution for private sector workers to 11.5% of pay, from 8%. They expected to find many people reducing their voluntary savings rates accordingly.

“Our data, which included the tax returns of everybody in the country, showed no reduction in personal savings to offset the increase in the employer contribution. We conducted a follow-up survey, and found that few people even realized that the employer contribution had increased. People are not as forward-looking or as rational as economists like to think,” he said.

In a 2019 paper, Zoega and others suggested a solution to a weakness that the Icelandic pension system shares with Social Security in the US.7 Wealthier participants, such as white-collar professionals, tend to live longer than lower-income workers and therefore collect pension benefits longer; that’s true even in Iceland, where everyone has lifelong access to subsidized health care. Zoega suggested that, like participants in defined benefit pensions in the US, blue collar workers in Iceland be given the option of a lump sum payout at retirement.

‘I won’t be stranded’

Mercer gave Iceland’s retirement system its top ranking (just ahead of perennial leaders like Denmark and the Netherlands), but that’s news to the Icelanders I spoke with this summer. Their own evaluations of the system were diverse.

“Like any system, it has good and bad points,” a man in Skuggabaldur, a Reykjavik jazz bar, told me. An emigre´ from Iran who runs an Airbnb said, “I don’t know anything about it. My accountant handles all that.“ A retailer who sells Icelandic delicacies like licorice salt and freeze-dried lamb stew in a shop on Laugavegur Street, Reykjavik’s touristy pedestrian mall, told me, “It’s a disaster.”

Why a disaster? In a country as small as Iceland, there are a limited number of domestic companies to invest in, the retailer said. Conflicts can arise when, for instance, a bank that manages the domestic investments of a pension fund has overlapping domestic investments of its own.

The 2014-2018 United Silicon smelter project near the Keflavik airport is one example. While managing the Free Pension Fund (Frjálsi lífeyrissjóðurinn), Arion Bank invested both its own money and Frjálsi money in the smelter. Environmentalist groups opposed the smelter, which ultimately failed. Arion Bank assumed ownership. In 2018, an inquiry by Iceland‘s Financial Supervisory Authority “assessed that the pension fund’s investment process was not normal and healthy.”[6]

Noting “the difficulty of investing all this money in a tiny economy,” Zoega added, “You cannot invest all the money abroad because of the currency mismatch. So the pension funds own almost all listed companies, which creates problems for corporate management.”

“Almost everyone has complaints,” said Stefan Halldorsson, a project manager at the Lifeyrismal and a former president of Iceland’s stock exchange. “Some people might say, ‘I’d rather manage my own savings, or ‘This system is bound to collapse.’ But, while the system may not be ideal, in general Icelanders have a strong perception that they will not be left stranded.” Since Iceland‘s banking meltdown in 2008, he added, the pension system has been more strictly controlled, and participants are better protected.

Conflicts and trade-offs

Means-testing of first-pillar benefits remains a sore point. The higher one’s income from the second-pillar annuity, the less one receives from the first-pillar. “If you have an income of ISK670,000 per month ($4,700) or more from the second pillar, you get nothing from the first pillar,” Asgrimsson, the Sedlabank risk analyst, told me. “Iceland is only country in the OECD where some retirees get nothing from the first pillar,” he said.

A single pensioner living alone with a complete 40-year work history would receive the tax-funded first-pillar benefit (the Social) of about ISK360,000 ($2,567), including a special supplement of about ISK75000 ($535). Members of a couple would each receive almost ISK300000 or about $2,000 each if they both had 40-year work histories.

As retirees‘ projected second-pillar income increases, their rights to the first-pillar benefit shrinks. Someone with ISK200000 ($1,426) in second-pillar monthly benefits would receive about the same amount in first-pillar benefits. Someone earning ISK400000 ($2,852) would receive only ISK100000 from the Social, for a total monthly benefit of about ISK500000 ($3,566).

This cannibalization problem is characteristic of means-tested programs everywhere.[7] Means-testing can be perceived as punishing high-income taxpayers for success rather than accepted by them as a gesture of noblesse oblige. In Iceland, retirees may not know in advance how much of their potential first pillar benefit will be crowded out by their second pillar income. Anecdotally, they are as likely to experience the means-test haircut as a loss of second-pillar benefits than as a loss of first pillar income. This strikes some as unfair.

Anecdotally, means-testing is suspected of inspiring the self-employed and others to under-report their earned income when possible—sometimes at the expense of their second-pillar accrual. “The self-employed have to divide their income into wages and profits for tax purposes,” Zoega said. “The marginal income tax rate is 47% and the capital gains tax rate is 22%, so they’re tempted to lower the wage component. But then their contributions to a pension fund are based on the calculated wages.”

A Laugavegur Street optician told me, while demonstrating a pair of blue-tinted polarized sunglasses, that he wondered why he should pay income tax (at the rate of either 31.45%, 37.95%, or 46.25%) on all of his taxable second pillar income. If his second pillar owes most of its growth to capital appreciation, shouldn‘t he pay the 22% capital gains tax instead? After exclusions, Iceland’s middle-class retirees pay income taxes equal to about 23%, Halldorsson said.

For richer or poorer

Iceland’s high tax rates and ambitious social insurance programs suggest an equitable society. Some of the data bears that out. According to figures from the Organization for Economic Cooperation and Development (OECD), Iceland has a Gini coefficient of about 30, or roughly equal to that of Denmark, Sweden or the Netherlands. The poverty rate for the elderly is listed at only 2.8%, compared with an OECD average of 14.7%.[8]

But others paint a different picture. “Most people in Iceland live hand to mouth,” Zoega told me.

Harpa Njalsdottir, an Icelandic scholar who has studied the nation’s social insurance system, sees Iceland’s shift toward DA and CDC as a shift away from a welfare society to a society where public benefits are relatively stingy.

“Seventy percent of the elderly in Iceland have incomes below subsistence standards, according to figures from the Ministry of Welfare,” Njalsdottir told the RUV in 2018. “More than 70% of those who live alone and are in poor health are women. Those who have worked in the low-wage labor market in childcare jobs for the state and the city, for example in kindergartens, elementary schools, retirement homes, home assistance for pensioners, have had low wages throughout their working lives and do not fare better when they leave the labor market. Due to low wages, their payments to the pension fund are low. Therefore, very low payments from the pension fund await them in their later years.”[9]

Rent consumes a big chunk of those low payments, Zoega said. “The main cause of old age poverty is the housing market,” he told me. “A 75-year-old who does not have any personal savings, who lives off pillar 1 or even a mixture of pillars 1 and 2, will be in poverty if most of the income goes to pay the rent—which is the case for thousands of people.”

Lessons for US?

When Iceland’s workers transfer part of their earned income to their retirement plans, they call each deferral an “idgjald.” In Iceland’s Northern Germanic language (it has also been called a Uralic language), idgjald can mean either a contribution or an insurance premium. Even though second pillar accounts are notional, irrevocable, largely illiquid and accessible only as annuity-like entitlements, Icelanders think of their accounts as assets—a feeling reinforced by their ability to track the growth of their entitlements on a virtual dashboard.

In the US, Social Security accruals are also notional, irrevocable, largely illiquid and accessible mainly as a life annuity. But since Social Security is a pay-as-you- go (PAYG) pension, and because participants perceive their contributions as direct transfers to the bank accounts of current retirees, they regard their contributions as a tax.

Polls indicate that Americans see only a tenuous guarantee that the generation of workers behind them will fund their retirement benefits. Otherwise the two systems, in their entirety, are less different than they might first appear.

Iceland’s second pillar pension combines elements of our Social Security and defined contribution systems in one program. It has the mandatory participation, universal coverage, and annuitized payouts of Social Security. It also has the individual accounts, exposure to financial markets, and professional fund management of our 401(k) system. With its first pillar, Iceland puts a floor under the incomes of poor retirees. With the third pillar, Iceland offers the rich an outlet for their higher propensity to save.

This hybrid pension system enables Iceland to solve two large retirement-related problems that the US faces: lack of access to 401(k) plans for almost half of full-time workers and a tax-funded PAYGO Social Security system that faces a revenue shortfall in the early 2030s.

Could the US convert to a DA system like Iceland’s? In 2007, the George W. Bush administration floated an idea to defer a share of the Social Security payroll tax (12.4% of earned income) into the US stock market. In 2019, Congress passed the SECURE Act, making it easier for employers to accept individual annuities as investment options or payout options in 401(k) defined contribution workplace plans. The seeds for a DA hybrid system have been planted.

The most substantive differences between the two system may be that Iceland has a) reduced costs by eliminating the need for many financial services intermediaries, b) raised contributions by subjecting 100% of earned income to the 15.5% idgjald, and c) incorporated flexibility to adjust benefits in response to demographic or economic change without political upheaval or disruptions in continuity.

© 2024 RIJ Publishing LLC. All rights reserved.

[1] For an evaluation of CDC plans, see Iwry, J. Mark, et al, “Collective Defined Contribution Plans,” Brookings Institution, December 2021. https://www.brookings.edu/wp-content/

uploads/2021/09/20211203_RSP_CDC-final-paper-layout.pdf

[2] FICA stands for Federal Insurance Contributions Act. The US Old Age and Survivors

Insurance tax is 12.4%, or 6.2% for both employer and employee, up to the taxable maximum.

[3] https://www.lifeyrismal.is/is/lifeyrisgattin

[4] Sigurdsson, 2020, p 60. “The returns of the pension funds are significantly higher than the investor achieves. After deducting the annual investment cost, which is 100,000 ISK annually over a 10-year period, the total return in ISK is 485,334 for the pension fund and 335,210 for the hypothetical investor. Which means that the pension funds achieve a 44.79% better return than the investor does on his own.”

[5] “A new type of payment that is intended to support the subsistence of persons 67 years and older who have permanent residency and have no or limited pension rights with the Social Security Administration will be implemented 1st of November. This additional support can amount to a maximum of ISK 231,110 [$1677] per month, which is 90% of the full old-age social security pension per month in the year 2020. Those who live alone may in addition be entitled to up to 90% of the household supplement, which is ISK 58,400 per month [$423.70] in the year 2020.” https://www.tr.is/en/65-years/additional-support-for-the-elderly 7 Forthcoming paper.

[6] “The result of an examination of the investment process of the Free Pension Fund in Umoðiné sílikoni hf.,” the Financial Supervisory Authority, Iceland. Reykjavik, April 10, 2018.

[7] For phase out curve, see https://www.lifeyrismal.is/is/landssamtok-lifeyrissjoda/grof/5frodleikur-um-lifeyriskerfid/53-lifeyrir-sjodir-tr

[8] Oecdbetterlifeindex.org, April 28, 2023.

[9] https://www.ruv.is/frett/ekkert-norraent-velferdarkerfi-a-islandi