I-bonds now offer 7.12% return

Individuals can now get the equivalent of a 7.12% annual return by investing in Series I savings bonds, which they can purchased direct from the US Treasury from now through April 2022.

It’s the second highest yield ever offered by the inflation-sensitive I-bonds, which are distinct from Treasury Inflation-Protected Securities, Bloomberg.com reported this week.

“The US Treasury is committed to unlimited supply until it decides to change the policy. After 23 years, the total amount of I-bonds outstanding is still a tiny fraction of the national debt, so perhaps the US Treasury will continue supplying them under today’s terms without limit,” said Zvi Bodie, retired Boston University pension expert.

In September, Bodie, David Enna, Mel Lindauer, and Michael Ashton published an “I-Bond Manifesto” in support of I-bonds, which were introduced by the US Treasury in 1998. It describes how I-bonds work and how investors can buy them.

Rising inflation is responsible for the high rate. The interest rate on the Series I bond is set twice a year based on recent changes to the consumer price index for all urban consumers. November’s pricing is based on the change from the previous March to September.

The rapid surge in inflation means investors can now get double the six-months-ago offer of 3.54%. With interest rates still at crisis-era levels, I-bonds are one of the few places individuals looking for inflation protection can go without getting into higher risk investments.

The maximum investment is $15,000 per calendar year, they can’t be traded, and purchases are limited to US citizens, residents and employees. The interest rate is guaranteed for the first six months and after that will rise or fall depending on inflation. You have to keep your investment for at least a year. If you exit before five years, you’ll lose three months of interest.

A great year for life insurer stocks: WSJ

“The flood of private-equity money into the industry has also enabled insurers to shift some of their risks onto others, and these moves were broadly rewarded in share prices.”

So said a news article in the January 5 edition of the Wall Street Journal.

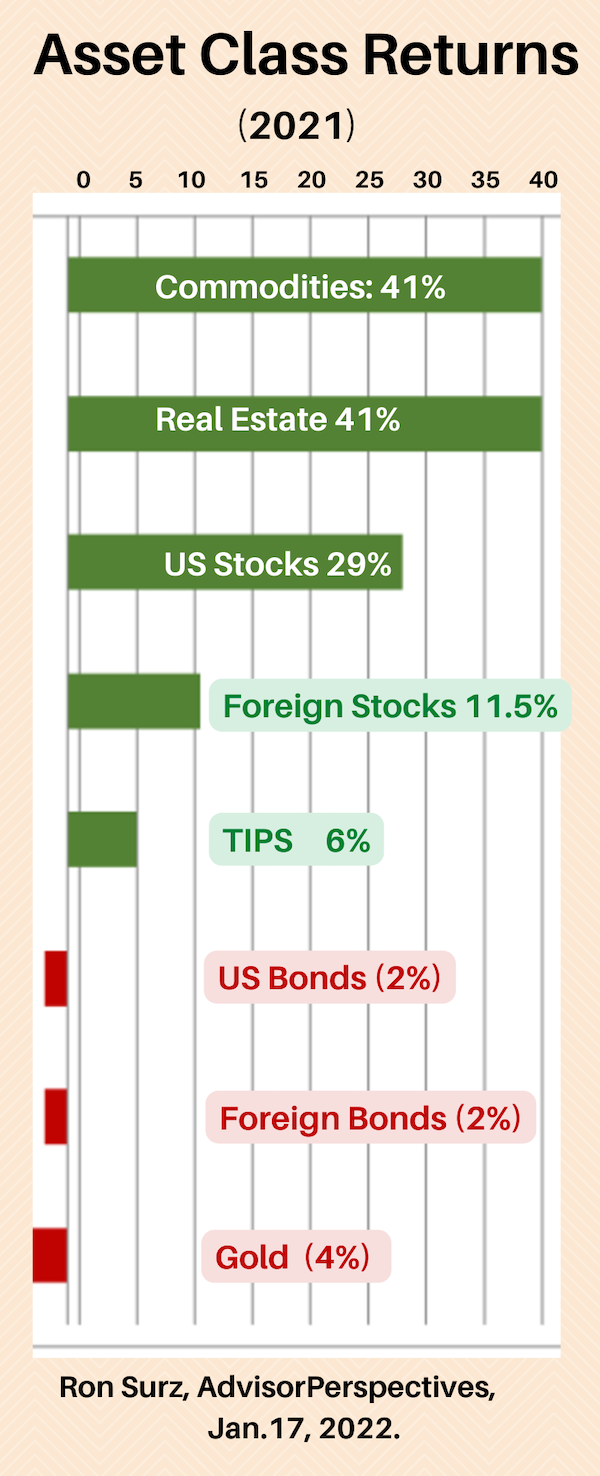

The impact of COVID notwithstanding, life insurance company stocks in the US enjoyed a strong year in 2021, the Journal reported. The sector kept up with financials overall and rose about a third. According to Autonomous Research analyst Erik Bass, their variable-income portfolios—in asset classes such as equities and alternatives—delivered a roughly 10% to 20% bump in earnings over what was anticipated.

Life-and-health insurance stocks in the S&P 500 did quite well in December, rising over 6% or about twice the gain of the broader financial sector. Overall, they gained 32% last year. So now, the forward price-to-earnings ratio for S&P 500 life & health insurers is about nine times—about where the sector averaged in the five years preceding 2020. The sector’s multiple reached 11 times in 2017, when interest rates were rising.

AllianzIM issues new iteration of its buffered outcome ETF

Allianz Investment Management LLC (AllianzIM), a unit of Allianz Life Insurance Company of North America, today launched a new buffered outcome ETF with a six-month outcome period: the AllianzIM US Large Cap 6 Month Buffer10 Jan/Jul ETF (NYSE: SIXJ).

The initial cap on January 1 was 5.30% (4.93% after fees); investors who purchase today face different effective caps depending on the performance of the fund.

Using FLEX Options, AllianzIM’s new ETF seeks to match the returns of the S&P 500 Price Return Index up to a stated cap, while providing downside risk mitigation through a Buffer against the first 10% of S&P 500 Price Return Index losses for SIXJ over a six-month outcome period.

The initial 6-month outcome period starts January 1, 2022, and ends June 30, 2022, with subsequent 6-month outcome periods from July 1 through December 31 or January 1 to June 30.

“Amid record-low interest rates and volatile equity markets, SIXJ offers investors another option to help mitigate risk in their portfolios.” said Johan Grahn, Vice President and Head of ETFs at AllianzIM, in a release.

With an expense ratio of 0.74%, SIXJ is one of the lowest-cost buffered outcome ETFs on the market. With two outcome periods per year, SIXJ resets the cap and the buffer every six months and the ETF may serve as an alternative to short-term, low-yielding investment options and provide tactical applications within an investment portfolio.

AllianzIM debuted its six-month outcome period Buffered Outcome ETFs in October 2021 with the launch of the AllianzIM US Large Cap 6 Month Buffer10 Apr/Oct ETF (NYSE: SIXO). SIXJ and SIXO are the latest evolution in AllianzIM’s suite of buffered outcome ETFs. Between the two ETFs, investors can now benefit from defined outcome periods with an opportunity to invest in such a way that caps and buffers reset every three months.

Additionally, the AllianzIM US Large Cap Buffer10 Jan ETF (NYSE: AZAJ) and the AllianzIM US Large Cap Buffer20 Jan ETF (NYSE: AZBJ) today begin a new one-year outcome period with new upside caps.

Funding levels of large pensions rose with markets in 2021: Mercer

The estimated aggregate funding level of pension plans sponsored by S&P 1500 companies increased to 97% as of December 31, 2021, from 84% as of December 31, 2020, according to a release from Mercer, a consulting business owned by Marsh McLennan.

“Over the course of 2021, increases in interest rates used to calculate corporate pension plan liabilities and increases in equity and fixed income markets supported the increase in funded status. The estimated aggregate deficit of $64 billion as of December 31, 2021 is far smaller than the $407 billion deficit at the end of 2020,” the release said.

The estimated aggregate value of pension plan assets of the S&P 1500 companies as of December 31, 2020 was $2.19T. Estimated aggregate liabilities were $2.6T. At the end of 2021, the estimated aggregate assets were $2.33T compared with the liabilities of $2.39T.

The S&P 500 index increased 26.89% during 2021 and the MSCI EAFE index increased 8.78%. Typical discount rates for pension plans as measured by the Mercer Yield Curve increased to 2.76% from 2.32% during 2021.

Matt McDaniel, a partner in Mercer’s Wealth Business said in a statement:

“Funded status rose three percent in December and was up 13% year over year. Over the course of 2021, we saw equity markets surge forward, frequently reaching fresh all-time highs, while rates rose propelling funded status to levels not seen since 2008.

“Nearly 40% of plan sponsors in the S&P 1500 are now over 100% funded. With many of those plans frozen, it begs the question of how many will look to actively de-risk or even fully terminate their plans. We have seen a marked increase of sponsors asking ‘how close’ to full termination they are, so we believe termination activity may be on the rise.

“For those plans still running deficits, the funding relief passed earlier this year is expected to reduce required contributions for several years so some may be leaning on investment performance to drive improvements in funded status. But this could be a risky strategy with equity markets at all-time highs, even as the Fed continues to taper and potentially increase rates this year.”

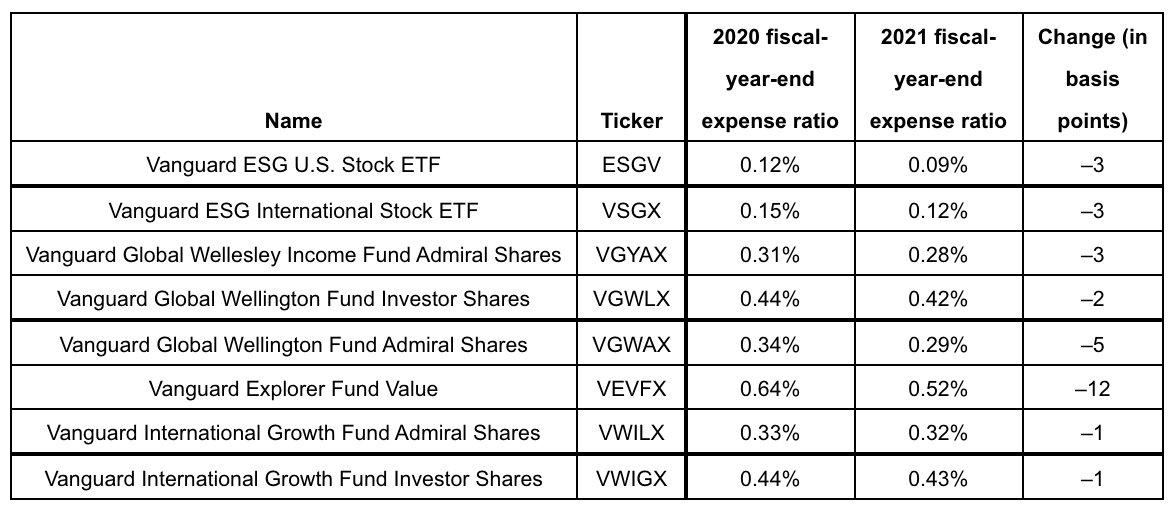

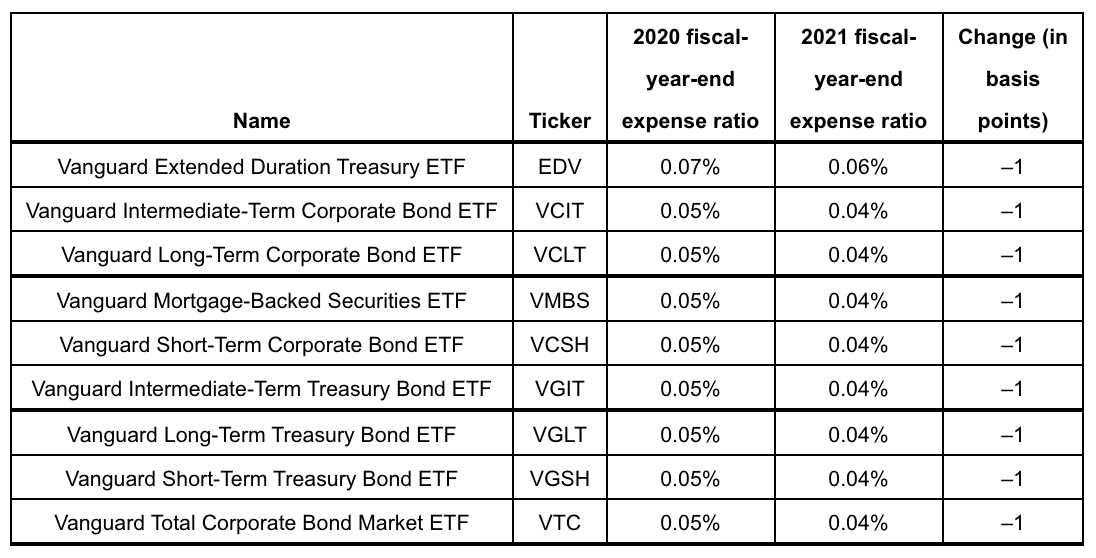

Vanguard reduces fees on bond ETFs and other funds

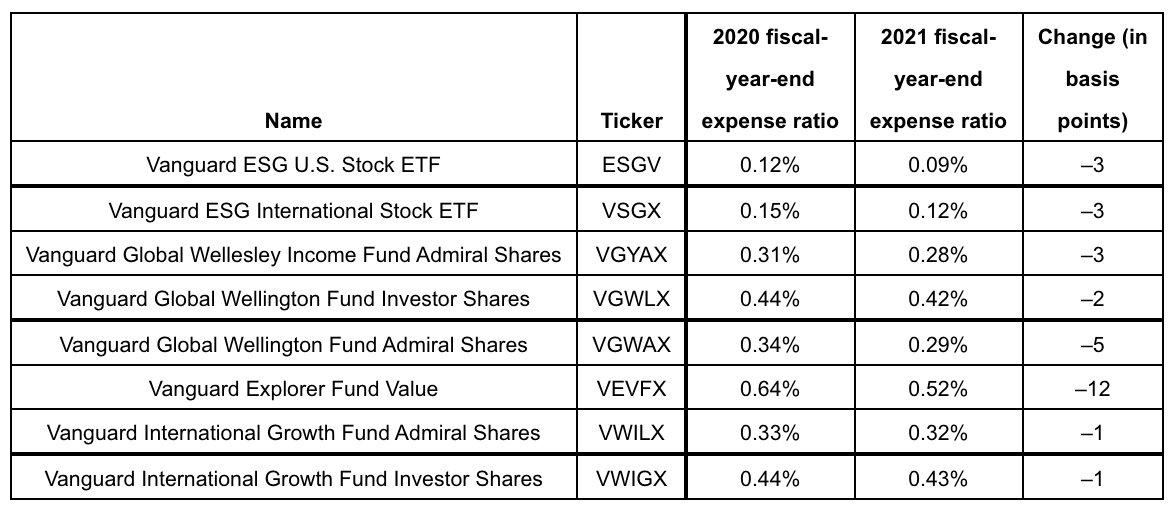

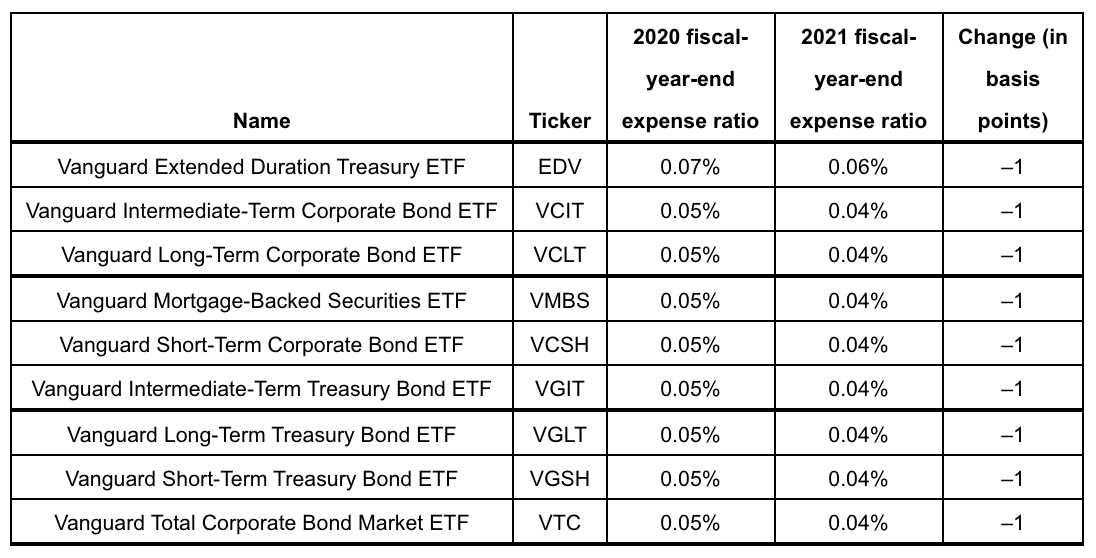

Vanguard has lowered expense ratios for 17 fund shares, including nine fixed income ETFs. Vanguard’s US bond ETF lineup has attracted $75.7 billion in cash flows through October 31, helped to drive economies of scale and lower expense ratios. (See tables below.)

As of October 31, 2021, Vanguard managed $8.4 trillion in global assets. The firm, headquartered in Valley Forge, Pennsylvania, offers 418 funds to its more than 30 million investors worldwide.

Vanguard operates under a unique, investor-owned structure in which US fund shareholders own the Vanguard funds, which in turn own Vanguard. This structure enables the firm to return value to shareholders through lower costs and reinvesting to improve capabilities, technology, and client experience.

AM Best upgrades Guggenheim Life and Annuity

Guggenheim Life and Annuity’s financial strength rating (FSR) has been upgraded by ratings firm AM Best to A- (Excellent). Guggenheim (GLAC) is no longer “under review with developing implications,” AM Best said in a release.

Guggenheim’s FSR was upgraded from B++ (Good). Its Long-Term Issuer Credit Rating was upgraded to “a-” (Excellent) from “bbb+” (Good). The outlook assigned to these Credit Ratings (ratings) is stable.

“The ratings reflect GLAC’s balance sheet strength, which AM Best assesses as strong, as well as its strong operating performance, neutral business profile and appropriate enterprise risk management,” the release said.

The removal of the ratings from under review and subsequent upgrades are due to GLAC being acquired by Group 1001 Insurance Holdings LLC, the parent company of the lead rating unit, Group 1001 Life & Annuity Group (formerly known as Delaware Life Insurance Group), for which GLAC will now become a group member in accordance with AM Best methodology. The acquisition closed Nov. 12, 2021.

The grouping of GLAC with Group 1001 Life & Annuity Group is due to the consistent executive management, shared services, its material contribution to the group’s premiums and earnings along with the significant level of financial support already shown to GLAC through a $400 million capital contribution post closure.

Venerable appoints new chief actuary, Parul Bhatia

Parul Bhatia has been promoted to Senior Vice President and Chief Actuary at Venerable, a manager of legacy variable annuity business acquired from other entities. Venerable was created by an investor group led by affiliates of Apollo Global Management, LLC, Crestview Partners, Reverence Capital Partners, and Athene Holdings, Ltd.

Previously Head of Valuation at Venerable, Bhatia led valuation of statutory, tax, and US GAAP reserves and capital metrics primarily for variable annuities and payout annuities. In her new position, she will also lead the organization’s valuation, inforce management and strategy, and capital management and modeling teams.

Prior to Venerable, Bhatia was a consultant at Willis Towers Watson. She holds a Bachelor of Science in Commerce from the University of Delhi, is a member of the American Academy of Actuaries, and a fellow of the Institute and Faculty of Actuaries, UK, and the Institute of Actuaries of India.

Venerable is privately held, with operations in West Chester, PA, and Des Moines, Iowa.

SmartAsset launches TV ad campaign

SmartAsset, the consumer financial education and lead-generation site for advisors, has launched a national TV campaign this week produced by TV agency Marketing Architects.

SmartAsset describes itself as an online destination for consumer-focused financial information and advice that powers SmartAdvisor, a national marketplace connecting consumers to financial advisors. It reaches ~75 million people each month (as of Sept. 2021).

Founded in 2012, SmartAsset offers free data-driven content, personalized calculators and educational tools to an estimated 75 million visitors per month. Additionally, SmartAsset operates SmartAdvisor, the leading independent client acquisition platform for financial advisors in America.

Marketing Architects worked with SmartAsset to pretest a variety of creative strategies. They landed on two spots, “Where Frank Used to Sit” and “Learning from Mistakes.” The commercials highlight how SmartAsset can help viewers prepare for retirement.

Ranked on the Inc. 5000 and Deloitte Technology Fast 500 lists of fastest growing companies in 2021, SmartAsset recently closed a $110 million Series D round, valuing the company at over $1 billion. SmartAsset was also named to Y Combinator’s list of Top 100 Companies of all time and Forbes’ list of America’s Best Startup Employers in 2020.

© 2022 RIJ Publishing. All rights reserved.

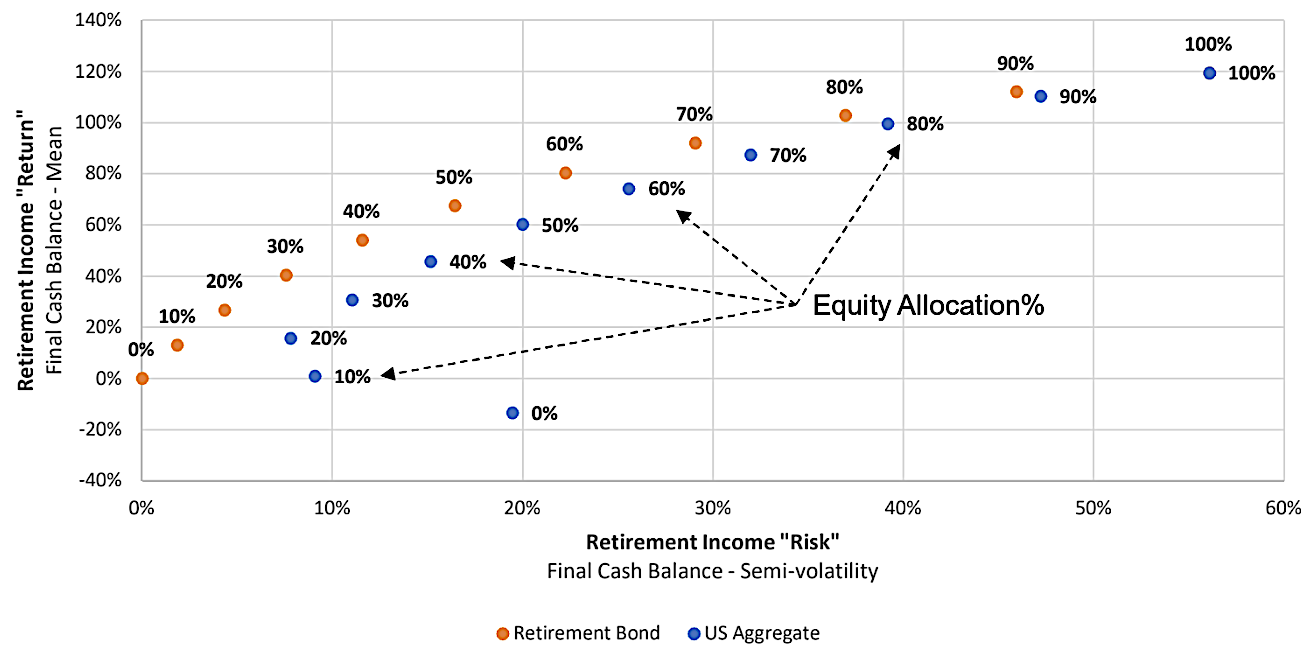

“We’re building a ‘Game of Life,’ and asking an algorithm to play it,” Parker said. “It would be simple to encode this into a robo-advisor, with the goal of maximizing the average return and minimizing the variants.” Instead of a software “recipe” for successful investing, the investor gets a “trained apprentice” who thinks like a human advisor (more or less).

“We’re building a ‘Game of Life,’ and asking an algorithm to play it,” Parker said. “It would be simple to encode this into a robo-advisor, with the goal of maximizing the average return and minimizing the variants.” Instead of a software “recipe” for successful investing, the investor gets a “trained apprentice” who thinks like a human advisor (more or less).