Annuities Genius to use Cannex data for annuity comparison tool

Annuities Genius, the developer of annuity point-of-sale software that helps financial professionals meet compliance and suitability requirements, will use contract data from CANNEX in its SPIA (single premium immediate annuity) and DIA (deferred income annuity) price and feature comparison tools.

Advisers and agents will be able to use Annuities Genius to show clients the annuity offerings of major carriers, compare product benefits, add pricing and performance information to product illustrations, and match products with each client’s income goals and risk tolerance.

“Clients are more likely to make the decision to buy an annuity when they have all the information they need to choose between products, and are guided by an advisor or financial professional,” said David Novak, CEO of Annuities Genius. “Our comparison tools not only help clients make purchase decisions, but also provide a documented process for meeting best interest standards.”

Annuities Genius, a comprehensive annuity decision-making platform, provides point-of-sale comparison tools that allow clients to make informed annuity purchases and enables advisers and agents to meet “best interest” standards for annuity sales. The platform was developed by Agatha Global Tech, LLC, which partnerswith insurance carriers, distribution organizations, financial advisors, and insurance agents to offer annuity information.

CANNEX provides data, research and analysis for retirement savings and income products in North America. It manages data, pricing and illustrations for insurance carriers and serves as a source of product information for distributors, as well as third-party tools and applications.

Envestnet advisers can now access SIMON’s structured products lineup

Fee-based financial advisers using Envestnet Inc.’s unified managed account (UMA) platform can now get access to structured investments and annuities, thanks to a new partnership between Envestnet and SIMON Markets LLC, according to a release this week.

SIMON offers access to structured investment, annuity, and defined outcome exchange-traded fund (ETF) solutions. Advisers will be able to place these structured products in UMAs, which are a part of many broker-dealers’ fee-based businesses.

SIMON Spectrum’s portfolio allocation analytics feature, which is part of Envestnet’s proposal generation tool, is intended to help advisors assess the suitability of structured investments and annuities for clients, based on each product’s protection, upside, liquidity, simplicity, and history.

Envestnet’s integration with SIMON will also:

- Facilitate the transition from proposal to implementation and execution through SIMON’s platform and order entry tools.

- Deliver all post-trade data in real time, so advisers can manage all their structured investments in one centralized location while integrating SIMON’s structured investment data in client reporting.

- Offer multimedia educational resources to help advisors and their clients better understand structured investment products, such as a library 90+ educational video and asset class education for all advisor experience levels.

- Customized compliance-tracking and supervisory tools to help advisors navigate self-paced certification requirements and deliver real-time oversight for home offices.

- SIMON’s tools and analytics will be integrated in workflows within:

- Envestnet | MoneyGuide: MyBlocks will include a block dedicated to structured investments for advisers to introduce clients to these products. The integration will later incorporate structured investments in financial plans and connect the plans to the Envestnet proposal workflow.

- Envestnet | Tamarac: Registered investment advisers (RIAs) that rely on Tamarac will receive single-sign-on (SSO) access to SIMON and incorporate structured investment data from SIMON into Tamarac reports.

Cost of transferring defined benefit pension risk falls slightly: Milliman

During October, the average estimated cost to transfer retiree pension risk to an insurer decreased from 102.7% of a plan’s total liabilities to 102.5% of those liabilities, according to the latest results of the Milliman Pension Buyout Index (MPBI), which is produced by Milliman, the global consulting and actuarial firm.

The average estimated retiree PRT cost for the month is now 2.5% more than those plans’ retiree accumulated benefit obligation (ABO). Meanwhile annuity purchase costs, which reflect competition amongst insurers, decreased substantially from the month prior, to 99.4% in October from 100.2% in September.

“As the Pension Risk Transfer (PRT) market continues to grow, it has become increasingly important to monitor the annuity market for plan sponsors that are considering transferring retiree pension obligations to an insurer,” a Milliman release said.

“De-risking activity typically increases toward year-end, and with only four non-holiday weeks left in 2021 we may see some insurers offering more competitive pricing rates to capture those last Q4 deals,” said Mary Leong, a consulting actuary with Milliman and co-author of the study.

The MPBI uses the FTSE Above Median AA Curve, along with annuity purchase composite interest rates from eight insurers, to estimate the average and competitive costs of a PRT annuity de-risking strategy. Individual plan annuity buyouts can vary based on plan size, complexity, and competitive landscape.

Lincoln updates ‘Level Advantage’ RILA; authorizes stock repurchase up to $1.5 billion

Lincoln Financial (NYSE: LNC) plans to launch a new crediting strategy within its indexed variable annuity. Beginning Nov. 22, 2021, new contracts with Lincoln Level Advantage registered index-linked annuity (RILA) will offer a “spread crediting strategy,” in addition to existing options.

“Lincoln Level Advantage has helped more than 76,000 clients2 safeguard the assets they’ve worked hard to save, stay positioned for growth and feel more confident about their financial futures,” says Kroll. “Now, this new spread indexed account further expands the product’s optionality and flexibility to best suit clients’ diverse investment needs.”

The Lincoln Level Advantage spread account works like this: If the index performance is positive, all of the index growth over an initial spread would accrue to the policyholder. A spread rate is the percentage of the index’s return deducted from the indexed account when the index return is positive.

If the index performance is negative, the account is protected against losses less than or equal to the downside buffer. In other words, if the index gained 9% and the spread was 2%, a gain of 7% would accrue to the policyholder. If the index gained 1.5%, the policyholder wouldn’t receive a gain. d

The spread indexed account option is currently available for new contracts with a six-year indexed account and a 15% protection level. Spread rates for new indexed segments will be declared five business days in advance of the beginning of a segment.

In its release, Lincoln cautioned that a policyholder’s return could be lower than if invested directly in a fund based on the applicable index. There is risk of loss of principal if negative returns exceed the selected protection level, as well as a risk of future availability as the indexed accounts with applicable spread rates will vary over time.

Policyholders must choose a crediting method by the end of each crediting terms (usually one year) or Lincoln will choose one for the policyholder, the release said. The available indexed account with applicable spread rates will vary over time.

Since its launch in May 2018, Lincoln Level Advantage has been Lincoln’s most successful product, with sales of more than $12 billion. The product has earned recognition from Structured Retail Products, was the top-selling RILA in 2020 and was among Barron’s “The 100 Best Annuities for Today’s Market.”

In other news, Lincoln Financial Group today announced that the board of directors of its parent company, Lincoln National Corporation, has authorized an increase to the company’s securities repurchase authorization, to $1.5 billion.

The plans were discussed on the call related to the reinsurance transaction with Resolution Life held on September 17, 2021, and on the company’s third quarter earnings call held on Thursday, November 4, 2021.

The repurchase authorization has no expiration date. The amount and timing of share repurchases depends on key capital ratios, rating agency expectations, the generation of free cash flow and an evaluation of the costs and benefits associated with alternative uses of capital.

“Our stock repurchases may be effected from time to time through open market purchases or in privately negotiated transactions and may be made pursuant to an accelerated share repurchase agreement or plans designed to comply with Rule 10b5-1(c) under the Securities Exchange Act of 1934, as amended. The purchase program may be suspended, modified or terminated at any time, Lincoln said.

More than one in five Americans own an annuity: F&G survey

Nearly three quarters of American investors (73%) are very or somewhat worried about inflation impacting their retirement, according to a new survey from F&G, part of the FNF family of companies and a provider of annuity and life insurance products to retail and institutional clients.

The company’s second annual Risk Tolerance Tracker asked American investors how the events of the last six to nine months have affected their views on risk. The survey showed that 61% of American investors are generally worried about their retirement income. Investors were most concerned about inflation (81%), increasing health care costs (78%) and market volatility (64%).

In 2020, nearly three of four (74%) American investors said they were less likely to take financial risks. The 2021 Risk Tolerance Tracker survey found 69% of American investors still feel this way.

Most American investors continue to avoid unnecessary financial risks following the COVID-19 pandemic, despite the vaccine and the easing of certain restrictions. This trend was consistent across generations: 67% of Gen X and 70% of Baby Boomers said they are less likely to take financial risks based on events of the last 6-9 months, down from 72% and 75% in 2020, respectively.

Only 15% of respondents and only 22% of Baby Boomers own an annuity. Nonetheless, 36% said they would be more likely to explore a new financial product since the pandemic, up from 28% in 2020.

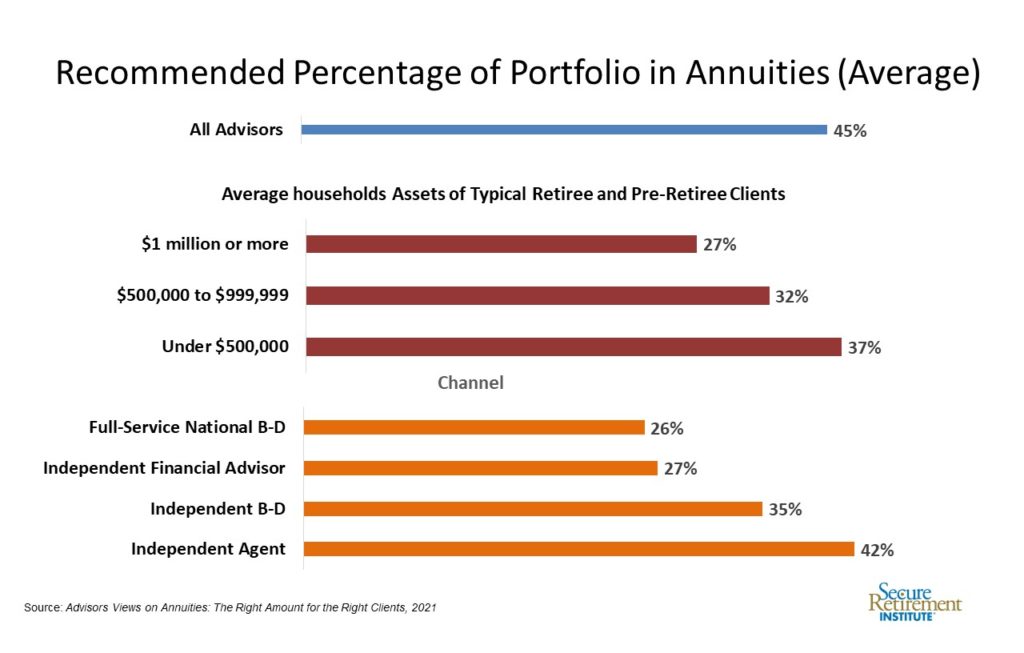

A majority of Americans (61%) do not work with financial advisors, despite the fact that those who use advisers are almost twice as likely to feel “very prepared” for retirement as those who don’t, according to recent data released by SRI.

When respondents to the Risk Tolerance Tracker were asked why they don’t work with an adviser, respondents to the Risk Tolerance Tracker named fees (36%), confidence in their own ability (27%) and lack of sufficient investable income (26%) as reasons.

This survey was conducted online by Directions Research and fielded from September 23 to October 1, 2021, among a demographically balanced nationally representative sample of 1,676 US adults 30 years of age and older. “F&G” is the marketing name for Fidelity & Guaranty Life Insurance Company issuing insurance products in the United States outside of New York. It is part of the FNF family of companies.

© 2021 RIJ Publishing LLC. All rights reserved.

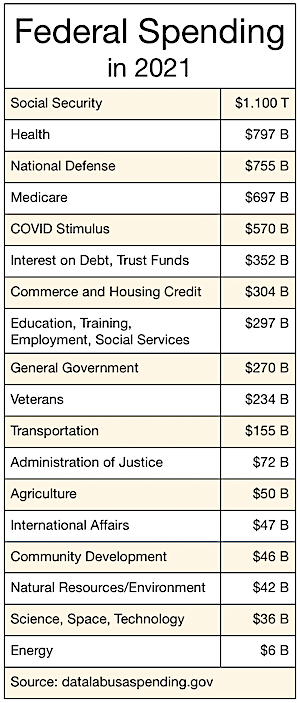

In the years since then, the demographic tailwind has turned into a headwind. Even so, Social Security doesn’t suffer from the vulnerabilities of defined benefit pension plans, which inevitably run into trouble as industries and demographics change. As for the supposed weaknesses of PAYGO and the unmet need for pre-funding, the program stopped being PAYGO in the 1980s, when workers began paying much more in payroll taxes than was paid out to beneficiaries. P

In the years since then, the demographic tailwind has turned into a headwind. Even so, Social Security doesn’t suffer from the vulnerabilities of defined benefit pension plans, which inevitably run into trouble as industries and demographics change. As for the supposed weaknesses of PAYGO and the unmet need for pre-funding, the program stopped being PAYGO in the 1980s, when workers began paying much more in payroll taxes than was paid out to beneficiaries. P