Number of Billionaires per Industry Sector, US 2021

IssueM Articles

Another global alternative asset manager has acquired a US life insurance company and created an “insurance solutions” group to assist other life/annuity companies transition to more sophisticated investment policies.

Investcorp, with $36.7 billion in assets under management, has financed the purchase of Sunset Life Insurance Company of America from Kansas City Life, and has established Investcorp Insurance Solutions platform, to provide investment management services to insurers.

To lead these businesses, Investcorp recruited executives with experience at asset managers with similar profit centers. It hired Todd Fonner as Chief Investment Officer of Investcorp Insurance Solutions. Fonner served as senior managing director, CIO North America, Blackstone Insurance Solutions, until 2020.

According to an Investcorp release, Fonner helped launch the Blackstone Insurance Solutions platform in late 2017. He also has held CIO, Treasurer and Chief Risk Officer roles at RenaissanceRe Holdings, where he spent nearly 15 years of his career.

Nathan Gemmiti will serve as CEO of Sunset Life. He came from where he was co-founder, COO and General Counsel of Knighthead Annuity and Life Insurance Company. Previously, he was an operating partner at Apollo Global Management, where he helped launch Athene, the life insurance and reinsurance company.

Sunset will outsource its investment management to Investcorp Insurance Solutions. On December 31, 2020, Sunset Life reinsured all of its then existing insurance business to Kansas City Life, who will provide all ongoing administration for such business.

In a November 2 press release, Kansas City Life said it expected to record a net gain of about $5.5 million on the sale of Sunset Life, which was founded in 1937 and acquired by Kansas City Life in 1974.

Sunset Life ceased writing new life and annuity business in the early 2000s. Kansas City Life reinsured 100% of the outstanding business of Sunset Life on December 31, 2020, and will continue to service all business issued prior to November 1, 2021.

Investcorp has a presence in the US, Europe, India, China, Singapore, and countries in the Gulf Cooperation Council. It purchased Sunset Life through Bona Holdings, a subsidiary of Cordillera Holdings LLP, a new insurance-focused investment platform.

© 2021 RIJ Publishing LLC. All rights reserved.

Broadridge Fi360 Solutions, data provider Cannex, and Fiduciary Insurance Services, a consulting firm, have organized a not-for-profit group to “evangelize” for the need for annuities in qualified retirement plans, the group announced this week.

Nationwide, an annuity provider, and Alliance Bernstein, an asset manager, have committed to joining the “Lifetime Income consortium,” and several other firms are interested, said John Faustino, head of Broadridge Fi360 Solutions, in a release this week.

“We expect to secure commitments by the end of the year and actively begin collaborative efforts in January,” the release added. The consortium foresees a four-phase rollout over the next two years.

The consortium will “provide an expertly substantiated framework and evangelism which enables plan fiduciaries to extend the scope of their advice and implementation capabilities beyond to-retirement solutions, into the through-retirement solutions,” the release said.

While their membership lists may overlap, the new Lifetime Income consortium is unrelated to the Alliance for Lifetime Income, the Washington, DC-based nonprofit 501(c)(6) organization that educates individuals about purchasing annuities to create retirement income.

“While our missions are complementary, we’re more retirement plan-centric. We’ll use webinars to help plan sponsors and others gain familiarity with and trust new solution sets,” Faustino said. “Our consortium will be run by a for-profit, Broadridge, and focus on accelerating the adoption of retirement income through employer-based plans.”

The release also said, “Central to our perspective is that lifetime income must add real value to participants and be profitable for advisors and product providers for it to be successful.”

© 2021 RIJ Publishing LLC.

A new set of risk-based capital (RBC) factors taking effect in 2021 could temper allocations to lower-rated bonds by insurers looking to capture higher yields according to an AM Best report.

The National Association of Insurance Commissioners’ (NAIC) RBC factors will be changing for 2021 filings, and with the change to 20 designations from six, lower-rated bonds will now have much higher RBC factors compared with the prior factors.

A new Best’s Special Report, “Navigating the New NAIC Risk-Based Capital Factors,” states that insurance companies likely will see increased required capital for bonds. Life/health insurers would see an increase in gross required capital for bonds of approximately $7.2 billion, or an increase of more than 18%, compared with prior RBC factors.

The property/casualty industry’s required capital for bonds is expected to nearly double from the prior class-based structure as a result of the new factors. The health industry required capital for bonds is expected to increase almost two and a half times over prior levels.

According to the report, while the increased property/casualty and health RBC for bonds is much higher on a percentage basis than that of the life/health RBC, the impact on RBC ratios should be minimal since most property/casualty and health risks are concentrated on premium and reserve risks.

Additionally, for life/health and property/casualty companies, a modified diversification factor offsets the higher overall bond risk required capital. The new formulas lower the threshold for companies to receive diversification credit. These changes will help smaller companies, as well as larger companies, which will receive even greater diversification benefits.

The NAIC also has implemented a reduction of real estate factors for 2021 filings by life/health companies. With reduced RBC charges for real estate, in particular BA real estate, AM Best expects higher allocations to this asset category going forward.

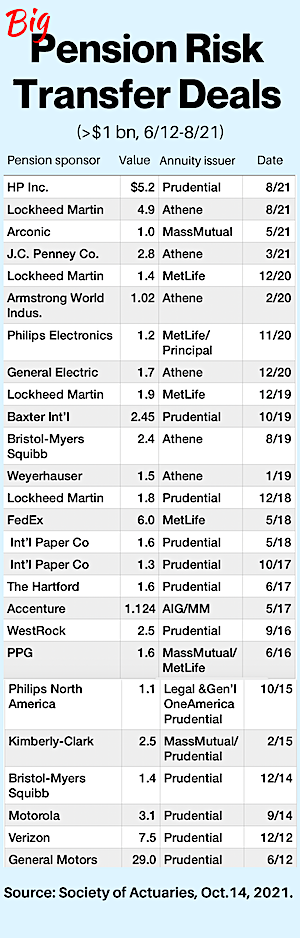

Life/health insurers also will see new longevity risk factors applied to annuity reserves held for life contingent payments. This could slow activity in the pension risk transfer market, although the impact of the RBC change depends on the company’s balance of mortality risk and longevity risk.

© 2021 RIJ Publishing LLC. All rights reserved.

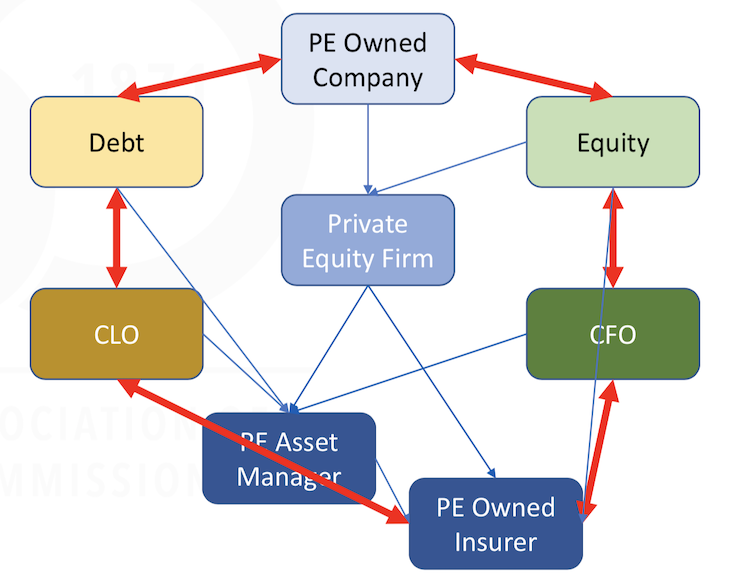

The growing control of small and mid-sized publicly traded US life/annuity companies by giant global private equity (PE) companies has created “novel regulatory risks,” according to a document posted on the National Association of Insurance Commissioners’ website last month.

Noting “broad concern” about the PE trend, the document described the NAIC staff’s recommendations for addressing those concerns. For instance, the staff suggested creating a special category for the 177 PE-affiliated life insurers in the US for regulatory purposes and to make certain of their operations more transparent.

The document was used in a September 30, 2021 presentation at a regular meeting of the NAIC’s Financial Stability Task Force. The NAIC’s director of Structured Securities and Capital Markets, Eric Kolchinsky, delivered the presentation.

An NAIC spokesperson characterized the document as a “think piece” about “an issue that people have been monitoring.” NAIC staffers created it to inform the 56 state and territorial insurance commissioners they serve.

The document is notable for the policy changes that the staff suggests. Kolchinsky’s slides contained these suggestions to the insurance commissioners regarding regulation of PE owned life insurers:

The slides don’t mention reinsurance. That might surprise close followers of this trend, because the reinsurance of annuity liabilities in Bermuda or the Cayman Islands is an essential component of the PE insurance business model and an important new source of liquidity for a growing number of life insurers.

By reinsuring tens of billions of dollars in certain jurisdictions, PE firms can use Generally Accepted Accounting Principles (GAAP) instead of Statutory Account Principles (SAP) to reduce the estimated cost of their long-term liabilities. All US life insurers must follow SAP, but certain jurisdictions allow the use of GAAP for reinsurance.

Doing so reduces the amount of capital that the insurer must hold in support of those liabilities. Reinsurance thus “releases” capital, in some cases making hundreds of millions of dollars available to the life insurance company. Holding extra capital enlarges the buffer of safety against loss for policyholders but represents a drag on the profitability of a life insurance company.

The pursuit of this strategy has put hundreds of billions of dollars worth of assets in motion over the past years, providing the substance of dozens of acquisitions and reinsurance transactions, putting vast pools of savings under the management of PE firms, and making life insurers more like asset management firms.

In the document, the NAIC staff pointed out that today’s regulations were created for a life/annuity industry made up of publicly traded and mutual insurers, with an eye toward ensuring that insurance companies remained solvent and that owners don’t extract too much in dividends or compensation.

PE companies got into the insurance business to gain access to large new pools of of assets, and they generate profits by charging fees to manage those assets and redirect them into sophisticated alternative assets. But today’s insurance regulations lack mechanisms for observing and determining how those fees are generated or if they are reasonable.

In short, a new kind of life insurance company has been born and regulations have not kept up with it. The PE business model has transitioned over the years from restructuring companies for profit to fee generation,” the document said. “PE companies seek to generate fees at every level of their investment from the underlying corporate to CLOs to managing assets for insurers.”

Not all of those levels are visible to regulators, especially when they are internal to the PE firm, which may obscure their relationships to affiliated entities. “It is common for PE owned firms to report affiliated managed CLOs [consolidated loan obligations] and structured products as ‘unaffiliated’ …We found that for one large insurer group that approximately 70% of their CLOs hold some exposure to their portfolio companies.” A large PE firm may have thousands of subsidiaries.

Forensic accountant Tom Gober is one of those concerned about the impact of PE firm involvement on the life/annuity industry. Gober scrutinizes life insurance regulatory filings to see if insurers or reinsurers have enough high quality assets backing their liabilities.

“I was delighted to see the NAIC step up and begin tackling this issue of PE-owned life insurers. Everything they said is so important; but perhaps most important is their discussion of Affiliated Transactions,” Gober told RIJ after seeing the Kolchinsky slides.

“In my 35 years of experience, the substance of all troubles I’ve investigated spin out of unregulated affiliates—not within the insurer itself. Special purpose vehicles, off-balance sheet deals, and captives are all only truly understood when you analyze both ends.”

For those unfamiliar with these issues, here’s some background:

Ever since the private equity firm Apollo established the life/annuity company Athene over a decade ago, a stream of other large PE firms—including KKR, Blackstone, Ares, the Carlyle Group, Brookfield—have followed suit. They’ve used their deep financial resources to buy or partner with publicly traded insurers and to establish reinsurers, hoping to manage a chunk of the trillions of dollars in annuity assets—that is, the retirement savings of millions of Baby Boomers—in existence today.

In a series of articles over the past 15 months, RIJ has called this business model the “Bermuda Triangle” strategy. The strategy typically involves a life/annuity company, a reinsurer and an asset manager. Through the use of regulatory arbitrage and sophisticated loan origination skills, the strategy can reduce the cost of operating a life insurance company and raise the yield on its investments.

Blocks of fixed indexed annuity contracts are important to this strategy. Purchasers of FIAs often leave their money with an insurer for five, seven or even 10 years. Annuity issuers can turn that money over to asset managers to make loans to high-risk borrowers.

The PE firms typically bundle such “leveraged loans” into long-dated securities of varying risks and yields. They can sell those securities to institutions who want long-term investments that are as safe as high-quality bonds but have higher yields. This process turns the insurance business into an asset management business.

Such alchemy has, in a real sense, meant financial salvation for small and mid-sized publicly traded life insurers whose primary business is selling annuities. The Federal Reserve’s low interest rate environment has made it nigh impossible for these firms to generate enough profit via the old-fashioned way. That is, by investing policyholder premiums in high-grade corporate bonds to maturity and earning enough yield on them to cover claims, expenses, and profits for shareholders.

With the Bermuda Triangle strategy, these life insurers can also move capital-intensive liabilities offshore, release hundreds of millions of dollars of surplus capital that they can use to buy back their own stock, raise executive compensation, price their annuities more competitively, and evolve into the kind of fee-generating businesses that Wall Street analysts and investors prefer.

But while Wall Street and affected life insurers applaud this transformation of their businesses, the Bermuda Triangle strategy has critics. As early as 2013, researchers Ralph Koijen and Motohiro Yogo, raised flags about the wide use of captive reinsurance by major life insurers to offset the costly increase in their capital requirements in the wake of the Great Financial Crisis.

In their paper, “Shadow Insurance” (NBER Working Paper 19568), Koijen and Yogo warned that “life insurers are using reinsurance to move liabilities from operating companies (i.e., regulated and rated companies that sell policies) to less regulated and unrated off-balance-sheet entities within the same insurance group.”

More recently, a group of Federal Reserve economists published “Capturing the Illiquidity Premium.” The economists expressed concerns about the increasing use of life insurer money to finance the origination of private debt by their asset manager partners. This business model, they asserted, might be vulnerable to failure during a financial downturn.

© 2021 RIJ Publishing LLC. All rights reserved.

American Equity Investment Life Insurance Company said it will provide “financing and capital support” to help Pretium, a specialized investment management firm, buy Anchor Loans, a large provider of financing to residential real estate investors and entrepreneurs.

Pretium boasts assets under management of some $30 billion. “This transaction builds on AEL’s previously announced partnership with Pretium and enables Pretium to achieve its next phase of growth in its residential real estate platform,” an AEL release said.

After the Great Financial Crisis and the foreclosures of countless residential mortgages, private equity firms were able to finance the purchases of homes at favorable prices.

“Blackstone Group Inc., KKR & Co. and other private-equity firms are increasingly making new investments in single-family homes to rent out, betting that the hot housing market will generate solid returns as the U.S. emerges from the coronavirus pandemic,” Bloomberg recently reported.

American Equity’s recent long-term reinsurance deal with Brookfield Re was reported by RIJ on October 21. Pretium’s acquisition of Anchor Loans will increase AEL’s allocation to “high quality residential real estate assets, which remains a key pillar of our AEL 2.0 investment strategy.”

As described in RIJ, the AEL 2.0 strategy enables AEL to convert gradually from a business based on earning an uncertain spread between assets and liabilities to a model based on earning predictable asset-based fees while investing in high-yield alternative assets and reinsuring its annuity liabilities offshore.

It’s a strategy that several public traded life insurers have pursued, often in partnership with a large alternative asset manager. RIJ calls it the “Bermuda Triangle strategy” because it involves a US annuity issuer, a large asset manager and a reinsurer domiciled in a regulatory haven such as Bermuda, Arizona or the Cayman Islands.

AEL described itself in the release as a leading issuer of “general account annuities,” an uncommon term that may distinguish its fixed or fixed indexed annuities from variable deferred annuities or structured variable annuities, such as registered index-linked annuities (RILAs).

The transaction demonstrates AEL’s “ability to provide flexible capital solutions, be responsive to market opportunities and deploy capital at scale,” said Pradip Ghosh, senior managing director and head of ROA [return on assets] for American Equity. “

Founded in 1998, Anchor Loans was the first institutional lending platform built to finance professional residential real-estate investors. Over the last two decades, Anchor Loans has become “the nation’s leading capital provider to experienced residential real-estate sponsors through its bridge and construction products,” the release said.

“Pretium’s underwriting expertise, real estate operating platform ecosystem and ability to originate attractive investments have made them a valued partner for AEL,” said Anant Bhalla, CEO of American Equity.

“At Pretium’s core, we are committed to providing capital solutions to the residential housing industry, including offering attractive rental homes and mortgages to consumers and investors” said Ted Huffman, Pretium’s senior managing director of Strategic Development, in the AEL release.

The Allstate Corporation today announced that it has closed the sale of Allstate Life Insurance Company (ALIC) and certain subsidiaries to entities managed by Blackstone for $4 billion, which is inclusive of Blackstone’s approximately $2.8 billion purchase price, as well as increases in statutory surplus since March 31, 2020.

The ALIC business is being renamed Everlake Life Insurance under its new ownership by entities managed by Blackstone.

“Allstate’s strategy is to increase personal property-liability market share and expand protection offerings to customers. This sale redeploys capital into highly attractive property-liability and protection service businesses and reduces interest-rate exposure,” said Tom Wilson, chair, president and CEO of The Allstate Corporation, in a release.

Gilles Dellaert, global head of Blackstone Insurance Solutions, said: “We believe the investment outperformance we can deliver through our industry-leading private credit origination platforms – while maintaining strong policyholder protections – will play a vital role in helping meet long-term customer obligations, especially at a time of historically low interest rates.”

The sale of ALIC, along with the previously announced sale of Allstate Life Insurance Company of New York (ALNY) to Wilton Re, reduces Allstate assets by $34 billion, to $99 billion, and liabilities by approximately $33 billion, to $72 billion, as of June 30, 2021, and resulted in a GAAP book loss of approximately $3.8 billion in the first quarter of 2021.

Approximately $1.7 billion of deployable capital was generated by these transactions and was considered when authorizing the current $5 billion share repurchase program. Going forward, Allstate agents and exclusive financial specialists will offer life insurance and retirement solutions from third-party providers.

American International Group, Inc. (NYSE: AIG) and Blackstone (NYSE: BX) announced the completion of the previously disclosed transaction for Blackstone to acquire a 9.9% equity stake in AIG’s Life & Retirement business and for Blackstone to manage an initial $50 billion of Life & Retirement’s existing investment portfolio.

American International Group, Inc. (AIG) is a global insurance organization whose member companies provide property casualty insurance, life insurance, retirement solutions, and other financial services to customers around the world. AIG common stock is listed on the New York Stock Exchange.

Blackstone’s $731 billion in assets under management include investment vehicles focused on private equity, real estate, public debt and equity, life sciences, growth equity, opportunistic, non-investment grade credit, real assets and secondary funds, all on a global basis.

AM Best has placed under review with developing implications the Financial Strength Rating of B++ (Good) and the Long-Term Issuer Credit Rating of “bbb+” (Good) of Sunset Life Insurance Company of America (Kansas City, MO).

Sunset Life Insurance Company of America’s ratings were placed under review with developing implications following the announcement that Cordillera Holdings has acquired the company. Cordillera Holdings, founded in 2020, is a holding company focused on investing in the insurance and reinsurance sectors. Under new CEO Nathan Gemmiti, Sunset Life Insurance Company of America will sell retirement-oriented fixed annuities. The acquisition was financed by Investcorp, a $36 billion alternative asset manager.

The developing implications reflect that AM Best is awaiting information concerning the financial position of Cordillera Holdings and the business plan and projections of Sunset Life Insurance Company of America under its new ownership.

© 2021 RIJ Publishing LLC. All rights reserved.

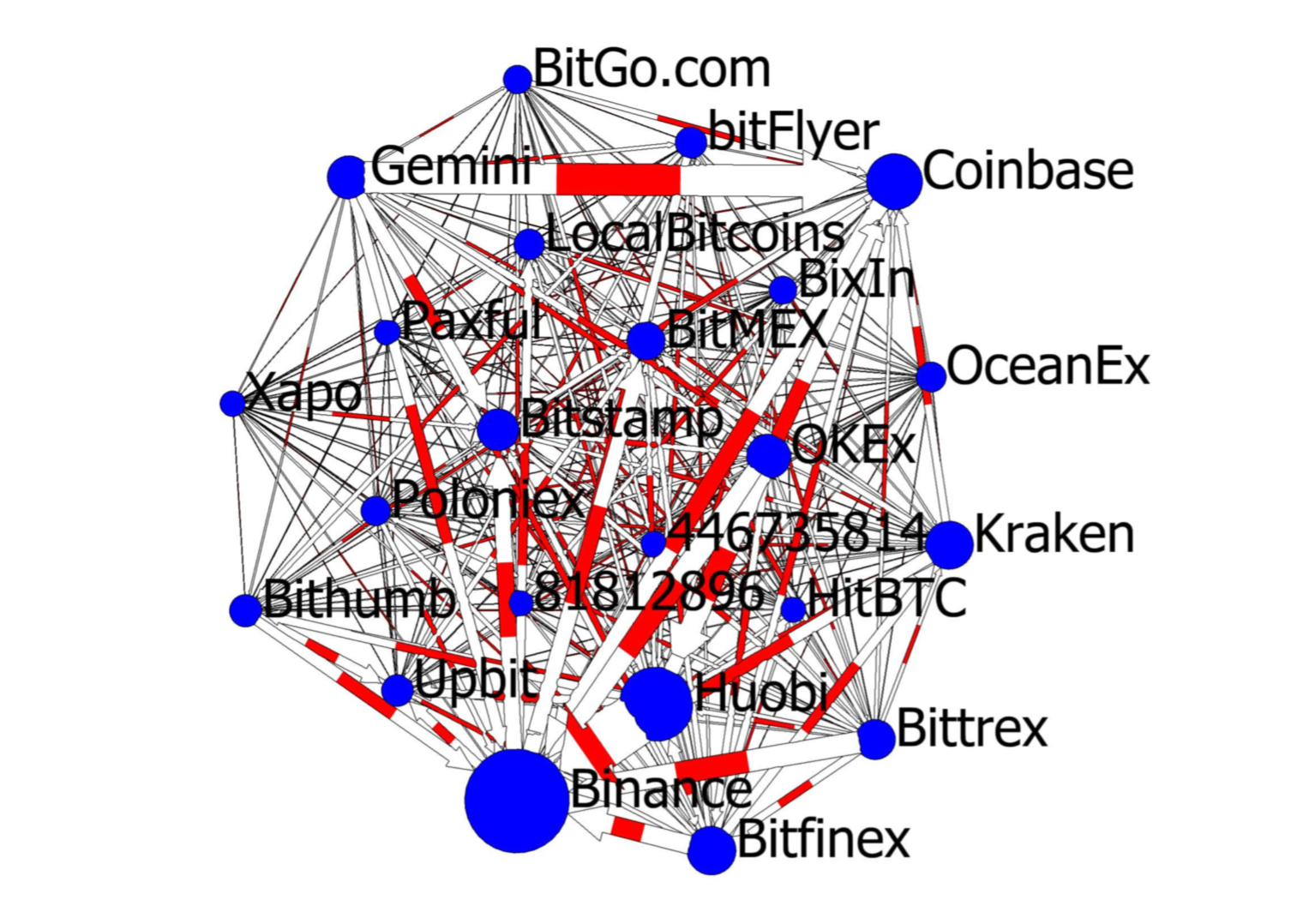

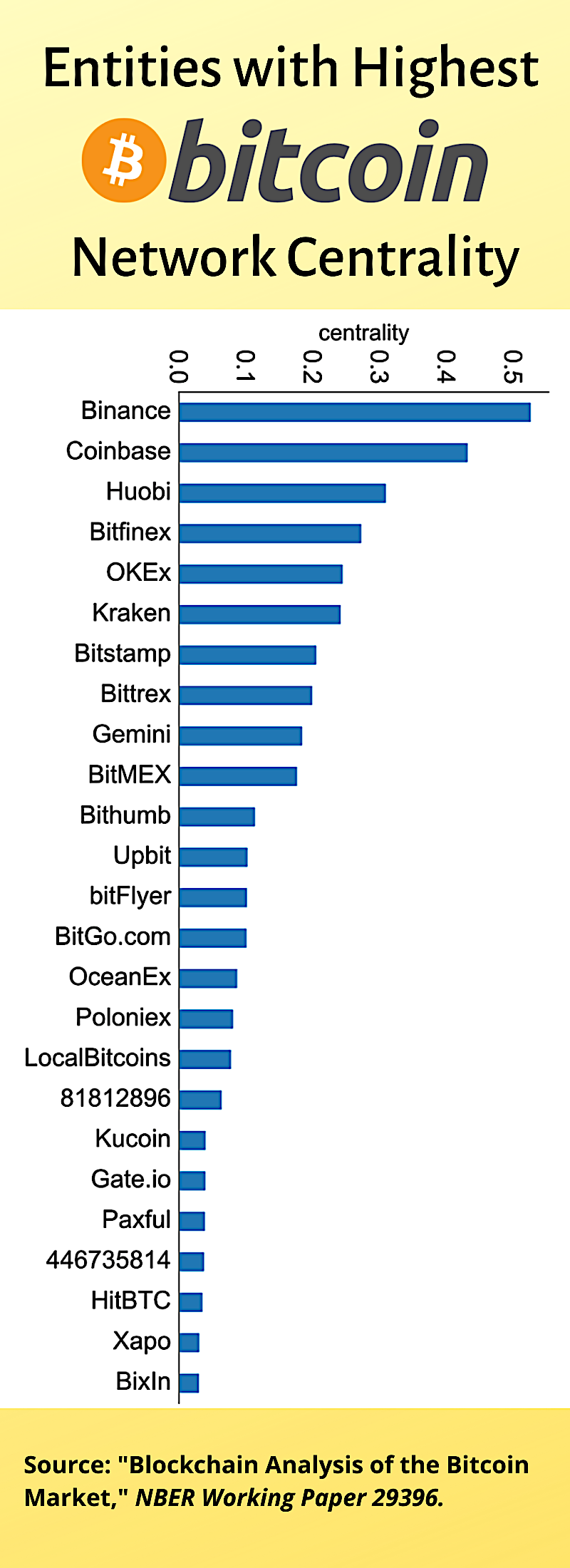

Cold wallets, hashing power, Chinese miners, 51% attacks, Satoshi Nakamoto, Kaiko data, peeling chains, the Hydra Market, and eigenvector centrality. These are just a few examples of the exotic vocabulary of the world of cryptocurrencies, including Bitcoin, the one most heavily traded.

A new article from the National Bureau of Economic Research offers a rare academic peek into this opaque world. Blandly titled, “Blockchain Analysis of the Bitcoin Market,” the article asserts that the Bitcoin universe is a noisy place, dominated by speculative and willfully redundant trading, with concentrated ownership of the coins. Money laundering and tax evasion represent a relatively small percentage of total trading volume, the researchers found. But it still represents a sizable sum of money.

The irony of cryptocurrencies is that, while the blockchain—the ledger that records cryptocurrency transactions—is available for all to see. Bitcoin users find ways to make it opaque—by using fake names and generating a fog of “spurious” trades.

“Many Bitcoin users adopt strategies designed to impede the tracing of Bitcoin flows by moving their funds over long chains of multiple addresses and splitting payments among them, resulting in a large amount of spurious volume,” write authors Igor Makarov of the London School of Economics and Antoinette Schoar of MIT.

The Bitcoin network, with clusters receiving >500,000 bitcoins from 2018 to end of 2020.

“Ninety-percent of transaction volume on the Bitcoin blockchain is not tied to economically meaningful activities,” they add. Instead, transaction volume is a byproduct of the Bitcoin protocol design, the participants yen for anonymity, and speculation in Bitcoin.

Speculation accounts for most Bitcoin activity, the authors concluded. But they suggest that traders may be hurt more by the opacity of the Bitcoin exchanges. “In contrast to traditional, regulated equity markets, the cryptocurrency market lacks any provisions to ensure that investors receive the best price when executing trades,” they write.

The authors estimate that illegal activity represents only 3% of Bitcoin activity, but that’s still a lot of money. “We calculate that there are about $550 million flowing to addresses that have been identified as scams, about $16 million in identified ransom payments, and more than $1.6 billion for dark net payments and dark net services. In addition, there are about $1.7 billion flowing to addresses affiliated with gambling and another $1.4 billion in mixing services.”

Many people own a little Bitcoin, but a handful of players own a lot. “The balances held at intermediaries (Bitcoin exchanges, online “wallets”) have been steadily increasing… By the end of 2020 it is equal to 5.5 million bitcoins, roughly one-third of Bitcoin in circulation. Individual investors collectively control 8.5 million bitcoins by the end of 2020. The top 1000 investors control about 3 million Bitcoin and the top 10,000 investors own around 5 million Bitcoins.

“This inherent concentration makes Bitcoin susceptible to systemic risk and also implies that the majority of the gains from further adoption are likely to fall disproportionately to a small set of participants,” Makarov and Schoar said.

Participating Longevity-Linked Annuities (PLLAs) are products that European pension experts have been studying. These group annuity products call for the sharing of longevity risk and market risk between the life insurers who issue annuities and the retirees who buy the annuities as a way to increase initial payout rates.

The strategy relies on options. “The embedded longevity put (call) options give the annuity provider (annuitant) the right to periodically adjust the benefit payments downwards (upwards) if the observed survivorship rates are higher (lower) than those predicted at the contract initiation, transferring part of the longevity risk to the annuitant.”

In a recent research paper, “Drawing Down Retirement Financial Savings: A Welfare Analysis using French Data,” two European pension economists, Jorge M. Bravo and El Mekkaoui Najat, test the effectiveness of a PLLA contract against seven common retirement drawdown methods. They find that a PLLA competes well.

Their paper, published in the Journal of the Association of Computing Machinery, investigates the individual welfare generated from eight alternative drawdown strategies, including four investment based solutions and four solutions using annuities:

“Among the full annuitization strategies, the highest nominal and inflation-adjusted average consumption (and welfare) values are generated by the PLLA contract, followed by the IPA structure,” the authors found. “The income and consumption volatility of PLLA benefits is naturally higher than that of fixed annuities with annuity payments variability bounded at 20% of the initial benefit, but consumption levels are higher.”

In the ultra-low interest rate environment that has prevailed (except in 2017-2018) since the Great Financial Crisis, individuals, insurance companies and institutions have “reached for yield” in excess of what high-quality bonds are paying.

Writing in the Journal of Wealth Management this year, respected academic researcher David Blanchett (who recently left Morningstar for Prudential), makes the case for substituting stocks for bonds as a source of retirement income when dividend yields exceed bond yields.

“The current yield gap environment today is relatively unprecedented, with dividend yields significantly exceeding bond yields in effectively every developed market. This anomaly suggests existing research on optimal income portfolios may need to be revisited, especially the structural decision of whether (and how) income-focused investors should consider allocating to equities.”

Blanchett told RIJ that his dataset allowed him only to compare stocks to bonds, not dividend-paying stocks to bonds. “In theory, if you’re allocating to stocks, you could allocate to those with higher dividend yields to generate more yield. You could also tilt the bond portfolio towards higher yielding bonds as well (e.g., corporates, especially high yield). My analysis is focused on the broad asset class decision, versus more nuanced asset class weights,” he said.

Dividends are a time-honored source of income for affluent retirees who never intend to liquidate their blue chip stocks, regardless in fluctuations in value. They bequeath the shares, taking advantage of the step-up in basis at death. Middle-class retirees rarely own enough equities to rely on the dividends for a significant portion of income. Retirement guru Wade Pfau sees no overall gain from buying equities for income, because the distribution of dividends coincides with a drop in the share price.

But after analyzing a database of bond yields and dividend yields in 17 different countries between 1870 and 2015, Blanchett sees a case for equities over bonds when bond yields are lower than dividend yields. He concedes that re-allocation to equities will raise the risk of a retiree’s portfolio and doesn’t recommend going “all in” to equities, recommending “a more measured approach.”

Even though the “annuity puzzle” isn’t really so puzzling, academics continue to ask: Why don’t more Americans buy retail annuities. The most obvious answer is that they already contribute to and own annuities; it’s called Social Security. They fund it over a lifetime, which is the least painful way to pay for a pension or annuity.

Second, because life insurers so often ask people to fund their annuities with lump sums, life insurers limit the annuity audience to those who can afford single premium payments of hundreds of thousands of dollars at or near retirement. That leaves out a lot of people.

In a new research paper sponsored by the Alliance for Lifetime Income’s Retirement Income Institute, financial literacy expert Annamaria Lusardi and others at the Global Financial Literacy Excellence Center in Washington, DC, document the roles that “liquidity constraints,” including “debt obligations,” put annuities out of reach.

“We find that many people who are in the retirement planning phase of the life cycle (individuals ages 40–61) and those who are of retirement age (individuals ages 62 and over) face these barriers to annuity ownership: Lack of financial knowledge, leveraged assets, debt obligations, and liquidity constraints are all likely barriers to annuity ownership.”

The team of authors found that “annuity owners are more likely to be older and wealthy, to have greater access to liquidity, and to experience higher levels of satisfaction with their financial situation than non-owners. Results indicate that having access to liquidity and letting a professional choose investments are both positively associated with annuity ownership.”

“While we do not find any significant relationship between financial literacy and annuity ownership,” they add, “results do indicate that financial literacy may lead to increased take-up rates through improving individuals’ access to liquidity.”

© 2021 RIJ Publishing LLC. All rights reserved.

Insurers’ continue their shift toward using non-traditional assets, external managers, and new technologies to provide transparency and reliable accounting data, among other findings, according to the findings of Clearwater Analytics’ 2021 Insurance Investment Survey Report.

Clearwater Analytics, a provider of SaaS-based investment accounting, reporting, and analytics solutions, has over $5.6 trillion in total assets on its SaaS platform, according to a release. It serves hundreds of insurers and asset managers as two of its key client market segments.

“The search for yield amid low interest rates has driven insurers into non-traditional asset classes and away from traditional safe havens,” said Sandeep Sahai, CEO, Clearwater Analytics.

“This creates significant challenges because non-traditional asset class data is often extremely complex and deciphering it requires multiple systems and manual processes, which brings serious risk for misinterpretation or misguided action. This report demonstrates the urgency of working with trusted partners to ensure accurate and timely accounting.”

The survey polled insurance investment and accounting professionals as well as C-level executives at hundreds of insurers worldwide. The key takeaways and data revelations were

Insurers focus on non-traditional assets

Clearwater’s Insurance Investment Survey results show the growing use of non-traditional asset classes.

Top 4 non-traditional asset classes. Fifty-five percent or more of insurers indicate some level of allocation to private placements, private funds (LPs), mortgage loans, and ETFs. More than one-third of respondents said they will increase exposures with non-traditional assets.

Other emerging asset classes. There is a growing use of bank loans and other complex asset classes. Insurers also reported increased investment in derivatives.

Regulator concerns. Despite the rise of non-traditional assets, some insurers hesitate to use them due to investment guidelines, regulatory constraints or concerns, and lack of expertise.

Reliance on external managers’ expertise is here to stay

External asset manager usage. The vast majority of respondents use external managers, ranging from 20% to 80% or more of their total portfolio. Insurers whose external managers manage at least half of their portfolio expect to increase or maintain their dependence on external managers.

Insurers’ requirements for asset managers. External managers are most commonly rated performance (62%) and insurance client expertise (46%).

Insurers are ramping up tech stack and risk analysis

Non-traditional asset classes often create technology challenges for insurers. More than half of the survey respondents use multiple technologies for investment accounting.

Risk and related analysis such as benchmark comparison, exposure analysis, scenario testing, VaR, and ex-post risk are required. Half of surveyed insurers say that manual processes often slow down their monthly close process.

“Insurers who deploy an advanced cloud-based singular platform, designed to deliver on any asset class, no matter the complexity, will benefit from actionable intelligence and as a result their investments will outpace those failing without trusted visibility,” added Sahai.

The full 2021 Clearwater Insurance Investment Survey Report is accessible here. Additionally, Clearwater Analytics held a webinar to discuss the findings with its subject matter experts. The recording can be accessed here.

For two months in 2021, Clearwater Analytics surveyed insurers worldwide as part of the 2021 Insurance Investment Survey Report. Respondents came from the Americas, EMEA, APAC, and offshore. More than 1,000 insurance professionals participated, comprising all types and sizes of insurers. Half of respondents identified as working in investment accounting, and the other half were split between operations and investment management. Respondents are anonymous.

© 2021 RIJ Publishing LLC.

The US Department of Labor’s Employee Benefits Security Administration has issued Field Assistance Bulletin 2021-02, “Temporary Enforcement Policy on Prohibited Transaction Rules Applicable to Investment Advice Fiduciaries.”

FAB 2021-02 provides that from Dec. 21, 2021, through Jan. 31, 2022, the department will not pursue prohibited transaction claims against investment advice fiduciaries who are working diligently, and in good faith, to comply with the Impartial Conduct Standards (i.e., best interest, reasonable compensation and without misleading statements) for transactions exempted in PTE 2020-02.

In addition, the department will not treat such fiduciaries as if they were violating the applicable prohibited transaction rules. Finally, the department will not enforce the specific documentation and disclosure requirements for rollovers in PTE 2020-02 through June 30, 2022. However, all other requirements of the exemption will be subject to full enforcement on Feb. 1, 2022.

The Sammons Financial Group, which sold the fifth most fixed indexed annuities (FIAs) in the first half of 2021, has partnered with Annexus, a designer of FIA contracts, are partnering on the launch of two new FIA contracts.

The contracts, to be issued by North American Company for Life and Health Insurance, are the North American Secure Horizon and the North American Secure Horizon Plus. The Plus version includes a rider that can pay off in the event of death, disability, a drop in Social Security benefits, or extreme longevity.

Only one of the four benefits may be elected under the contract rider, however. Once a benefit is elected, no other benefits are available. The program can be sold by insurance agents, advisors or Investment Advisor Representatives of Registered Investment Advisors.

Contract owners can allocate premium to the BlackRock ESG US 5% Index ER, the Loomis Sayles Managed Futures Index, and the S&P 500 Low Volatility 5% ER Index. It also features an innovative first-to-market Performance Strategy Ladder that can provide “greater growth opportunities,” a Sammons release said.

The department continues to review issues of fact, law and policy related to the exemption, and more generally, its regulation of fiduciary investment advice.

The Allianz Index Advantage Income ADV Variable Annuity, from Allianz Life Insurance Company of North America (Allianz Life), which offers a lifetime income rider, is available now on the DPL Financial Partners web-based platform for registered investment advisors (RIA)s.

Investors in the annuity product and its income rider can select from several index crediting methods with varying levels of protection against market downturns. The income options include a flat payout or one with growth potential. The product enables advisors to bill directly from the annuity rather than needing to pull their fee from a separate account.

A 0.25% product fee and 0.70% Income Benefit rider fee are accrued daily and deducted on each quarterly contract anniversary, calculated as a percentage of the contract value. The Income Benefit rider is automatically included in the contract at issue and cannot be removed.

Investor demand for RILAs has been strong, with flows up 104% year over year in the first half of 2021 according to LIMRA. DPL Financial Partners is a turnkey insurance management platform that brings commission-free insurance solutions to RIA practices.

© 2021 RIJ Publishing.

In a new report, the Congressional Budget Office (CBO) estimates that major tax expenditures reached a combined $1.2 trillion in 2019, or 5.8% of gross domestic product, and accounted for roughly three-quarters of the total budgetary effects of all tax expenditures that year.

The exclusion and deferrals for the contributions and earnings associated with pensions and retirement savings accounts ($276 billion) and the exclusion for employment-based health insurance ($280 billion including the payroll tax expenditure) were the two largest. The smallest of the major tax expenditures was the state and local tax deduction ($22 billion).

Tax expenditures are exclusions, deductions, credits, and net preferential rates in the federal tax system that cause government revenues to be lower than they would otherwise be for any given structure of tax rates.

In the new report, the Congressional Budget Office showed how the benefits from major tax expenditures in the individual income tax and payroll tax systems were distributed among households in different income groups in 2019.

In 2019, the distribution of benefits from the tax expenditures analyzed in this report varied considerably among income groups:

Overall, about half of the total benefits from income tax expenditures accrued to households in the highest quintile (the top 20%) of the income distribution, whereas 9% of such benefits accrued to households in the lowest quintile. Payroll tax expenditures were more evenly distributed.

Households in the lowest quintile received benefits equal to 16% of their total income before transfers and taxes, whereas households in the highest quintile received benefits equal to 7% of such income.

Among the various tax expenditures, the distribution of benefits varied greatly. For example, about 95% of the benefits from the qualified business income deduction accrued to households in the two highest quintiles of the income distribution, whereas 82% of the benefits from the earned income tax credit accrued to households in the two lowest quintiles.

Provisions of the 2017 tax act (Public Law 115-97) reduced the total estimate of benefits from income tax expenditures by 9%. On net, those provisions made the distribution of tax expenditures more progressive because most of the benefits reduced by the tax act would have accrued to households in the highest quintile.

© 2021 RIJ Publishing LLC.

Significant retirement-related provisions have been removed from the rapidly shrinking Build Back Better Act, according to NAPA Net, a publication of the American Retirement Association.

Dropped from the bill were provisions designed to close the so-called “back door” Roth IRA, impose contribution limits on higher-income individuals with large account balances, and prohibit IRA investments conditioned on the account holder’s status.

“A backdoor Roth IRA is a way for people with high incomes to sidestep the Roth’s income limits,” according to nerdwallet.com. If you earn too much to qualify to use a Roth IRA, you can put money in a traditional IRA, convert your contributed funds into a Roth IRA. You simply have to pay any taxes due on the distribution from the traditional IRA.

Distributions from a Roth IRA in retirement are tax-free; contributions are after-tax and principal can be withdrawn penalty-free.

Until Wednesday night, several other retirement related provisions were under consideration:

© 2021 RIJ Publishing.

Investcorp, a global provider and manager of alternative investment products, has launched the Investcorp Insurance Solutions platform, the firm’s newly formed business that will provide investment management services to meet the investment needs of insurers.

Investcorp has hired Todd Fonner as Chief Investment Officer, who has over 28 years of experience in the insurance and asset management industries, having held a variety of roles across functions including investments, treasury, enterprise risk, underwriting and strategy.

Most recently, he served as Senior Managing Director, CIO North America, Blackstone Insurance Solutions until 2020. There, he contributed significantly to the build out and enhancement of the Blackstone Insurance Solutions platform formed in late 2017. He also has held CIO, Treasurer and Chief Risk Officer roles at RenaissanceRe Holdings, where he spent nearly 15 years of his career.

Investcorp is a global investment manager, specializing in alternative investments across private equity, real estate, credit, absolute return strategies, GP stakes and infrastructure. Since our inception in 1982, we have focused on generating attractive returns for our clients while creating long-term value in our investee companies and for our shareholders as a prudent and responsible investor.

Investcorp has today presence in 12 countries across the US, Europe, GCC and Asia, including India, China and Singapore. As of June 30, 2021, Investcorp Group had US $37.6 billion in total AUM, including assets managed by third party managers, and employed approximately 430 people from 45 nationalities globally across its offices.

Iceland’s retirement income system has been named the world’s best in its debut in the 13th annual Mercer CFA Institute Global Pension Index (MCGPI). The Netherlands and Denmark have taken second and third places respectively in the rankings, after a decade of competing for the top spot.

The study also reveals that there is much that pension systems can do to reduce the gender pension gap—an issue inherent in every system.

The US index value increased from 60.3 in 2020 to 61.4 in 2021, primarily due to an increase in individual’s net replacement rates, higher household savings, and an increase in the value of the assets held in private pension arrangements.

While COVID-19-related legislation passed by Congress provided some relief to individuals and employers in 2020 and 2021, the resulting increases in government debt and retirement asset leakage caused by providing individuals access to funds before retirement were negative side effects.

These results, coupled with the projected depletion of social security by 2034, will have a significant impact on the ability for the US pension system to adequately provide for its retirees in the future.

The MCGPI is a comprehensive study of global pension systems, accounting for two-thirds (65%) of the world’s population. It benchmarks retirement income systems around the world highlighting some shortcomings in each system and suggests possible areas of reform that would provide more adequate and sustainable retirement benefits. The top three systems, all receiving an A-grade, were sustainable and well-governed systems, providing strong benefits to individuals.

Women are still facing retirement with substantially less saved in their pensions than men and the MCGPI’s analysis highlighted that there was no single cause of the gender pension gap worldwide, despite all regions having significant differences in the level of retirement income across genders.

Pay equity is a major contributing factor to the gender pension gap. Women also tend to have less time in the workforce compared to men, largely due to family leave policies, or lack thereof, and greater expectation for women to manage caregiving and family commitments, which ultimately means less time for accumulation of savings for retirement.

As a result, they tend to become self-employed or hold more part-time positions, which aren’t always eligible for retirement program participation, or leave the workforce all together. Women also have longer life expectancies and are more likely to experience poverty in their old age than men; therefore requiring more capital to get them through their retirement years.

Pacific Life has launched the Invesco V.I. Defined Outcome Funds, available with certain Pacific Life variable annuities. These funds are designed to give investors the benefits of a registered index-linked annuity (RILA) but with more flexibility, control, and transparency.

The Invesco V.I. Defined Outcome Funds offer growth potential linked to a market index, up to a cap, and downside protection through a buffer that protects against the first 10% of loss over a one-year outcome period. These features are available to clients without the need for an optional benefit for an additional cost.

By offering the funds through a variable annuity, clients can combine this strategy with other investment options to create a custom portfolio. Clients can also move in and out of the Invesco V.I. Defined Outcome Funds.

A tool on the Invesco website allows financial professionals and their clients the ability to view the cap, buffer, and time remaining in the outcome period for each fund.

“We’ve seen industry growth in RILAs, low-cost mutual funds, and outcome-focused exchange-traded funds (ETFs),” said Kevin Kennedy, senior vice president of sales and chief marketing officer for Pacific Life’s Retirement Solutions Division. “By placing these Invesco funds inside our variable annuities, we are one of the first to give investors an additional vehicle to get the growth and protection they need without sacrificing flexibility.”

Long-term mutual funds and exchange-traded ETFs had $58 billion of inflows in September, their lowest intake since October 2020 when they gathered $15 billion, according to the latest monthly fund and ETFs flow report from Morningstar, Inc.

Consistent with the broader shift in favor of index-tracking US equity strategies, passive US equity funds had $12.5 billion of inflows in September, while active funds had outflows of $20.0 billion. US equity funds’ overall $7.4 billion outflow was the most among U.S. category groups.

International-equity funds had inflows of $9.8 billion, compared to the category group’s average monthly intake of $24 billion over the first eight months of 2021.

Funds with sustainability mandates incorporated into their prospectuses, as measured by Morningstar, had inflows of $3.8 billion in September. Sustainable US equity funds gathered $1.6 billion, bringing their year-to-date intake to $25.7 billion, equal to more than half the inflows into US equity funds without an explicit focus on sustainability. As of September, sustainable funds within the international-equity and sector-equity category groups posted trailing 12-month organic growth rates of 57% and 122%, respectively.

Taxable bond funds’ $40 billion intake led all US category groups for the sixth consecutive month, with 70% of all long-term net flows in September. Their year-to-date intake of $464 billion more than doubled the next-closest, international-equity funds’ $203 billion. Short-term bond funds led all taxable-bond funds by gathering $7.1 billion in September. Bank loan funds added $3.2 billion, their 10th consecutive month of inflows, and inflation-protected bond funds extended their streak of positive flows to 17 months after collecting $5.6 billion in September.

Vanguard collected $19.8 billion in September, which marked its lowest monthly inflow of the year but still led all fund families for the 10th consecutive month. The firm’s lineup of index funds represented the majority of September’s intake and has now claimed over 90% of the firm’s inflows year to date. Fidelity and iShares saw the second- and third-most inflows, respectively, with over $9 billion apiece in September.

To help registered investment advisers (RIAs) manage transition and longevity risks in client portfolios, Allianz Life Insurance Company of North America (Allianz Life) announced has launched an advisory version of its Allianz Index Advantage Income Variable Annuity.

The Allianz Index Advantage Income ADVSM Variable Annuity offers an advisor-centric product design with seamless integration, low fees, greater control and enhanced fee billing.

In a recent Allianz Life study, 88% of financial advisors said it is more important to effectively manage risk in client portfolios than generate the highest gains. The product can help address retirement risks associated with the rising cost of living over a longer retirements by offering indexed return potential with a level of protection through multiple crediting methods (also called index strategies), tax deferral, a variety of lifetime payout options, and a choice of death benefit options within the accumulation phase.

In addition to the robust product benefits, advisors can leverage their preferred financial planning and portfolio management tools to help demonstrate the value of integrating insurance solutions to clients.

© 2021 RIJ Publishing LLC. All rights reserved.

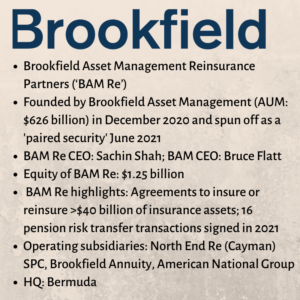

The completion of a $10 billion partnership between American Equity Investment Life Insurance company (AEL) and Brookfield Asset Management Reinsurance (BAM Re), which was announced last week, is significant in many ways—for AEL, Brookfield, and the US annuity industry.

For American Equity Investment Life, the deal marks the realization of its “AEL 2.0” strategy. CEO Anant Bhalla announced the strategy not long after he joined AEL from Brighthouse Financial in March 2020. His goal: to release surplus capital, raise investment yields, and please impatient shareholders.

“We are taking what would be a spread business focused on return-of-equity and turning that into a fees business focused on return-on-assets,” Steven Schwartz, head of Investor Relations at AEL, told RIJ. “A spread business requires us to hold significant capital. A fees business requires holding less capital. That’s what AEL 2.0 is all about.”

For BAM Re, created only months ago by Toronto-based Brookfield, which manages $626 billion in alternative investments worldwide, the deal makes it a player in the gold rush to manage “sticky” annuity assets. Its competitors—Athene/Apollo, KKR, Blackstone and other private equity firms—are already there.

For the annuity industry, the deal embodies what RIJ has named the “Bermuda Triangle” strategy. It involves a US life insurer, an offshore reinsurer, and an asset manager. For small to mid-sized publicly traded annuity issuers squeezed for years by the Fed’s low interest rate policy, this strategy represents nothing short of survival and independence, at least temporarily.

The deal with BAM Re gives AEL, which has an A- rating from AM Best, what it wants and needs. Reinsuring about $4 billion (of AEL’s $55 billion in assets) in existing “IncomeShield” fixed indexed annuity (FIA) contracts with surrender periods of up to 10 years with BAM Re’s North End (Cayman) reinsurer releases about $200 million.

That’s on top of the $350 million AEL gained by reinsuring about $5 billion in a deal with Värde Partners and Agam Capital Management in 2020. To free up more capital over the next six or seven years, AEL will send another $6 billion in assets (75% of projected FIA sales) to BAM Re and North End Re for reinsurance.

Technically, the annuity assets and liabilities will stay on AEL’s balance sheet. But when it moves $3.8 billion to a trust account at North End Re, it will receive a “reserve credit.” Because the capital requirements are lower in the Cayman Islands, AEL only has to move $3.8 billion to North End Re to back $4 billion in liabilities. That’s where the $200 million in released capital comes from.

North End Re’s parent, BAM Re, will manage the money. (AEL’s chief investment officer said in September that AEL intends to allocate” 30% to 40% [of its money] to private asset strategies.”) Out of what BAM Re earns on those assets, it will pay AEL a “ceding commission” of 49 basis points (bps) and an “asset liability management” fee of 30 bps (0.30%). On the $6 billion in future transfers, BAM Re will pay AEL a ceding commission of 140 bps and a 30 bps asset liability matching fee.

“This transforms a piece of AEL’s $55 billion spread business into a fee-based business without capital requirements. It’s an important step in diversifying their earnings mix,” Ryan Krueger of Keefe, Bruyette & Woods told RIJ. “AEL will retain over $50 billion of annuity business not being reinsured to Brookfield, of which a portion will be reinsured to a new captive reinsurer” called Project Ray Re. The reinsurer is mentioned in AEL’s December 2020 Form 8-K filing with the Securities and Exchange Commission.

CEO Anant Bhalla of AEL

“Like most of publicly traded life insurance companies, AEL wants to return capital to shareholders,” said JP Morgan analyst Pablo Singzon. “Reinsurance transactions can help them do that. They also need to bring up investment yield. Lower yields mean less attractive products and less profits for the insurer. So they’re updating their investment strategy.”

“AEL had to evolve,” Erik Bass, an analyst at Autonomous Research, said in an interview. “The old formula wasn’t going to work. They were at a disadvantage on the asset side and they were using almost all the capital they generated to support new business growth. They’ve had to issue equity capital in the past to fund some of that growth. They also had a lot of credit risk on their balance sheet.”

AEL’s new strategy also keeps it independent at a time when other small to mid-sized public traded life insurers are being scooped up by private equity (PE) firms. Fending off a takeover bid from Athene Re and MassMutual earlier this year, AEL chose to go its own way. Instead of letting one PE firm manage all of its assets, it will use several.

The stable of asset managers now includes Värde Partners, Agam Capital Management, and now Brookfield. AEL engaged Brookfield to manage only the assets that North End Re reinsures, and not the rest of AEL’s assets. In September, AEL outsourced the management of its traditional fixed income holdings to BlackRock and Conning. “Their goal is to have a diverse mix of best-in-class asset managers,” Bass told RIJ.

BAM Re’s parent, Brookfield Asset Management, the $626 billion Toronto-based alternative asset manager, wanted this deal as much as AEL needed it. Best known as a real estate investor, BAM saw rivals Apollo, KKR, Blackstone and others setting up reinsurers and reeling in chunks of the $500-billion FIA asset pool. It created BAM Re in late 2020 (spinning it off in June 2021) to do the same.

In its first foray into the annuity business, BAM Re paid $5.1 billion for American National Insurance Group, acquiring the Galveston, TX-based, publicly traded insurer’s $30.4 billion in assets (against $23.6 billion in liabilities). American National Insurance Co. had $436.2 million in FIA sales in the first half of 2021, for 17th place on LIMRA SRI’s top-20 list of FIA issuers. American National also sold $468.4 billion in fixed deferred annuity sales, and $53.8 million in income annuity sales.

“The private equity industry is drawn to sticky, low-cost liabilities. FIAs are the most popular right now,” Krueger told RIJ. “The [PE firms] also like funding agreements and pension liabilities with low acquisition costs, which generates assets to invest at more favorable spreads.”

Asset managers have begun referring to FIA assets as “permanent capital.”

FIAs are seen as sticky or permanent because they have terms as long as 10 years. Many of them include surrender charges and market value adjustments that discourage or sterilize withdrawals by policyholders. While contract owners can withdraw 10% per year without penalty, there’s negligible risk of “runs” that would force the asset managers to liquidate illiquid assets like collateralized loan obligations (CLOs).

The AEL-BAM Re relationship, while not exclusive, is meant to last awhile. To “cement” its relationship. BAM Re has already purchased 9.9% of AEL, or about 9.1 million of its common shares. S&P Global reported that BAM Re paid $287.1 million for the shares. BAM Re is waiting for regulatory approval to buy another 10% of AEL, according to press reports.

CEO Sashin Shah of BAM Re

The “flow reinsurance” aspect of the deal extends the BAM Re-AEL partnership out for at least six years. That’s how long the 170 bps fee arrangement is guaranteed for. BAM Re will reinsure new IncomeShield contracts as quickly as agents and advisers sell them. The prospect of AEL receiving steady fees (170 bps on $6 billion is $102 million) for the next several years may comfort AEL shareholders.

Flow reinsurance appears to be on the rise. Lincoln Financial Group, which signed a flow reinsurance deal with Athene in 2017, entered into another one last month with Talcott Resolution Life Insurance Company. Talcott will reinsure up to $1.5 billion in sales of Lincoln’s flagship variable annuity with living benefit riders. (Living benefits are capital-intensive. They are tied to the equity markets and are optional. It’s difficult to predict how many contract owners will exercise them.) The transaction covers business issued from April 1, 2021, through June 30, 2022.

As noted above, the AEL-BAM Re deal epitomizes the Bermuda Triangle strategy. The strategy requires a publicly traded US-based life insurer to gather long-term fixed annuity premiums, a Bermuda or Cayman Island reinsurer that saves capital by estimating the annuity liabilities at a lower value, and a deep-pocketed asset manager with expertise in originating bespoke loans to leveraged companies. For the life insurers, there may be tax advantages to reinsuring offshore as well.

The companies at the points of the triangle are often related. The asset manager or the US life insurer may set up and capitalize the reinsurer. In some cases, the asset manager, the US life insurer, and/or the offshore reinsurer are affiliated or co-owned. Indeed, annuity issuers owned by or partnering closely with private equity firms have already captured almost half of the FIA market in the US, according to data from LIMRA’s Secure Retirement Institute.

Analysts see credit risk as the biggest hazard in these deals. As in the run-up to the Great Financial Crisis, the asset managers are securitizing bundles of below-investment grade loans and valuing some of their “tranches” as investment grade securities that life insurers are allowed to own. And when the same company controls all three points of the triangle, the deal may lack the safeguards that unrelated counter-parties might require.

The analysts who spoke with RIJ didn’t seem overly concerned.

“The asset managers may take more risk with the assets than the ceding company did. That’s part of the strategy,” said Bass. “But the asset managers say they’re taking liquidity risk, not more credit risk. They’re investing in, for instance, private corporate loans, private direct mortgages, and aircraft leases instead of publicly traded bonds. And they’re increasing the spread by doing so. But the rating assigned for the assets, and the capital charge for the credit risk on those assets is the same as publicly traded BBB corporate bonds. The credit risk is the same, but they’re taking liquidity risk.”

“They’re investing in assets that AEL previously would not have,” JP Morgan’s Singzon said. “The net effect will be higher yields, which will make AEL more competitive. They haven’t been uncompetitive. But if they want to stay in the FIA market, they have to offer higher crediting rates. It’s all tied to earning more yield on what they have. Now they can ‘drive in both lanes.’ They can be competitive with their policyholders and earn enough profits for their shareholders.”

“Will these higher allocations to private assets produce risk-adjusted returns as good as companies think, or is there more risk than they expect?” Krueger asked rhetorically. “The evidence to date has been positive. There have been no material problems. Lots of smart companies and individuals are adamant that these private assets will continue to generate strong risk-adjusted returns.”

Analysts expect AEL’s 2.0 strategy to help widen its spreads to the neighborhood of 4% and to increase its return-on-equity. “This has been a transition year for the company,” said Krueger. “They’ve been making business investments and holding excess liquidity. We expect an 8% return on equity [ROE] in 2021. But, with the refreshed strategy and completion of various transactions, we’re projecting 11.3% in 2022 and 11.7% in 2023.”

In its December 2020 8-K, AEL bullishly predicted a potential (15+%) ROE over time, “even in a low interest rate environment.” If so, 2.0—and the Bermuda Triangle strategy—will be validated.

© 2021 RIJ Publishing LLC. All rights reserved.

My “foreign car” mechanic used to tell me, when I asked how long it would take to repair my Fiat: “You can have it fast, cheap or good. Pick two.” He liked using that phrase, as if it embodied some eternal truth.

It did, in a way. Right now, many Americans worry about the possibility of higher interest rates, higher inflation, higher taxes and higher federal debt. I would bet you the price of a 30-weight oil change that we’re not going to get all four.

If we have higher interest rates and/or higher taxes, we probably won’t have high inflation. Allowing rates to rise would quell inflation. Taxing the wealthy would also be anti-inflationary, assuming they didn’t find a way to avoid it.

(How can you tell if you are wealthy enough to afford higher taxes? If a $1,000 car repair bill doesn’t spoil your afternoon, you’re wealthy.)

We can indulge in low taxes and low interest rates, but we will only increase the national debt by doing so. The least painful solution is to raise taxes. There’s no easy way to do it. We can restore higher marginal rates, raise the limit on salary subject to payroll taxes, and find an acceptable way to tax extreme wealth.

Personally, I would love to see a 3% 10-year Treasury in a more balanced equity/fixed income world. But a rate hike would put people out of work, and there are few things worse for the poorest 75% of America than layoffs. And, of course, higher rates would cause an instant mark-down in the value of assets. In 2018, when 10-year T rates touched 3% for the first time in years, Wall Street threw a tantrum, the Fed stopped tightening.

Raising taxes, on the other hand, won’t kill anybody. It won’t cause unemployment. It won’t reduce the value of existing assets. It won’t even impair the banks’ ability to lend, since government spending replaces what taxes remove from bank reserves.

I don’t like taxes any more than anyone else. Four times a year, I write large checks to the federal government. That’s one of the less pleasurable aspects of self-employment. But I’ve made my peace with the tax man. After a deep dive into economic history, I now understand that taxes are the cost of money.

Taxes, inflation, debt, interest rates. Like my mechanic said, Take your pick. They can’t all be low.

© 2021 RIJ Publishing LLC. All rights reserved.

We have a relatively sanguine view on the likelihood of inflation becoming ingrained in the system (much as it pains us to agree with the Fed). However, the dark arts of macroeconomics are notoriously tricky, and we have often talked of the need to build robust (as opposed to optimal) portfolios – effectively, portfolios that can withstand multiple outcomes. As such, it behooves us to consider how to deal with inflation in the context of your portfolio.

The first choice you must make is to determine whether you are interested in an inflation hedge (something that closely tracks inflation) or a store of value (something that will preserve purchasing power). For long-term investors, the latter is probably of more interest. A focus on the store of value naturally leads to a search for real assets. Despite conventional wisdom, commodities in general haven’t been a good store of value.

The ‘best’ real asset we have found is equities. They make a terrible inflation hedge but over the long term publicly traded companies are the businesses that charge prices and pay wages, so their cash flows should be real if these two elements are roughly matched. Thus they act as a store of value in the longer term. Of course, you can do better than simply buying equities, you can buy cheap equities. This is like being offered inflation insurance at a discount.

We have a relatively sanguine outlook on inflation, as discussed in “Part 1: Inflation – Tall Tales and True Causes.” Perhaps you don’t share our view. Or perhaps like us you are always interested in how to build a robust portfolio (one which can survive a lot of different outcomes). Either way it is time to turn our attention to how to protect your portfolio from an inflationary outcome.

As with all ‘tail risk’ insurance you need to ask yourself three questions.

In this case, we need to consider the sources of inflation. Unfortunately inflation seems to follow the Anna Karenina principle. As Tolstoy put it, “Happy families are all alike; every unhappy family is unhappy in its own way”. The ‘good’ news is that the labour market dynamic is truly key for an inflation to take hold so pondering this aspect may make it slightly easier to think about, rather than trying to find the proximate cause.

We will explore some of the options that you might choose to pursue in the next section of this paper.

As always, it is important to remember that insurance is as much a value-based proposition as anything else in investing. So you need to be sure to analyse the cost of the insurance that you are buying.

Before we look at the potential ways you might try to hedge inflation, we need to make a distinction between what we might call hedging and a store of value. We think this is a vital distinction. To us, the term hedge implies a tight correlation with inflation (and therefore takes you into the world of swaps and caps, etc.). The concept of store of value is probably more important to a long-term investor.

We think of this as an asset that should outperform inflation but isn’t necessarily closely correlated with inflation (especially in the short term). Equities (assuming fair value for a second) are a real asset and we should expect their underlying cash flows to keep pace with inflation over the long term. As such, they meet the criteria for a store of value. However, due to behavioral issues, sometimes valuations get compressed in inflationary times, so they don’t correlate well with inflation as a hedge. Hence, they are a store of value but not an inflation hedge. Figuring out which of these two dimensions is important to you is vital when it comes to the choices you will make.

Let’s turn to the various instruments that might be thought to act as either a hedge or a store of value when it comes to inflation.

To read this story in its entirety, click here.

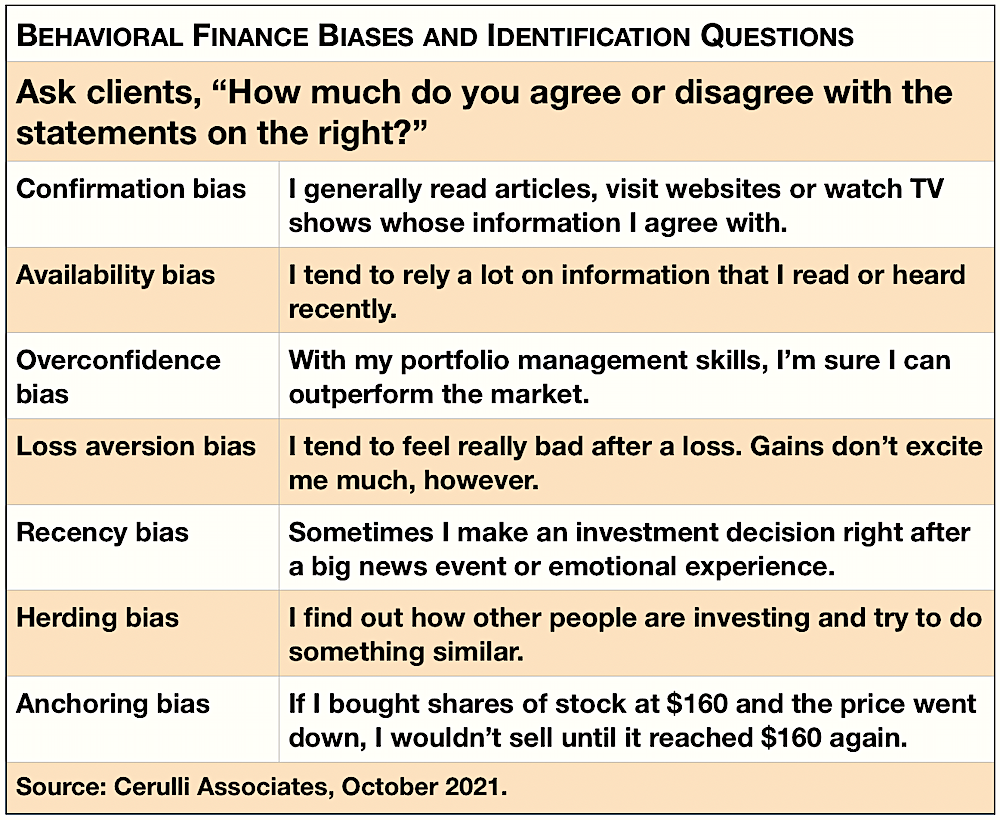

US investors held nearly $55 trillion in financial assets as of year-end 2020, up from $46 trillion in 2019, according to Cerulli Associates. In its latest report, the Boston-based consulting firm suggests that advisers use behavioral finance techniques to help retain investor trust—and assets.

“As investors navigate perpetual unease resulting from the pandemic, advisors should pay increased attention to clients’ emotional biases through the lens of behavioral finance to acquire, retain, and grow financial assets,” said the report, US Retail Investor Advice Relationships 2021: Navigating Perpetual Unease.

According to the research, advisers most commonly see three so-called information-gathering biases among investors: availability bias (91%), confirmation bias (80%), and recency bias (71%).

“The fact that investors realize they rely on things that they just read, that were easy to find, and reinforce what they already think underscores the challenge with investor ‘research,’” said Scott Smith, director of retail investor advice relationships, in a release. “Instead of seeking out a variety of inputs from independent experts, consumers are predisposed to choose the path of least resistance.”

Investors’ behavioral biases evolve as they age, Cerulli found. Investors ages 40–49 report the highest incidence of acute behavioral bias—confirmation bias (47%) and overconfidence (42%). To advise an “emerging affluent” investor, advisers should “start early to help investors understand their biases and nudge them toward better outcomes,” Smith said.

Investors with more than $5 million in investable assets report elevated levels of confirmation (39%) and availability (39%) bias. “These investors have frequently made long-term decisions about the direction of their portfolios and are reluctant to be swayed by new information.

“While they should not overreact to short-term changes, they should also be open to the reality that the landscape of finance is one of constant evolution and refinement, necessitating ongoing portfolio oversight,” said Smith.

“Increased attention to clients’ emotional biases through the lens of behavioral finance can be an impactful tool in helping set goals, maintain investment discipline, and reduce decision fatigue,” he added.

“Advisors need to ensure that investment decisions are being optimized for the financial betterment of the investor. Understanding their underlying biases and mitigating suboptimal investment decisions is critical for advisors in a digitally pervasive environment.”

© 2021 RIJ Publishing LLC. All rights reserved.

Smart people have been writing retirement income planning software for over a decade, much of it very useful. But most of it falls short of what the market demands today: easy-to-use web-based software that checks all the boxes and makes the complex simple.

The difficulty is that there are a lot of boxes to check, and complexity often defies simplification. Complexity is funny that way.

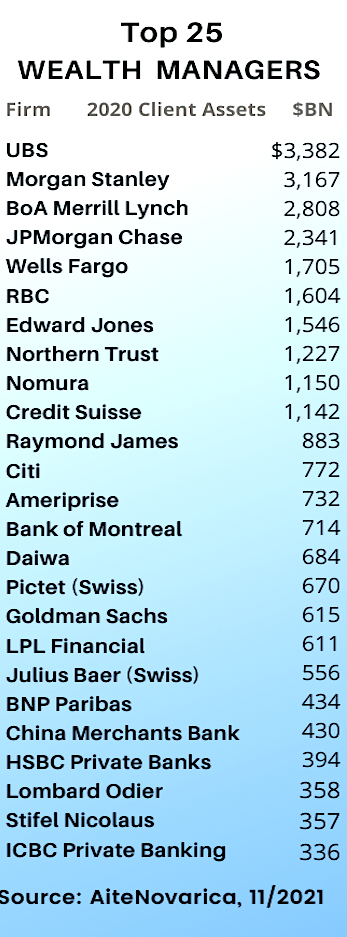

Satisfying retirees—who need to turn a “stock” of savings into a “flow” of income, as MIT’s Jim Poterba put it in a webcast this week—isn’t necessarily the biggest lift. The software has to meet the business needs of the wealth managers, recordkeepers or broker-dealers.

To the extent that those enterprises are buying, building or licensing software or “robos” with income planning capability—and the major ones are—they want those tools to do more than “optimize” a client’s withdrawal rate on the basis of a growing number of variables and preferences.

They want it to encompass or integrate with every step in the client service process, from the online hand-shake to customer relationship management to documentation of due diligence to fulfillment of a monthly paycheck—and, ultimately, to enhance productivity, asset under management (AUM), market share and profitability. Manish Malhotra calls this capability “unified managed income,” or UMI.

Malhotra

“It’s a must-have,” Malhotra told RIJ this week. He’s the founder of Fiducioso Advisors, a registered investment advisor (RIA) whose flagship technology is Income Discovery. Over the past decade, it has evolved into a UMI. He’s been pitching it—at $99 per retail client per year—to recordkeepers, asset managers and broker-dealers.

Malhotra spoke with us this week about the growing demand for this type of product and what makes his stand out. “Our competitors have planning capabilities, but we go beyond planning and issue the paycheck instructions,” he said. “The wealth managers don’t have paycheck capability, and their advisers are asking for this.”

Malhotra sent me a few short video demonstrations of the Income Discovery platform and three of its modules: Safe Income Portal, Income Planning 2.0, and Paycheck. The Safe Income Portal provides a digital front-door for attracting prospects and establishing leads. Income Planning 2.0 is the drawdown optimizer itself. Paycheck is the fulfillment function, deciding how much money to send to clients, when to send it and what accounts to source it from. The service mark for the artificial intelligence powering all this is “AIDA.”

In the Income Planning module, a pre-retired client sees three possible options displayed. On the left, there’s a playing card-shaped window displaying the client’s current strategy—retirement date, Social Security claiming date and benefit, investment asset allocation—and the bad news: that his desired spending rate comes with a 50% chance of portfolio failure at the desired spending rate, which the portfolio can’t safely sustain until the end of retirement.

In the middle, there’s a field that gives the client a reality check. It shows the (lower) level of income that the current strategy could support with a negligible risk of failure. On the right, there’s a panel revealing the good news: that the client could spend even more than the initially desired rate by working longer and/or changing the Social Security claiming date.

Once the client approves a specific plan, the adviser can set up planned disbursals such as monthly income, unplanned disbursals for a large purchase, as well as time-sensitive disbursals for Roth conversions.

The Paycheck program includes automatic communications after each disbursal and a year-end report. If the client is withdrawing more than the system says he can afford, he gets a warning in the report. The idea is to help advisers “grow their retirement decumulation business” and automate “a tedious ad hoc chore” for the adviser.

“We come up with a tax-targeted plan,” Malhotra told RIJ. “Based on that, we would issue instructions on how much money will go out, and who will issue the checks. If the money is an account ‘held away’ from the adviser, the client will let the outside institution know and do self-service. We estimate the client’s taxes. We set up a disbursal schedule. We say, ‘This is the amount you should taken from each source.’”

The capacity to direct all this traffic lies with AIDA (not to be confused with the tragic heroine of Verdi’s opera or the famous marketing acronym). As a mere user, however, I was focused on interface. I saw a presentation of information in a choice pattern that allows clients to reach a decision on their own. It also positioned the adviser as the bearer of good news.These steps are arguably as important as the achievement of an ideal income plan—if such a thing can even be said to exist.

Malhotra created Income Discovery in 2010. It is already used as a white-labeled algorithm by two of the largest financial services companies. The competition for contracts with the largest institutions is intense, but there’s opportunity in any venue where there are older clients with substantial assets who are transitioning from accumulation to decumulation.

In a recent white paper (“US Retirement Strategies Shift to Decumulation and Mass Personalization”) that Income Discovery and Capgemini, the global IT services and consulting firm, co-produced, the authors survey a varied competitive landscape and its emerging opportunities for decumulation wizardry.

If you’re interested in this complex space, it makes worthwhile reading. The geography includes old and new entrants. They tend to be on one side or the other of the 401(k)/brokerage IRA divide, although some, like Fidelity and Vanguard, are in both. Tens of trillions of dollars of retirement savings are in play.

In 401(k) plans, the QDIA (qualified default investment alternative) providers, like target date fund managers (e.g., BlackRock, Capital Group, T. Rowe Price) and managed account providers (e.g., Financial Engines, GuidedChoice or Morningstar), need income tools to distract participants from rolling their money over to IRAs at retirement, and to adapt to the anticipated introduction of in-plan annuities. The Department of Labor has mandated estimates of future income from plan balances to encourage participants to think about their savings in terms of income. Plan providers will feel pressure to support it.