In addition to the ever-growing forest of white papers and surveys that document Americans’ failure to save enough for retirement, there exists a less voluminous but more upbeat lumber pile of literature that shows how much Americans have saved. And it’s a lot—on paper at least.

Two recent surveys, one by Cerulli Associates (of 401(k) participants) and the other by the Investment Company Institute (of IRA owners) throw some fresh, crunchy numbers onto the pile.

Taken together, the two reports shed light on a pivotal question: Which type of account will most Boomers draw their retirement incomes from? Will it be rollover IRAs, 401(k)s, annuities or “All of the above”? The answer will help determine the market shares that different types of intermediaries—investment advisors, fund companies or insurance companies—are likely to enjoy as the Boomers move through retirement.

‘Evolution of the Retirement Investor’

Cerulli’s report, “Evolution of the Retirement Investor 2013,” is proprietary, but a summary is made available to the press. One of the charts, titled “Distribution of RIO Households’ Investable Assets by Investable Assets and Age Range 2012E,” is a prism that reveals the five underlying color-bands of the “ROI,” or retirement income opportunity.

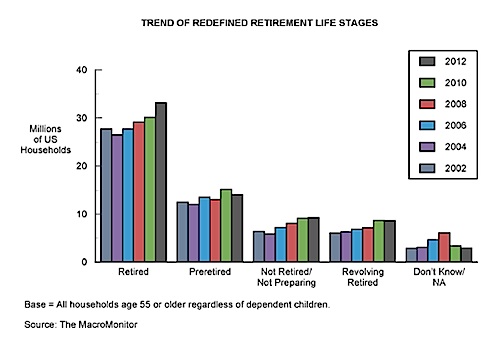

What’s immediately observable is the sheer amount of money saved by households headed by people ages 55 to 69. This group of about 30 million Americans has saved about $15 trillion, of which about $6 trillion is in retirement accounts. The Cerulli data shows not only how much wealth exists in America, but also how concentrated it is.

Of the five groups that the chart encompasses, the least wealthy and most wealthy are both probably—or very different reasons—outside of the retirement market per se. The least wealthy are by far the most numerous (17.3 million) but they have average retirement savings of only $8,900 each. All but invisible to financial services companies or advisers, they will likely rely on Social Security, family members and income from part-time jobs in retirement.

At the other extreme are the 457,000 older heads-of-households who have $1.07 trillion in retirement savings, or about $2.34 million each. Because their retirement savings represent only about 22% of their total investable wealth, however, retirement may not represent a challenge or even a milestone that will drive them to seek new sources of advice or assistance.

Cerulli sees “an opportunity for independent and direct providers” in the lowest of the middle three groups. This group is large (6.3 million) and not so wealthy ($960 billion in retirement assets; $1.54 trillion in other investable assets) that its members won’t need help in trying to stretch their savings over 20 or 30 years of retirement.

This mass-affluent group is currently “underserved” by the financial services industry, the report says. The group’s retirement assets represent a big share (62%) of its total investable wealth. With average retirement savings of only $154,000, this group will be financially “constrained” in retirement. Since their longevity risk will be high, they could be potential annuity purchasers.

‘The Role of IRAs’

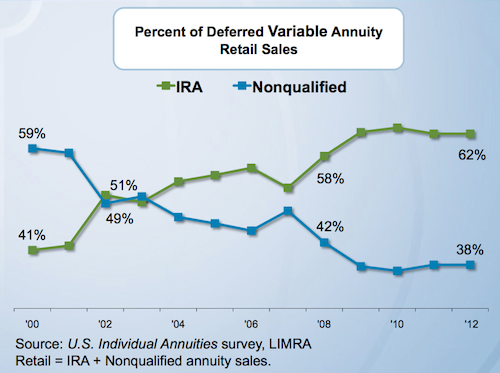

The Investment Company Institute (ICI) report, “The Role of IRAs in U.S. Households’ Saving for Retirement, 2013,” looks at the IRA side of the retirement savings picture—especially rollovers. Rollover IRAs are the subject of much scrutiny these days; while nest eggs are usually laid in 401(k)s, they’re increasingly likely to hatch in rollover IRAs.

While the IRA may originally have been intended as a way for the millions of people without employer-sponsored retirement plans to save for retirement on a tax-deferred basis, it hasn’t exactly worked out that way. Americans mainly use IRAs as the default havens for the tax-deferred savings that they voluntarily or involuntarily transfer (“roll over”) from a former employer’s plan. Most of the $5.7 trillion in IRAs today came from rollovers, not from piecemeal contributions.

That’s a boon for the retirement industry. The savings that finds it way into retail rollover IRAs is available for a much wider range of investment options than savings in Department of Labor-regulated workplace retirement plans, while remaining tax-deferred. That worries the Department of Labor, which would prefer that retirement assets continue to grow in an institutionally-priced environment with a fiduciary standard of conduct.

Rollovers, which in about three out of four cases are triggered by a job change, have arguably made IRAs a much larger phenomenon than they would otherwise be. Although there’s roughly an even split between owners of IRAs with and without rollovers, there’s about twice as much money on average in rollover-funded IRAs ($173,000 vs. $90,000).

The median amount of former 401(k) money in IRAs is 70%, and 49% of IRA owners say that 75% or more of their IRA assets are rollover money, according to the ICI. The most common reason (72%) cited for executing a rollover was to preserve tax deferral—an answer that makes sense only for the 46% who said they were forced to move money out of their former employers’ plans.

IRA ownership tends to be a marker for greater household wealth and education, according to the ICI. IRA-owning households have more than double the household income and eight times as much financial assets as non-IRA households, on average. Decision-makers in IRA households are twice as likely to have a college or graduate degree.

Once people set up rollover IRAs, fewer than half seem to contribute to them in a given year—either because they are contributing to a 401(k) at work or because they are retired or because they don’t have extra money to save. (It stands to reason that, without the automatic payroll deferral of a 401(k) plan, people are less likely to contribute to a tax-deferred account.)

Retirees who have IRAs don’t seem in a hurry to dip into them unless they have to. The vast majority of IRA withdrawals are taken after age 70½, when annual minimum distributions are required to begin. Most people of RMD age withdraw the minimum amount required under tax law. Many people evidently experience the annual RMD simply as the occasion for an unwelcome tax bill, especially if they intend to reinvest the withdrawal rather than spend it.

Compare and contrast

It’s interesting to compare the answers that IRA owners and 401(k) participants gave to a question about their primary source of financial advice. Sixty percent of IRA owners in the ICI survey said a “financial adviser” was their most common source of advice on “creating a retirement strategy.” In the Cerulli survey of participants, the largest single share (26.9%) named “401(k) provider” as their primary source of retirement advice.

That might suggest that as long as people have most of their money in 401(k) plans, they’re most likely to rely on the provider’s recommendations. That might be good news for major 401(k) providers like Vanguard and Fidelity. But after a rollover, people seem more likely to rely on advisors, which would appear to be good news for brokers and financial advisers. The data isn’t definitive either way, however. Even among participants, 15.7% name “financial advisor” and an additional 8.4% name “financial planner” as their primary source of advice.

The prospect of managing the Boomers’ trillions is galanizing, to be sure. But it’s worth remembering that those are still mainly paper trillions, and the assets could deflate at almost a moment’s notice. The jury is still out on whether and by how much the sales of securities by Boomer retirees might depress market values, and whether or not the U.S. economy will be strong enough to keep security prices high in coming years.

© 2013 RIJ Publishing LLC. All rights reserved.