Archives: Articles

IssueM Articles

A Closer Look at “Income+”

As Baby Boomers retire, they threaten to roll their money out of 401(k) and 403(b) plans, thereby endangering the livelihood of all those who manage plan assets or advise participants. How, then, to keep managing those billions even after the employees vacate their cubicles?

Financial Engines, the big third-party provider of unbiased advice to participants in hundreds of large plans, thinks that its Income+ program, announced on January 31, will help solve that problem, at least for participants who use its managed account program. This week, FE’s chief investment officer, Chris Jones, answered a few questions about Income+.

RIJ: Chris, FE has said that Income+ can succeed where other in-plan concepts have failed. Please elaborate.

Jones: Retirement income products have been pitched to plan sponsors for about five years. None of these products have received any traction in the large employer space. Large employers aren’t adopting them. Most of the programs involve putting some form of insurance into the plan. But that produces a ‘fiduciary lock-in.’ A fiduciary has to be able to hire and fire providers. Those programs are easy to hire, but hard to fire. It’s messy. That’s one of the big constraints on sponsor behavior. With Income+, the idea is to take away the big objection, the fear of fiduciary lock-in.

RIJ: But Income+ seems to go to the other extreme. It’s voluntary, liquid and has no costs beyond the basic managed account fees. Is it ‘sticky’ enough to be effective? How do you make sure the money stays in the plan?

Jones: We see this as a way to extend our relationship with the near-retiree participant beyond the accumulation years. Our expectation is that once people get into the strategy and we start managing their portfolio, these relationships will be sticky. Who ‘owns’ the client? It depends on who the fiduciary advisor is. Sometimes we have a direct relationship with the participant. In some cases we’re a subadvisor and maybe JP Morgan, for example, owns the client. Participants with large balances will be targeted by outside advisors, as they have always been. But our objective is to reach people of relatively modest means, people who need income for groceries.

RIJ: Are the managed account holders defaulted into Income+ when they’re five years away from retirement?

Jones: Income+ will be a mix of opt-in or opt-out. It depends on the provider. One advantage of default into the plan is that it lowers the fees. So some sponsors are likely to choose that. We’ll have to see how it plays out.

RIJ: What exactly happens when the program starts?

Jones: We’ve built in a transition period. As most people approach their retirement horizon, they worry more. Beginning five years before retirement, we’ll move about 20% of their assets each year from an accumulation focus to an income focus, so that they have a ‘payout-ready’ portfolio at retirement. If you’re three years from retirement, for example, 40% of your portfolio is retirement ready. This reduces the risk of the portfolio from going down. We call it a ‘glide path,’ but we’re generally not using target date funds. Usually we’re using the core options that are in that particular plan.

RIJ: As I understand it, Income+ allocates 65% of a client’s assets to a bond fund composed of short, intermediate and, if available in the plan, long-term maturities. A floor income is drawn from that. Twenty percent of the assets goes into equities for upside potential. And the last 15% goes into a reserve of fixed income investments. This sounds like an institutionalized bucket strategy, where the bonds offer ready money and protect against market risk, where equities offer inflation protection, and where a ‘granny fund’ protects against longevity risk.

Jones: There’s some analogy there, between Income+ and buckets. But financial advisors usually structure their buckets by saying, ‘We’ll invest in ladder of certificates of deposit for five years of income, then well invest in stocks for the later years. It’s a bonds-early-stocks-late approach. But the problem with that approach is that it’s reliant on stocks achieving their historical returns so that the money will be there. We’re doing something quite different. We use the fixed income investments to lock in a floor income for life, not just for the early years. We use the equities as your upside. If the equities do well, you spend more. If not, still have your income from the bond portion. We want to take equity risk out of the equation. We don’t ever want to rely on that to meet the needs of the floor.

RIJ: You also promise that income can grow but not shrink.

Jones: We’re managing the assets in such a way that there’s a high probability that the payouts won’t go down. We’ve done historical backtesting, and we’ve never seen a historical situation where we couldn’t maintain the ratchet.

RIJ: In the past, Jason Scott and other FE researchers have published academic papers espousing the benefits of a retirement strategy that involves buying an advanced life deferred annuity at age 65, managing assets from age 65 to 85, and the relying on income from the ALDA, if necessary, from age 85 onward. But there’s no mention of ALDAs in Income+.

Jones: In the first generation of the product, we’re not having people buy longevity insurance—the deferred income annuity—for tax reasons. Right now you can’t buy a longevity contract with qualified dollars because the contract wouldn’t allow you to take required minimum distributions at age 70½. You’d have to take a taxable distribution from the plan and use that money to pay for the contract. With Income+, to deal with the RMD rules, we’ll invest about 15% of your assets to help you buy a fixed immediate income annuity at some point in the future that will lock in whatever annual payments you’re receiving at the time. If you wait until age 85 to buy the annuity, that 15% will probably have become, because of growth and the pay-down of the rest of the portfolio, about 80% to 90% of your portfolio. In short, we’re managing the portfolio in such a way that you can maintain a steady income for life.

RIJ: Who will provide the income annuities? Will you be using the Hueler Companies’ Income Solutions platform, where plan participants can choose among competing bids from a variety of annuity providers?

Jones: We will make use of the Hueler platform if it’s available to the 401(k) plan in question. We think the concept is a good one. If Hueler isn’t available, we’ll provide annuity options another way. Our objective is to provide a multitude of annuity vendors. We’ll facilitate the process but the participant has to make the decision. No commissions are involved, and they’re purchasing the annuity outside of the plan. We have no affiliation with Hueler. We’ve talked to Cannex and explored the idea of getting information about annuities from them, but we have no relationship with them right now. The question of when to buy an annuity is mostly driven by issues in the individual household. Most people are not interested in annuitizing early. At about age 73, they become more aware of the need for a lifetime annuity.

RIJ: But FE’s 20 to 60 basis point managed account fee is asset-based. Won’t you lose revenue if people buy life annuities?

Jones: Ultimately, that’s a challenge. Our business model is asset-based. On the other hand, we have no interest in any particular [investment products]. We think that annuities will be the right choice for a substantial number of participants. With Income+, at least we’ll be extending the relationship longer. And by time most people buy the annuity, we’ll have sold down most of the assets for income annuity. But we can’t completely eliminate that issue. We just want to be objective about the pros and cons of annuitization. In many cases, we think it’s the right thing to do. A big part of our value proposition is trust. None of our advisor reps work on commission. We have embraced that business model.

RIJ: This is either the best of times or the worst of times to start your new income program, given the interest rate environment. Are you prepared for whatever the future might bring?

Jones: The idea is to pursue liability driven investing. Historically, pension funds have invested in an allocation of stocks and bonds, and when the market goes up or down, they’re affected. But if you match up assets and liabilities, you immunize against changes in interest rates and market movements. We’re doing that at the individual account level. We’re exposed if long-term rates go down a lot, so we have to be conservative early in the period. We aren’t buying hedges, but we’re hedging in the sense that we use a dynamic [bond] portfolio strategy. If you’re of the mind that interest rates are going to rise, then that’s a good thing for this concept. Your liabilities get cheaper faster than your assets decline in value. So if that’s your belief, then this is a decent time to engage in a strategy like this. On the other hand, interest rates can stay low for a long time.

RIJ: Thank you, Chris.

© 2011 RIJ Publishing LLC. All rights reserved.

“Impatience” helps explain failure to save, researchers say

Why do so many people undersave for retirement, take on too much debt, and make poor mortgage decisions? Researchers Mitchell, director of the Wharton School’s Pension Research Council and Justine Hastings of Brown University recently sought to determine whether poor decisions were the result of financial illiteracy or inability to defer gratification.

After reviewing responses to a survey in Chile, Mitchell and Hastings determined that both factors play a role, but that inability to defer gratification, or “impatience,” was a bigger influence on the failure to accumulate adequate savings for retirement.

The two researchers looked at the results of the 2009 Social Protection Survey in Chile, during which each participant was asked to play an “Investment Game” for a gift card. In return for filling out a short questionnaire, each participant received a gift card for use at Chile’s largest grocery chain.

Respondents who completed the questionnaire right away would immediately receive a 5,000 peso gift card (US$8). If he or she decided to fill out the questionnaire later and mail it back in a pre-paid, addressed envelope within four weeks, the gift card would be worth more. The higher amount ranged from 6,000–8,000 pesos in 500 peso increments, and respondents who were willing to wait the longest (up to four weeks) got the biggest gift card.

The experiment revealed three different types of people: the “impatient” who took the lower gift-card amount immediately, the “efficacious deferrers” who chose the later amount and returned the survey for the higher amount, and the “inefficacious deferrers” who opted for the later higher amount but never sent in the questionnaire to activate their cards.

The more impatient respondents were the ones less likely to have saved a lot for retirement. “Our results show that our measure of impatience is a strong predictor of retirement saving and investment in health,” the researchers reported. Financial literacy, though also correlated with accumulated retirement saving, “is a weaker predictor of sensitivity to framing in investment decisions.”

“These results have implications for policymakers interested in enhancing retirement well-being through addressing shortcomings in behavior and economic decision making that may hinder planning, decision making and investments for long-run financial and physical health,” the researchers said.

© 2011 RIJ Publishing LLC. All rights reserved.

JP Morgan Hedges U.K. Workers’ Longevity Risk

In the first deal to hedge against higher life expectancy for a company pension plan’s working members—as opposed to retirees—JP Morgan has taken on £70 million ($113 million) of longevity risk of the Pall UK Pension Fund, Reuters reported.

The index-based longevity swap with the trustees of the Pall Pension Fund, part of global manufacturer Pall Corp., has a 10-year term. If the life expectancy improves at a greater rate than specified in the contract, the fund receives an insurance payout.

The first longevity risk bond was issued by Swiss Re in December, which passed on $50 million of its own longevity exposure to the capital market in a bond format.

How does it work? According to a 2008 article in, “In a swap, the pension scheme or annuity provider agrees to pay a fixed sum (based upon the sum–or principal–that the scheme is seeking to protect from erosion by a specific risk) at certain times to the other party, usually an investment bank. In return, at certain times, the scheme will receive a payment that is calculated upon a floating basis. This is the difference between the assumptions used when determining the scheme’s payments, and the actual position of that risk,” said a 2008 article in Engaged Investor magazine.

“In a longevity swap,” the article continued, “the fixed leg is based on projected mortality rates, while the floating leg is based on subsequently realized mortality rates. If realized mortality rates are lower than projected, the swap involves a net payment to the buyer (i.e., the pension scheme) and, if the swap has been appropriately designed, this will be approximately sufficient to compensate the pension scheme for the additional pension payments it has to make on account of the mortality of its members being lower than anticipated.”

JP Morgan said on Tuesday the Pall swap contract was based on future values of its LifeMetrics longevity index—a toolkit for measuring longevity and mortality risk in England and Wales, United States, Netherlands and Germany.

“Index-based hedges are particularly well suited to hedging the longevity risk of pension plans with significant deferred and active members,” David Epstein, head of longevity structuring at JP Morgan, said.

JP Morgan is the hedge provider and collateral custodian for the deal, which was structured by investment manager Schroder, to cover the British pension scheme liabilities related to about 1,800 members, with assets of £120 million.

Only a handful of longevity swaps have been formatted to work for a pension scheme in Britain—around £8 billion worth in the past five years, according to specialist insurer Pension Insurance Corporation.

In the biggest swap so far, German carmaker BMW offloaded £3 billion ($4.6 billion) of risk from its British pension scheme to Deutsche Bank’s insurance subsidiary Abbey Life last December.

Previous longevity deals have focused solely on pension plan members who have already retired, as hedging against increased life expectancy of members still working has been difficult to measure, JP Morgan said.

JP Morgan belongs to the Life & Longevity Markets Association, an organization of investment banks, insurers, brokers and pension providers set up last year to construct capital market instruments to slice longevity risk into tradable portions. Other current members of the LLMA are AVIVA, AXA, Deutsche Bank, Legal & General, Morgan Stanley, Pension Corporation, Prudential PLC, RBS, Swiss Re and UBS.

© 2011 RIJ Publishing LLC. All rights reserved.

GuidedChoice rolls out its participant income roadmap

GuidedChoice, the provider of investment advice and managed account services for defined-contribution retirement plans, is launching GuidedSpending 2.0, an update of its retirement income advice program.

Reactions from beta testers and early adopters, including a 13,000 participant Fortune 500 company, have been extremely positive and helped shape the final product offering. This is the first online tool of its kind to be offered to all participants within a plan, rather than just as an executive benefit.

GuidedSpending will be demonstrated in a by-invitation-only webcast for journalists and analysts on Wednesday, 9 February 2011. Chief Architect Harry M. Markowitz, Ph.D., creator of modern portfolio theory (MPT), and Sherrie Grabot, Chief Executive Officer, will explain key features and answer questions.

GuidedSpending was designed to replace the overly simplistic ‘4% rule’ approach long used by financial planners. It addresses the need for an easy way to find a personal answer about the amount of money to withdraw each year in retirement in a way that is both more flexible and more effective. The new tool uses the same sophisticated analytics engine first developed for GuidedSavings, the flagship retirement planning product by GuidedChoice.

“A wise post-retirement policy must steer a course between two dangers: one, running out of money; the other, living too frugally, forgoing conveniences and experiences that the retiree can well afford,” said Dr. Markowitz in a release. “A policy of spending a fixed percent of the retiree’s capital, like the 4% rule—independent of the retiree’s age, wealth, bequest and consumption aspirations, current interest rates, etc.—is likely to eventually run afoul of one or the other of these dangers.”

© 2011 RIJ Publishing LLC. All rights reserved.

Fidelity to help participants move to income stage

To help near-retirement plan participants through the transition from accumulation to income, Fidelity Investments has introduced a new program, mediated by the web and with phone support, called Fidelity Income Strategy Evaluator.

The new program, which Fidelity is rolling out with 200 free, live educational events and seminars at Fidelity branches, worksites and on the Web, was unveiled only two days after Financial Engines announced its Income+ retirement income guidance program (see today’s RIJ cover story) and less than a week before GuidedChoice conducts a webcast on the launch of the second generation of its GuidedSpending program (see news story below).

Fidelity Income Strategy Evaluator is designed to help investors nearing or early in retirement assess their income needs and structure a portfolio and withdrawal strategy to help ensure their specific sources of retirement income and expenses are aligned throughout retirement.

Participants input estimates of their anticipated income and expenses in retirement, along with information about accounts held outside Fidelity and their current pre-tax income amount and state of tax residence.

The tool takes this information and provides an estimation of monthly income, a suggested “Target Income Mix” (i.e., a combination of investments designed to generate income), an idea of how the client’s portfolio may perform during market ups and downs, a printable report that can be referenced during conversations with Fidelity phone reps about turning savings into income.

With “Target Income Mix,” Fidelity illustrates the trade-offs of a variety of investment combinations, which may include stocks, bonds, cash and/or annuities, and lets the participant choose.

For solutions, the Evaluator suggests Fidelity and non-Fidelity income and investment products. It helps answer questions like, “How do I turn my savings into a “paycheck” I can receive in retirement?” “How can I maximize my retirement income?” “How can I ensure that my money will last?” and “What’s the potential impact of taxes, inflation and rising health care costs on my savings?”

In addition to the Fidelity Income Strategy Evaluator, and the 200 educational events being hosted across the county and over the Web for the public and Fidelity’s workplace plan participants in February, Fidelity’s income planning program also includes the following components, all free of charge for both Fidelity customers and non customers:

- The Fidelity Guide to Retirement Income Investing (www.fidelity.com/incomeguide) : new online material that includes 13 different interactive modules to help investors learn more about key considerations associated with creating a retirement income plan and selecting an income strategy.

- One-on-one consultations with Fidelity investment professionals.

- A new series of Retirement Income Viewpoints: educational articles with content focusing on three key components related to the income planning process, entitled “Taking On Retirement’s New Normal,” “Smart Strategies for Retirement Income” and “How to Efficiently Turn Savings into Income.”

- Workplace-focused educational resources: Over 25,000 workplace retirement plans where Fidelity is the recordkeeper have adopted the Income Strategy Evaluator. They represent over 10 million participants. Employers have also received a white paper, “Retirement Income Guidance Strategies: Helping Employees Move from Savings to Spending,” and other educational literature.

© 2011 RIJ Publishing LLC. All rights reserved.

Gimme Shelter

Life, the 547-page autobiography of Rolling Stones guitarist Keith Richards, was sitting on my night table when the 533-page report of the Financial Crisis Inquiry Commission was published last week. Since then, I’ve been switching back and forth between them.

Both books tell tales of men behaving badly. As Richards admits, he mainlined heroin and dabbled in a pharmacy of other drugs. His behavior under their influence left a long trail of overturned Bentleys, arrests, dead buddies, broken hearts and (on the bright side) some great rock-and-roll songs.

As some of the bankers admit, they were addicted to collateralized debt obligations and credit default swaps. Their exploits resulted in a long trail of government bailouts, displaced homeowners, unemployed Americans and (on the bright side) many cul-de-sacs of 6,000-sq.ft. Mcmansions with granite-countertop kitchens.

The two books are both limpidly written. Even the FCIC report (unless you’ve already OD-ed on Crisis-related literature) makes for swift, entertaining and persuasive reading. Both books recalled the catch phrase, “You can’t make this stuff up.”

In Richards’ case, and in the case of the mortgage crisis, there’s not much mystery about why the addictions began or lasted as long as they did. In both instances, the drugs of choice had a notable upside: they helped generate vast wealth and other pleasures. (Richards rationalizes that his use of heroin, USP-quality cocaine and quaaludes helped him write immortal riffs and insulated him from the torments of fame. The dude with the skull ring also had a posse of dealers, lawyers, bodyguards, girlfriends, healers, agents, and managers as well as a knife and a Smith & Wesson to help spring him from nasty jams.)

That’s why the users didn’t “just say no.” It doesn’t seem much more complicated than that. In the absence of intervention by a higher authority, the process plays itself out until the bad overwhelms the good. Or until, as former Citigroup chairman Charles Prince put it, “the music stops.”

* * *

Even without producing the proverbial smoking gun, the FCIC report should help dispel the myth that a mass delusion or mania caused the financial crisis. Lots of people saw it coming, warned about it, and tried to take action. (I remember thinking, ‘Uh-oh,’ when Goldman Sachs went public in 1999.) Those conscientious objectors were simply drowned out by the power of $2.7 billion worth of lobbying from 1999 to 2008, by complicit or naive legislators, by complacent or captive regulators, and by the prosperity (real or imagined) that even a debt-fueled boom temporarily brings.

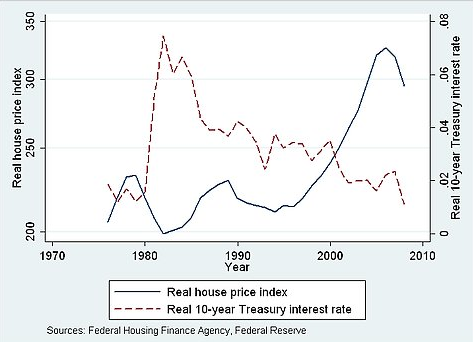

People who actually believed that home prices would continue to rise forever at a steep rate were obviously not aware that, after 20 years of falling interest rates—a key factor in the escalation of home prices—by 2003 interest rates had run out of room to fall.

You didn’t have to be a financial engineer, an economist or even a Fed chairman to see that the 25-year bull market in bonds and homes was nearing an end. Look at the chart below. Some people still deny a causal relationship between the two. But the association is strong enough for me. In any event, it’s nearly impossible to prove absolute causation. Just ask the chicken or the egg.

When Alan Greenspan raised interest rates a quarter-point at a time from mid-2004 to mid-2006 without tipping the stock market, I thought the Nobel Prize committee would soon be waking him with one of its famous 5 a.m. telephone calls. That was wishful thinking. The explosion was merely delayed. And, long before the September 2008 market crash, the smart money was already betting against Greenspan’s boom.

I haven’t finished Life yet, but Keith Richards appears to have survived his heroin binge. He cleaned up his act in the early 80s, married supermodel Patti Hansen and, tan and trim at age 67, now resides in Connecticut and abroad. The U.S. financial system, on the other hand, hasn’t recovered from its debt binge yet. We’re still in cold turkey, and will be for years to come.

© 2011 RIJ Publishing LLC. All rights reserved.

A New Cylinder for Financial Engines

It’s new, it’s free, it’s easy and it requires almost no action on the part of 401(k) managed account participants. But the income isn’t necessarily guaranteed and it’s still not clear exactly how the program is financially engineered.

On Monday, to an audience of stock analysts in New York, Financial Engines, Inc. (FE) announced “Income+”—an retirement income enhancement to its 401(k) managed account program, which is an enhancement to FE’s advice program for plan participants.

With Income+, FE wants to beat the annuity companies—but perhaps to join them too.

“First generation solutions have largely failed to get any traction in the marketplace,” FE CEO Jeff Maggioncalda said—apparently referring to Prudential’s IncomeFlex, Genworth’s ClearCourse, and MetLife’s SponsorMatch. But Income+ also offers clients an option to buy an immediate annuity with their plan assets at any time until age 85.

“Income+ is the first retirement solution designed for the 401k market,” Maggioncalda said. “It’s an extension of our managed account program. It keeps the money in the 401(k) plan. It provides a monthly payment from the 401k plan to the client’s checking account.” There’s no rollover involved, no departure from the plan, no consolidation of household assets.

“Clients can start and stop their payouts whenever they want. They can take withdrawals up to the full account balance whenever they want. The payout stays steady, even if the market goes down. There’s growth potential and the option of guaranteed income. We have a lot of confidence that this is what you must do to succeed in this market,” he added.

“For employers, there’s income without adding an annuity to the plan and without change to their investment lineup. We remain an independent fiduciary without conflicts of interest, and our managed account is a QDIA (qualified default investment alternative). So there’s no waiting for the government to rewrite the regulations. There’s no additional fee for the employee or the employer at any time.”

Whether Income+ will capture the imagination of plan participants remains to be seen. But it already has traction with plan service providers. FE claims buy-in from big plan providers like Aon Hewitt Live, Mercer, ING, JP Morgan Retirement Plan Services and ACS, a Xerox company, “who’ve committed to offering Income+ in the next year or so.”

FE currently serves about 400 large plan sponsors, including 100 members of the S&P 500. It provides product-neutral advice to some 4.5 million plan participants via desktop and phone. Of those, about 460,000 have managed accounts, which have an average balance of about $140,000 and a median balance of about $80,000.

Financial Engines shares, which had declined steadily from January 20 to January 31, jumped five percent on Tuesday, to $23.67, before closing at $23.30.

“I like the concept: Managed account morphs into a glide path then an option in retirement to buy an annuity,” said Ron Surz, president of Target Date Solutions and an advocate of zero-allocation to equities in target date funds at retirement.

But, he added, “I’m afraid the bonds will not do what the description intends them to do, not in this [rate environment]. The [bonds] might not avoid the volatility in stocks and are likely to decrease in value regardless of what stocks do. Also, some stocks are not even close to being an inflation hedge. Quite the contrary.”

In a statement that was issued to RIJ after a request for comment on Income+, Jamie Kalamarides, Prudential Retirement’s senior vice president for Retirement Strategies and Solutions said:

“Prudential Retirement is a strong supporter of the need to provide guaranteed retirement income options to all DC plan participants. We’ve offered an in-plan solution since 2006 and continue to expand our offering, announcing distribution agreements with Hewitt and Mercer in 2009 and launching a solution for the 403(b) market that same year. We believe that participants want and deserve institutional pricing; principal protection in the years prior to retirement; and access to guaranteed lifetime income while still retaining control of their principal.”

How Income+ works

As described by FE’s Chris Jones in Monday’s live presentation and webcast, Income+ works like this:

Five years before retirement, a plan participant who has an FE managed account would see his or her money put on a “glide path” so that the account is “payout ready” at the retirement date.

At retirement, 65% of the account value would be allocated to a bond fund containing short, intermediate and (if available) long-term bonds. Twenty percent of the money would be allocated to equities. The last 15% of the money, also in bonds, could be used to buy an income annuity outside the plan.

“We use the investments early in retirement, and the insurance option later in retirement,” said Maggioncaldo.

Starting at retirement, the bond fund would start paying out between 4% and 5% of the account value each year. Every year, about one percent of the equity fund would be transferred to the bond fund, thus enhancing the annual payout. At any point up to age 85, the client can use all of the money, including the 15% reserve, to buy an annuity that locks in the current income for life. If no annuity is purchased, all of the assets would be in bonds at age 85.

This appears at first glance to be a kind of bucket/systematic withdrawal system where the bond fund—the first bucket—provides a floor of safe but not guaranteed income, thus protecting the client against market risk. The equity fund, as the second bucket, feeds the first and protects against inflation risk. The reserve, as the third bucket, stays invested in bonds as a hedge against longevity risk—either as a conservative “granny fund” or to be used to help buy a life annuity.

A hypothetical scenario

As an example, FE offered a retiree named “George” with $100,000 in his retirement fund. With Income+, George would start getting transfers of $4,166 a year ($347 a month) from his 401(k) account to his checking account. He’d continue to pay the same annual fees he paid as an active employee—20 to 60 basis points for the managed account service and about 30 bps for fund management.

The annual income would never dip below that $4,166, said Chris Jones, FE’s chief investment officer, and it could go up a lot or a little over time, depending on the future performance of the financial markets.

Under average historical conditions, Income+ clients would see their initial 4% to 5% payout go up by two to three percent per year, he said. He calculated that an increase of 5% in the value of equities in a year would boost the payout by 1.7%while a 15% market decline would still result in a 0.3% increase in the payout.

“We would expect normal 2% to 3% raises on average,” Jones said. “Most people will keep up with inflation.”

Regarding the administration of the program, Jones said it would be personalized for every client with weekly updates. Clients with questions would be able to get counseling from phone reps. Before retirement, clients would get a personalized plan estimating how much their income would be when they started receiving payments, and what their income from other sources, such as Social Security and/or a defined benefit pension, might be. The system can also show clients how their payouts would change if they took a lump sum distribution.

Maggioncalda said that FE’s process-oriented program will be hard for others to duplicate, either because they’re tied to specific insurance or investment products and have conflicts of interest or because they don’t have the technical capabilities to provide personalized account administration for hundreds of thousands of people with relatively small account balances.

“If you’re not independent and you don’t have the technology to create personalized solutions at cost-efficient scale, then it will be difficult to duplicate what we’re doing here,” he said.

© 2011 RIJ Publishing LLC. All rights reserved.

The Bucket

DSG releases “2010 Retirement Income Products and Solutions Study”

Diversified Services Group, Wayne, PA, has released a synopsis of its 11th annual study of retirement income products, issues and market trends. The synopsis concludes by saying :

At the completion of last year’s report, a major retrenchment was taking place across the retirement income industry. Now, at this point in time, much of the industry has worked through much of this adjustment, and there is a resurgence of optimism among many respondents regarding the outlook for the retirement income market.

Most of the companies in this study are actively preparing for the future, rather than reacting to the recent past.

As companies focus again on building their retirement income business, they face a set of critical challenges that take into account recent market and product adjustments. These challenges include:

- Turning the retirement income market into an expansive and distinctly profitable line of business. Employing a business model that takes into account the fact that the decumulation phase of retirement is very different from the accumulation phase.

- Acknowledging that a broad array of retirement income planning services and product solutions will be necessary to satisfy all the retirement income needs of the retail consumer.

- Solving for consumer needs that are rapidly becoming critical concerns, but do not yet have widely-accepted or appropriate solutions.

This list of challenges is by no means exhaustive, but it highlights some of the major problems that need to be targeted. How well companies respond to these, and other, challenges will ultimately determine their long-term success.

The complete in-depth Report, which covers survey findings and key perspectives from the executive interviews, is available for purchase by interested parties. For additional information about the 123-page Report from DSG’s1th Annual Retirement Income Products & Solutions Study, please contact Borden Ayers at (610) 989-1710, ext. 21 or by e-mail at [email protected].

Financial crisis report to be published January 27; Commission finds many to blame

The bipartisan Financial Crisis Inquiry Commission will publish its long-awaited and partially-leaked findings as a 576-page book on January 27, the New York Times reported Wednesday. The report is said to conclude that the crisis was not an accident, it was foreseen by many, and it was preventable.

“The crisis was the result of human action and inaction, not of Mother Nature or computer models gone haywire,” the report states. “The captains of finance and the public stewards of our financial system ignored warnings and failed to question, understand and manage evolving risks within a system essential to the well-being of the American public. Theirs was a big miss, not a stumble.”

Wealth2k announces LTC modeling tool for advisors

Wealth2k today launched the LTC Impact Calculator, a web-based, interactive tool for showing investors the impact of long-term care costs on retirement security.

The LTC Impact Calculator uses state-specific daily rates for nursing home care, enabling advisors to visually demonstrate the impact of uninsured long-term care costs on an investor’s retirement assets. Advisors may use the tool to develop a variety of “what if” scenarios by assuming relevant factors, including:

1. The investor’s age and life expectancy

2. The duration of nursing home care

3. The capital sum of the investor’s retirement assets

4. The projected ROR on retirement assets

5. The rate of asset liquidation

The LTC Impact Calculator offers visual representations that address the effects of LTC costs on both cash flows and ending balances. Wealth2k believes that the LTC Impact Calculator will help investors better understand the value of long-term care insurance, especially in the context of safeguarding retirement security.

Wealth2k also announced that the LTC Impact Calculator will be added to Retirement Time websites, free of charge. In addition, Wealth2k’s new compliant, investor education multimedia presentation, Why Long-Term Care Insurance is Needed*, will also be added to Retirement Time websites at no additional cost.

To sign-up for The Income for Life Model, including Retirement Time, visit www.IncomeForLifeModel.com. Wealth2k is offering a 50% discount promotion on licensing costs for the first three months. The promotion applies only to new customers who sign-up by Thursday, January 27.

Natixis Expands Retirement Strategy Group

Natixis Global Associates (NGA), a global asset manager, announced that today two new key staff appointments that complete the organizational plan for its retirement strategy group.

Paul M. Davidson and Charles N. Johnson have been named to the position of vice president, retirement strategy, working with financial advisors to provide information for plan sponsors and individual investors.

Based in Dallas, Texas, Davidson heads the South Central region. Johnson is located in San Francisco, California and oversees the Western region. Both men report to Matt Coldren, executive vice president and head of the retirement strategy group located in Boston, MA.

The announcement noted, “2010 retirement-related gross sales serviced by NGA are up 24% as compared to the previous year.”

Headquartered in Paris and Boston, Natixis Global Asset Management’s assets under management totaled $719 billion (€527 billion) as of September 30, 2010. In the U.S., NGA includes Natixis Asset Management Advisors, L.P. (a registered investment advisor).

HPconsolidates retirement plans with Fidelity

Fidelity Investments has extended its relationship with HP (Hewlett-Packard), the world’s largest technology company, to provide its employees in North America with total retirement services for an additional five years. The extension began on January 1, 2011. The agreement extends the relationship Fidelity and HP began in 1991.

As of November 30, 2010, HP’s defined contribution assets totaled $14.2 billion.

As a part of the agreement, Fidelity will begin servicing an additional 162,500 participants in the EDS retirement plans previously serviced by other providers. In total, Fidelity will now be servicing all of HP’s retirement plan participants, covering more than 135,000 defined contribution and 192,000 defined benefit participants.

HP participants will continue to access their retirement accounts as well as planning tools through Fidelity’s NetBenefits Web site. They may also receive personal finance education and employer benefit support through HP Finance Central, a customized retirement planning portal developed by Fidelity’s Benefits Consulting business.

In addition, participants have access to virtual guidance and telephone support, Web-based workshops and seminars, plus in-person assistance at Fidelity’s 152 investor centers.

ING’s Planwithease.com reaches million 403(b) participants

ING’s U.S. Retirement Services business announced that it now reaches more than one million 403(b) retirement plan participants with its plan administration service, planwithease.com®.

ING developed planwithease.com prior to the new IRS 403(b) regulations taking effect in January 2009, and in anticipation of the greater responsibilities that many tax-exempt plan sponsors would have under these regulatory changes.

The system was designed to assist tax-exempt employers—public schools and 501(c)(3) nonprofit organizations—with increased plan administration burdens arising out of the new 403(b) regulations. The goal is to help them remain compliant as they manage their new role as a primary point of contact for participants initiating retirement plan transactions.

Currently, more than 1,400 of ING’s 403(b) plan customers use planwithease.com, which

enables various retirement plan vendors to input their respective data into the system. This data is then merged so that sponsors can generate reports and conduct a number of administrative tasks required by the IRS regulations, such as annual notifications to employees, contribution limit monitoring, and review and approval of participant withdrawal requests.

The service provides participants with 24-hour access to account summary information for each of their selected vendors, and allows participants to initiate withdrawal requests, all in a secure environment. Planwithease.com can also provide employees with electronic salary-reduction agreements, and enable them to make contribution rate changes online. Additionally, the site offers retirement planning tools and calculators to help educate employees about whether they’re on track to meet their personal retirement goals.

Mass affluent don’t expect to be rich: Merrill Edge Report

Despite reports of improving economic conditions, the mass affluent lack confidence that their financial picture will brighten in the near future, according to the Merrill Edge Report, a new semi-annual study from Bank of America Merrill Lynch that looks at the financial concerns of consumers with $50,000 to $250,000 in investment assets.

Nearly half (45%) of the mass affluent surveyed believe they will never be wealthy, even though 75% of them have a household income in excess of six figures, according to the survey.

Sixty-three percent of respondents believe that preparing for long-term goals such as retirement and college education will only get harder in the future. Nearly two in five (36%) consider themselves low-risk investors, and 45% said they are more conservative with their investment decisions today than they were a year ago.

Balancing short- and long-term financial needs is a priority for 63% of mass affluent, but they struggle to accomplish both goals. In the last year 28% of mass affluent have tapped into their long-term investments, such as retirement and college savings accounts, to meet monthly living expenses like bills or groceries (29%), and a mortgage payment or car loan (14%).

© 2011 RIJ Publishing LLC. All rights reserved.

BMO ‘Lifetime Cash Flow’ Product Critiqued

In response to RIJ’s article last week on the Lifetime Cash Flow product from the Bank of Montreal, we received a letter from RIJ reader and guest columnist Garth Bernard, CEO of Sharper Financial Group, and former resident of Toronto.

Saying that the product “is a fair value with room for improvement,” Bernard observed that the guaranteed lifetime withdrawal riders on U.S. indexed and variable annuities offer more income than Lifetime Cash Flow (LCF) and that differences between U.S. and Canadian tax law would prevent a U.S. bank or insurer from offering an identical product. “Essentially, BMO has introduced a Canadian version of the GLWB to Canadian retirees,” he wrote.

After reviewing LCF’s data sheet and disclosures, Bernard found:

- Lifetime Cash Flow’s 10-year deferral with a payout of 6% of the original deposit for life is substantially less than a U.S. variable annuity with a GLWB would pay. LCF also provides no inflation protection.

- The initial principal deposit for LCF is invested in an illiquid structured note for the 10-year deferral period. The note’s underlying investments are mutual funds. As with a GMAB (guaranteed minimum accumulation benefit) on a U.S. variable annuity, the value of the note at the maturity date is the greater of the mutual fund value or the initial principal deposit.

- After the 10-year period, the client can receive a distribution of 6% of the original principal per year for 15 years (or take a lump sum equal to the fee-adjusted value of the underlying mutual fund account). In the 25th year, after the 10-year deferral and 15 years of distributions, the client can continue the 6% distributions regardless of the value of the underlying funds. In that sense, it is no different from a GLWB after the 10th year).

- Tax-free principal is distributed first from the LCF, followed by taxable distributions of gains. This is exactly the opposite of the tax treatment of deferred annuity distributions in the U.S., where taxable gains come out first and non-taxable distributions later.

- BMO recommends funding an LCF with after-tax savings, allows the use of pre-tax savings. Funding with pre-tax dollars wouldn’t work in the U.S., where the illiquidity of the product during the first 10 years would prevent purchasers over age 61 from making their required minimum distributions starting at age 70½.

- The article says that the income is not insured. That’s incorrect. If the funds are depleted to 10% of the original principal, BMO makes the payments for life. Therefore, the income is effectively insured—by the claims-paying ability of the bank. Insurance, income tax and securities laws are different in Canada. A Canadian bank can insure a product like LCF, but a non-insurance company in the U.S. could not.

- The fees on this BMO product appear quite high in relation to the guaranteed benefits provided. Under Series 1 of the notes, the explicit fees are 275 basis points. But there is an implicit additional fee because the participation rate of the principal-protected note in the performance of the underlying fund portfolio is 75%. In other words, there is an additional fee equal to 25% of the underlying fund performance. For example, if the funds were to return a steady 6% every year, the total annual fee would be 275 bps + 150 bps (0.25 x 6%) for a total of 425 bps. The net return to the client would be only 1.75%.

- The product does provide a benefit for beneficiaries that the article doesn’t mention. The article says that payouts after year 25 do not come out of the account value. BMO’s product disclosures state however that interest distributions are paid from the account value after year 25, but 10% of the capital is preserved. Remember that only 90% of the original principal (15 x 6%) was distributed by year 25. So, instead of tapping into its own reserves when the account value goes to zero, BMO taps in when the account value reaches 10% of principal. As a result they leave 10% of the original principal for beneficiaries.

“In conclusion,” Bernard wrote, “this product resembles a VA with two riders. The first rider is a 10-year GMAB with no guaranteed increase (“rollup”) in the benefit base; the second is a 6% GLWB with a 10-year waiting period, no rollup, and no step-ups (mark-ups of the benefit base to the account value).

“The Canadian version differs in that there is no liquidity for the first 10 years (not possible under U.S.-regulated deferred variable annuities), and the fees would be comparable to those of a relatively rich U.S. benefit. I would speculate that the profits on LCF would have to be high relative to variable annuity profits because reserve requirements are higher in Canada than in the U.S.

“As a result, makers of U.S. annuities—variable annuities with GLWBs, fixed indexed annuities with GLWBs, and 10-year deferred income annuities (which currently yield 11% of principal for life at age 65 when purchased by a 55-year-old male from Symetra)—probably wouldn’t want to issue a product identical to LCF even if they could.”

© 2011 RIJ Publishing LLC. All rights reserved.

Poland’s pension makeover offers a cautionary tale

In the 1990s, Poles faced a situation like the one the U.S. faced in early 2005, when Social Security reform dominated domestic politics. Supporters of reforming Poland’s state pension, including the central bank, the stock exchange, and the pension fund industry, said the state pension was unsustainable because of Poland’s aging population. They called for a diversion of a portion of the payroll tax to privately-run DC pension funds.

Pension reform was enacted. Poles used to contribute 19.5% of their pay to the DB state pension. Since the reforms, however, they’ve diverted 7.3% of that to the DC pensions. But the government can’t seem to afford the diversion away from public coffers. Its public debt is 55.5% of GDP. Anything over 55% triggers automatic public spending cuts, including freezes of pension benefit increases.

In the 2000s, the privately-run pension funds were roiled by financial crises. Personal account values fell, jeopardizing retirement security. Liberals now argue that the pension reforms of the 1990s were a mistake.

Last autumn, prime minister Donald Tusk told his chief adviser, Michael Boni, to revise the rules for managing the DC funds. Boni’s proposals were published in October and included:

- Target-date investing. The existing, one-size-fits-all portfolio, which includes an equity cap of 40% of the net asset value of the portfolio, and a 5% limit on overseas investment, would be replaced with three sub-funds, A, B and C. “A,” for new entrants to the labour market, would be a high risk, high- growth portfolio. The equity limit for “B” would be raised to 45%, for mid-career workers. When workers reach 55, their funds would be incrementally transferred to “C,” a low-risk portfolio with a 15% limit on equities. Workers could delay or accelerate their move to “C” by up to five years.

- Lower fees. A reduction in the up-front management fee, currently capped at 3.5% of contributions, to 2.8% for sub-funds A and B, and 2.1% for sub-fund B. However, as an incentive to improve performance, the pension fund management companies could earn a 2% profit fee.

- No more costly poaching. Client soliciting (acquisition) by pension fund companies of members of other funds will be curtailed and banned outright by 2014. In the meantime, agents would only be able to contact by email, phone or post, not in person. The reasoning is that the management companies are spending large sums of monies on poaching each others’ clients. Companies competing for new entrants to the labour market would have to supply them with historical returns.

In mid-November, Boni proposed the creation of retirement (pension) bonds. Returns of the illiquid bonds, in 20 and 30-year maturities, would be linked to GDP growth and redeemable at maturity by the state Treasury. Boni assured the parliament that the bonds would not count as public debt under EU criteria. Most observers are said to be baffled by the proposal.

Prime minister Tusk at one point suggested that participation in the DC schemes could be voluntary. His deputy, Waldemar Pawlak, announced that the 2011 budget was being drafted on the basis of suspended contributions, but Pawlak was contradicted by the finance ministry, which drafts the budget. Tusk has reassured pension fund members and the markets generally that he won’t adopt Hungary’s strategy of effectively nationalizing its DC system.

As of 2011, Polish DC contributions will be reduced to 5% from 7.3%. The reduction in new DC monies could total close to €5bn in 2009 and €4.4bn in the first three quarters of 2010. That will hurt the Warsaw Stock Exchange and the Polish private pension funds, which are heavily invested in equities. According to the stock exchange, in the first half of 2010, payroll DC contributions funded 21% of equity trading.

With 65-odd IPOs completed in the first 11 months of 2010, the Warsaw exchange is also one of Europe’s leading venues for new issues. The exchange is concerned that reduced DC contributions would decrease liquidity and reduce available capital. Fifteen IPOs set for November 2010 were reportedly postponed due to the prospect of declining pension contributions.

© 2011 RIJ Publishing LLC. All rights reserved.

Morningstar VA bulletin looks back at 2010, ahead to 2011

The Annuity Solutions division of Morningstar has published a report summarizing the variable annuity industry highlights of 2010 and predicting that “the pendulum [will] swing back toward more generous benefits during 2011” after the de-risking trend of 2009 and early 2010.

The report, “Continued Innovation Helps Fuel VA Sales in 2010,” also noted new filings of products not yet available:

- Allianz filed a Lifetime GMWB with a guaranteed withdrawal percentage based not on age, but on the rate of a 10-year treasury note. This ties payouts directly to market performance, removing the age factor. The benefit has not been rolled out yet.

- Lincoln National filed a new long-term care benefit that pays a monthly amount for long-term care expenses and costs 1.26% to 1.57%, depending on options chosen (fee calculation is complicated). This benefit pays for long-term care expenses up to three times the initial purchase amount (which must range from $50,000 to $400,000). Payments are offered monthly beginning after the first anniversary and are not taxable. The optional Growth feature gives the ability to increase the monthly maximum benefit amount using a calculation based on the investment growth and the remaining benefit base. The Growth option has a step-up feature through age 76. The benefit is capped at $800,000, covers a single life, and applies only to non-qualified assets.

© 2011 RIJ Publishing LLC. All rights reserved.

Annuity income drops at five of top 10 bank holding companies

Income earned from the sale of annuities at bank holding companies (BHCs) declined 7.6% to $1.84 billion in the first three quarters of 2010, down from $2 billion in the first three quarters of 2009, according to the Michael White-ABIA Bank Annuity Fee Income Report.

Wells Fargo & Company (CA), Morgan Stanley (NY), JPMorgan Chase & Co. (NY) and Bank of America (NC) led all bank holding companies in annuity commission income in the first three quarters of 2010, accounting for just under 60% of the total for BHCs. Wells Fargo became a leader in bank annuity sales by acquiring Wachovia Bank in the financial crisis.

Morgan Stanley and BBVA USA Bancshares (TX) posted the greatest annuity commission growth, with 41% and 26% higher sales through the first three quarters of 2010 compared to the same period in 2009. JP Morgan Chase, Bank of America, PNC Financial, and SunTrust all posted double-digit declines, year-over-year.

Third-quarter annuity commissions fell 3.1%, to $621.3 million from $640.9 million in 2Q 2010 and 7.3% less than the $669.8 million earned in 3Q 2009.

Compiled by Michael White Associates and sponsored by the American Bankers Insurance Association, the report measures and benchmarks the banking industry’s annuity fee income. It is based on data from all 7,020 commercial and FDIC-supervised banks and 915 large top-tier bank holding companies operating on September 30, 2010.

Of the 915 BHCs, 386 or 42.2% sold annuities during the first three quarters of 2010. Their $1.84 billion in annuity commissions and fees constituted 11% of their total mutual fund and annuity income of $16.84 billion and 15.9% of total BHC insurance sales volume (i.e., the sum of annuity and insurance brokerage income) of $11.6 billion.

Of the 7,020 banks, 923 or only 13.2% sold annuities, earning $560.9 million in annuity commissions or 30.4% of the banking industry’s total annuity fee income. However, bank annuity production was down 20.5% from $705.5 million in the first three quarters of 2009.

Seventy-four percent (74%) of BHCs with over $10 billion in assets earned third quarter year-to-date annuity commissions of $1.74 billion, constituting 94.1% of total annuity commissions reported. This was a decrease of 8.1% from $1.89 billion in annuity fee income in the first three quarters of 2009.

Among this asset class of largest BHCs in the first three quarters, annuity commissions made up 10.5% of their total mutual fund and annuity income of $16.59 billion and 15.9% of their total insurance sales volume of $10.92 billion.

BHCs with assets of $1 billion to $10 billion recorded a slim 0.2% increase in annuity fee income, rising to $91.6 million in the first three quarters of 2010 from $91.4 in the same period a year before and accounting for 36.7% of their mutual fund and annuity income of $249.6 million.

BHCs with $500 million to $1 billion in assets generated $16.9 million in annuity commissions in the first three quarters of 2010, up 1.0% from $16.7 million in the first three quarters of 2009.

Only 33.5% of BHCs this size engaged in annuity sales activities, which was the lowest participation rate among all BHC asset classes. Their annuity commissions constituted just 13.3% of their total insurance sales volume of $127.5 million.

Among BHCs with assets between $1 billion and $10 billion, leaders included Stifel Financial Corp. (MO), Hancock Holding Company (MS), and National Penn Bancshares, Inc. (PA).

Among BHCs with assets between $500 million and $1 billion, leaders were First American International Corp. (NY), CCB Financial Corporation (MO), and Ironhorse Financial Group, Inc. (OK).

© 2011 RIJ Publishing LLC. All rights reserved.

Prudential updates ‘Highest Daily’ living benefit

In a risk-reduction move that was first announced early last December, Prudential is reducing the size of the roll-up guaranteed by its top-selling Highest Daily Lifetime variable annuity rider to 5% per year until the first withdrawal from 6% per year.

Prudential was the largest seller of variable annuities through the first three quarters of 2010, with $15.55 billion in total sales.

On future sales, a new Highest Daily Lifetime and a Spousal Highest Daily Lifetime rider will replace the existing Highest Daily Lifetime 6. Under the rider, the benefit base—the notional amount on which the future annual payouts will be calculated—ratchets up at an annualized compounded rate of 5% every business day or grows with the account value, whichever is greater.

The benefit base grows as long as withdrawals are deferred, and the benefit base is guaranteed to double after 12 years if withdrawals are deferred for that time. After income payments begin, at the rate of 2.6% to 6% per year depending on the age of first withdrawal.

The mortality and expense risk fee for Prudential variable annuities ranges from 55 to 185 basis points, depending on the share class. The HD lifetime income rider is available for an additional 95 basis points. Investment management fees are extra.

Prudential controls the downside risk of the product by automatically re-allocating assets out of equities and into an investment grade bond portfolio when equity prices fall. This method, a form of Constant Proportion Portfolio Insurance, tends to limit losses during bear markets but may also prevent the account value from reaching new high-water marks during a recovery.

© 2011 RIJ Publishing LLC. All rights reserved.

SEC Staff Recommends Uniform Fiduciary Standard

The Securities and Exchange Commission staff has recommended “establishing a uniform fiduciary standard for investment advisers and broker-dealers when providing investment advice about securities to retail customers that is consistent with the standard that currently applies to investment advisers.”

The recommendations, which were said to reflect the views of the SEC staff but not necessarily the commissioners, appeared in the 208-page “Study on Investment Advisors and Broker-Dealers” that the SEC produced as directed by section 913 of the Dodd-Frank Wall Street Reform and Investor Protection Act of 2010. The study was published January 19.

Joan E. Boros, Of Counsel at the Washington law firm of JordenBurt LLP and a former SEC staff attorney, has heard little enthusiasm for the report in either direction.

“I don’t assume a uniformed standard will be adopted, nor vice-versa. Mainly, I don’t know what might end up being adopted. The study really didn’t go very far to give any clue of what any rule or rules would require or excuse,” Boros told RIJ yesterday.

“While Commissioners Paredes and Casey seem to want to do less and that’s why they criticized the study, everyone I have spoken to agrees that the study doesn’t really have much substance and [is] a long way from anything that could be adopted,” she added.

“One speculation is that the study was an attempt by the others to get Congress to do the work. That in my book is exhibit one for ‘Beware of What You Wish For.’ As a savvy Hill lawyer has cautioned: It is a lot easier to revise a rule written by a regulatory agency than to amend a statute that Congress enacted.”

The debate over the uniform fiduciary standard has frequently focused less on the ethical issue—the reduction of asymmetrical information and hidden conflicts of interest in the retail securities marketplace—and more on the in-house issue of how a new regulatory regime might upset the business models of various distribution channels.

In opposing the recommendations last week, for instance, two of the SEC commissioners cited commercial factors as their primary concern—defining the main impact of the recommended changes in terms of their potential impact on the price and availability of financial advisory services as opposed to their probity.

Last Friday, January 21, SEC commissioners Kathleen Casey and Troy Paredes released their objections to the study’s findings. They said that it “fails to justify its recommendation” and “does not adequately recognize the risk that its recommendations could adversely impact investors.” They strongly imply that a uniform standard would hurt consumers either by putting brokers and insurance agents out of the advice business or forcing them to charge more for advice.

In the statement, Casey and Paredes write, “The Study unduly discounts the risk that, as a result of the regulatory burdens imposed by the recommendations on financial professionals, investors may have fewer broker-dealers and investment advisers to choose from, may have access to fewer products and services, and may have to pay more for the services and advice they do receive. Any such results are not in the best interests of investors; nor do they serve to protect them.”

Casey and Paredes are the only two Republicans on the commission. Under SEC rules, the five-member commission must have a majority of the party currently in power. The other commissioners are Luis Aguilar, Elisse Walter, and chairperson Mary Schapiro.

Trade groups either praised or condemned the new recommendations, depending on which advisory or distribution channels they represent. The Financial Planning Coalition and the Committee for the Fiduciary Standards, which represent the advisors who are already required to conform to the higher standard, agreed with the SEC staff

Those groups representing registered reps and insurance agents, who are currently held to a standard of conduct that admits a larger element of caveat emptor in relations with clients, opposed the recommendation. These groups included the National Association of Insurance and Financial Advisors (NAIFA), and the Association for Advanced Life Underwriting (AALU).

In their statement, Casey and Paredes echoed the concern among brokerage and insurance groups that creating a uniform standard could bring about lots of unintended consequences—such as raising the cost of financial advisory services for middle-class investors.

That concern is based on their belief that advisors might have to pass along the added costs—caused by spending more hours on each client or switching from commission-based to fee-based compensation or increasing their education—that might be associated with meeting the higher standard of conduct.

Brokers—that is, registered representatives of broker-dealers—currently need to meet the “suitability” standard. This rule-based standard requires them not to sell products to customers for whom they aren’t suitable, but tolerates conflicts of interest (such as broker-dealer sales incentives) in the broker-client relationship.

Often overlooked in the debate, it seems, is a subtle distinction between registered reps of broker-dealers and professional advisors. To the extent that registered reps are rule-following employees of large companies, it’s not clear that they have enough discretion or independence to choose to put the clients’ interests first, even if they wanted to. A self-employed financial advisor has both.

If brokers dispense advice, or if they’re viewed as advisors by their clients, it seems reasonable that they should respect a higher standard. They can’t expect to have it both ways. Whether they will have to charge more for switching from rules-based to principles-based conduct is a separate problem—or perhaps merely a red herring.

© 2011 RIJ Publishing LLC. All rights reserved.

The New Madoff Windfall

Bernard Madoff’s investors are now likely to get back most of the money they sank into his Ponzi scheme.

Indeed, given the favorable tax treatment they will receive, many of his investors will outperform those unfortunates who held legitimate stock market portfolios in the crash of October 2008. Meanwhile, Fortress Investment Group and other savvy hedge funds are now scrambling to buy up Madoff-related losses for as little as 61 cents on the dollar.

Madoff’s fraud is providing opportunities for hedge funds because his court-appointed bankruptcy trustee, Irving H. Picard, with help from federal prosecutors and the Securities and Exchange Commission, has been able to collect $7.2 billion from the estate of Madoff’s alleged accomplice, Jeffrey Picower.

Picower, who died in his Florida swimming pool on October 25, 2009, had been, according to the complaints filed by the trustee, so deeply involved in the scheme that Madoff advised him in advance of his monthly profit “targets,” or the amounts that Madoff planned to pay into Picower’s accounts. Picower could also request higher or lower “profits” for his many accounts.

Moreover, to amplify Picower’s fictional profits, and allow him to siphon off billions, Madoff extended him so much notional ledger credit that Picower’s accounts had, according to the bankruptcy trustee’s analysis, a “negative net cash balance of approximately $6 billion at the time of Madoff’s arrest.”

Picower clearly collaborated in manufacturing his spectacular, if fictitious, profits by faxing Madoff back-dated letters to support fabricated trades. In some of the faked trades, Picower’s reported gains ran as high as 550%. Picower’s funds were frozen before his death, and his wife Barbara Picower and other relatives controlling the Picower estate faced years of litigation, if not prosecution by Federal authorities, if they did not settle with the trustee.

The estate came up with the $7.2 billion it needed to settle through a lucky break. When it was frozen, a large part of Picower’s $5 billion account at Goldman Sachs was invested in Apple stock. Over the next two years, that stock nearly tripled in value. So the estate had not only enough money to settle, but over a billion dollars extra.

The trustee also applied pressure to the families of two other Madoff collaborators: Carl Shapiro, who was 97 years old and infirm, and Stanley Chais, who died of a blood disease on September 26, 2010. Shapiro’s family agreed to repay $625 million. Chais’ estate is expected to surrender over $1 billion (currently frozen).

Hedge funds like Fortress are betting that this $9 billion fund, together with additional monies that the trustee squeezed out of the feeder funds and banks that profited from the Madoff Ponzi scheme, will enable investors (and purchasers of investors’ losses) to recover at least 70 cents on the dollar. If so, the final irony of the Madoff fraud may be that it will provide a windfall for the hedge funds that bought up his losses at a steep discount.

© 2011 RIJ Publishing LLC. All rights reserved.

A Death in the Family, Part II

(This is the second part of a two-part article. The first part can be found here.)

One of the Ruth Cohen’s ambitions, in her last decade, was to master a difficult piano piece: Rachmaninoff’s arrangement of Fritz Kreisler’s Liebeslied. She did learn it, and performed it (with her daughter-in-law turning the pages of the sheet music). Her son videotaped the performance and posted it on YouTube in August 2007.

The following spring, a hiatal hernia required surgery, but Ruth recovered. Then, in December 2009, she fell while leaving her southern California condo for a long-postponed lung examination. In the hospital, she at first appeared to need only a few stitches to close a cut on her chin. But after two days, she started coughing blood.

One specialist diagnosed a treatable reappearance of lung cancer. Another specialist suspected terminal lung cancer. At that point the Cohens dropped into a medical-financial-emotional zone of ambiguity that traps many families in their situation. It’s a triangle where families carom between hope and fear and where the prospect of bottomless expense may open like a crevasse beneath their feet.

“We were led to believe that she might get better,” her son told me. But, faced with contradictory prognoses, the family wasn’t sure whom to trust. “My wife was afraid they might be trying to make money from her by saying they could reverse her lung cancer.” he said. Optimism naturally won out.

Ruth moved into a nursing facility, qualifying for Medicare and Medi-gap coverage because she received regular radiation treatments at a nearby hospital. Her son paid out-of-pocket for a private room. At some point she contracted MRSA—Methicillin-Resistant Staphylococcus Aureus—and began receiving intravenous antibiotics.

At the nursing home, Ruth’s daughter-in-law was struck by the impersonal way that much of the medical staff treated Ruth. To combat the institutional indifference, she loaded Ruth’s Liebeslied video onto her smartphone and began playing it or e-mailing it to almost every doctor, nurse and technician on the floor. She became the ombudsperson—the “official PITA” [pain-in-the-ass], her husband said—that all hospital patients need but few get.

“I wanted them to know that the way she looked now was not her,” the younger woman said. “I wanted them to know how vibrant she was, and how much more music she had in her. I also wanted her to get great treatment. And everybody she met there was deeply affected by Ruth.”

The daughter-in-law’s own mother’s situation back in Connecticut was an important reference point for her. As much as she wanted her mother-in-law to live, she didn’t want to repeat what was happening in her own parents’ home. Her father, a retired professional, had for years been spending large sums on 24-hour in-home professional nursing care for her mother, who had dementia.

Talking finances

Outside the hospital, the family talked finances. They agreed to sell Ruth’s condo and rent an apartment for her in an assisted-living facility where one of Ruth’s close friends lived. The rent would consume the condo profits in about two years, they figured. It would also wipe out any prospect of a bequest.

A bequest was more important to some family members than to others. The attorney and his wife were well-fixed; they had no need for an inheritance. His younger brother did need one, but without hesitation the brother agreed to spend whatever was available to helpp his mother. A licensed real estate agent, he flew with his wife to California to put the condo on the market. It sold quickly.

“My brother understood that if she died he’d get a benefit,” the attorney said. “But he still favored making all the decisions toward helping her live. He loved her. There were no financial hesitations. We were glad to use all the money from the condo. We were already thinking about using up all our own money after hers ran out. That was stupid, probably, but nevertheless… We thought she was getting better and that she might live five or ten years more.”

In the end, they didn’t have to spend all of their money, or hers. After a week in the new apartment, when Ruth was barely settled in with her furniture and piano, she suddenly weakened and was re-hospitalized.

“The new doctor in hospital said, Why didn’t you tell us she has cancer?’” her daughter-in-law said. “We thought she had slow growing cancer. They said no. Her lung cancer was advanced. Besides that, her kidneys were failing. In the end her body was so heavily loaded with antibiotics for the MRSA that her kidneys shut down.” She was put on dialysis and her condition improved. The family became optimistic again.

“Ruth wanted to live more than anything,” her daughter-in-law said. She wanted everything done, despite having said ‘no heroic measures.’ She had wanted the esophageal surgery. She wanted to be on dialysis. But she was dying of cancer.”

After three weeks, a new doctor came to talk to Ruth. Her daughter-in-law and younger son were in the room. This doctor had watched and listened to the Liebeslied video. He had evaluated Ruth’s x-rays and charts. His purpose at that point was clearly not to treat her but to help her let go of life and accept her own death. But calling this a “death panel” would be a disservice.

“He said he had seen the video. He told her how rich and full and worthwhile her life had been and that life was not something to cling to,” her daughter-in-law told me. “He said what a privilege it was to know her even for a short time. He was near tears himself. He was amazing. And after that it was easy for her to decide to end the dialysis.”

The family’s feelings were understandably mixed, however. In another conversation, the daughter-in-law said, “The saddest moment was when she gave up on the dialysis. My husband wanted her to live. There was no peaceful resignation in this death at all.”

Two days later, at half past midnight, in a bedroom at her son’s home, released from dialysis machines, flashing monitors and PICC-lines and eased by morphine injections that her daughter-in-law learned to administer, Ruth Cohen struggled for a moment, then died at the age of 87 with her family around her. Her performance of Fritz Kreisler’s Liebeslied is still posted on YouTube. At last count, it had 62,566 views.

© 2011 RIJ Publishing LLC. All rights reserved.

New Income Solutions for Long Retirements

As Americans live longer—20, 30 or even 40 years into retirement—and depend less on Social Security and defined benefit plans for income, the need for longer-term retirement income solutions is greater than ever.

Longevity insurance annuities, also known as deferred income annuities, may provide part of the solution. These annuities are usually purchased at retirement, but don’t make their first income payment until a pre-determined future date, typically 10 or 20 years later.

For example, a 65-year-old might buy an annuity that provides a monthly distribution check starting at age 80 or 85. The older the contract owner is when payments begin, the less the annuity will cost initially. Longevity insurance annuities may therefore help provide a source of guaranteed income for people who live beyond the average life expectancy.

This income stream is life-contingent, however. That is, the annuities generally have no cash value if the owner dies before the income start date. This may be one of the principal reasons few financial advisors have considered them, and why they do not appear on many investment platforms. But, with the numbers of people over age 100 growing rapidly—more rapidly than any other age group— there is an equally growing need for advisors to consider an array of retirement income solutions.

Longevity Annuities—Often Overlooked

Although privately purchased annuities are the only commercial source of guaranteed longevity protection, they still aren’t widely available on the platforms through which most advisors deliver retirement products and services to individuals. Most asset allocation models, for instance, have no “longevity bucket” that reserves a spot for annuities in an individual’s retirement income plan.

At the same time, longevity insurance products don’t easily fit the fee-based compensation structure toward which more advisors are moving. Simply put, fee-based advisors get paid based on assets under management, and pure longevity insurance isn’t a liquid, quantifiable asset. So even those advisors who might believe longevity insurance is right for their clients must leave the managed account structure to purchase it.

If longevity insurance were an asset class in the traditional sense, incorporating them into existing platforms might be easier. But, while stocks, bonds and commodities are all classified by the levels of market risk to which they are exposed to, there is no traditional classification for the longevity risk—the risk of outliving one’s savings—that deferred income annuities address.

Longevity Insurance and Managed Account Platforms

Despite significant effort, the wirehouse brokerage community has been slow to integrate longevity products into its asset allocation models. We estimate that only about 10% of wirehouse advisors and 25% of independent advisors regularly sell annuities. In other words, 75% to 90% of advisors may have clients who want or need longevity insurance but aren’t getting it. While there has been some innovation by smaller brokerage firms, wire houses tend to be extremely proprietary with asset allocation models and resistant to outside asset allocation methodologies.

We expect a variety of non-insurance financial firms to design and build new products incorporating or complementing longevity insurance and income annuities. The aim of such new products wouldn’t be to displace existing annuity providers—most investors don’t use annuities anyway—but to reach the clients who have unmet needs for longevity protection.