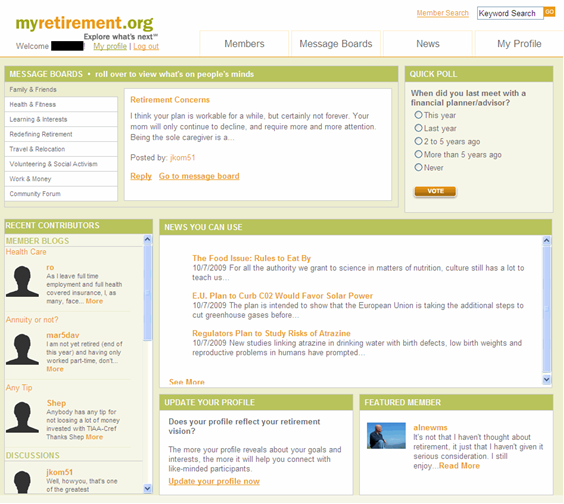

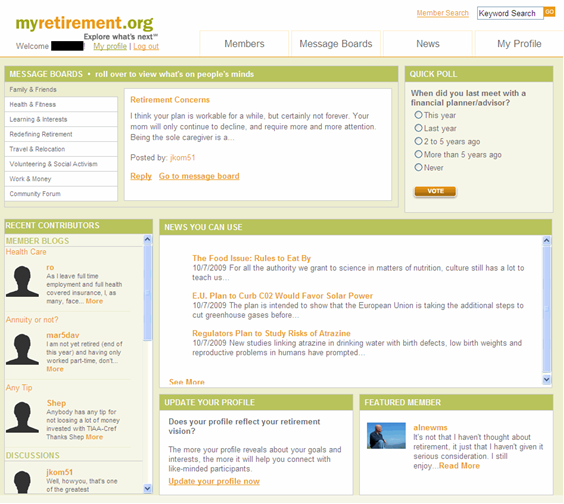

Should Annuity Firms Care About Social Media?

The annuity industry has been slow to adopt social media. But given the industry’s target audiences, does it matter? Download an excerpt from the report "Social Media: Trends and Tactics in the Financial Services Industry."