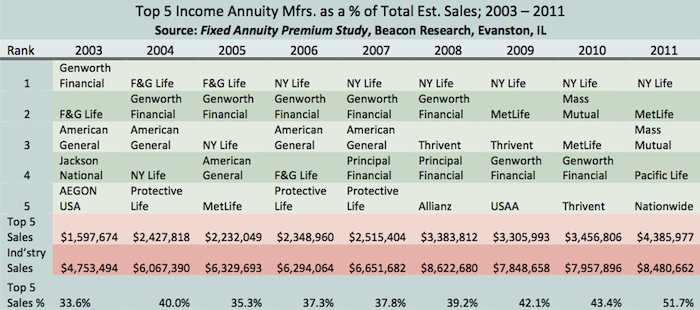

Like sales of variable annuities, sales of single premium immediate annuities have become more concentrated among a handful of companies. Back in 2003, the top five sellers accounted for only a third of SPIA sales; in 2011, the top five accounted for more than half, according to the Fixed Annuity Premium Study by Beacon Research. (See chart below.)

In addition, none of the insurance companies who comprised the top five SPIA sellers in 2003 were still represented among the top five in 2011. Over that time, SPIA sales among the top five more than doubled, to $4.39 billion from $1.6 billion, while total SPIA sales rose to $8.48 billion from $4.75 billion.

The leader in SPIA sales for the past six years, New York Life, wasn’t even among the top five nine years ago. Genworth Financial, once a leading SPIA manufacturer, is no longer among the top 5. American General slipped out of the top five after 2008, the year in which its parent, AIG, had its catastrophic meltdown.