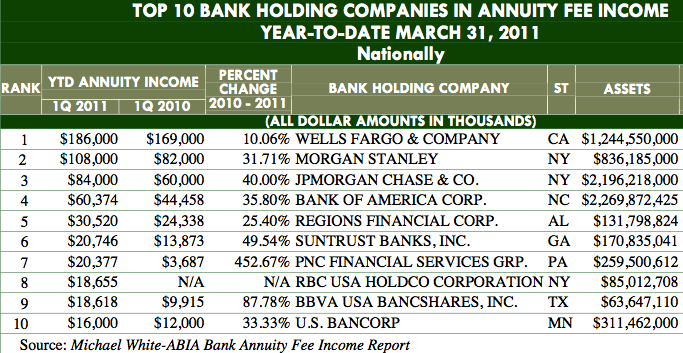

Wells Fargo & Company ($186m), Morgan Stanley ($108m), JPMorgan Chase & Co. ($84m), Bank of America Corporation ($60.4m), and Regions Financial Corp. ($30.5m) led all bank holding companies in annuity commission income in first quarter 2011, according to the Michael White-ABIA Bank Annuity Fee Income Report.

Wells Fargo acquired Wachovia Bank, a former leader in annuity sales, during the financial crisis.

Together, ten large bank holding companies accounted for about $563 million or more than 64% of the $748.2 million in bank annuity income in the first quarter, up 28% from $582.6 million in first quarter 2010 and 2.6% higher than in the fourth quarter of 2010.

Not since the first quarter of 2007, when these data first became available, has the quarterly amount of annuity fee income been so high. The report uses data from all 6,850 commercial and FDIC-supervised banks and 942 large bank holding companies (BHC) operating on March 31, 2011.

Of the 942 BHCs, 378 or 40.1% sold annuities sales in first quarter 2011. Their $748.2 million in annuity commissions and fees constituted 11.9% of their total mutual fund and annuity income of $6.31 billion and 15.8% of total BHC insurance sales volume (i.e., the sum of annuity and insurance brokerage income) of $4.73 billion.

Of the 6,850 banks, 821 or 12.0% sold annuities in the first quarter, earning $204.2 million in annuity commissions or 27.2% of the banking industry’s total annuity fee income. In contrast to BHCs, the banks’ annuity production was up only 9.7%, from $186.1 million in first quarter 2010.

Seventy-four percent (74.3%) of BHCs with over $10 billion in assets earned first-quarter annuity commissions of $708.3 million, constituting 94.7% of total annuity commissions reported by the banking industry. This was an increase of 29.3% from $547.8 million in annuity fee income in first quarter 2010. Among this asset class of largest BHCs, annuity commissions made up 11.4% of their total mutual fund and annuity income of $6.20 billion and 15.8% of their total insurance sales revenue of $4.49 billion in first quarter 2011.

BHCs with assets between $1 billion and $10 billion recorded an increase of 13.9% in annuity fee income, growing from $29.7 million in first quarter 2010 to $33.8 million in first quarter 2011 and accounting for 31.6% of their mutual fund and annuity income of $1.33 billion. BHCs with $500 million to $1 billion in assets generated $6.12 million in annuity commissions in first quarter 2011, up 19.0% from $5.15 million in first quarter 2010. Only 30.5% of BHCs this size engaged in annuity sales activities, which was the lowest participation rate among all BHC asset classes. Among these BHCs, annuity commissions constituted the smallest proportion (15.1%) of total insurance sales volume of $40.6 million.

Among BHCs with assets between $1 billion and $10 billion, leaders included Stifel Financial Corp. (MO), Hancock Holding Company (MS), National Penn Bancshares (PA), Iberiabank Corporation (LA), and Bremer Financial Corp. (MN). Among BHCs with assets between $500 million and $1 billion, leaders were Northeast Bancorp (ME), First Volunteer Corporation (TN), Van Diest Investment Co. (IA), River Valley Bancorporation, Inc. (WI), and First American International Corp. (NY). The smallest community banks, those with assets less than $500 million, were used as “proxies” for the smallest BHCs, which are not required to report annuity fee income. Leaders among bank proxies for small BHCs were Jacksonville Savings Bank (IL), Essex Savings Bank (CT), Savers Co-operative Bank (MA), FNB Bank, N.A. (PA), and The Hardin County Bank (TN).

Among the top 50 BHCs nationally in annuity concentration (i.e., annuity fee income as a percent of noninterest income), the median Annuity Concentration Ratio was 7.3% in first quarter 2011. Among the top 50 small banks in annuity concentration that are serving as proxies for small BHCs, the median Annuity Concentration Ratio was 16.6% of noninterest income.

© 2011 RIJ Publishing LLC. All rights reserved.