Opportunities occur when luck meets preparation, wise people are known to say. When the pandemic panic struck US financial markets last March, and bond prices fell, a window opened and Sammons Financial Group jumped through it—scooping up investment-grade fixed income assets whose prices were beaten-down and whose yields were elevated.

Market timing? Yes, but in the best sense of that expression.

The employee-owned (ESOP) company—created by the late entrepreneur Charles Sammons, an Oklahoma Territory orphan who diversified a Dallas hay-and-grain business into insurance and finance and died a billionaire in 1988—made hay out of those yields by increasing the payout rates of its fixed-rate annuities.

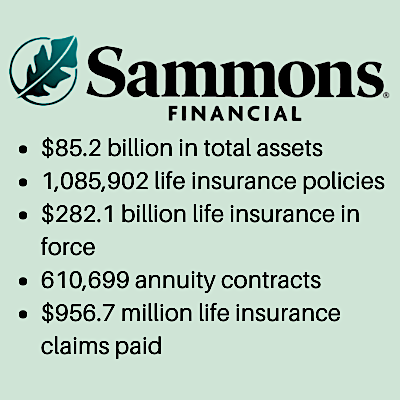

Fixed rate annuities were what many nervous investors fled to in the middle of 2020. Sammons’ high payout rates got attention and led to a spike in sales. By the end of the third quarter of 2020, Sammons YTD fixed annuity sales were $6.59 billion, second only to New York Life. Six months earlier, by contrast, Sammons had been ranked 15th, with only $880 million in YTD fixed annuity sales. The West Des Moines-based company has $100 billion in assets, according to its website.

Bill Lowe

“It was an interesting year for us,” Sammons Institutional Group president Bill Lowe said in an interview this week. “We had been preparing for a recession and were going up in the quality in our portfolio in preparation for it. During a recession, credit spreads widen and high quality assets appreciate in value.

“No one predicted the pandemic, but when spreads gapped, we had an opportunity get some attractive yields. So we saw a monstrous increase in sales of fixed multi-year guaranteed rate annuities (MYGAs).” Of Sammons’ $6.59 billion in fixed annuity sales through the end of the third-quarter 2020, $3.93 billion was in MYGA contracts and $2.59 billion was in fixed indexed annuities (FIAs).

One might think that the same opportunity to buy depressed high-quality bonds was available to all of Sammons’ direct competitors in the fixed annuity market. Not necessarily.

“It all depends on what your portfolio looked like,” Lowe said. “We had been moving up in quality. A large share of our assets were rated NAIC 1.” That’s the highest strength rating that the National Association of Insurance Commissioners assigns to insurer’s general account assets.

Life/annuity companies with weaker investment portfolios, perhaps because they were already straining for yield and taking more risk, “couldn’t have bought what we did. If their assets had slipped out of NAIC 2, there are greater capital requirements for those bonds.

“Many companies needed to increase their reserve capital because of their variable annuities with guaranteed lifetime withdrawal benefits (VAs with GLWBs),” he added. “So, yes, everybody saw the same opportunity, but not everybody was in a position to take advantage of it.”

As Sammons ramped up sales, some of its competitors intentionally reduced theirs. “Other companies really pulled back. Some companies almost exited the fixed annuity business. Or they dropped rates to such uncompetitive levels that they were effectively out of the business. So there was less competition. We had the added advantage of being an A-rated company. There are not a lot of A-rated fixed rate annuity carriers.” Sammons Financial is rated A+ by Fitch, AM Best and Standard & Poor’s.

Five factors contributed to Sammons’ sales burst in 2020, Lowe said. The first was competitive rates, based on the timely bond purchases. The second was Sammons’ strength ratings. The third was the rate advantage that fixed annuities always enjoy relative to Treasury bonds and certificates of deposit.

Five factors contributed to Sammons’ sales burst in 2020, Lowe said. The first was competitive rates, based on the timely bond purchases. The second was Sammons’ strength ratings. The third was the rate advantage that fixed annuities always enjoy relative to Treasury bonds and certificates of deposit.

“The prescription for uncertainty is certainty. People want something certain when there is uncertainty. If you look at the fixed annuity market overall, it was up slightly [1%] year-over-year on September 30, 2020,” Lowe told RIJ.

“In the third quarter of 2020, fixed rate sales were up 60% compared with the third quarter of 2019. People could see what had happened to the yields on other safe money, such as Treasuries or certificates of deposit. Those rates were not very attractive.”

Regarding the last two items that contributed to Sammons’ 2020 success, “one is that we were well-equipped to do e-business. We required that of our strategic partners. In a pandemic, you can’t do paper applications. That’s one reason why the overall annuity market dropped,” he said.

“Advisers couldn’t meet face to face with their clients. Even if a client lived only a mile away, advisers would still have to mail the contract to the client. That’s why rep productivity dropped a lot in April and May.

“The last point in our favor was the simplicity of the fixed rate annuity sale. During a disruption, the fixed rate product is easy to sell over the phone. A VA with a GLWB is much harder. In the third quarter we were the number one seller of fixed rate annuities in the industry and number one in the bank channel.

“We’ve expanded our distribution in the bank channel. Banks are where the action takes place in MYGAs. Early on, the ‘seven-year’ MYGA business was terrific. Over time sales gravitated toward the three-year contract. It’s always a big seller.

Lowe was asked if Sammons’ sales burst was sustainable. “The BBB+ instruments gapped significantly last March. They’ve since come back, and spreads have tightened over the year. Can our competitiveness be sustained? Will we see another opportunity like March, April, and May?

“I can only say that we were well positioned for this last spring. When you combine very attractive rates with a 100-plus year-old company that’s conservative and rated A+, and you have the distribution positioned in the right places, you’re going to be positioned for an opportunity like this.”

Before 2020, Sammons reported the annuity sales of its two member insurers, Midland National and North American Company for Life and Health Insurance, separately to the Secure Retirement Institute at LIMRA. In January of last year, the company refreshed its brand. It adopted an oak leaf as its corporate symbol and began reporting its consolidated annuity sales as Sammons Financial.

© 2020 RIJ Publishing LLC. All rights reserved.