Athene USA was the annuity sales leader (overall market share of 8.2%; 11.9% for non-variable deferred annuities), followed by MassMutual, Corebridge Financial, Equitable Financial and Nationwide.

Honorable Mention

Milliman to offer Hueler Income Solutions to its recordkeeping clients; Principal issues its second RILA; John Hurley joins Ibexis from Global Atlantic.

Private credit holdings of US life/annuity firms reach $1.7 trillion: AM Best

Aside from providing new data, this article describes the 'Bermuda Triangle' strategy, and includes comments from an AM Best managing director.

High rates drive high interest in annuities: LIMRA

'After years of ultra-low interest rates, LIMRA believes conservative investors, who were sitting on the sidelines reluctant to lock in low rates, have poured money into the market as...

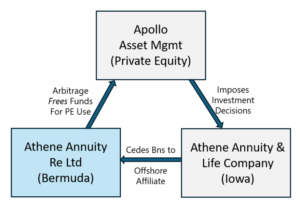

Offshore Regulatory Arbitrage by US Insurers Explained

In a recent report, Moody's analysts showed that the accounting 'regime in Bermuda tends to allow for a higher discount rate than other jurisdictions' and this 'directly impacts the...

Calamos Structured ETFs: An alternative to FIAs

The one-year contract issued by Calamos on May 1, 2024 provided 100% principal protection and a maximum credited interest of 9.81% at the end of the term, less a...

MetLife and Micruity expand their DC savings-to-income IT partnership

The two firms have already worked together on connecting MetLife’s retirement income services with Fidelity’s Guaranteed Income Direct and State Street Global Advisors IncomeWise platforms.

Bermuda Shorts

Nassau Financial gets $200 million from Golub Capital; AM Best affirms ratings of Aspida Group, backed by Ares Mgt; 3M swaps its $2.5bn DB pension for a MetLife group...

Annuities enjoy record sales in 1Q2024

'Total annuity sales have come down from fourth quarter 2024, largely due to a softening in the fixed-rate deferred annuity market. However, LIMRA expects annuity sales to perform well...

Athene’s group annuities not the ‘safest available,’ lawsuit charges

The suit against Athene may be a test case for the legitimacy of Bermuda Triangle strategy. In other news from the Bermuda Triangle: Annuity sales boom attracts private equity-backed...

Test-drive annuities at CANNEX/Luma ‘Marketplace’

The Annuity Marketplace will provide income, rate, yield, and product information on annuities from more than 60 issuers, a CANNEX release said. Advisers can illustrate the outcomes of market...

The age-old question: How long will your clients live?

For financial advisers trying to estimate how long their high-net-worth clients will live, a new white paper from HealthView suggests that only the very healthiest people need expect to...

News briefs

High interest rates lead to record-breaking 1Q2024 annuity sales; Life insurers warm to private credit, survey shows; Jackson National introduces ‘+Income’ VA rider.

What are ‘excess return’ indexes?

Like many FIA issuers, Ibexis Life uses 'excess return' indexes in its product. In the context of FIA indexes, 'excess return” doesn’t mean 'out-performance relative to a benchmark' or...

The case for affiliated reinsurance in the Cayman Islands

The Cayman Island's "legislative and regulatory regime is less prescriptive and therefore affords prospective Cayman reinsurers greater flexibility to propose a bespoke capital model to our regulator without being...

News in brief

Researchers probe tie between auto-enrollment and household debt in the UK; Prudential closes $12.5 bn reinsurance deal with Somerset Re; Strong fourth quarter for pension risk transfers: LIMRA; PE-backed...

Auto workers’ DC plan will link to Hueler Income Solutions

Union workers at General Motors and Stellantis (Chrysler et alia) in Detroit will be able to link directly from their 401(k) platform or employee benefits portal to the Hueler...

MassMutual platform to distribute Aspida Life fixed-rate annuities

The platform, Flourish, is a wholly owned and independently operated subsidiary of MassMutual. It serves more than 750 wealth management firms managing some $1.5 trillion in financial assets.

Reinsurance on NAIC agenda this week

More news: Private ownership of life re/insurers may affect credit ratings, says Fitch; F&G issues its first RILA; American Equity Investment Life reports 2023 results; Global Atlantic closes $10bn...

MetLife to offer income annuities on Fidelity’s platform

The MetLife solution enables participants at all savings levels to purchase an immediate income annuity through an insurer selected by their employer and annuitize any portion of their savings,...