Even if the DOL conflict of interest rule is ultimately diluted, it has reinforced shift to fee-based advice from commission-based sales, according to Bing Waldert, managing director of...

Market value of U.S. retirement savings reaches $26.6tr in 2Q17

Mutual funds managed $3.3 trillion, or 65%, of assets held in 401(k) plans at the end of June 2017. Forty-eight percent of IRA assets, or $4.0 trillion, was invested...

Wells Fargo led all banks in annuity fee income in 2Q17

Among large bank holding companies, only Citigroup and KeyCorp posted significant increases in annuity commission revenue in the second quarter of 2017, according to the Michael White Associates quarterly...

Honorable Mention

Brief or late-breaking items from One America, Voya, BlueRock, the National Reverse Mortgage Lenders Association, New York Life, Prudential, MassMutual, Ubiquity Retirement + Savings, and HealthEquity.

To increase sales of active funds, bundle them with passive: Cerulli

'Asset managers must be able to shift and reshape as the industry does. As advisors' needs are changing, so must the product lines,' said Brendan Powers, senior analyst at...

As risk premium shrinks, so does investors’ risk appetite

Investors pulled $23.0 billion out of actively-managed U.S. equity funds, compared with $19.6 billion in July, according to Morningstar’s latest monthly asset flow report.

How wholesalers should adapt to disruption: DST

A new report from DST, "Prevailing in a Changing Distribution Landscape," describes how investment product wholesalers can respond to changes in the advisory and brokerage world.

Economic conditions lift interest in retirement plans: Nationwide

Competition for the best workers and confidence in the economy are causing more business owners to start offering retirement plans or enhance the ones they have, according to a...

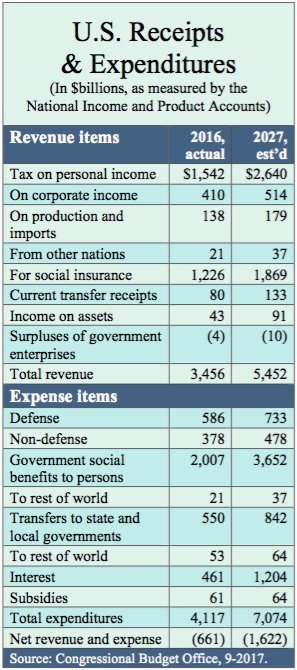

Trump Tax Plan Revealed

'The framework retains tax benefits that encourage work, higher education and retirement security,' said the report issued by the White House Wednesday. It was entitled, Unified Framework for Fixing...

Allianz, Aegon et al Inject New ‘Variable’ into Dutch DC Biz

In the Netherlands, American-style drawdowns of variable payments from defined contribution plans is a novel idea.

How to attract IRA asset transfers: LIMRA SRI

People ages 45 and older were significantly less likely than people ages 40 to 44 (29% vs. 11%) to move their IRAs recently, according to research by the LIMRA...

MassMutual aims to compete harder for defined benefit business

PensionSmart Analysis, as MassMutual calls its newest tool, is available to DB plan sponsors through financial advisors and consultants who serve the pension recordkeeping, investments and actuarial marketplaces.

A few big IBD deals, lots of smaller RIA deals: Fidelity

The ten largest independent broker-dealers manage 65% of all b/d assets and 48% of all b/d advisors, according to a new report from Fidelity Clearing & Custody Solutions, a...

Honorable Mention

Brief or late-breaking items from Nuveen, Ubiquity Retirement + Savings, and Conning.

Trend toward centralized investment advice will continue: Cerulli

Advisors at wirehouses and national broker-dealers will be do less investment management and focus more on client relationship-building and financial planning, explains Tom O'Shea, associate director at Cerulli.

Goodbye HelloWallet. Hello, United Income

Matt Fellowes, who sold HelloWallet to Morningstar for $52.5 million, is introducing United Income, a digital advisor that promises even to help clients sign up for Social Security and...

Fixed annuities outsell variable in second quarter: IRI

'While total variable annuity sales rose slightly,' said John McCarthy, Senior Product Manager at Morningstar, “the largest increases were in non-qualified sales. We are also seeing growth in newer...

A heads-up from Wagner Law on the fiduciary rule

In a new posting, ERISA expert Marcia Wagner helps financial advisers and financial institutions answer the question, 'What do I do during the Transition Period?'